TIDMPOLX

RNS Number : 4985A

Polarean Imaging PLC

30 September 2020

Polarean Imaging Plc

("Polarean" or the "Company")

Half-year Report

Polarean Imaging plc (AIM: POLX), the medical-imaging technology

company, with a proprietary investigational drug-device combination

diagnostic for magnetic resonance imaging ("MRI"), announces its

unaudited interim results for the six months ended 30 June 2020

.

Highlights

-- Positive results from Phase III trials (the "Clinical Trials") announced in January 2020

-- Raised gross proceeds of GBP8.4m in April 2020, which

included a GBP2.2m subscription from new strategic investor Bracco

Imaging S.p.A. ("Bracco")

-- Appointment of former NED Jonathan Allis as Chairman in February 2020

-- Appointment of Cyrille Petit as Non-Executive Director and

representative of Bracco in June 2020

-- Net cash of US$9.2m as of 30 June 2020

Post-period end

-- Significant progress toward submission of New Drug Application ("NDA")

- Small Business Waiver of Human Drug Application Fee granted by

the United States Food and Drug Administration ("FDA") on 28

September 2020

- NDA to be submitted in early October 2020

-- Presentation of data at the American Thoracic Society and the

International Society for Magnetic Resonance in Medicine virtual

conferences

-- Installed a 9820 Xenon Polariser system at University of

Kansas Medical Center ("KU Medical Center")

-- Government COVID-19-related grants are being applied for and

received by our current device users, including a recent award for

a multi-center initiative coordinated by Western Ontario Professor

Grace Parraga PhD to better understand the long-term effects of

COVID-19 using hyperpolarised 129Xe MRI in combination with

computed tomography (CT)

Richard Hullihen, CEO of Polarean, commented: "During the period

under review, Polarean achieved one of its most important

milestones to date, the positive readout from our Phase III

Clinical Trials. We subsequently undertook an GBP8.4m fundraising

and welcomed our new strategic investor Bracco to our share

register, alongside several new institutional investors. We are

also grateful for the continued support we received from our

existing long-term investors and partners. The installation of new

polarisers has continued and users of our systems are publishing

research at an increased rate, expanding and deepening the

knowledge base of the use of hyperpolarised 129Xe in pulmonary

medicine, while further validating Polarean's technology. We look

forward to providing our shareholders with updates regarding

further progress and specifically the imminent submission of the

Company's NDA to the FDA."

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) 596/2014.

Enquiries:

Polarean Imaging plc www.polarean.com / www.polarean-ir.com

Richard Hullihen, Chief Executive Officer Via Walbrook PR

Jonathan Allis, Chairman

SP Angel Corporate Finance LLP Tel: +44 (0)20 3470 0470

David Hignell / Soltan Tagiev (Corporate Finance)

Vadim Alexandre / Rob Rees (Corporate Broking)

Walbrook PR Tel: +44 (0)20 7933 8780 or polarean@walbrookpr.com

Paul McManus / Anna Dunphy Mob: +44 (0)7980 541 893 / +44 (0)7876 741 001

About Polarean ( www.polarean.com )

The Company and its wholly owned subsidiary, Polarean, Inc.

(together the "Group") are revenue generating, medical drug-device

combination companies operating in the high resolution medical

imaging market.

The Group develops equipment that enables existing MRI systems

to achieve an improved level of pulmonary function imaging and

specialises in the use of hyperpolarised Xenon gas ((129) Xe) as an

imaging agent to visualise ventilation and gas exchange regionally

in the smallest airways of the lungs, the tissue barrier between

the lung and the bloodstream and in the pulmonary vasculature.

Xenon gas exhibits solubility and signal properties that enable it

to be imaged within other tissues and organs.

The Group operates in an area of significant unmet medical need

and the Group's technology provides a novel diagnostic approach,

offering a non-invasive and radiation-free functional imaging

platform which is more accurate and less harmful to the patient

than current methods. The annual burden of pulmonary disease in the

US is estimated to be over US$150 billion.

The Group also develops high performance MRI radiofrequency (RF)

coils which are a required component for imaging (129) Xe in the

MRI system. The development of these coils by the Group facilitates

the adoption of the Xenon technology by providing

application-specific RF coils which optimise the imaging of (129)

Xe in MRI equipment for use as a medical diagnostic as well as a

method of monitoring the efficacy of therapeutic intervention.

