ArcelorMittal completes sale of ArcelorMittal USA to Cleveland-Cliffs

09 Diciembre 2020 - 7:15AM

ArcelorMittal completes sale of ArcelorMittal USA to

Cleveland-Cliffs

9 December 2020, 14:15 CET

ArcelorMittal announces that the sale of ArcelorMittal USA to

Cleveland-Cliffs for a combination of cash and stock has completed

today.

Under the terms of the sale, ArcelorMittal has received $505

million cash, 78 million shares of Cleveland-Cliffs common

stock and non-voting preferred stock which is redeemable for

approximately 58 million shares of Cleveland-Cliffs common stock or

an equivalent amount in cash1. As agreed, Cleveland-Cliffs has

assumed the liabilities of ArcelorMittal USA, including net

liabilities of approximately $0.5 billion and pensions and other

post-employment benefit liabilities (‘OPEB’)2.

Commenting, Mr. Lakshmi Mittal, Chairman and CEO,

ArcelorMittal, said:

“I would like to thank everyone at ArcelorMittal USA for the

important contribution they have made to the group. We wish you all

the best for the future – Cleveland-Cliffs will be acquiring a

great team. “The sale of ArcelorMittal USA is an opportunity

to create excellent value for our shareholders and reposition our

North American footprint on our most competitive assets, for which

we have targeted growth plans. The recently announced EAF at

Calvert and the new hot strip mill in Mexico, which will complete

next year, will further enhance these assets and ensure we have the

flexibility and quality to meet demand, particularly for

higher-added value products. We intend to remain a strategic player

in the NAFTA region.”

ENDS

1 Cleveland-Cliffs Inc.’s share price closed on 25/9/20 (the

last day of trading prior to the transaction announcement) at

$5.88; its closing price yesterday (8/12/20) was $13.04.2 For the

balance sheet carrying values please refer to the financial

statements included in ArcelorMittal’s 2019 annual report on Form

20-F.

About ArcelorMittal

ArcelorMittal is the world's leading steel and

mining company, with a presence in 60 countries and primary

steelmaking facilities in 18 countries. In 2019, ArcelorMittal had

revenues of U.S.$70.6 billion and crude steel production of 89.8

million metric tonnes, while iron ore production reached 57.1

million metric tonnes.

Our goal is to help build a better world with

smarter steels. Steels made using innovative processes which use

less energy, emit significantly less carbon and reduce costs.

Steels that are cleaner, stronger and reusable. Steels for electric

vehicles and renewable energy infrastructure that will support

societies as they transform through this century. With steel at our

core, our inventive people and an entrepreneurial culture at heart,

we will support the world in making that change. This is what we

believe it takes to be the steel company of the future.

ArcelorMittal is listed on the stock exchanges

of New York (MT), Amsterdam (MT), Paris (MT), Luxembourg (MT) and

on the Spanish stock exchanges of Barcelona, Bilbao, Madrid and

Valencia (MTS). For more information about ArcelorMittal please

visit: http://corporate.arcelormittal.com/

|

|

|

|

Contact information ArcelorMittal Investor

Relations |

|

|

|

|

|

Europe |

+44 20 7543 1156 |

|

Americas |

+1 312 899 3985 |

|

Retail |

+44 20 7543 1156 |

|

SRI |

+44 20 7543 1156 |

|

Bonds/Credit |

+33 171 921 026 |

|

|

|

|

|

|

|

Contact information ArcelorMittal Corporate

Communications |

|

|

E-mail: |

press@arcelormittal.com |

|

Phone: |

+442076297988 |

|

|

|

|

|

|

|

ArcelorMittal Communications |

|

|

Paul Weigh |

+44 20 3214 2419 |

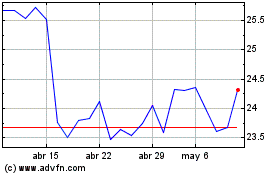

ArcelorMittal (EU:MT)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

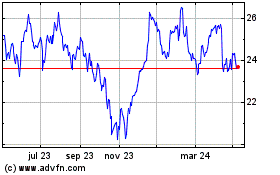

ArcelorMittal (EU:MT)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024