Report of Foreign Issuer (6-k)

02 Octubre 2020 - 5:03AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 6-K

Report of Foreign Private

Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange

Act of 1934

For the month of

October, 2020

Commission File Number

1-15106

PETRÓLEO BRASILEIRO

S.A. – PETROBRAS

(Exact name of registrant

as specified in its charter)

Brazilian Petroleum

Corporation – PETROBRAS

(Translation of Registrant's

name into English)

Avenida República

do Chile, 65

20031-912 – Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal

executive office)

Indicate by check mark

whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form

40-F _______

Indicate by check mark

whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

Petrobras on leasing of the LNG Regasification

Terminal

—

Rio de Janeiro, October

1, 2020 - Petróleo Brasileiro S.A. - Petrobras, following up on the releases disclosed on 08/03/2020 and 09/29/2020, informs

that on September 30, 2020, the Public Session was held in person to open the commercial bids of the bidders interested in the

leasing of the Bahia LNG Regasification Terminal (TR-BA) and associated facilities, and the following companies attended:

|

|

·

|

BP Energy do Brasil LTDA:

|

Registered the request

to postpone the opening of commercial proposals to eventually solve pending issues and state that it intends to present its answers

to the integrity questionnaire to allow Petrobras to grade the company's integrity risk. At the time, BP informed that the commercial

proposal to be presented would be indicative and non-binding, not having signed the declaration of compliance with the requirements

of the bidding process call, an essential document of the bidding process. In view of these facts, no commercial proposal was received.

|

|

·

|

Compass Gás e Energia

S.A.:

|

Presented letter of

decline of the commercial proposal. In addition, it informed that it has already sent the integrity form answered to Petrobras

and corroborates with the importance of compliance and evaluation of the company's integrity risk rating.

|

|

·

|

Golar Power Comercializadora

de Gás Natural LTDA:

|

Registered its opposition

to the request made by BP for understanding it contrary to the terms of the Bidding Process Call and registered that he will forward

an integrity questionnaire to allow Petrobras to grade the company's integrity risk and corroborates the importance of compliance

and assessment of the company's integrity risk grade. A commercial proposal was received.

In the scope of the stages

of (i) verification of effectiveness, in order to guarantee the alignment with the requirements of the Public Notice; and (ii)

qualification, the integrity/compliance requirements were verified, having been assigned a high Risk Grade of Integrity (RGI) for

the company Golar Power Comercializador de Gás Natural LTDA, implying its disqualification from the contest based on items

5.1.1 and 10.6.4 of the Bidding Process Call.

The bidding process enters

its recursal phase. If the contest is closed without valid proposals having been obtained by Petrobras, the company will carry

out a new bidding process.

|

www.petrobras.com.br/ri

|

|

For more information:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

| Investors Relations

email: petroinvest@petrobras.com.br/acionistas@petrobras.com.br

Av. República do Chile, 65 – 1803

– 20031-912 – Rio de Janeiro, RJ.

Tel.: 55 (21) 3224-1510/9947 | 0800-282-1540

|

|

|

|

This document may contain

forecasts within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the

Securities Trading Act of 1934, as amended (Trading Act) that reflect the expectations of the Company's officers. The terms: "anticipates",

"believes", "expects", "predicts", "intends", "plans", "projects",

"aims", "should," and similar terms, aim to identify such forecasts, which evidently involve risks or uncertainties,

predicted or not by the Company. Therefore, future results of the Company's operations may differ from current expectations, and

the reader should not rely solely on the information included herein.

|

|

|

About the terminal

The TR-BA consists of a pier

type island with all the necessary facilities for mooring a Floating Storage and Regasification Unit (FRSU) vessel directly to

the pier and a supply vessel on the port side of the FSRU. LNG transfer is done directly between the FSRU and the suppressor in

the side-by-side configuration. The maximum regasification flow rate of TR-BA is 20 million m³/d (@ 1 atm and 20°C). The

FSRU is not part of the TR-BA lease process.

The integrated gas pipeline

is 45 km long and 28 inches in diameter, connecting the TR-BA to two delivery points, the São Francisco do Conde Pressure

Reduction Station and the São Sebastião do Passé Flow Control Station.

Also included in the scope

of the transaction are the equipment for power generation and supply located at the Madre de Deus Waterway Terminal (TEMADRE),

members of the TR-BA.

|

www.petrobras.com.br/ri

|

|

For more information:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

| Investors Relations

email: petroinvest@petrobras.com.br/acionistas@petrobras.com.br

Av. República do Chile, 65 – 1803

– 20031-912 – Rio de Janeiro, RJ.

Tel.: 55 (21) 3224-1510/9947 | 0800-282-1540

|

|

|

|

This document may contain

forecasts within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the

Securities Trading Act of 1934, as amended (Trading Act) that reflect the expectations of the Company's officers. The terms: "anticipates",

"believes", "expects", "predicts", "intends", "plans", "projects",

"aims", "should," and similar terms, aim to identify such forecasts, which evidently involve risks or uncertainties,

predicted or not by the Company. Therefore, future results of the Company's operations may differ from current expectations, and

the reader should not rely solely on the information included herein.

|

|

|

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

Date: October 1, 2020

PETRÓLEO BRASILEIRO

S.A–PETROBRAS

By: /s/ Andrea Marques de Almeida

______________________________

Andrea

Marques de Almeida

Chief Financial Officer and

Investor Relations Officer

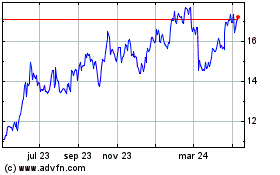

Petroleo Brasileiro ADR (NYSE:PBR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

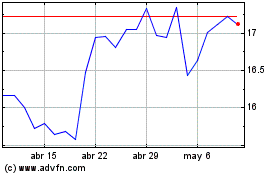

Petroleo Brasileiro ADR (NYSE:PBR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024