TIDMINV

RNS Number : 9947K

Investment Company PLC

08 January 2021

LEI: 2138004PBWN5WM2XST62

The Investment Company PLC

(the "Company")

Interim Dividend Declaration

Portfolio Update

NAV Announcements

The Company is pleased to provide an update following the

approval of the Company's new investment policy and objective at

the General Meeting held on 4 November 2020, together with the

declaration of an interim dividend.

Dividends

The Company announces that it has declared an interim dividend

of 1 pence per ordinary share, payable on 26 February 2021 to

ordinary shareholders on the register on 22 January 2021. The

ex-dividend date will be 21 January 2021.

Following the implementation of the Company's new investment

policy and objective, focused on protecting the purchasing power of

its capital in real terms, payment of dividends is not the key

objective of the Company. The Company will therefore discontinue

its policy of paying quarterly dividends and will instead make any

dividend declarations on an annual basis. As a result, the

directors do not intend to declare any further dividends until

after the end of the current financial year ending 30 June 2021 and

future dividends, if any, will reflect any excess income from the

investment portfolio after accounting for the Company's costs.

Portfolio Update

The Company has made substantial progress in transitioning its

portfolio away from the historical income focus and towards the new

objectives of protecting the purchasing power of its capital and

participating in enduring businesses. Though this transition is

still ongoing, the directors are pleased to provide details of the

portfolio as at 31 December 2020, shown in the table below, as an

indication of the progress made so far.

Further updates will be provided at the time of the release of

the Company's interim results for the six months ended 31 December

2020, which are expected to be released in February 2021.

Unaudited portfolio as

at

31 December 2020

Security Country Holding Value (GBP) %

Hal Trust Netherlands 10,000 1,047,261 6.8%

Bakkafrost Faroe Islands 15,000 785,008 5.1%

Tonnellerie François

Frères Group France 25,000 597,476 3.9%

Unilever UK 13,300 584,136 3.8%

British American Tobacco UK 21,000 568,680 3.7%

Franco-Nevada Canada 6,000 548,975 3.6%

Emmi Switzerland 700 527,766 3.4%

Lucas Bols Netherlands 55,000 485,410 3.2%

Rio Tinto UK 8,320 455,104 3.0%

Strix Group Isle of Man 208,636 454,826 3.0%

Imperial Oil Canada 32,000 443,388 2.9%

Barrick Gold Canada 25,000 416,453 2.7%

Bucher Industries Switzerland 1,200 402,814 2.6%

ForFarmers Netherlands 70,000 333,333 2.2%

Safilo Group Italy 300,000 202,336 1.3%

Diageo UK 6,600 189,948 1.2%

Total equity participations 8,042,914 52.3%

------------ -------

Six Hundred Group 8% 14/02/2022 UK 500,000 435,000 2.8%

Intercede Group 8% 29/12/2021 UK 450,000 360,000 2.3%

Renold 6% Preference Shares UK 422,109 363,014 2.4%

Northgate 5% Preference

Shares UK 532,763 181,139 1.2%

Other legacy holdings Various 118,204 0.8%

Total fixed income & other

legacy holdings 1,457,356 9.5%

------------ -------

Invesco Physical Gold ETC UK 15,000 2,012,364 13.1%

WisdomTree Physical Gold

ETC UK 11,500 1,510,169 9.8%

WisdomTree Physical Swiss

Gold ETC Switzerland 9,000 1,201,558 7.8%

Total gold 4,724,091 30.7%

------------ -------

Sterling Cash 1,221,865 7.9%

Other liabilities net of

other assets (59,053) -0.3%

Total cash and other net

assets 1,162,362 7.6%

------------ -------

Total Assets 15,386,723 100.0%

------------ -------

NAV Announcements

As announced on 5 January 2021, the Net Asset Value ("NAV") per

Ordinary Share (including unaudited current period revenue) at 31

December 2020 was 322.43 pence.

To reflect the long term nature of the Company's portfolio and

to reduce the costs and administrative burden on the Company,

announcements of the Company's NAV will in future be made on a

monthly basis, following the month end, rather than weekly as was

the previous practice.

Enquiries

The Investment Company

Ian Dighé, Chairman +44 (0) 20 3934 6630

info@theinvestmentcompanyplc.co.uk

Shore Capital (Financial Adviser

and Broker)

Robert Finlay +44 (0) 20 7408 4090

Rose Ramsden

Maitland Administration Services

Faith Pengelly +44 (0) 1245 950317

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DIVUPUMAGUPGGMM

(END) Dow Jones Newswires

January 08, 2021 02:00 ET (07:00 GMT)

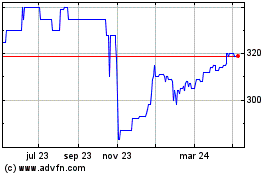

Investment (LSE:INV)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

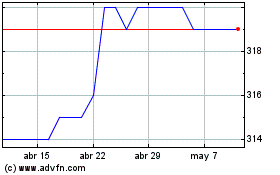

Investment (LSE:INV)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024