Pound Spikes Up As BoE Bailey Downplays Negative Rate Hopes

12 Enero 2021 - 3:13AM

RTTF2

The pound was higher against its major counterparts during

European deals on Tuesday, after Bank of England Governor Andrew

Bailey downplayed expectations of taking interest rates negative to

stimulate the economic growth.

In an online speech to the Scottish Chambers of Commerce, Bailey

said that the monetary policy committee is debating the merits of

negative interest rates.

It has a lot of implications such as reducing bank profits, he

added.

The third national lockdown to contain the spread of the

coronavirus will delay the economic recovery.

The resurgence in COVID-19 cases would 'delay, probably, the

trajectory' of recovery.

Data from the British Retail Consortium showed that UK retailers

logged the worst year on record for sales growth due to the

Covid-19 pandemic.

In 2020, total retail sales decreased 0.3 percent, the worst

annual change since records began in 1995.

The pound jumped to 0.8933 versus the euro, its biggest level

since December 1. If the pound continues its rise, 0.88 is possibly

seen as its next resistance level.

The pound climbed to a 4-day high of 1.3607 against the

greenback from Monday's close of 1.3510. On the upside, 1.42 is

likely seen as the next resistance level for the pound.

The pound advanced to more than a 4-month high of 141.80 against

the yen and an 8-day high of 1.2110 against the franc, compared to

yesterday's closing values of 140.88 and 1.2026, respectively. The

pound is likely to find resistance around 144.00 against the yen

and 1.24 against the franc.

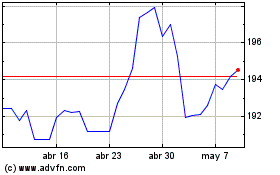

Sterling vs Yen (FX:GBPJPY)

Gráfica de Divisa

De Mar 2024 a Abr 2024

Sterling vs Yen (FX:GBPJPY)

Gráfica de Divisa

De Abr 2023 a Abr 2024