UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of September, 2020

Commission File Number 1-15106

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

(Exact name of registrant as specified in its charter)

Brazilian Petroleum Corporation – PETROBRAS

(Translation of Registrant's name into English)

Avenida República do Chile, 65

20031-912 – Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

Petrobras on Tupi field

—

Rio de Janeiro, September

28, 2020 - Petróleo Brasileiro S.A. - Petrobras informs that the accumulated production of the Tupi field, located in the

pre-salt of the Santos Basin, approximately 230 km from the coast of the state of Rio de Janeiro, reached 2 billion barrels of

oil equivalent (boe) on July, 2020, according to the Brazilian National Agency of Petroleum, Natural Gas and Biofuels (ANP). This

milestone takes place in the same month in which we celebrate the 20th anniversary of the signing of the concession agreement for

block BM-S-11, where the field is located and is currently the largest deep water oil producer in the world, with approximately

1 million barrels per day (bpd).

This accumulated production

occurs just ten years after the start of the first permanent production system, the Floating Production Storage and Offloading

(FPSO) Cidade Angra dos Reis, and fourteen years after it was discovered, in 2006. From 2010 to 2019, the consortium, formed by

Petrobras, with a 65% stake in partnership with Shell Brasil Petróleo Ltda (25%) and Petrogal Brasil S.A. (10%), put into

operation nine production systems, an average of one system per year.

For this, Petrobras

had to overcome a series of unprecedented challenges in the industry, such as the distance from the coast and the existence of

very few similar reservoirs in the world, ultra-deep reservoirs under a thick layer of salt. In partnership with research institutions,

partner companies and suppliers, the Company developed a series of technologies and innovations that allowed safe and profitable

productions in pre-salt fields, still being a reference in terms of its environmental performance. As a result of the unprecedented

technologies developed by the Company, in 2015, Petrobras received the Distinguished Achievement Award for Companies, Organizations

and Institutions, which is the main award in the industry and is promoted by the Offshore Technology Conference (OTC).

The Future of Tupi

Petrobras,

together with its partners in the BM-S-11 block, has already developed several initiatives aimed at revitalizing the field

even before the start of its decline, seeking to increase the oil and gas recovery factor that can be extracted from the

field and, thus, maximize the value of the asset for the Company. For this, the Company develops projects, such as

interconnecting new wells into already implemented production systems and the use of alternating water and gas injection

technology (Water Alternating Gas - WAG), to maintain the reservoir's pressure. In addition to these projects, the

Company together with its partners, is also analyzing actions that will be taken according to the terms of the concession and

is seeking to develop other low-cost and highly reliable technologies that may contribute with the increase in the recovery

factor.

Click here to access

more information about the Tupi field (https://www.investidorpetrobras.com.br/en/results-and-notices/company-presentations/).

www.petrobras.com.br/ri

For more information:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

| Investors Relations

email: petroinvest@petrobras.com.br/acionistas@petrobras.com.br

Av. República do Chile, 65 – 1803

– 20031-912 – Rio de Janeiro, RJ.

Tel.: 55 (21) 3224-1510/9947 | 0800-282-1540

This document may contain

forecasts within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the

Securities Trading Act of 1934, as amended (Trading Act) that reflect the expectations of the Company's officers. The terms: "anticipates",

"believes", "expects", "predicts", "intends", "plans", "projects",

"aims", "should," and similar terms, aim to identify such forecasts, which evidently involve risks or uncertainties,

predicted or not by the Company. Therefore, future results of the Company's operations may differ from current expectations, and

the reader should not rely solely on the information included herein.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: September 28, 2020

PETRÓLEO BRASILEIRO S.A–PETROBRAS

By: /s/ Andrea Marques de Almeida

______________________________

Andrea Marques de Almeida

Chief Financial Officer and Investor Relations Officer

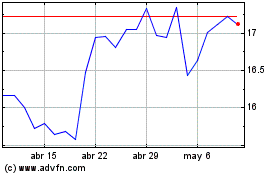

Petroleo Brasileiro ADR (NYSE:PBR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

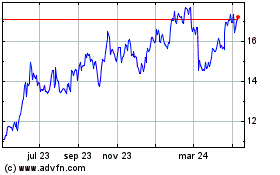

Petroleo Brasileiro ADR (NYSE:PBR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024