Bloomberg's Big Challenger Can't Afford to Slip -- Heard on the Street

15 Enero 2021 - 9:08AM

Noticias Dow Jones

By Rochelle Toplensky

A new financial data giant will be born in the coming weeks, and

investors are cooing. Living up to their hopes could be hard

work.

This week, London Stock Exchange Group got the green light from

European Union antitrust officials to proceed with its takeover of

Refinitiv, a full 18 months after the $15 billion all-share tie-up

was announced. This was the last major hurdle for a deal that will

bring together financial-market plumbing and data services. The

transaction is now expected to complete within weeks.

Financial data is a hot sector. Shares in listed providers

S&P Global and FactSet Research Systems are up by roughly

two-thirds over three years and trade for 26 and 28 times

prospective earnings respectively, according to the latter -- more

than the wider market. Investors have even higher expectations for

LSE: Its stock changes hands for 37 times, having risen almost 150%

in dollar terms over three years.

The underlying reason is strong demand for financial

information. Users want it to identify trading signals, design

portfolios, feed automated trading systems, better assess risk,

track regulatory compliance and improve operations. Market-data

revenues grew roughly 6% in both 2018 and 2019, according to

consulting firm Burton-Taylor. Bloomberg and Refinitiv are the

market leaders, and smaller players have been consolidating.

S&P Global agreed late last year to buy IHS Markit, itself the

product of a 2016 merger.

The fourth-largest exchange company globally by market

capitalization, LSE focuses on trading, post-trade clearing, and

information services including the FTSE Russell index group. That

data business contributed around 40% of revenue and profit last

year, and will be a greater share after LSE sells its Italian

business, a concession made to secure EU merger approval. Privately

held Refinitiv collects, consolidates and sells data, primarily via

its Eikon terminals and linked data-feeds, and has fixed-income and

currency-trading platforms.

The basic logic of the LSE-Refinitiv deal is to combine a data

producer with a data supplier. By linking both ends of the value

chain, the companies hope to cross-sell services to each other's

clients and create new products, such as indexes for fixed income

and trendy ESG factors.

They are promising top-line growth of 5% to 7% in the three

years after completion. That looks ambitious: In the third quarter

last year both posted around 2% year-over-year revenue growth.

Returns from the deal will also come from refinancing and paying

down some of Refinitiv's $12.5 billion debt and cutting costs,

which should be more straightforward.

Refinitiv's desktop business will be a challenge. It has been

losing market share as Bloomberg has continued to grow. It has good

data, but needs to be simpler to use, says Michael Werner, an

analyst at UBS. He thinks the combined new group doesn't need to

beat Bloomberg but rather just "narrow the gap," so its can

eventually raise prices. This will likely require investment in its

systems and possibly bolt-on acquisitions.

Bloomberg has an agreement with Dow Jones & Co., the

publisher of The Wall Street Journal, to distribute news, and the

companies' newswires compete.

There are the usual deal risks too. Integrating IT systems and

company cultures can be tough and expensive, though acquisitive LSE

has extensive experience.

Understandably, the companies limited disclosure ahead of what

promised to be an intense merger investigation. With that complete,

investors need more detail on the lofty revenue ambitions that have

helped boost the stock 78% in dollar terms since news of the deal

leaked. A true challenger to Bloomberg is an exciting prospect, but

LSE has a lot to do.

Write to Rochelle Toplensky at rochelle.toplensky@wsj.com

(END) Dow Jones Newswires

January 15, 2021 09:53 ET (14:53 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

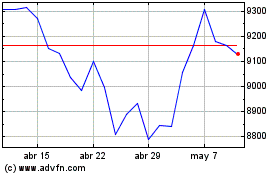

London Stock Exchange (LSE:LSEG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

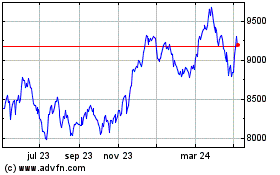

London Stock Exchange (LSE:LSEG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024