By Dana Mattioli

A House antitrust panel took direct aim at one of Amazon.com

Inc.'s defenses against scrutiny of its retail dominance and

detailed allegations about the company wielding its market

power.

In a report issued Tuesday, the Democratic-led House Antitrust

Subcommittee challenged the company's stance that its share of

total U.S. retail shopping is the most relevant way to understand

its size. The committee asserted repeatedly that Amazon dominates

U.S. e-commerce. The company's market share of U.S. online sales is

often said to be about 39%, but the figure is as high as 74% across

a range of product categories, according to the report.

"Amazon functions as a gatekeeper for e-commerce," the report

said. The document provided details that it says shows how Amazon

uses its size and platform to thwart competitors, dedicating more

pages to its findings about the Seattle-based technology giant than

the other large rivals featured in the probe.

Amazon addressed the findings in a blog post. "All large

organizations attract the attention of regulators, and we welcome

that scrutiny. But large companies are not dominant by definition,

and the presumption that success can only be the result of

anti-competitive behavior is simply wrong."

The House panel argued that Amazon has amassed "monopoly power"

over sellers on its site, bullied retail partners and improperly

used seller data to compete with rivals. The subcommittee cited

examples that it said showed how Amazon has launched copycat

versions of products sold by third-party merchants on its platform.

The report also accused the company of blocking search advertising

on its site for competitors and attempting to "replicate some of

the startups it meets with or invests in."

Several investigative articles by The Wall Street Journal

published earlier this year accused the company of similar actions.

Amazon launched an internal investigation following the story into

whether its employees used seller data to inform the company's

private-label strategy.

Amazon Chief Executive Jeff Bezos, in testimony before the House

subcommittee this summer, said the investigation was continuing and

that the company has a policy of prohibiting employees from using

data on specific sellers to inform decisions about launching or

developing its own products. "I can't guarantee you that that

policy has never been violated," Mr. Bezos said then.

The company has told the Journal that it doesn't use

confidential information from companies it meets with. It didn't

directly address the question of whether or not it hobbles rivals'

marketing on its website.

The committee suggested legislation that could cause Amazon to

exit business lines, such as its private-label or devices

businesses, that compete with sellers on its platform. Such

legislation would be a blow for Amazon, which has developed more

than 100,000 private-label products and made significant

investments in the areas of smart devices, such as its Echo

speakers.

The report is the culmination of a more-than-yearlong review of

Amazon, Apple Inc., Facebook Inc. and Alphabet Inc.'s Google and

whether these companies engage in anticompetitive behavior.

"The investigation revealed that the dominant platforms have

misappropriated the data of third parties that rely on their

platforms, effectively collecting information from customers only

to weaponize it against them as rivals," the report said.

The report noted the example of a seller of apparel for

construction workers and firefighters. The seller found success

with a new item and was making about $60,000 a year selling it on

Amazon's site, said Rep. David Cicilline (D., R.I.), who chairs the

subcommittee.

"One day, they woke up and found that Amazon had started listing

the exact same product, causing their sales to go to zero

overnight," Mr. Cicilline said to Mr. Bezos at the hearing. "Amazon

had undercut their price, setting it below what the manufacturer

would generally allow it to be sold," the congressman said.

Citing interviews and emails, the subcommittee accused Amazon of

discriminating against major competitors through its advertising

arm and using its dominance in some areas to extract advantages in

others.

Last month, the Journal reported that Amazon was limiting the

ability of some device competitors, such as Roku Inc., to place

certain ads on its website, according to Amazon employees and

executives at rival companies and advertising firms. Roku, which

makes devices that stream content to TVs, couldn't buy Amazon ads

tied to its own products, the article said, citing people familiar

with the matter. Amazon told the Journal that it is common practice

among retailers to choose which products they promote on their

websites.

Multiple agencies are looking into whether the mergers and

acquisitions process has been weaponized by technology companies

who buy small competitors and stifle innovation. The report cited

evidence that it says shows Amazon using its venture-capital arm to

"inform and improve Amazon's smart home ecosystem." The Journal

reported in July that since launching its Alexa Fund

venture-capital arm in 2015, Amazon had a pattern of meeting with

startup founders for deal meetings and investments and then

introducing competing products and services, according to

interviews with founders and investors.

In some cases, as the Journal reported, Amazon's decision to

launch a competing product devastated the business in which it

invested. In other cases, it met with startups about potential

takeovers, sought to understand how their technology works, then

declined to invest and later introduced similar Amazon-branded

products, according to some of the entrepreneurs and investors.

The congressonal report said Amazon "displayed a lack of candor"

and transparency when communicating with the committee over the

course of its investigation.

Write to Dana Mattioli at dana.mattioli@wsj.com

(END) Dow Jones Newswires

October 07, 2020 11:37 ET (15:37 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

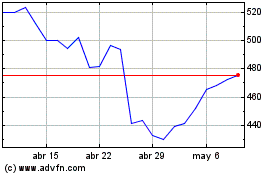

Meta Platforms (NASDAQ:META)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Meta Platforms (NASDAQ:META)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024