TIDMTIFS

RNS Number : 2993E

TI Fluid Systems PLC

05 November 2020

5 November 2020

TI Fluid Systems plc

Q3 2020 Trading Update

TI Fluid Systems plc, a leading global manufacturer of highly

engineered automotive fluid storage, carrying and delivery systems

for light vehicles issues a trading update for the third quarter

and nine months ended 30 September 2020.

Summary

-- Group Q3 revenues continued to outperform global light

vehicle production volumes by 2.2%, despite Q3 revenues decreasing

5.1% year over year (down 1.3% at constant currency)

-- Results supported by strong performances in the Asia Pacific region and FTDS segment

-- All production facilities in every region remain open and

continue to support customer production demands

-- Continued business resilience demonstrating effective cost

flexibility, free cash generation, balance sheet strength and

liquidity

-- Further progress with respect to electrification strategy,

with the launch of thermal management products on Volkswagen's

newly released ID.3 and ID.4 battery electric vehicles ("BEVs") and

additional new BEV business wins at accretive value per vehicle

content

-- 2020 full year guidance reinstated with an expectation of consistent year over year market outperformance and positive adjusted operating margins and free cash generation

-- Commitment to resume annual dividend payments in accordance

with policy as well as expectation of a 2020 interim dividend in Q1

2021 based on the strength of the Group's financial position and

prospects

Q3 Trading Results

Overall, global light vehicle production volumes trended better

in Q3 2020 compared to H1 2020 with OEM production activity

resuming in all regions following the COVID-19 related factory

shutdowns in H1. Q3 2020 Group revenue is recovering and decreased

by 5.1% year over year compared to an H1 2020 revenue decrease of

30.7%. At constant currency, revenue declined 1.3% compared to a

global light vehicle production decrease of 3.5%, representing an

outperformance of 220 bps for the quarter.

By region, on a constant currency basis, Europe and Africa

revenue decreased 11.4% compared to the same quarter last year with

continued weakness in Europe markets. North America had a marginal

increase of 0.8% compared to the same quarter last year while Asia

Pacific demonstrated solid revenue growth of 10.7% year over

year.

By division, on a constant currency basis, year over year, FCS

Q3 revenue declined 3.8% while FTDS Q3 revenue increased 1.9%,

benefitting mainly from new business launches particularly in the

Asia Pacific region.

Nine months ended 30 September 2020

The Group achieved revenue of EUR1,950.7 million in the nine

months ended September 2020, a decrease of 22.5% year over year. At

constant currency, revenue declined 21.5% compared to the same

period last year despite global light vehicle production declining

by 23.2% year over year. This 2020 year to date revenue

outperformance of 170 bps was mainly driven by solid performance in

the Asia Pacific region where the Group continues to benefit from

new business launches.

EURm 9 months 9 months % Change % Change

ended ended at constant

September September currency

2019 2020

Group Revenue 2,516.6 1,950.7 -22.5% -21.5%

----------- ----------- --------- -------------

By Region

----------- ----------- --------- -------------

Europe and Africa 1,016.6 727.4 -28.5% -28.2%

----------- ----------- --------- -------------

Asia Pacific 737.0 680.7 -7.6% -5.6%

----------- ----------- --------- -------------

North America 708.6 515.6 -27.2% -27.2%

----------- ----------- --------- -------------

Latin America 54.4 27.0 -50.4% -35.1%

----------- ----------- --------- -------------

By Segment

----------- ----------- --------- -------------

Fluid Carrying Systems ("FCS") 1,428.0 1076.9 -24.6% -23.3%

----------- ----------- --------- -------------

Fuel Tank and Delivery Systems

("FTDS") 1,088.6 873.8 -19.7% -19.1%

----------- ----------- --------- -------------

Source: October IHS Markit and company estimates

Revenue by Region

In Europe and Africa, revenue decreased 28.2% year over year at

constant currency while volumes decreased 28.6%.

This revenue outperformance of 40 bps was due to new business

launches in both divisions offsetting the impact of lower

volumes.