CEO Statement

Introduction

The six month period ending 30 June 2020 has seen Polarean make

substantial progress towards its goal of seeking FDA approval for

the Company's drug-device combination. After successfully

completing two Phase III Clinical Trials in Q4 2019, the Company

announced positive top line results of these Clinical Trials on 29

January 2020. During the first half of 2020, the Company performed

the post trial in depth analysis of the results of the Clinical

Trials and initiated work associated with the construction of both

the drug and device components of our NDA submission.

Despite the challenging market conditions in the first half of

2020, the Company closed a financing that resulted in gross

proceeds of US$10.4m (GBP8.4m). This financing included a new

strategic investor, Bracco Imaging S.p.A., several new

institutional investors and the continued support of previous VCT

and EIS investors. We are encouraged with the support shown by new

and existing shareholders and these additional funds will further

support our preparation of our NDA for submission to the FDA, focus

on preparations for commercial launch and continue development of

our polariser system.

Also, during the period, former NED Jonathan Allis was appointed

Chairman of Polarean after the sale of his former company, Blue

Earth Diagnostics, to Bracco. We also welcomed Cyrille Petit to the

Board, as a result of the Bracco investment.

Results overview

Group revenues for the first half were US$0.3m (2019: US$0.4m)

and were largely derived from our collaboration with the University

of Cincinnati where work under our SBIR grant has been completed.

We continue to sell our polariser systems on a research-use-only

basis to academic institutions in the US, Canada and Europe. Due to

COVID-19, we were unable to complete the installation of a

polariser system we had delivered to KU Medical Center during

December 2019. The system installation completed recently as per

the Company's announcement on 18 September 2020. Operating expenses

for H1 2020 (US$3.4m) were flat compared with H1 2019 (US$3.4m), as

Administrative Expenses (H1 2020 US$2.7m, H1 2019 US $3.1m)

decreased after we completed the Clinical Trials and Selling and

Distribution Expenses (H1 2020 US$0.4m, H1 2019 US $0.1m) increased

as we began preparations for commercial launch. During H1 2020, the

Company received a US$0.3m forgivable loan under the US Paycheck

Protection Program ("PPP"), which was recognised as Finance Income.

Our overall loss before tax decreased from US$3.4m to US$3.2m in

the same comparable period, due to the PPP proceeds. The Company

completed the GBP8.4m fundraise during H1 2020 via the issue of new

equity and as at 30 June 2020 we held US US$9.2m in net cash or

cash equivalents.

Post-period end events

Presentation at Medical Conferences and Studies Utilising our

Technology

The Company's technology was prominent at the American Thoracic

Society and International Society of Magnetic Resonance in Medicine

virtual conferences during August 2020. Over 40 abstracts related

to the use of hyperpolarised (129) Xe were presented at the two

conferences, including the Company's Clinical Trial results. The

content of our publications and those of our customers, along with

our participation is available on our website at www.polarean.com .

The users of our polarisers continue to expand and document the

applications of our technology across the spectrum of pulmonary

disease.

The " (129) Xe MRI Clinical Trials Consortium" continues to

discuss the application of our technology to the case of post

infection COVID-19 patients to assess the long-term effects and

case management of these patients. Investigator-initiated

government research grants have been submitted to study the use of

our technology to assess the long-term effects of COVID-19 post

infection in patients. Some of these grants have been awarded and

COVID-19-related clinical research has begun.

Installation of Xenon Polarisers

Whilst we seek clinical approval for our medical drug-device

combination we continue to expand our installed base of systems

through additional sales of research units to academic

institutions. We recently completed the installation of a new

system at the KU Medical Center, which is starting up a research

programme under the guidance of a veteran researcher in the field

of hyperpolarised 129Xe imaging.

Researchers continue to apply for and receive grants to purchase

our polariser systems. We are in discussions with several potential

customers and anticipate additional orders during calendar year

2020. The number of systems currently installed is 23.

NDA Submission

We have continued to compile the components of the NDA

submission. On 28 September 2020, the Company was granted a Small

Business Waiver of Human Drug Application Fee (the "Waiver") by the

FDA. The Waiver exempts the Company from having to pay the US$2.9m

filing fee for our NDA submission. We anticipate submitting our NDA

to the FDA in early October 2020.

Outlook

We continue to demonstrate that Polarean's technology has the

potential to be of tremendous benefit to patients and a powerful

new tool for clinicians in discovering and characterising treatable

traits in pulmonary medicine. In addition, our latest new

techniques lead us into the field of cardiology and pulmonary

vascular disease which is one example of the further potential of

our technology. We also look forward to evaluating new uses of our

technology in pharmaceutical drug development. There are currently

40 clinical trials ongoing into the use of (129) Xe MRI according

to the FDA website.

