TIDMWEIR

RNS Number : 0173E

Weir Group PLC

03 November 2020

The Weir Group PLC trading update for the third quarter ending

30 September 2020(1)

Underlying(2) Q3 activity robust

-- Continuing orders(3) down 11% excluding record Q3'19 Iron Bridge order

o Minerals AM orders down 5%; revenues stable

o ESCO orders down 24%; revenues more robust, down 14%, and

modestly up Q2 to Q3

-- Demand strengthened towards the end of the quarter

-- Longer-term bid activity improving, reflecting positive fundamentals for mining

-- Transforming Weir into a premium mining technology business

o As previously announced, proposed $405m sale of the Oil &

Gas division; Circular to be published

Jon Stanton, Chief Executive, commented:

"Our priority remains the health and well-being of our people

and communities while continuing to fully support our customers and

I am proud of the ongoing commitment of my colleagues around the

world. Mining markets remained relatively robust in the third

quarter and while Covid-19 continued to impact ore production

levels and customer decision making, there was a strengthening in

demand towards the end of the period.

The positive long-term fundamentals for our markets are

unchanged, including the key role of essential metals in building

the new economy and the need for mining operations to reduce their

environmental impact. This is reflected in our strengthening

project pipeline, particularly for our smarter, more efficient and

sustainable solutions.

We were delighted to agree the sale of the Oil & Gas

division, enabling the Group's transformation into a focused,

premium mining technology business. The transaction remains on

track for completion in 2020."

Analyst and investor conference call

A conference call for analysts and investors will be held at

0800 GMT on Tuesday 3 November 2020 to discuss this statement.

Participants can join the call by registering in advance by

visiting www.global.weir/investors and following the link on the

page. A recording of this conference call will be available until

Tuesday 17 November 2020.

Third quarter review - Continuing Operations

The Group continued to prioritise safety and well-being with all

facilities operational and able to support customers throughout the

period despite ongoing Covid-19 challenges. Demand in mining

markets remained broadly resilient, with demand strengthening

towards the end of the quarter helped by both the essential status

of the industry and supportive commodity prices. A small number of

mines remained closed and many are operating with skeleton crews

and limited third-party access due to Covid-19 restrictions. This

translated into overall ore production levels that remain below

pre-Covid volumes and slower customer decision making.

In total, the Group's third quarter orders were 11% lower on an

underlying(2) basis (-26% as reported). Underlying OE orders were

down 8% (-55% as reported) while AM orders were down 12%. The

Continuing Operations' book-to-bill ratio in the period was 0.82

reflecting the ongoing delivery of the Iron Bridge OE project and

destocking. The Group remains on track to deliver its previously

announced 2020 cost saving programme. Full year guidance remains

withdrawn due to ongoing Covid-19 uncertainty.

Divisional review

Minerals

Underlying(2) divisional orders were resilient, down 5%,

supported by robust mining demand. As reported orders were down

27%, reflecting the record c.GBP100m Iron Bridge order in the prior

year period. At a regional level demand was good in South America,

Russia and Central Asia but more subdued in Africa and Australia,

principally due to Covid-19 challenges. Underlying OE orders were

down 6% (-57% as reported) with good contract wins for the

division's crushers, pumps and tailings technology, more than

offset by reduced demand for integrated solutions that rely on mine

site access to complete plant productivity audits. More broadly,

the division's longer-term project pipeline strengthened further,

reflecting mining customers' confidence in their future prospects,

with the number of firm bids increasing towards the end of the

quarter. AM orders were down 5% driven by ore production trends,

some destocking and the deferral of non-essential maintenance, but

strengthened towards the end of the period. AM revenues were stable

year-on-year and modestly higher sequentially. The division

continued to execute on its GBP30m current year cost savings

programme, supporting operating leverage. Book-to-bill in the

period was 0.80 as a result of higher OE revenues as the division

delivers the Iron Bridge contract, and some destocking.

Assuming commodity prices remain supportive and we do not see a

significant increase in disruption to either Weir or our customers'

operations from Covid-19, we would expect activity levels to remain

robust for the remainder of 2020.

ESCO

Divisional orders were down 24% year-on-year but showed

improvement sequentially from Q2 to Q3. This was in line with

mining machine utilisation levels that benefited from slightly

increased activity towards the end of the quarter, but overall

utilisation was on average c.12% below pre-Covid levels in the

period. North America was most significantly impacted, principally

as a result of lower coal and oil sands demand, and the gradual

return to operation of iron ore customers. Year-on-year performance

also reflected the impact of customers building stock levels in Q3

2019 as divisional foundry upgrades temporarily extended the

division's lead times. As expected, infrastructure markets remained

subdued, although sequential improvement was also seen in core

consumable products. Revenues, which were not impacted by

destocking and better reflect underyling activity, were down 14%,

more in line with machine utilisation trends and also showed a

modest improvement sequentially Q2 to Q3. ESCO's GBP9m 2020 cost

savings programme remains on track and the division also benefited

from operational efficiencies as a result of previous foundry

investment, both of which underpinned margins. Its book-to-bill was

0.88 and improved towards the end of the period.

The outlook for ESCO's mining end markets is consistent with

Minerals. While conditions in infrastructure markets have

stabilised recently, the pace of further recovery will be modest

and dependent on the level of future Covid-19 restrictions, which

remain uncertain.

Discontinued operations - Oil & Gas

As expected, the third quarter saw improved demand in North

America from the record lows of Q2. However, with North American

land rig count down c.70% year-on-year, activity levels remained

extremely low. Divisional orders fell 56% with OE down 45% and AM

down 60%.

An agreement to sell the Oil & Gas division to Caterpillar

Inc. for an enterprise value of $405m, subject to customary working

capital and debt-like adjustments, was announced on 5 October 2020.

