By Patricia Kowsmann and Margot Patrick

European banks say they are doing just fine during the

coronavirus pandemic. But regulators and bank executives are

concerned about the elephant in the room: a wave of bad loans that

could overwhelm lenders when government rescue packages end.

The economies of Europe plunged this year, and fresh lockdowns

in many countries are weighing on nascent recoveries. Yet the

unprecedented levels of government and financial-sector support,

including repayment moratoriums sometimes covering a quarter of all

outstanding loans, have kept households and companies afloat. That

means banks haven't had to recognize those loans as potentially

soured.

Even bank CEOs are wondering what happens when the support

ends.

"What we have is a very strange crisis" in which economies are

falling sharply but defaults aren't rising mostly because of the

relief measures, Steven van Rijswijk, chief executive of ING Groep,

said last week. "When these measures stop, what then will the

picture be? We have limited visibility as of yet."

Regulators fear some European banks are too slow to react to

borrowers' potential troubles ahead. The European Central Bank said

bad loans in the eurozone could soar as high as EUR1.4 trillion,

equivalent to $1.7 trillion, if the economies fall even more than

expected, a scenario the central bank said is severe but plausible.

That amount would be more than during the aftermath of the

financial crisis.

The concern is that banks could run out of capital if they are

suddenly overwhelmed by defaults, needing state support or even

failing. What isn't clear right now is how quickly those defaults

could pile up, or if state programs might cushion banks' losses for

years to come.

Elke König, head of a European Union agency set up after

Europe's financial crisis to handle troubled banks, said lenders

need to act quickly to identify and deal with loans that are

unlikely to be repaid. "There is no magic wand to make potential

losses go away," Ms. König said.

European banks were already far behind U.S. rivals in recovering

from that last severe shock in 2008. Then, U.S. banks got help from

government programs and central banks to unload bad assets quickly,

while banks in Europe became ensnared by a sovereign-debt crisis

that curbed economic growth. Low interest rates, imposed to

stimulate spending, further hit banks' profits.

This time around, U.S. workers who lost their jobs got weekly

payments of $600 for several months, while others stayed at work

because of Paycheck Protection Program loans to small

businesses.

While many U.S. banks let borrowers skip some payments, overall

support has been less generous than in Europe.

In Italy -- where banks are still trying to deal with old

bad-debt portfolios -- over 25% of loans to businesses and 15% to

households, totaling around EUR300 billion, were put under payment

holidays, according to Marco Troiano, deputy head of the banks team

at the ratings company Scope Ratings. The country was for a long

time the epicenter of the virus outbreak in Europe and has been

hurt by a collapse in tourism.

In Portugal, where companies and the government are highly

indebted, loan moratoriums to businesses covered almost a third of

the total, according to the country's central bank. Over half of

the credit to companies in the hospitality and restaurant sectors

are under the program.

"Until the moratoriums are resolved, it will be challenging to

assess the real extent of losses," Mr. Troiano said.

Carlo Messina, chief executive of the Italian lender Intesa

Sanpaolo, sounded upbeat in recent comments, saying that despite

the pandemic his bank had the lowest-ever inflow of bad loans in

the first nine months of 2020.

In Spain and elsewhere, "customers' behavior has been better

than the guidance we gave in April and July," said Ana Botín,

executive chairman at Banco Santander SA, a major lender in Europe

and Latin America. Most borrowers restarted payments when

moratorium programs expired, she said, and the ratio of

nonperforming loans actually fell this year. Around EUR40 billion

in loans, or 4% of Santander's loan book, is still under

moratorium, including many Spanish mortgages.

According to an analysis by Spain's central bank, the heaviest

users of payment holidays are households that were already more

financially vulnerable. It estimates that more than EUR52 billion

of household and personal business loans in Spain, or about 8% of

those that qualify, is currently on hiatus.

Countries across Europe have also rolled out subsidies to

companies so they could keep idled workers, preventing unemployment

from shooting up. In contrast, the jobless rate had jumped in the

U.S.

Part of the reason for the rosy picture from banks comes down to

accounting rules. Banks can typically count a loan as performing

until there is actual deterioration, such as missed interest

payments or a company going bankrupt.

Andrea Enria, the head of the ECB's supervision arm, said some

banks are being optimists and waiting until there is concrete

evidence a customer is going bankrupt. He told European lawmakers

last month that banks shouldn't let loans "rot in their balance

sheets."

European banks are lending now, including more than EUR400

billion to businesses this year under government programs that

guarantee a chunk of the repayment to the banks. The programs are

giving companies much-needed cash to keep their businesses going,

but they can also keep nonviable companies alive.

Local cinemas, family-run restaurants and hair salons are among

the businesses receiving such loans, according to announcements by

banks, even though it is unclear when those sectors will fully

recover.

"At the moment the biggest bank is governments," said Matt Long,

head of capital markets for Europe at Accenture. "When that stops,

that's when we get to see the real ability of the borrowers to pay

back the loans and meet their borrowing commitments."

Write to Patricia Kowsmann at patricia.kowsmann@wsj.com and

Margot Patrick at margot.patrick@wsj.com

(END) Dow Jones Newswires

November 11, 2020 05:48 ET (10:48 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

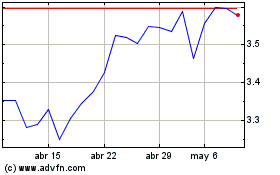

Intesa Sanpaolo (BIT:ISP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

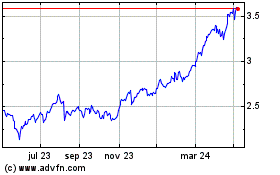

Intesa Sanpaolo (BIT:ISP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024