The burden of pulmonary disease in the USA is approximately

US$150bn and is widespread and growing, affecting nearly 40 million

Americans. Given the limitations of existing methods of diagnosis

and lung disease monitoring, we estimate that there is a

significant unmet need for non-invasive, quantitative, and

cost-effective image-based diagnosis technology. We believe that

our unique medical drug-device combination utilising 129Xe offers

the ideal solution for improving pulmonary disease diagnosis.

This is an exciting time for the Company, as we enter the final

stages of submitting our NDA and look towards a potential

commercial launch before the end of 2021.

Richard Hullihen

Chief Executive Officer

30 September 2020

POLAREAN IMAGING PLC

Consolidated unaudited statement of comprehensive income

for the six months ended 30 June 2020

Unaudited Unaudited Audited

6 months 6 months 12 months

ended 30.6.20 ended 30.6.19 ended 31.12.19

US$ US$ US$

Note

Revenue 327,896 399,639 2,301,093

Cost of sales (41,387) (75,185) (925,612)

--------------- --------------- ----------------

Gross profit 286,509 324,454 1,375,481

Administrative expenses (2,724,411) (3,068,371) (6,010,119)

Depreciation (73,204) (4,661) (63,121)

Amortisation (359,677) (341,937) (683,873)

Selling and distribution expenses (351,754) (147,821) (324,791)

Share based payment expense (213,906) (139,886) (305,747)

--------------- --------------- ----------------

Loss from operations (3,436,443) (3,378,222) (6,012,170)

Finance expense (9,647) (22,356) (91,678)

Finance income 267,155 274 508

--------------- --------------- ----------------

Loss on ordinary activities

before taxation 3 (3,178,935) (3,400,304) (6,103,340)

Taxation - - -

--------------- --------------- ----------------

Loss and total other comprehensive

expense (3,178,935) (3,400,304) (6,103,340)

Basic and fully diluted loss

per share (US$) 3 (0.023) (0.034) (0.057)

POLAREAN IMAGING PLC

Consolidated unaudited statement of financial position

at 30 June 2020

Unaudited Unaudited Audited

As at 30.6.20 As at 30.6.19 As at 31.12.19

US$ US$ US$

Assets Note

Non-current assets

Property, plant and equipment 312,287 13,091 355,958

Intangible assets 3,119,120 3,735,973 3,427,547

Right-of-use asset 224,414 131,773 98,263

Trade and other receivables 5,539 5,539 5,539

-------------- -------------- ---------------

3,661,360 3,886,376 3,887,307

Current assets

Inventories 950,674 1,233,039 554,211

Trade and other receivables 522,625 1,094,988 636,783

Cash and cash equivalents 9,190,862 1,277,195 1,961,869

-------------- -------------- ---------------

10,664,161 3,605,222 3,152,863

-------------- -------------- ---------------

Total assets 14,325,521 7,491,598 7,040,170

-------------- -------------- ---------------

Equity

Share capital 4 77,518 49,767 55,776

Share premium 23,573,058 11,200,461 13,659,912

Group reorganisation reserve 7,813,337 7,813,337 7,813,337

Share-based payment reserve 1,584,640 1,218,221 1,370,734

Accumulated losses (21,488,616) (15,619,993) (18,309,681)

-------------- -------------- ---------------

Total equity 11,559,937 4,661,793 4,590,078

Liabilities

Non-current liabilities

Deferred income 192,817 87,029 192,817

Lease liability 5 149,487 83,168 50,455

Contingent consideration 316,000 316,000 316,000

-------------- -------------- ---------------

658,304 486,197 559,272

Current liabilities

Trade and other payables 1,985,828 1,604,792 1,773,582

Lease liability 5 102,213 82,716 70,914

Deferred income 19,239 656,100 46,324

-------------- -------------- ---------------

2,107,280 2,343,608 1,890,820

-------------- -------------- ---------------

Total equity and liabilities 14,325,521 7,491,598 7,040,170

-------------- -------------- ---------------

POLAREAN IMAGING PLC

Consolidated unaudited statement of changes in equity

at 30 June 2020

Share-based

Share Group payment Accumulated

capital Share premium re-organisation reserve losses Total equity

--------- --------------- -------------------- ------------- -------------- --------------

Balance as at 31

December 2018

(audited) 49,427 11,063,075 7,813,337 1,078,335 (12,212,767) 7,791,407

Change in accounting

policy - - - - (6,922) (6,922)

Restated total equity

at 1 January 2019 49,427 11,063,075 7,813,337 1,078,335 (12,219,689) 7,784,485

--------- --------------- -------------------- ------------- -------------- --------------