In Asia Pacific, revenue decreased 5.6% compared to last year at

constant currency while volumes decreased 17.8%. The region

achieved strong revenue outperformance of 1220 bps compared to the

market. The double digit outperformance was driven by the continued

success of our new business launches in fuel tanks, particularly in

China where the Group is benefiting from the automotive megatrends

of reduced evaporative emissions and increased fuel efficiency.

In North America, revenue decreased 27.2% year over year at

constant currency while volumes decreased 26.5%. The region's

revenue growth was 70 bps below market growth. Revenue was impacted

unfavourably by the lower volumes for the region as a result of the

customer shutdowns earlier in the year and also certain platforms

reaching end of production.

Revenue by Segment

FCS revenue decreased 23.3% compared to last year at constant

currency broadly in line with market performance. The overall

decrease in revenue was mainly driven by lower volumes in Europe

and North America regions where the segment is weighted more.

FTDS revenue decreased 19.1% year over year at constant currency

and outperformed the market by 410 bps. Strong performance in FTDS

is mainly driven by new business launches in Asia Pacific partially

offset by some programmes reaching the end of life in North

America.

Financial Position

The Group continues to demonstrate the resilience of its

business model and ability to generate solid adjusted cash flow

during these unprecedented times. Net debt is expected to continue

to reduce and liquidity strengthen as light vehicle production

volumes increase over time, with net leverage expected to also go

down steadily as earnings normalise. This dynamic provides the

Group with a solid platform and sufficient financial capacity from

which to continue our focus on investment to support growth and

positive returns.

The Group is pleased to announce that on 30 September 2020 it

successfully completed the amendment and extension of its existing

credit and debt facilities, moving maturity dates out to 2024.

Completing this transaction maintains existing levels of liquidity

and increases flexibility to support the Group's continued

resilience through all economic cycles and execution of its

electrification growth strategies.

COVID-19 Response

In response to the ongoing global COVID-19 pandemic, the Group

has continued to take steps to protect and prioritise the safety of

our employees, their families and our communities. Health and

safety remains our number one priority. This response includes the

donation of protective face masks, hand sanitation supplies and

other personal protection equipment to support communities in areas

we operate. We also are proud to supply our 'one size fits all' air

flex tube solution for the Ford/ 3M powered air-purifying

respiratory systems (PAPR) helping to meet the need for protective

equipment for front line health care workers in the United

States.

The Group is also following detailed health and safety protocols

with enhanced workplace and manufacturing measures such as

temperature checks, protective facial coverings, social distancing,

improved hygiene procedures and modified work proximities and

altered shift patterns.

We believe that these efforts have greatly limited the impact of

COVID-19 infection across our employees and has enabled all of the

Group's production facilities to safely re-open and remain

operational.

Electrification Strategy Progress

We are pleased to see the continued results of the successful

execution of our organic growth strategy and focus on BEVs. We have

launched into production a range of products for thermal fluid

management on Volkswagen's newly introduced ID.3 and ID.4 BEVs. In

addition to supplying Volkswagen various thermal coolant

assemblies, the Group is also proud to be the sole supplier of the

cabin comfort Co(2) heat pump valve unit assembly on this BEV

platform, an exciting new technology which delivers increased

operating efficiency and supports extended driving range over that

of a traditional refrigeration based cabin comfort system. We look

forward to the success of these vehicles and our growing content in

this important strategic BEV segment.

As further evidence of the Group's positive transition to

electrification, we are excited to see the continued growth in our

awarded value per vehicle ("VPV") for BEVs. VPVs for new BEV

business wins have increased from an average of EUR120 per vehicle

and a maximum of EUR400 per vehicle in 2018, to an average of

EUR135 per vehicle and maximum of EUR480 per vehicle in 2020,

clearly illustrating the upside contribution to the Group's growth

provided by the transition to electrification.

The Group also continues to win new business awards for BEV

programs with a wide range of global and regional OEMs across all

three major light vehicle production regions. These continued wins

further demonstrate our ability to meet the fluid handling and

thermal management needs of all propulsion modes including

electrification. As mentioned previously in our half year results

for 2020 the Group has a significant representation of thermal

product content on key BEVs launching over the next three

years.

