TIDMEXPN

RNS Number : 0935M

Experian plc

19 January 2021

news release

Trading update, third quarter

19 January 2021 -- Experian, the global information services

company, today issues an update on trading for the three months

ended 31 December 2020 .

Commenting on the performance, Brian Cassin, Chief Executive

Officer, said:

"Our performance in Q3 was better than we expected. We delivered

organic revenue growth of 7% and total revenue growth of 10% at

constant exchange rates.

"Experian is performing very well, even in the exceptional

circumstances created by the pandemic, and we expect to deliver a

strong performance for this financial year. This again illustrates

the resilience of our business. We remain highly focused on

investing to sustain this performance and to take full advantage of

the recovery when it comes.

"I am hugely grateful to my colleagues for their hard work and

commitment. Their efforts have demonstrated the positive role our

business plays in our communities and that data can be a

significant force for good in helping to navigate the crisis,

ensuring financial support reaches those most in need."

% change in revenue from ongoing activities year-on-year for the

three months ended 31 December 2020

Ongoing activities Total revenue Total revenue Organic revenue

only growth % growth % growth %

At actual At constant At constant

exchange rates(1) exchange rates exchange rates

-------------------- ------------------- ---------------- ----------------

North America 11 11 9

Latin America (11) 13 13

UK and Ireland 1 (2) (2)

EMEA/Asia Pacific 21 16 (11)

------------------- ---------------- ----------------

Total global 7 10 7

-------------------- ------------------- ---------------- ----------------

1 Experian reports in US dollars.

% change in organic revenue year-on-year for the three months

ended 31 December 2020

Organic revenue growth Data Decisioning B2B(3) Consumer Total

% (2) Services

North America 7 2 6 18 9

Latin America 1 5 2 178 13

UK and Ireland (1) (5) (2) 1 (2)

EMEA/Asia Pacific (8) (15) (11) n/a (11)

----- ------------ ---------- ------

Total global 4 (1) 2 22 7

------------------------ ----- ------------ ------- ---------- ------

2 Ongoing activities only, at constant exchange rates.

3 B2B = Business-to-Business segment consists of Data and

Decisioning business sub-divisions.

Business mix including % change in organic revenue year-on-year

for the three months ended 31 December 2020

Segment Business unit Q1 organic Q2 organic Q3 organic

revenue revenue revenue growth

growth %(4) growth %(4) %(4)

------------------- ------------- ------------- ----------------

North America 4 9 9

----------------------------------- ------------- ------------- ----------------

Data CI / BI Bureaux 4 14 12

--------------

Automotive (3) 1 (3)

Targeting (15) (16) (7)

---------------------------------- ------------- ------------- ----------------

Decisioning Health 1 4 5

--------------

DA / Other (1) 0 (2)

---------------------------------- ------------- ------------- ----------------

Consumer Consumer Services 10 16 18

-------------- ------------------- ------------- ------------- ----------------

Latin America (1) 10 13

----------------------------------- ------------- ------------- ----------------

Data CI / BI Bureaux (5) 1 1

--------------

Other 12 7 0

---------------------------------- ------------- ------------- ----------------

Decisioning DA / Other (9) 3 5

-------------- ------------------- ------------- ------------- ----------------

Consumer Consumer Services 104 197 178

-------------- ------------------- ------------- ------------- ----------------

UK and Ireland (15) (8) (2)

----------------------------------- ------------- ------------- ----------------

Data CI / BI Bureaux (14) (8) 3

--------------

Targeting /

Other (21) (3) (13)

---------------------------------- ------------- ------------- ----------------

Decisioning DA / Other (13) (8) (5)

-------------- ------------------- ------------- ------------- ----------------

Consumer Consumer Services (18) (11) 1

-------------- ------------------- ------------- ------------- ----------------

EMEA/Asia Pacific (20) (17) (11)

----------------------------------- ------------- ------------- ----------------

EMEA (25) (16) (9)

----------------------------------- ------------- ------------- ----------------

Asia Pacific (13) (18) (14)

----------------------------------- ------------- ------------- ----------------

Total global (2) 5 7

----------------------------------- ------------- ------------- ----------------

4 Ongoing activities only, at constant exchange rates.

CI = Consumer Information, BI = Business Information, DA =

Decision Analytics.

North America - 63% of Group revenue(5)

North America delivered a strong performance. Organic revenue

growth was 9%, with B2B up 6% and Consumer Services up 18%. Total

revenue growth at constant exchange rates was 11%, mainly

reflecting the contribution from Tapad, acquired in November.

B2B growth was driven by a combination of factors, including

ongoing strength in both mortgage volumes and Experian Ascend, with

volume recovering for Clarity Services. These factors offset

ongoing COVID-19 related weakness in credit reference volumes in

support of unsecured lending, as well as in targeting (marketing

data). In Decisioning, strong performances in health and fraud

management offset softness in decisioning software.