Loss and total

comprehensive

income for the

period - - - - (3,400,304) (3,400,304)

Issue of shares 340 137,386 - - - 137,726

Share-based payments - - - 139,886 - 139,886

--------- --------------- -------------------- ------------- -------------- --------------

Balance as at 30

June 2019

(unaudited) 49,767 11,200,461 7,813,337 1,218,221 (15,619,993) 4,661,793

Comprehensive income

Share based payment

- lapsed share

options - - - (13,348) 13,348 -

Loss and total

comprehensive

income for the

period - - - - (2,703,036) (2,703,036)

Transaction with

owners

Issue of shares 6,009 2,618,903 - - - 2,624,912

Share issue costs - (159,452) - - - (159,452)

Share-based payments - - - 165,861 - 165,861

Balance as at 31

December 2019

(audited) 55,776 13,659,912 7,813,337 1,370,734 (18,309,681) 4,590,078

--------- --------------- -------------------- ------------- -------------- --------------

Loss and total

comprehensive

income for the

period - - - - (3,178,935) (3,178,935)

Issue of shares 21,742 10,427,537 - - - 10,449,279

Share issue costs - (514,391) - - - (514,391)

Share-based payments - - - 213,906 - 213,906

Balance as at 30

June 2020

(unaudited) 77,518 23,573,058 7,813,337 1,584,640 (21,488,616) 11,559,937

========= =============== ==================== ============= ============== ==============

POLAREAN IMAGING PLC

Consolidated unaudited cash flow statement

for the six months ended 30 June 2020

Unaudited Unaudited Audited

6 months 6 months 12 months

ended 30.6.20 ended 30.6.19 ended

US$ US$ 31.12.19

US$

Cash flows from operating activities

Loss for the period before taxation (3,178,935) (3,400,304) (6,103,340)

Adjustments for non-cash/non-operating

items:

Depreciation of plant and equipment 73,204 4,661 63,121

Amortisation of intangible assets 359,677 341,937 683,873

Share based compensation 213,906 139,886 305,747

Interest paid - 22,356 91,678

Interest received (92) (274) (508)

(2,532,240) (2,891,738) (4,959,429)

Changes in working capital:

Increase in inventories (396,462) (581,257) (97,570)

Increase in trade and other receivables 114,157 (301,448) (14,737)

(Decrease)/increase in trade and

other payables 189,407 36,955 (285,074)

Increase/(decrease) in deferred

revenue (27,085) 617,575 595,961

--------------- --------------- ------------

Net cash flows used from operating

activities (2,652,223) (3,119,913) (4,565,709)

Cash flows from investing activities

Purchase of plant and equipment (29,534) - (401,327)

--------------- --------------- ------------

Net cash used in investing activities (29,534) - (401,327)

Cash flows from financing activities

Issue of shares 10,449,279 3,577,509 6,373,919

Cost of issue (514,391) (159,452)

Interest paid - (22,356) -

Interest received 92 274 508

Funds received from PPP loan 22,840 - -

Principal elements of lease payments (56,717) (42,793) (69,993)

Interest elements of lease payments 9,647 8,873 (91,678)

--------------- --------------- ------------

Net cash generated from financing

activities 9,910,750 3,521,507 6,053,304

Net increase in cash and equivalents 7,228,993 404,594 (1,086,268)

Cash and equivalents at beginning

of period 1,961,869 875,601 875,601

Cash and equivalents at end of

period 9,190,862 1,277,195 1,961,869

NOTES TO THE INTERIM ACCOUNTS

1. Basis of preparation

The accounting policies adopted are consistent with those of the

previous financial year ended 31 December 2019.

This interim consolidated financial information for the six

months ended 30 June 2020 has been prepared in accordance with AIM

rule 18, 'Half yearly reports and accounts'. This interim

consolidated financial information is not the group's statutory

financial statements within the meaning of section 434 of the

Companies Act 2006 (and information as required by section 435 of

the Companies Act 2006) and should be read in conjunction with the

annual financial statements for the year ended 31 December 2019,

which have been prepared in accordance with International Financial

Reporting Standards (IFRS) and have been delivered to the Registrar

of Companies. The auditors have reported on those accounts; their

report was unqualified, did not include references to any matters

to which the auditors drew attention by way of emphasis of matter

without qualifying their report and did not contain statements

under section 498(2) or (3) of the Companies Act 2006.

The interim consolidated financial information for the six

months ended 30 June 2020 is unaudited. In the opinion of the

Directors, the interim consolidated financial information presents

fairly the financial position, and results from operations and cash

flows for the period. Comparative numbers for the six months ended

30 June 2019 are also unaudited.

This interim consolidated financial information is presented in

US Dollars ($).

