Today's Logistics Report: Buying Into Uber Freight; Maritime's Fresh Cyberattacks; Moving Boeing Planes

02 Octubre 2020 - 7:35AM

Noticias Dow Jones

By Paul Page

Sign up: With one click, get this newsletter delivered to your

inbox.

Uber Freight is getting new funding and fresh direction as its

parent company copes with broader upheaval in its core business.

Greenbriar Equity Group is leading a $500 million investment round

in the truck brokerage arm of Uber Technologies Inc., the WSJ

Logistics Report's Jennifer Smith writes, in an agreement that

values the digital freight business at $3.3 billion. The

transaction comes as Uber pushes to cut costs in a ride-hailing

business that has staggered under the pandemic and to complete a

$2.65 billion all-stock deal to acquire Postmates Inc. Uber has

said it is looking at all of its businesses, and its adding two

partners from transport and logistics-focused Greenbriar to Uber

Freight's board under the new investment. Uber Freight has grabbed

market share with its load-matching app, but it lost $49 million in

the second quarter on $211 million in revenue and the unit's growth

rate has slowed.

TRANSPORTATION

The maritime world's cybersecurity problem is getting deeper.

The International Maritime Organization was hit by what the global

regulator called a "sophisticated cyberattack," the WSJ Logistics

Report's Costas Paris writes, days after a hack at CMA CGM SA

operations crippled electronic systems at the container line. The

incident at the French ocean carrier was apparently a ransomware

attack and CMA CGM suspects that data was stolen. It's unclear how

far hackers got with the IMO, a high-profile agency attached to the

United Nations, but the regulator's website was down. Experts say

most ransomware and other intrusions are financially motivated, and

regulators such as the IMO can be a target if hackers suspect they

hold valuable data. Some carrier executives have blanched at the

potential cost of cybersecurity fixes, but they may find the cost

of growing incursions and communications shutdowns too much to

bear.

SUPPLY CHAIN STRATEGIES

America's troubled aerospace supply chains are tilting a bit

more to the Southeast. Boeing Co. is ending production of its 787

Dreamliner in the Seattle area after more than a decade, the WSJ's

Andrew Tangel reports, and consolidating assembly of the popular

wide-body jet in South Carolina next year. The aircraft maker is

taking a reduced manufacturing operation from Everett, Wash., after

slashing production because of the pandemic-driven drop in travel.

The action will bring more manufacturing to the North Charleston,

S.C., site along with deliveries of high-value aircraft parts. It

isn't clear how the shift will affect Boeing's heavily unionized

workforce in the Puget Sound region. Efforts to organize Boeing's

workforce in the right-to-work state of South Carolina haven't

succeeded. Boeing still produces wide-body 767s, 777s and 747s in

Everett, but those assembly lines are slowing and the 747 program

is set to end in 2022.

QUOTABLE

IN OTHER NEWS

Amazon.com Inc. says more than 19,000 of its workers have

contracted coronavirus this year. (WSJ)

U.S. consumer spending rose 1% in August while personal income

fell 2.7%. (WSJ)

A measure of U.S. manufacturing activity expanded in August for

the fourth straight month. (WSJ)

New filings for jobless benefits in the U.S. held nearly steady

at 837,000 for the fifth straight week. (WSJ)

Sales figures suggest the U.S. auto industry bounced back

relatively strongly in the second quarter. (WSJ)

U.S. highway fatalities fell this spring amid coronavirus

lockdowns but the rate of crash deaths rose sharply. (WSJ)

Logistics automation provider AutoStore claims in a lawsuit that

U.K. online grocer Ocado Group PLC infringed on its technology

patents. (Dow Jones Newswires)

Gilead Sciences Inc. is taking control of supplies of its

Covid-19 treatment drug remdesivir from the U.S. government.

(WSJ)

Bed Bath & Beyond Inc.'s quarterly comparable sales rose for

the first time since 2016 as digital sales soared 89%. (WSJ)

PepsiCo Inc.'s quarterly revenue rose 5.3% as beverage sales

rebounded. (WSJ)

The government spending bill passed by Congress and signed into

law extends highway programs for a year. (Heavy Duty Trucking)

Engine-maker Rolls-Royce Holdings PLC plans to raise $2.6

billion in a rights issue to bolster its tattered balance sheet.

(Financial Times)

Walmart Inc. plans to hire more than 20,000 seasonal workers for

e-commerce fulfillment centers this year. (Supply Chain Dive)

Hennes & Mauritz AB plans to close about 250 of its apparel

stores next year, or 5% of its global sites. (Bloomberg)

The New York Shipping Exchange raised $13.5 million in new

capital to back its business setting freight contracts between

shippers and ocean carriers. (The Loadstar)

Mediterranean Shipping Co. is considering a new round of

purchases of ultra-large container ships. (TradeWinds)

Vessel handling-equipment makers Cargotec and Konecranes plan to

merge. (Splash 247)

Amazon dropped its search for a distribution center site in

Gaithersburg, Md., in the Washington, D.C., suburbs. (Bethesda

Magazine)

E-commerce logistics operator Radial will build a $40 million

fulfillment center outside Atlanta. (Henry Herald)

XPO Logistics Inc. is closing a Jenkins Township, Pa.,

distribution center and laying off 111 employees. (Times

Leader)

SAS Cargo resumed freighter flights to China. (Air Cargo

News)

Bicycles are in tight supply amid enormous pandemic-driven

demand. (Colorado Sun)

ABOUT US

Paul Page is editor of WSJ Logistics Report. Follow the WSJ

Logistics Report team: @PaulPage, @jensmithWSJ and @CostasParis.

Follow the WSJ Logistics Report on Twitter at @WSJLogistics.

Write to Paul Page at paul.page@wsj.com

(END) Dow Jones Newswires

October 02, 2020 08:20 ET (12:20 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

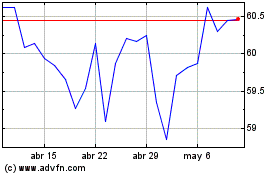

Walmart (NYSE:WMT)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Walmart (NYSE:WMT)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024