TIDMPRES

RNS Number : 0172E

Pressure Technologies PLC

03 November 2020

3 November 2020

Pressure Technologies plc

("Pressure Technologies" or the "Group")

FULL YEAR TRADING UPDATE

Pressure Technologies (AIM: PRES), the specialist engineering

group, provides a trading update for the year to 3 October

2020.

Whilst the Covid-19 pandemic has brought significant challenges

to our markets and operations over the course of the financial

year, the Group continues to make good progress against strategic

priorities. The investments made since 2019 have underpinned

growing diversification and sustainability in both divisions this

year, evidenced by new customer acquisitions and new market

development. However, tougher trading conditions, Covid-19

disruption and the previously announced deferral of revenue and

profit for a defence contract into FY21 resulted in a reduction in

Group revenue for the year to approximately GBP25 million (2019:

GBP28.3 million) and overall the Group is expected to deliver an

adjusted(1) operating loss for the year (2019: GBP2.2 million

profit).

CHESTERFIELD SPECIAL CYLINDERS

The Chesterfield Special Cylinders ("CSC") division delivered

revenue of approximately GBP11 million (2019: GBP13.9 million) and

is expected to break even at the adjusted operating profit level.

The phasing of major defence contracts resulted in significantly

lower revenue in the year, driving lower overall gross margin

performance, which was further compounded by the previously

announced deferral of revenue on a defence contract from Q4 FY20

into Q1 FY21.

The diversification of end markets in CSC continues to reduce

the historical dependence on the oil and gas sector and over the

year, CSC secured major contracts with established UK and export

defence customers and won a second major contract to supply

nitrogen storage solutions for UK nuclear power customer EDF

Energy, as previously announced. Good progress also continues to be

made in the rapidly developing hydrogen energy market. Three

contracts for transport refuelling high-pressure storage were

successfully completed over the past two years for customers

including ITM Power and Haskel, with three further projects

currently in production.

As expected, following a strong start to the year, CSC's

Integrity Management services were heavily impacted by Covid-19

travel restrictions from March 2020 onwards, causing disruption to

ongoing overseas projects and the deferral of several UK

deployments. Despite these challenges, strong growth was delivered

for the fifth consecutive year, driven by in-situ inspection and

recertification projects for the UK submarine and surface vessel

fleets.

PRECISION MACHINED COMPONENTS

Despite very challenging trading conditions in the oil and gas

market during the second half of the year, the Precision Machined

Components ("PMC") division delivered full-year revenue of

approximately GBP14 million (2019: GBP14.4 million), but is

expected to make an operating loss, driven by lower than expected

gross margins, as poor operational performance in the first half of

the year failed to improve in the second half.

A depressed oil price has resulted in continued disruption and

uncertainty for our oil and gas OEM customers and the deferral of

project spend. Consequently, order intake in the second half fell

sharply and the divisional order book at the start of FY21 was less

than half the pre-pandemic value six months earlier. Significantly

higher indirect costs and depreciation following two years of

growth investment were not fully offset by the proactive steps

taken early in the second half of the year to limit the impact of

trading conditions on the division. These actions included closure

of the persistently loss-making Quadscot operation, management

restructuring and the implementation of other cost saving and cash

preservation measures, whilst seeking to protect core capability.

Whilst the consolidation of the Quadscot operation and order book

into our Roota facility through the peak of Covid-19 disruption

took longer than expected and adversely impacted divisional margins

and customer delivery schedules, this transition has now resulted

in a lower cost base and increased utilisation of capacity across

the remaining sites.

Further progress was made during the year with diversifying the

customer base and extending our range of precision machined

components for specialised oil and gas applications. This includes

long-term strategic supply agreements being signed or under

negotiation with key OEM customers, demonstrating their confidence

in PMC's products and service levels as they seek to consolidate

their approved supplier lists. The investment in new production

management systems and the use of data to drive production

scheduling and customer reporting is starting to deliver

improvements, most notably to on-time delivery performance with key

customers. The investment in production engineering capability and

new advanced machining centres have also helped deliver significant

time and cost savings in the production of familiar and new

component designs, which will contribute to improved margins and

competitiveness through shorter lead times.

The current trading performance and medium-term outlook of our

OEM customers regarding the depressed oil and gas market has driven

an impairment review of the goodwill and other intangible assets of

the PMC division as they relate to Al-Met, Quadscot, Roota and

Martract subsidiaries, acquired by the Group between 2010 and 2016.

Lower than previously considered growth rates and higher

risk-factored discount rates applied to future cash flows have

resulted in a non-cash exceptional impairment to goodwill and other

intangible assets of approximately GBP14 million, which will be

reflected in the FY20 Group results.

BANKING AND NET DEBT

We remain in constructive and supportive dialogue with Lloyds

Bank regarding the amendment and extension of the Group's Revolving

Credit Facility (RCF).

On 3 October 2020, total net borrowings (excluding right of use

assets) reduced to GBP6.4 million (28 September 2019: GBP11.4

million). The Group's GBP12.0 million RCF was drawn at GBP6.8

million (28 September 2019: GBP10.8 million). Cash and cash

equivalents increased to GBP3.4 million (28 September 2019: GBP2.2

million) taking net RCF debt down to GBP3.4 million (28 September

2019: GBP8.6 million). Finance leases on 3 October 2020 increased

slightly to GBP3.0 million (28 September 2019: GBP2.8 million). The

right of use asset debt recognised in the year under IFRS 16 as

leases totalled GBP1.1 million at the year end.