Completion is expected by the end of 2020. A separate Circular

relating to the sale is being issued to shareholders today.

Net debt

Net debt at 30 September 2020 was higher than that reported at

30 June 2020 reflecting normal seasonal patterns.

Board Changes

As previously announced, Non-Executive Director Cal Collins

stepped down from the Board in September 2020. The Group has also

announced that Srinivasan Venkatakrishnan and Ben Magara will join

the Board as Non-Executive Directors with effect from 19 January

2021. Srinivasan, who is popularly known as Venkat, previously

served as CEO of both Vedanta Resources plc, the diversified global

natural resources company, and AngloGold Ashanti Limited, one of

the world's largest gold producers. Ben served as CEO of Lonmin

plc, the then third largest global platinum producer, having

previously held a number of senior mining executive roles for Anglo

American plc.

Notes:

1. Financial information is given for the three months ended 30

September 2020 and relates to continuing operations.

2. Adjusted to exclude the impact of the c.GBP100m Iron Bridge

original equipment order in Q3 2019

3. Orders are reported on a constant currency basis.

4. Continuing Operations excludes Oil & Gas which has been

classified as held for sale since 5 October 2020 and is reported in

Discontinued Operations.

Enquiries:

Investors: Stephen Christie +44 (0) 141 308 3707

Media: Raymond Buchanan +44 (0) 141 308 3781

Citigate Dewe Rogerson: Chris Barrie +44 (0) 207 638 9571

/ Kevin Smith Weir@citigatedewerogerson.com

-------------------------------

About The Weir Group PLC

Founded in 1871, The Weir Group PLC is a premium mining

technology business whose purpose is to make customers' operations

more sustainable and efficient. The Group is ideally positioned to

benefit from structural trends that support long-term demand for

its technology including the need for more essential metals to

support economic development and carbon transition. Weir's highly

engineered technology enables these critical resources to be

produced using less energy, water and waste - reducing customers'

total cost of ownership. The Group has c.13,000 employees in over

50 countries.

Weir's ordinary shares trade on the London Stock Exchange

(ticker: WEIR LN) and its American Depositary Receipts trade

over-the-counter in the USA (ticker: WEGRY).

Appendix 1 - Continuing Operations(1) quarterly order trends

(constant currency)

Reported growth Like-for-like growth(2)

2019 2019 2020 2020 2020 2019 2019 2020 2020 2020

Division Q3 Q4 Q1 Q2 Q3 Q3 Q4 Q1 Q2 Q3

-------------------- ----- ----- ----- ----- ----- ----- ----- ----- ----- -----

Original Equipment 72% 20% -13% -9% -57% 72% 20% -13% -9% -57%

Aftermarket -5% 8% -1% -6% -5% -5% 8% -1% -6% -5%

Minerals 17% 12% -5% -7% -27% 17% 12% -5% -7% -27%

-------------------- ----- ----- ----- ----- ----- ----- ----- ----- ----- -----

Original Equipment 83% 54% 25% 16% -23% - - 25% 16% -23%

Aftermarket 22% -18% -8% -28% -24% - - -8% -28% -24%

ESCO 25% -16% -7% -26% -24% - - -7% -26% -24%

-------------------- ----- ----- ----- ----- ----- ----- ----- ----- ----- -----

Original Equipment 72% 21% -11% -8% -55% 72% 20% -11% -8% -55%

Aftermarket 3% -1% -4% -13% -12% -5% 8% -4% -13% -12%

Continuing Ops 19% 4% -5% -12% -26% 17% 12% -5% -12% -26%

-------------------- ----- ----- ----- ----- ----- ----- ----- ----- ----- -----

Book to Bill 1.12 0.98 1.10 1.03 0.82 1.17 1.03 1.10 1.03 0.82

-------------------- ----- ----- ----- ----- ----- ----- ----- ----- ----- -----

1. Continuing Operations excludes Oil & Gas which has been

classified as held for sale since 5 October 2020 and is reported in

Discontinued Operations.

2. Like-for-like excludes the impact of acquisitions. ESCO was

acquired on 12 July 2018 and excluded from 2018 and 2019.

This information includes 'forward-looking statements'. All

statements other than statements of historical fact included in

this presentation, including, without limitation, those regarding

The Weir Group PLC's ("the Company") financial position, business

strategy, plans (including development plans and objectives

relating to the Company's products and services) and objectives of

management for future operations, are forward-looking statements.

These statements contain the words "anticipate", "believe",

"intend", "estimate", "expect" and words of similar meaning. Such

forward-looking statements involve known and unknown risks,

uncertainties and other important factors that could cause the

actual results, performance or achievements of the Company to be

materially different from future results, performance or

achievements expressed or implied by such forward-looking

statements. Such forward-looking statements are based on numerous

assumptions regarding the Company's present and future business

strategies and the environment in which the Company will operate in

the future. These forward-looking statements speak only as at the

date of this document. The Company expressly disclaims any

obligation or undertaking to disseminate any updates or revisions

to any forward-looking statements contained herein to reflect any

change in the Company's expectations with regard thereto or any

change in events, conditions or circumstances on which any such

statement is based. Past business and financial performance cannot

be relied on as an indication of future performance.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTKKBBNKBDBDDK

(END) Dow Jones Newswires

November 03, 2020 02:00 ET (07:00 GMT)

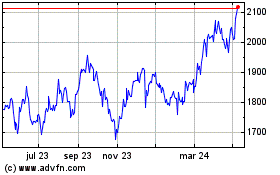

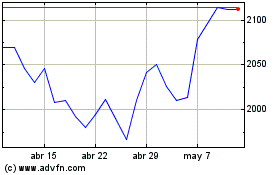

Weir (LSE:WEIR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Weir (LSE:WEIR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024