Princess Private Equity Holding Ltd NAV increases by 3.8% in September (2505D)

27 Octubre 2020 - 1:00AM

UK Regulatory

TIDMPEY TIDMPEYS

RNS Number : 2505D

Princess Private Equity Holding Ltd

27 October 2020

News Release

Guernsey, 27 October 2020

NAV increases by 3.8% in September

-- Princess Private Equity Holding Limited's (Princess) net

asset value increased by 3.8% to EUR 12.96 per share

-- Portfolio developments (+4.2%) and currency movements were positive (+0.3%)

-- Princess invested EUR 5.0 million during the month and

received distributions of EUR 11.2 million

In September, Princess' NAV increased in value by 3.8%. The

largest value driver was Foncia, a France-based property management

and real estate services provider. Foncia continues to steadily

ramp-up its activities following the COVID-19-related disruptions

earlier in the year, generating positive revenue growth for the

twelve months ended 31 August 2020, while maintaining an EBITDA

margin of around 25%. There is no expected long-term COVID-19

impact on the business given that the majority of the revenue is

recurring, driven by its stock of more than two million properties

under management. Another positive value driver was Permotio

International Learning (Permotio). After several months of

successful distance learning, Permotio's students are gradually

returning to school, with the vast majority of schools having

reopened by September. Looking ahead Permotio expects to generate

like-for-like EBITDA growth of more than 10% for the financial year

to August 2021 reflecting a combination of fee increases and cost

savings, while continuing to expand its global platform via

M&A.

EUR 4.5 million was invested in Rovensa. On behalf of its

clients, Partners Group acquired a major equity stake in Rovensa, a

leading provider of specialty crop nutrition, biocontrol and crop

protection products, in a transaction which valued the company at

an enterprise value of around EUR 1.1 billion. The company has

approximately 1'440 employees and works with over 1'000 customers

in more than 80 countries. Rovensa operates in the agricultural

sub-sector, which has a low correlation to GDP and has demonstrated

its resilience during the COVID-19 outbreak. Food production has

been mostly uninterrupted during the pandemic given sustained

demand for food, stability of food prices and the desire of

governments to ensure a robust food supply chain. Following the

acquisition, Partners Group will work closely with Rovensa to

continue developing its biological solutions portfolio and to

position the business as a clear global leader, while focusing on a

variety of strategic topics, from sales efficiency to product

development.

Princess received distributions of EUR 11.2 million during the

month, of which EUR 6.5 million was received from GlobalLogic, a

global provider of software product engineering services.

GlobalLogic remains conservatively capitalized with cash available

to support the company's M&A program. EUR 1.9 million was

received from the sale of the remaining shares in Ceridian, marking

the full exit at an investment multiple of 3.7x the initial EUR 4.5

million investment in 2007. The balance of EUR 2.8 million was

received from Princess' mature legacy fund portfolio and other

direct investments.

Post month-end, Princess made a EUR 50 million commitment to

Partners Group Direct Equity 2019 program ("the Program"). The

Program will continue the strategy of predecessor programs,

constructing a global portfolio of approximately 20 companies in

the extended mid-market. The strategy seeks to identify companies

which are well-positioned to benefit from transformative growth

trends and to develop them through an active value creation

strategy.

Further information is available in the monthly report, which

can be accessed via: http://www.princess-privateequity.net/ .

Ends.

About Princess

Princess is an investment holding company founded in 1999 and

domiciled in Guernsey. It invests, inter alia, in private equity

and private debt investments. Princess is managed in its investment

activities by Partners Group, a global private markets investment

management firm with USD 96 billion in investment programs under

management in private equity, private debt, private real estate and

private infrastructure. Princess aims to provide shareholders with

long-term capital growth and an attractive dividend yield. Princess

is traded on the Main Market of the London Stock Exchange (ticker:

PEY for the Euro Quote; PEYS for the Sterling Quote).

Contacts

Princess Private Equity Holding Limited:

princess@partnersgroup.com

www.princess-privateequity.net

Registered Number: 35241

LEI: 54930038LU8RDPFFVJ57

Investor relations contact

George Crowe

Phone: +44 (0)20 7575 2771

Email: george.crowe@partnersgroup.com

Media relations contact

Jenny Blinch

Phone: +44 207 575 2571

Email: jenny.blinch@partnersgroup.com

www.partnersgroup.com

This document does not constitute an offer to sell or a

solicitation of an offer to buy or subscribe for any securities and

neither is it intended to be an investment advertisement or sales

instrument of Princess. The distribution of this document may be

restricted by law in certain jurisdictions. Persons into whose

possession this document comes must inform themselves about and

observe any such restrictions on the distribution of this document.

In particular, this document and the information contained therein

are not for distribution or publication, neither directly nor

indirectly, in or into the United States of America, Canada,

Australia or Japan.

This document may have been prepared using financial information

contained in the books and records of the product described herein

as of the reporting date. This information is believed to be

accurate but has not been audited by any third party. This document

may describe past performance, which may not be indicative of

future results. No liability is accepted for any actions taken on

the basis of the information provided in this document. Neither the

contents of Princess' website nor the contents of any website

accessible from hyperlinks on Princess' website (or any other

website) is incorporated into, or forms part of, this

announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NAVQQLFLBBLEFBQ

(END) Dow Jones Newswires

October 27, 2020 03:00 ET (07:00 GMT)

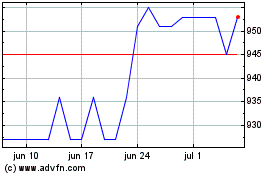

Princess Private Equity (LSE:PEYS)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

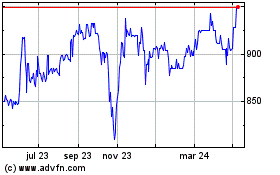

Princess Private Equity (LSE:PEYS)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024