The significant reduction in total net borrowings was driven

principally by the receipt in February 2020 of a GBP2.1 million

prepayment of the Greenlane Renewables Inc. Promissory Note with

associated interest and the receipt in July 2020 of GBP2.6 million

from the sale of our shareholding in Greenlane Renewables Inc.

Receipt of the outstanding Promissory Note balance of GBP3.1

million is expected in the second half of FY21.

STRATEGY AND OUTLOOK

The Group's strategy remains focused on the diversification,

continued development and organic growth of both divisions.

CSC has a strong order book going into FY21, with high-margin

projects, including the defence contract deferred from FY20,

weighted to the first half of the year. We will continue to drive

the operational improvements that underpin margin growth from

established defence and industrial contracts, while strengthening

our capability and readiness for further growth in Integrity

Management services. Periodic inspection regimes will require

product revalidations as current travel restrictions are lifted and

the Group expects to see continued growth in Integrity Management

services in defence, nuclear power generation and hydrogen energy

sectors, where risk management and asset availability are

paramount.

Hydrogen energy storage remains an area of strategic focus and

significant future growth potential for the Group. The progress

already made in this rapidly developing market is expected to

continue as governments increasingly acknowledge the role of

hydrogen in the overall energy mix, with its contribution to

meeting net zero carbon targets in transportation and in

decarbonising industry. In addition to the transport refuelling

station projects successfully completed or currently in production,

CSC has a strong pipeline of opportunities with new and existing

partners, including the previously announced five-year framework

agreement with Shell Hydrogen for their European refuelling

stations. These opportunities are supported by the ongoing

development of products and services to reduce through-life cost

and risk for the operators of static and mobile hydrogen

storage.

In PMC, our priority remains to stabilise and protect the

consolidated operations, complete operational improvements and

maintain service levels for our growing base of OEM customers, as

we seek to conserve cash and recover profitability. As we

anticipate at least a further year of challenging trading

conditions in a depressed oil and gas market, we continue to

appraise opportunities for our specialist engineering capability in

other sectors.

Chris Walters, Chief Executive of Pressure Technologies

commented:

" Despite challenging trading conditions, we have continued to

make strategic progress through FY20 with increased diversification

of the customer base in both divisions.

Recent major contract wins and the further growth in Integrity

Management services have strengthened the outlook for CSC. I am

also really encouraged by the progress made in the rapidly

developing hydrogen energy sector, where our successful development

of products and services for high-pressure hydrogen storage has

been followed by new projects and a growing pipeline of

opportunities. A focus on decarbonisation by governments worldwide

is establishing hydrogen firmly in the global energy mix and I

expect to see this sector become an increasingly significant part

of the Group's business over the next few years.

Depressed oil and gas markets and slower than expected

turnaround of operational performance have impacted the PMC

division and the outlook remains uncertain. Management actions are

focused on maintaining customer service levels and completing

operational improvements, while preserving cash and protecting the

capabilities built over the past two years.

With further UK-wide lockdown restrictions announced in the last

week, Covid-19 continues to impact our target markets, our

operations and our people. I would like to thank all our employees

for their continued hard work and commitment through these

challenging times."

Note

(1) Adjusted operating loss is stated before exceptional items.

The Board believes exceptional items should be separately

identified on the face of the income statement to assist in

understanding the underlying financial performance achieved by the

Group. For FY20, exceptional items included costs associated with

divisional and Group restructuring, the closure of an operational

facility, profit on sales of assets and investments and impairment

charges related to goodwill, intangible assets and promissory note

receivables.

ENDS

For further information, please contact:

Pressure Technologies plc Tel: 0114 257 3616

Chris Walters, Chief Executive PressureTechnologies@houston.co.uk

N+1 Singer (Nomad and Broker) Tel: 0207 496 3000

Mark Taylor / Carlo Spingardi

Houston (Financial PR and Investor Tel: 0204 529 0549

Relations)

Kate Hoare / Anushka Mathew /

Ben Robinson

The information contained within this announcement is deemed by

the Group to constitute inside information as stipulated under the

Market Abuse Regulations (EU) No. 596/2014 ("MAR"). Upon the

publication of this announcement via a Regulatory Information

Service ("RIS"), this inside information is now considered to be in

the public domain

COMPANY DESCRIPTION

www.pressuretechnologies.com

With its head office in Sheffield, the Pressure Technologies

Group was founded on its leading market position as a designer and

manufacturer of high-integrity, safety-critical components and

systems serving global supply chains in oil and gas, defence,

industrial gases and hydrogen energy markets.

The Group has two divisions, Chesterfield Special Cylinders and

Precision Machined Components.

Chesterfield Special Cylinders (CSC) - www.chesterfieldcylinders.com

-- Chesterfield Special Cylinders, Sheffield, includes CSC

Deutschland GmbH and Chesterfield Special Cylinders Inc.

Precision Machined Components (PMC) - www.pt-pmc.com

-- Precision Machined Components includes the Al-Met, Roota

Engineering, Quadscot Precision Engineers and Martract brands.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTBLLLBBFLLFBX

(END) Dow Jones Newswires

November 03, 2020 02:00 ET (07:00 GMT)

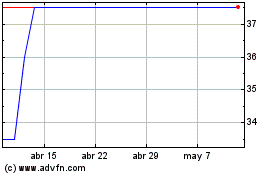

Pressure Technologies (LSE:PRES)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Pressure Technologies (LSE:PRES)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024