Current Report Filing (8-k)

05 Noviembre 2020 - 3:09PM

Edgar (US Regulatory)

0001345016false00013450162020-10-302020-10-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 30, 2020

YELP INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-35444

|

|

20-1854266

|

|

(State of incorporation)

|

|

(Commission File No.)

|

|

(IRS Employer Identification No.)

|

140 New Montgomery Street, 9th Floor

San Francisco, California 94105

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (415) 908-3801

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class

|

|

Trading Symbol(s)

|

|

Name of Each Exchange on Which Registered

|

|

Common Stock, par value $0.000001 per share

|

|

YELP

|

|

New York Stock Exchange LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On November 5, 2020, Yelp Inc. (the “Company”) announced its financial results for the third quarter ended September 30, 2020 by issuing a Letter to Shareholders (the “Letter”) and a press release. Copies of the press release and the Letter are furnished as Exhibits 99.1 and 99.2 to this Current Report on Form 8-K, respectively.

The information in this Item 2.02 and the exhibits attached hereto are furnished to, but not “filed” with, the Securities and Exchange Commission (“SEC”) and shall not be deemed to be incorporated by reference into any of the Company’s filings with the SEC under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On October 30, 2020, the Company’s board of directors (the “Board”), upon the recommendation of the Nominating and Corporate Governance Committee of the Board, increased the size of the Board from eight to nine directors and appointed Tony Wells to fill the newly created directorship, effective immediately. Mr. Wells will serve as a Class III director on the Board until the Company’s 2021 Annual Meeting of Stockholders and until his successor has been duly elected and qualified, or until his earlier death, resignation or removal. Mr. Wells will serve as a member of the Compensation Committee of the Board.

In connection with his election, Mr. Wells will be entitled to receive (a) a stock option to purchase shares of the Company’s common stock, valued at $162,500, and (b) restricted stock units covering shares of the Company’s common stock, valued at $162,500. Mr. Wells will also be entitled to receive the Company’s standard compensation for non-employee directors, as described in the Company’s definitive proxy statement on Schedule 14A filed with the SEC on May 21, 2020.

The Company entered into a standard form of indemnification agreement (the “Indemnification Agreement”) with Mr. Wells in connection with his appointment to the Board. The Indemnification Agreement provides, among other things, that the Company will indemnify Mr. Wells under the circumstances and to the extent provided for therein, for certain expenses he may be required to pay in connection with certain claims to which he may be made a party by reason of his position as a director of the Company, and otherwise to the fullest extent permitted under Delaware law and the Company’s Amended and Restated Bylaws. The foregoing is only a brief description of the Indemnification Agreement, does not purport to be complete and is qualified in its entirety by the Company’s standard form of indemnification agreement, previously filed as Exhibit 10.6 to the Company’s Registration Statement on Form S-1 (No. 333-178030), as amended, on February 3, 2012.

There are no arrangements or understandings between Mr. Wells and any other persons pursuant to which he was elected as a director of the Company. There are no family relationships between Mr. Wells and any other director or executive officer of the Company and he has no direct or indirect material interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K promulgated by the SEC.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

|

|

|

|

|

|

|

Exhibit

Number

|

|

Description

|

|

|

|

|

|

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date:

|

November 5, 2020

|

YELP INC.

|

|

|

|

By:

|

/s/ David Schwarzbach

|

|

|

|

|

David Schwarzbach

|

|

|

|

|

Chief Financial Officer

|

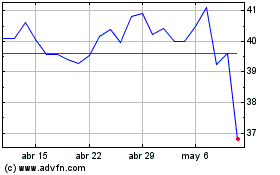

Yelp (NYSE:YELP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

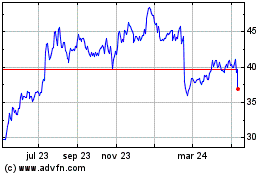

Yelp (NYSE:YELP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024