By Ryan Tracy

WASHINGTON -- America's biggest technology companies have

leveraged their dominance to stamp out competition and stifle

innovation, according to a Democratic-led House panel, which said

Congress should consider forcing the tech giants to separate their

dominant online platforms from other business lines.

The report released Tuesday from Democratic staff of the House

Antitrust Subcommittee capped a 16-month inquiry into the market

power of Amazon.com Inc., Facebook Inc., Alphabet Inc.'s Google and

Apple Inc.

Republicans issued a separate response endorsing strong

antitrust enforcement targeting the companies but didn't endorse

many of the Democrats' policy prescriptions. It also accused the

companies of bias against conservative viewpoints.

No legislative changes are imminent, but the report's sweeping

conclusions boost the odds for new laws in the future and

publicizes evidence that will give momentum to the companies'

critics in both parties.

In one snippet, the report describes an alleged effort by

Facebook's leadership to prevent the company's Instagram app from

competing with the original Facebook platform.

"The question was how do we position Facebook and Instagram to

not compete with each other," the report quotes a former Facebook

employee as saying. "If you own two social media utilities, they

should not be allowed to shore each other up. It's unclear to me

why this should not be illegal."

A 2018 memo by Facebook executive Tom Cunningham on the possible

"end states" of Facebook's family of apps concluded that "it is

unclear whether Instagram and Facebook can coexist," the report

said, with Mr. Cunningham worried about a possible tipping point in

which one might come to dominate the other.

"Instagram and WhatsApp have reached new heights of success

because Facebook has invested billions in those businesses,"

Facebook said in a statement. "A strongly competitive landscape

existed at the time of both acquisitions and exists today."

The company is facing an antitrust investigation by the Federal

Trade Commission, which is preparing a potential lawsuit, The Wall

Street Journal has reported. Google is also expected to be the

subject of an antitrust lawsuit filed by the Justice Department

this fall.

Amazon disputed the report's conclusions.

"All large organizations attract the attention of regulators,

and we welcome that scrutiny," it said in a blog post. "But large

companies are not dominant by definition, and the presumption that

success can only be the result of behavior is simply wrong."

--anti-competitive

Google said in a statement it disagrees with the findings, which

it said "feature outdated and inaccurate allegations from

commercial rivals."

"Americans simply don't want Congress to break Google's products

or harm the free services they use every day," the company

said.

Apple disputed the report's findings. "We have always said that

scrutiny is reasonable and appropriate but we vehemently disagree

with the conclusions reached in this staff report with respect to

Apple," a company spokesman said in a statement. "Our company does

not have a dominant market share in any category where we do

business."

The Democratic staff report says all four companies wield

monopoly power and criticizes U.S. antitrust enforcement agencies

as failing to curb their dominance.

"These firms have too much power, and that power must be reined

in and subject to appropriate oversight and enforcement," the

449-page report says. "Our economy and democracy are at stake."

The report outlines a series of responses Congress could adopt,

including legislation forcing at least some of the companies to

separate certain dominant online platforms from other business

lines, as well as changes to antitrust laws to reinvigorate a

perceived lack of strong enforcement.

"This report could end up being a turning point in antitrust and

tech," said Paul Gallant, an analyst for investment bank Cowen Inc.

"It creates momentum for legislation next year, and it also might

nudge regulators to bring cases even under existing law knowing

they've got congressional backup."

Republicans on the panel issued a 28-page response, detailing

what they say are abuses of power by social-media companies in

censoring online speech. "Big Tech is out to get conservatives,"

the report concluded, criticizing Democrats for ignoring the issue.

The tech companies say they don't make content moderation decisions

based on political bias.

The report concluded that Amazon has monopoly power over its

third-party sellers, bullies its retail partners and improperly

uses third-party data to inform its strategy for selling self-made

private-label products on its e-marketplace.

The panel's legislative proposals could cause Amazon to exit

that business and others, in what would be a significant blow. The

tech giant has developed more than 100,000 private-label products

and made significant investments in the areas of home devices, such

as its Echo speakers.

In April, the Journal reported that Amazon's private-label

employees had used individual third-party data to copy products for

its own line of goods. The subcommittee uncovered similar behavior

in its interviews with Amazon's employees.

The report lays out Google's dominance of the search industry,

where it commands default placement for 87% of desktop search

traffic and more than 99% of mobile traffic.

The subcommittee attributed that to Google's ability to make

billions of dollars in annual payments to companies like Apple and

Firefox to keep Google the first choice even on rival browsers.

Separately, the findings echoed longstanding complaints from

businesses that Google's shift to trolling the internet for facts

that it can place at the top of the search page has been a blow to

websites that would otherwise have received incoming traffic from

the search engine to answer such queries.

"With the flip of a switch," one website owner told the

subcommittee, "Google turned our original content into its own

content."

Google has said previously that changes to search were designed

to get information to users faster. Alphabet produced 1,135,398

documents for House investigators, though the report noted that

"subcommittee staff did not view this volume as a proxy for

quality."

The report concluded that Apple exerts monopoly power as it

controls software distribution to more than half the mobile devices

in the U.S. and allows it to generate "supra-normal profits" from

its App Store and service business.

Apple has said in the past that its restrictions on mobile app

sales for its devices are necessary to control the quality of user

experience.

The subcommittee's findings cast a harsh appraisal of Apple's

control over the App Store, saying the iPhone company uses its

gatekeeper power in ways that harm third-party software developers

and favor its own apps on its devices. The report noted an article

by the Journal last year that said Apple's app routinely appeared

first in search results in its App Store ahead of rivals.

The report also casts doubt on Facebook's argument that its apps

could never be separated, a case it made in a summary of its legal

arguments reported by the Journal on Sunday. The report cites an

unnamed former Instagram employee who told the subcommittee that

Facebook and Instagram could potentially be pulled apart. "It's not

building a skyscraper; it's turning something on and off," the

employee said.

Ahead of the report's release, the Consumer Technology

Association, an industry group, said in a statement the tech sector

is "the reason for America's global innovation leadership and

powers our economy" and warned against action targeting its most

successful companies. "To undercut our nation's 'crown jewel'

companies would take our competitiveness out at the knees."

Republicans on the House panel are split about the report's

policy recommendations. Some believe U.S. antitrust laws don't need

to be changed, while others support some of the Democrats'

recommendations. Rep. Ken Buck (R., Colo.) said antitrust laws need

updating, but "it's very important that we proceed with a scalpel

and not a chain saw."

--Rob Copeland, Tim Higgins, Dana Mattioli, John D. McKinnon and

Jeff Horwitz contributed to this article.

Write to Ryan Tracy at ryan.tracy@wsj.com

(END) Dow Jones Newswires

October 06, 2020 20:22 ET (00:22 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

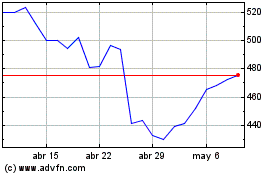

Meta Platforms (NASDAQ:META)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Meta Platforms (NASDAQ:META)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024