Strength in Consumer Services was supported by ongoing expansion

of the membership base. Free memberships reached 38m, with 5.7m US

consumers having connected their accounts to Experian Boost. There

was good demand for credit education and identity monitoring

subscription services which benefited from heightened consumer

interest during this period. Lead generation revenues performed

well, notwithstanding tighter lending conditions for credit card

and personal loan offers and helped by the expansion into

automotive insurance earlier this year.

Latin America - 14% of Group revenue (5)

In Latin America, both total and organic revenue increased by

13%.

B2B revenue was up 2% with strength in new initiatives

offsetting weakness in credit bureau volumes. Brazil benefited from

increased contributions from positive data propositions, Experian

Ascend and from our automotive vertical. Spanish Latin America had

a strong quarter, helped by recovering bureau volumes in

Colombia.

We delivered considerable growth in Consumer Services in Latin

America, with revenue up 178%. In Brazil, free consumer memberships

increased to 56m. Limpa Nome, our debt resolution service,

delivered strong growth following a highly successful annual credit

fair. We also benefited from transaction growth on our eCred credit

matching marketplace, as well as a growing contribution from

identity theft protection services.

UK and Ireland - 15% of Group revenue (5)

In UK and Ireland both total and organic revenue, at constant

exchange rates, were down (2)%.

While still down overall, the trajectory in B2B has improved and

organic revenue declined (2)%. Recovery has been driven by

increased new business and strengthening transactions reflecting

improved credit supply. Business credit and consumer information

delivered growth, largely offsetting ongoing weakness in

Decisioning.

Consumer Services returned to growth with organic revenue up 1%.

We continue to add free memberships, now at 8.9m, and we are

encouraged by the initial consumer reaction to Experian Boost.

Since the launch in November 230,000 consumers have connected their

accounts. Credit monitoring subscription revenue delivered growth

and, while lead generation revenues are still down overall, the

trajectory has improved considerably.

EMEA/Asia Pacific - 8% of Group revenue (5)

At constant exchange rates, total revenue across EMEA/Asia

Pacific increased by 16%, while organic revenue declined by (11)%.

The difference principally related to the contribution from the

acquisition of the Risk Management division of Arvato Financial

Solutions.

There was some gradual sequential improvement in bureau volumes

in EMEA, although these remain lower overall year-on-year. Our

bureaux in Asia Pacific continue to be heavily impacted by the

effects of the pandemic crisis, particularly in India. Decisioning

also remains weak due to slower client decision-making in relation

to software acquisition.

Near-term guidance

We expect that organic revenue growth for Q4 FY21 will be in the

range of 3-5%, against a strong prior year comparative as we lap

last year's mortgage uplift. For the full year ending 31 March 2021

we expect Benchmark EBIT in the range of US$1,360 - 1,380m.

Future events

Experian will release results for the full year ending 31 March

2021 on Wednesday 19 May 2021.

5 Percentage of Group revenue based on FY20 revenue at actual

rates.

Contact:

Experian

Nadia Ridout-Jamieson Investor queries +44 (0)20 3042 4278

Gerry Tschopp Media queries

Tulchan

Graeme Wilson, Louise Male and Guy Bates +44 (0)20 7353 4200

This announcement is available on the Experian website at

www.experianplc.com . There will be a conference call today to

discuss this update at 9.00am (UK time), which will be broadcast

live on the website with a recording available later.

All financial information in this trading update is based on

unaudited management accounts. Certain statements made in this

trading update are forward-looking statements. Such statements are

based on current expectations and are subject to a number of risks

and uncertainties that could cause actual events or results to

differ materially from any expected future events or results

referred to in these forward-looking statements.

Neither the content of the Company's website, nor the content of

any website accessible from hyperlinks on the Company's website (or

any other website), is incorporated into, or forms part of, this

announcement.

About Experian

Experian is the world's leading global information services

company. During life's big moments - from buying a home or a car,

to sending a child to college, to growing a business by connecting

with new customers - we empower consumers and our clients to manage

their data with confidence. We help individuals to take financial

control and access financial services, businesses to make smarter

decisions and thrive, lenders to lend more responsibly, and

organisations to prevent identity fraud and crime.

We have 17,800 people operating across 45 countries and every

day we're investing in new technologies, talented people and

innovation to help all our clients maximise every opportunity. We

are listed on the London Stock Exchange (EXPN) and are a

constituent of the FTSE 100 Index.

Learn more at www.experianplc.com or visit our global content

hub at our global news blog for the latest news and insights from

the Group.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTKVLFFFFLBBBZ

(END) Dow Jones Newswires

January 19, 2021 02:00 ET (07:00 GMT)

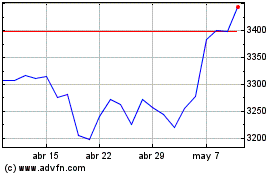

Experian (LSE:EXPN)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Experian (LSE:EXPN)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024