2020 Outlook

Following the strong performance in the third quarter, we

believe that we now have sufficient visibility to provide guidance

for our full year 2020 expectations. The Group's extensive cost

reduction and cash preservation activities continue to support the

optimization of returns in the current depressed volume

environment, and we expect our fixed cost reduction and

restructuring actions to provide ongoing competitiveness and the

ability to return to double digit profitability at lower overall

light vehicle production levels.

For 2020, excluding the impact of currency movements, we expect

revenue to continue to outperform global light vehicle production

volume levels with outperformance to be in line with the prior year

2019 outperformance of approximately 2.0%.

Despite the extremely challenging environment, our operating

flexibility is expected to deliver a full year Adjusted EBIT margin

in the mid-single digit range. Additionally, we expect Adjusted

Free Cash Flow conversion to remain solid and to be in the high

double digit millions.

We expect full year net debt to decrease from the prior year

2019 level of EUR738 million.

Dividend Update

As announced, the Group has initiated the restructuring of the

business and continues to deliver strong adjusted free cash flow

despite the pandemic and unprecedented challenging market

conditions. The Group expects to repay any previously received UK

employee furlough payments by the end of 2020.

In light of the unprecedented conditions and associated

uncertainty resulting from COVID-19, and the Group's 2020 H1

results, the Board did not declare an interim dividend for the 2020

financial year. However the Board is mindful of the importance of

dividends to the Group's shareholders and, given the continued

strength of cash generation and greater confidence in the outlook,

is committed to reinstating dividend payments.

As such, in March 2021, the Board intends to recommend a final

2020 dividend based on the 2020 full year results, subject to there

being no significant deterioration in market conditions. Any such

final dividend would be recommended in accordance with the

Company's existing dividend policy of paying 30% of Adjusted Net

Income, which the Board currently believes is both affordable and

sustainable, and will be subject to shareholder approval at the

Company's 2021 AGM.

In addition, and in light of the exceptional performance during

the past several months, the Board also anticipates being in a

position to declare a 2020 interim dividend in Q1 2021 based on the

strength of the Group's financial position and prospects. A final

decision on the amount and timing of any such interim dividend will

be communicated at the time of the Group's full year trading update

in January 2021.

The Group continues to remain confident in its business model,

cost flexibility, solid cash generation, experienced management

team, and successful transition to electrification.

Trading update call

TI Fluid Systems plc is holding a call for analysts and

investors at 09:00am UK time today.

Conference Call Dial-In Details:

UK: +44 (0)330 336 9105

Conference Code: 1616526

The audio recording will be available on www.tifluidsystems.com

later today

Enquiries

TI Fluid Systems plc

David J Royce

Investor Relations

Tel: +1-248-376-8624

FTI Consulting

Richard Mountain

Nick Hasell

Tel: +44 (0) 20 3727 1340

Cautionary Statement

This announcement contains certain forward-looking statements

with respect to the financial condition, results of operations and

business of TI Fluid Systems plc (the "Company"). The words

"believe", "expect", "anticipate", "intend", "estimate",

"forecast", "project", "will", "may", "should" and similar

expressions identify forward-looking statements. Others can be

identified from the context in which they are made. By their

nature, forward-looking statements involve risks and uncertainties,

and such forward-looking statements are made only as of the date of

this announcement. Accordingly, no assurance can be given that the

forward-looking statements will prove to be accurate and you are

cautioned not to place undue reliance on forward-looking statements

due to the inherent uncertainty therein. Past performance of the

Company cannot be relied on as a guide to future performance.

Nothing in this announcement should be construed as a profit

forecast.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTKKQBBOBDDKDK

(END) Dow Jones Newswires

November 05, 2020 02:00 ET (07:00 GMT)

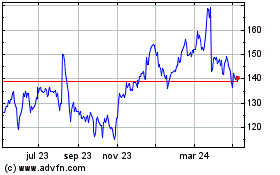

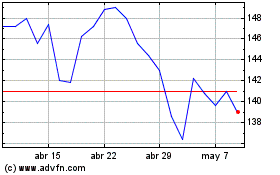

Ti Fluid Systems (LSE:TIFS)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Ti Fluid Systems (LSE:TIFS)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024