Tritax Big Box REIT plc Valuation update: strong portfolio performance (6232L)

14 Enero 2021 - 1:00AM

UK Regulatory

TIDMBBOX

RNS Number : 6232L

Tritax Big Box REIT plc

14 January 2021

14 January 2021

VALUATION UPDATE

STRONG PORTFOLIO PERFORMANCE

Tritax Big Box REIT plc (the Company) today announces an update

on its valuation ahead of its full year results for the twelve

months to 31 December 2020, which are due to be published on

Wednesday, 10 March 2021. All figures disclosed in this

announcement are unaudited.

UK large-scale logistics real estate market has significantly

strengthened

The second half of 2020 saw a significant increase in the value

of prime, larger scale, UK logistics real estate assets let to high

calibre occupiers on long leases. The supply of these prime assets

remains constrained and occupier demand for larger scale logistics

buildings continues to strengthen. When combined with a buoyant

investment market, this is driving tighter pricing in transactions,

accelerating yield compression and increasing valuations for prime

assets both in the broader logistics real estate market and in our

own high-quality investment and development portfolio.

Portfolio valuation ahead of market expectations

The independent valuation of our portfolio's investment and

development assets (1) as at 31 December 2020 indicates a

like-for-like increase in value of approximately 8% since 30 June

2020. This has been driven by the strength of the logistics real

estate market, our active development and asset management

activity, alongside the high-quality nature of our portfolio as

demonstrated through consistently high levels of rent

collection.

As a result, we expect our 31 December 2020 EPRA NTA per share

to have increased materially since the half year (30 June 2020:

154.85 pence per share) and to exceed the upper end of current

analysts' estimates (2) .

The Company will publish its Q4 2020 trading update on Thursday,

28 January 2021.

(1) Excludes land and land options.

(2) Based upon a Company compiled consensus, the current range

of nine sell side analysts' estimates for EPRA NTA per share at 31

December 2020 is 152 pence to 166 pence, with an average of 159

pence.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Tritax Group Tel: +44 (0) 20 8051 5057

Colin Godfrey (CEO, Fund Management)

Frankie Whitehead (Finance Director)

Ian Brown / Jo Blackshaw (Investor

Relations)

Tel: +44 (0) 20 7379 5151

Maitland/AMO (Media enquiries) tritax-maitland@maitland.co.uk

James Benjamin

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation EU 596/2014 as it forms

part of retained EU law (as defined in the European Union

(Withdrawal) Act 2018).

The Company's LEI is: 213800L6X88MIYPVR714

NOTES:

Tritax Big Box REIT plc (ticker: BBOX) is the only listed

vehicle dedicated to investing in very large logistics warehouse

assets (Big Boxes) in the UK and is committed to delivering

attractive and sustainable returns for Shareholders. Investing in

and actively managing existing built investments, land suitable for

Big Box development and developments predominantly delivered

through pre-let forward funded basis, the Company focuses on large,

well-located, modern Big Box logistics assets, let to

institutional-grade tenants on long-term leases (typically at least

12 years in length) with upward-only rent reviews and geographic

and tenant diversification throughout the UK. The Company seeks to

exploit the significant opportunity in this sub-sector of the UK

logistics market owing to strong tenant demand and limited supply

of Big Boxes.

The Company is a real estate investment trust to which Part 12

of the UK Corporation Tax Act 2010 applies (REIT), is listed on the

premium segment of the Official List of the UK Financial Conduct

Authority and is a constituent of the FTSE 250, FTSE EPRA/NAREIT

and MSCI indices.

Further information on Tritax Big Box REIT is available at

www.tritaxbigbox.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

PFUBCGDBISBDGBX

(END) Dow Jones Newswires

January 14, 2021 02:00 ET (07:00 GMT)

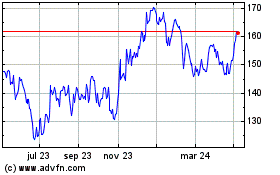

Tritax Big Box Reit (LSE:BBOX)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

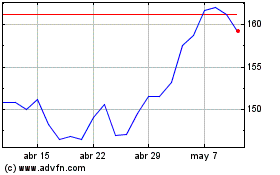

Tritax Big Box Reit (LSE:BBOX)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024