Software Firm Coupa to Buy Supply-Chain Tech Provider Llamasoft

02 Noviembre 2020 - 8:49AM

Noticias Dow Jones

By Jennifer Smith

Coupa Software Inc. is buying supply-chain planning company

Llamasoft Inc. for roughly $1.5 billion, as the pandemic brings

greater attention to technology that helps businesses make

operations from raw materials sourcing to distribution more

resilient.

The acquisition expands the supply-chain capabilities of San

Mateo, Calif.-based Coupa, whose cloud-based enterprise software

helps companies manage their business spending. The deal, which

Coupa expects to close Monday, will give customers such as BMW

Group AG, Airbus SE and Procter & Gamble Co. access to

Llamasoft's artificial intelligence-powered technology.

Llamasoft's software helps companies model, design and optimize

their supply-chain networks, using AI and algorithms to map out

scenarios and mitigate potential risks. The Ann Arbor, Mich.,

company is backed by private-equity fund TPG Capital, which took a

stake in 2017, and counts Boeing Co., Danone SA and Home Depot Inc.

among its customers.

This is Coupa's third acquisition this year. The company's

platform helps businesses manage procurement, invoicing, payments,

sourcing and other spending functions and has more than $1.95

trillion in cumulative spending by its customers under

management.

"We've pulled all these siloed processes together," Coupa CEO

Rob Bernshteyn said. "We're like Salesforce, but on the

supply-chain management side of the house."

The deal, over time, will give Coupa's customers the ability to

redesign and plan their supply chains through Llamasoft's software,

and allow Llamasoft's clients to execute supply-chain decisions and

manage supplier relationships through Coupa's platform, which has a

network of more than 5 million suppliers.

Events this year, including shortages of goods from household

staples to industrial components, amid coronavirus-driven

lockdowns, demonstrated that businesses must be able to respond

quickly to supply volatility and shifting demand, Mr. Bernshteyn

said. "Supply chains need to be sorted out in 2021 and 2022, and we

want to be a strategic partner to the companies," he said.

The turmoil in supply chains is drawing more investment in

software and technology that can help companies minimize risks and

build in backstops, such as holding additional inventory or adding

suppliers in different locations.

Supply-chain software provider E2open LLC said last month it

plans to go public through a merger with a blank-check company that

would value E2open at about $2.57 billion. In April, private-equity

firm KKR & Co. invested $100 million in o9 Solutions Inc.,

valuing the cloud-based supply-chain management software maker at

more than $1 billion.

Write to Jennifer Smith at jennifer.smith@wsj.com

(END) Dow Jones Newswires

November 02, 2020 09:34 ET (14:34 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

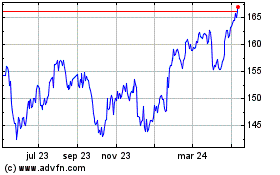

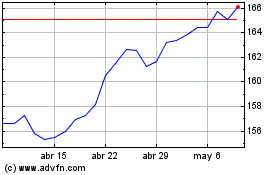

Procter and Gamble (NYSE:PG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Procter and Gamble (NYSE:PG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024