UniCredit Did Better Than Expected in 3Q -- Earnings Review

05 Noviembre 2020 - 5:12AM

Noticias Dow Jones

By Pietro Lombardi

UniCredit SpA on Thursday reported consensus-beating results for

the third quarter. Here is what we watched:

NET PROFIT: The Italian bank's net profit for the period fell

42% to 680 million euros ($797.1 million), but beat analysts'

expectations of EUR300 million, according to a consensus forecast

provided by the bank.

REVENUE: The bank's top line dropped 7.4% to EUR4.35 billion,

beating expectations of EUR4.21 billion.

WHAT WE WATCHED:

-TARGETS: The bank improved its cost savings target and

confirmed the profits targets for this year and the next. "We have

improved our gross savings target for 'Team 23' by 25% to EUR1.25

billion," Chief Executive Jean Pierre Mustier said.

-PROVISIONS: Provisions for credit losses rose 32% to EUR741

million. However, they came below analysts' expectations of EUR1.11

billion, and were 21% lower than what the lender had set aside in

the second quarter. UniCredit expects its cost of risk to rise in

the last three months of the year compared with the third

quarter.

-REVENUE STREAMS: Net interest income fell 8.6% on year, while

fees were down 6.4%. Trading income rose more than 10%. "Revenues

were [roughly ] 3% better vs. consensus, mainly driven by higher

trading income," Citi said.

Write to Pietro Lombardi at pietro.lombardi@dowjones.com;

@pietrolombard10

(END) Dow Jones Newswires

November 05, 2020 05:57 ET (10:57 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

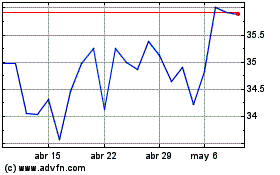

Unicredit (BIT:UCG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Unicredit (BIT:UCG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024