2. Going concern

The interim consolidated financial information for the six

months ended 30 June 2020 have been prepared on the going concern

basis.

The Directors consider the going concern basis of preparation to

be appropriate in preparing the financial statements. In

considering the appropriateness of this basis of preparation, the

Directors have received the Group's working capital forecasts for a

minimum of 12 months from the date of the approval of this

financial information. Based on their consideration the Directors

have reasonable expectation that the Group has adequate resources

to continue for the foreseeable future and that carrying values of

intangible assets are supported. Thus, they continue to adopt the

going concern basis of accounting in preparing this financial

information.

3. Loss per share

The basic and diluted loss per share for the period ended 30

June 2020 was US$0.023 (2019: US$0.034) The calculation of loss per

share is based on the loss of US$3,178,935 for the period ended 30

June 2020 (2019: loss of US$3,400,304) and the weighted average

number of shares in issue during the period for calculating the

basic profit per share of 137,598,239 shares (2019:

101,087,330).

4. Called up share capital

Unaudited Unaudited Audited

30.6.20 30.6.19 31.12.19

US$ US$ US$

Allotted, issued and fully paid

Ordinary Shares 77,518 49,427 55,776

---------- ---------- ---------

The number of shares in issue was as follows: Number of shares

Balance at 1 January 2019 100,730,893

Exercised warrants 705,040

-----------------

Balance at 30 June 2019 101,435,933

Issued during the period 11,666,667

Exercised warrants 1,336,000

-----------------

Balance at 31 Dec 2019 114,438,600

Issued during the period 46,624,997

Exercised warrants 766,410

-----------------

Balance at 30 June 2020 161,830,007

-----------------

5. Borrowings

Unaudited Unaudited Audited

30.6.20 30.6.19 31.12.19

US$ US$ US$

Non-current

Lease liability 149,487 83,168 50,455

---------- ---------- ---------

Current

Bank Overdraft - 8,443 -

Lease Liability 102,213 74,273 70,917

---------- ---------- ---------

Total 251,700 82,716 121,369

---------- ---------- ---------

6. Share based payments

Share Options

The Company grants share options as its discretion to Directors,

management and employees. These are accounted for as equity settled

transactions. Should the options remain unexercised after a period

of ten years from the date of grant the options will expire unless

an extension is agreed to by the board. Options are exercisable at

a price equal to the Company's quoted market price on the date of

grant or an exercise price to be determined by the board.

Details of share options granted, exercised, forfeited and

outstanding at the year-end are as follows:

Number of share options Weighted average exercise price

(US$)

Outstanding at 1 January 2020 17,436,722 0.15

Outstanding at 30 June 2020 17,436,722 0.15

-------------------------------- ------------------------ --------------------------------

Exercisable at 30 June 2020 9,383,074 0.10

-------------------------------- ------------------------ --------------------------------

There have been no options granted in the period to 30 June

2020.

The weighted average contractual life of the share options

outstanding at the reporting date is 6 years and 278 days.

Share Warrants

The Company grants share warrants at its discretion to

Directors, management, employees, advisors and lenders. These are

accounted for as equity settled transactions. Terms of warrants

vary from agreement to agreement.

Details for the warrants exercised, lapsed and outstanding at

the period ending 30 June 2020 are as follows:

Number of Weighted average exercise price (US$)

share warrants

Outstanding at 1 January 2020 4,824,703 0.09

Exercised during the period (766,410) 0.10

Outstanding at 30 June 2020 4,058,293 0.09

-------------------------------- ---------------- --------------------------------------

Exercisable at 30 June 2020 4,058,293 0.09

-------------------------------- ---------------- --------------------------------------

On 2 March 2020, 232,010 new ordinary shares were issued by the

Company following the exercise of warrants at an exercise price of

0.037 pence per warrant. On 1 June 2020, the Company issued a

further 534,400 new ordinary shares following an exercise of

warrants at an exercise price of 0.003 pence per warrant.

The weighted average contractual life of the share warrants

outstanding at the reporting date is 3 years and 99 days.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BLGDCLSDDGGC

(END) Dow Jones Newswires

September 30, 2020 02:00 ET (06:00 GMT)

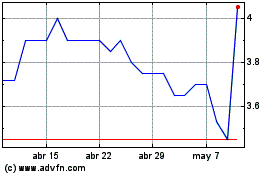

Polarean Imaging (LSE:POLX)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Polarean Imaging (LSE:POLX)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024