UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 6-K

Report of Foreign Private

Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange

Act of 1934

For the month of

February, 2021

Commission File Number

1-15106

PETRÓLEO BRASILEIRO

S.A. – PETROBRAS

(Exact name of registrant

as specified in its charter)

Brazilian Petroleum

Corporation – PETROBRAS

(Translation of Registrant's

name into English)

Avenida República

do Chile, 65

20031-912 – Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal

executive office)

Indicate by check mark

whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form

40-F _______

Indicate by check mark

whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

Petrobras: Alignment to international prices has not changed

—

Rio de Janeiro, February 7, 2021 - Petróleo

Brasileiro S.A. - Petrobras is clarifying a piece of news published on Friday afternoon, February 5, 2021, based on distorted statements

released by the press.

The maintenance of the periodicity for

the measurement of the adherence between realization prices and international prices, adopted since June 2020 and confirmed in

January 2021, was mistakenly communicated by the press as a change in the company's commercial policy.

As a practice previously adopted and

maintained since 2019, Petrobras follows the pricing of fuels in line with international prices converted into Reais by the Real/US

dollar exchange rate. This system has been widely and repeatedly disclosed to the market over time.

In June and August 2019, we publicly

announced that price adjustments would no longer follow a pre-defined periodicity, and this remains unchanged.

Although Petrobras is practically the

only oil by-products producer in Brazil, with 98% of the refining capacity, it faces competition from importers whose market shares

varies from 20 to 30% of the domestic market, depending on the product.

Fuels are global commodities, such as

soybeans and iron ore, whose prices are typically volatile, as well as exchange rates.

In view of the significant increase

in the volatility of these variables, the company decided in June 2020 to change from quarterly to annual the period for measuring

the adherence between realization prices and international prices. Such change should not be mistaken, in any way, for a change

in commercial policy, the setting of periodicity for readjustments or in performance targets.

Likewise, the continuous monitoring

of the markets by our team remains unchanged, which includes, among other procedures, the daily computation and analysis of the

behavior of our prices in relation to international prices and the planning of actions to correct deviations.

This business routine, unlike strategic

goals, policies and results, is not a subject that deserves public disclosure.

As expected, the change in the periodicity

for the measurement of the adherence between realization prices and international prices did not result in losses, having been

achieved the objective of maintaining import prices parity, in the same way that occurred in 2019.

Even in an extremely challenging period

for the global oil industry, financial results for the first nine months of 2020 showed strong cash flow generation and debt reduction,

contradicting claims of alleged losses from our commercial policy.

In January 2021, Petrobras kept unchanged

the periodicity adopted from June 2020 onwards for the measurement of the adherence of the alignment between realization prices

and international prices, without any further changes.

The volatility of fuel prices and exchange

rates, whether upward or downward, is a permanent phenomenon, which may increase or decrease in the face of unanticipated specific

events.

www.petrobras.com.br/ir

For more information:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

| Investors Relations

email: petroinvest@petrobras.com.br/acionistas@petrobras.com.br

Av. República do Chile, 65 – 1803

– 20031-912 – Rio de Janeiro, RJ.

Tel.: 55 (21) 3224-1510/9947 | 0800-282-1540

This document may contain forecasts

within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the Securities

Trading Act of 1934, as amended (Trading Act) that reflect the expectations of the Company's officers. The terms: "anticipates",

"believes", "expects", "predicts", "intends", "plans", "projects",

"aims", "should," and similar terms, aim to identify such forecasts, which evidently involve risks or uncertainties,

predicted or not by the Company. Therefore, future results of the Company's operations may differ from current expectations, and

the reader should not rely solely on the information included herein.

The simple modification of the period

for assessing the adherence between realization prices and international prices brought about eight months ago does not constitute

a rupture of our unswerving commitment to align our prices in Brazil to international prices and the consequent generation of value

for shareholders.

Petrobras reaffirms the statements made

by CEO Roberto Castello Branco, at an event on the morning of last Friday, February 5, 2021, in Brasília, of independence

from external interferences in determining its prices.

Petrobras remains strongly committed

to value generation, reliability in the supply of quality fuels for its customers, respect for people, the environment and the

safety of its operations.

www.petrobras.com.br/ir

For more information:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

| Investors Relations

email: petroinvest@petrobras.com.br/acionistas@petrobras.com.br

Av. República do Chile, 65 – 1803

– 20031-912 – Rio de Janeiro, RJ.

Tel.: 55 (21) 3224-1510/9947 | 0800-282-1540

This document may contain forecasts

within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the Securities

Trading Act of 1934, as amended (Trading Act) that reflect the expectations of the Company's officers. The terms: "anticipates",

"believes", "expects", "predicts", "intends", "plans", "projects",

"aims", "should," and similar terms, aim to identify such forecasts, which evidently involve risks or uncertainties,

predicted or not by the Company. Therefore, future results of the Company's operations may differ from current expectations, and

the reader should not rely solely on the information included herein.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: February 7, 2021

PETRÓLEO BRASILEIRO S.A–PETROBRAS

By: /s/ Andrea Marques de Almeida

______________________________

Andrea

Marques de Almeida

Chief Financial Officer and Investor Relations

Officer

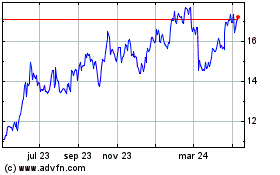

Petroleo Brasileiro ADR (NYSE:PBR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

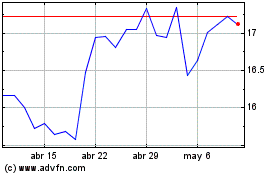

Petroleo Brasileiro ADR (NYSE:PBR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024