BoE's Vlieghe Sees Need For More Stimulus As Pandemic Poses Downside Risks

20 Octubre 2020 - 3:44AM

RTTF2

Bank of England policymaker Gertjan Vlieghe said additional

monetary stimulus is needed as the coronavirus pandemic poses

downside risks to the economy.

It appears that the downside risks to the economic outlook are

starting to materialize, he said in a speech on Tuesday. "The

outlook for monetary policy is skewed towards adding further

stimulus."

He observed that the speed of the recovery is likely to be

slower while the virus prevalence remains a concern, with risks of

a higher and/or more prolonged trajectory of job losses.

Since the negative interest rate has not been tried in the UK,

there is uncertainty about its effectiveness, and the monetary

policy committee is not at a point yet when it can reach a

conclusion on this issue, the banker said.

According to Vlieghe, the risk that negative rates end up being

counterproductive to the aims of monetary policy is low.

Although additional asset purchases remain an available policy

tool, the effects of quantitative easing are state-dependent, and

that a key channel through which QE works is by affecting expected

future real interest rates, which are already very low, Vlieghe

noted.

The economy is going through a process of unprecedented

reallocation across sectors. The scale and persistence of the

reallocation associated with both the pandemic and with Brexit, is

likely to weigh on employment and investment.

The risks to the economic outlook are skewed towards a longer

period of labour market slack with weak inflationary pressure.

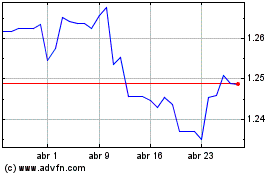

Sterling vs US Dollar (FX:GBPUSD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

Sterling vs US Dollar (FX:GBPUSD)

Gráfica de Divisa

De Abr 2023 a Abr 2024