Report of Foreign Issuer (6-k)

02 Octubre 2020 - 5:01AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 6-K

Report of Foreign Private

Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange

Act of 1934

For the month of

October, 2020

Commission File Number

1-15106

PETRÓLEO BRASILEIRO

S.A. – PETROBRAS

(Exact name of registrant

as specified in its charter)

Brazilian Petroleum

Corporation – PETROBRAS

(Translation of Registrant's

name into English)

Avenida República

do Chile, 65

20031-912 – Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal

executive office)

Indicate by check mark

whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form

40-F _______

Indicate by check mark

whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

Petrobras on ICMS

—

Rio de Janeiro, October 1, 2020 - Petróleo

Brasileiro S.A. – Petrobras informs that its Board of Directors, in a meeting held today, approved the adhesion to the ICMS

debt and interest penalty reduction programs (Amnesties), according to the CONFAZ regulations ICMS 146/2019 and 51/2020, instituted

by the states Espírito Santo and Rio de Janeiro, respectively.

The total amount of contingencies to be closed

in the states of Espírito Santo and Rio de Janeiro, as a result of joining the Amnesties, is R$ 4.3 billion, upon disbursement

by the Company of R$ 2 billion - updated until 09/30/2020 – and with savings of 57% of the total amount of litigation. Approximately

70% of this amount will be disbursed in October 2020 and the remainder in monthly installments due until December this year.

The agreement involves the disbursement of Petrobras

to the state of Rio de Janeiro of R$ 1.8 billion to close contingencies related to the collection of ICMS and fines in the internal

consumption operations of diesel oil used by the maritime units chartered by the company, and the adherence to the program will

be materialized through an agreement (TAC). In addition, a reduction of the ICMS calculation base to 4.5% was approved in the internal

supplies of marine diesel oil, thus reaching a definitive solution to the root cause of these contingencies.

In Espírito Santo, upon payment of R$ 208

million, tax debts resulting from divergences on the appropriation of ICMS credits over fixed assets and of ICMS differences on

operations with oil and oil products will be closed.

The tax contingencies selected for adherence are

incorporated in the 2019 financial statements, through note 19 (Provisionas for legal proceedings - item 19.3 – Contigent

liabilities).

The decision to adhere to the amnesties is part

of the continuous process of evaluation of tax liabilities and mitigation of associated risks and, in the case of Rio de Janeiro,

is conditioned to the publication of a state law that fully incorporates the rules set forth in the ICMS regulation 51/2020.

|

www.petrobras.com.br/ri

|

|

For more information:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

| Investors Relations

email: petroinvest@petrobras.com.br/acionistas@petrobras.com.br

Av. República do Chile, 65 – 1803

– 20031-912 – Rio de Janeiro, RJ.

Tel.: 55 (21) 3224-1510/9947 | 0800-282-1540

|

|

|

|

This document may contain

forecasts within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the

Securities Trading Act of 1934, as amended (Trading Act) that reflect the expectations of the Company's officers. The terms: "anticipates",

"believes", "expects", "predicts", "intends", "plans", "projects",

"aims", "should," and similar terms, aim to identify such forecasts, which evidently involve risks or uncertainties,

predicted or not by the Company. Therefore, future results of the Company's operations may differ from current expectations, and

the reader should not rely solely on the information included herein.

|

|

|

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

Date: October 1, 2020

PETRÓLEO BRASILEIRO

S.A–PETROBRAS

By: /s/ Andrea Marques de Almeida

______________________________

Andrea

Marques de Almeida

Chief Financial Officer and

Investor Relations Officer

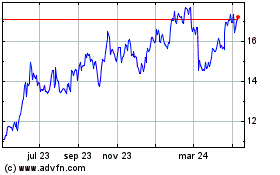

Petroleo Brasileiro ADR (NYSE:PBR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

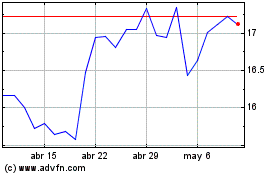

Petroleo Brasileiro ADR (NYSE:PBR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024