Trifast PLC LTIP awards targets and Total Voting Rights (9736O)

12 Febrero 2021 - 5:41AM

UK Regulatory

TIDMTRI

RNS Number : 9736O

Trifast PLC

12 February 2021

Friday, 12 February 2021

Trifast plc

(the "Company")

PERFORMANCE CONDITIONS FOR LTIP AWARDS GRANTED ON 25 NOVEMBER

2020 UNDER TRIFAST PLC's EMPLOYEE SHARE PLAN

Trifast plc (the Company) granted a Nil-Cost Option over shares

(the Awards) under the Employee Share Plan on 25 November 2020 to

the CEO and CFO as listed in the table below.

Name Role Number of Shares subject

to Award

Mark Belton CEO 380,701

----- -------------------------

Clare Foster CFO 291,666

----- -------------------------

As disclosed in the FY2020 Directors' Remuneration Report, the

Committee felt it was unlikely that it would be able to robustly

set three-year EPS targets for the Awards as at their grant date,

given the significant uncertainty in the wider economic

environment. On this basis, the Committee agreed to determine the

EPS targets applicable to the Awards within six months from the

Date of Grant, in line with the Investment Association's

concession.

The Committee has now conducted a review of the EPS targets

taking account of the internal business plan, the outlook for the

sector and general macroeconomic conditions. Following careful

consideration, the Committee approved the target range set out

below with EPS stated as an absolute figure which needs to be

achieved in the financial year ending 31 March 2023.

The Committee is cognisant that the threshold level of EPS in

FY2023 is broadly flat compared to the Company's FY2020 results.

The Committee noted that given the projected outcome for FY2021,

threshold performance represents significant growth over the next

two financial years and that this growth trajectory will be

reflected in the targets for the FY2021 LTIP award. Finally, the

Committee was comfortable that threshold performance was in excess

of analysts' consensus forecast for FY2023.

The relative TSR performance measure is unchanged from that

previously disclosed in the FY2020 Directors' Remuneration Report

and will be measured over a three-year performance period ending 31

March 2023.

Measure Threshold Maximum

(25% vesting) (100% vesting)

Underlying diluted EPS ('EPS') 10.55p in 13.28p in

(70% weighting) FY2023 FY2023

--------------- ----------------

Total Shareholder Return ('TSR') Equal to 8% p.a. in

relative to FTSE Small Cap excluding index return excess of

investment trusts (30% weighting) index return

--------------- ----------------

1. Vesting between threshold and maximum performance is based on

a sliding scale

2. TSR growth for Trifast and the FTSE Small Cap Index

(excluding investment trusts) will be measured using a three-month

average prior to the start and the end of the three-year

performance period

In line with the Directors' Remuneration Policy approved at the

2020 AGM, the Committee will have overriding discretion to change

the formulaic vesting outcome of this award (both downwards and

upwards) if it is out of line with the underlying performance of

the Company.

Total voting rights (TVR)

The Company's total issued share capital is 136,012,462 Ordinary

Shares with one voting right per share. The Company does not hold

any Ordinary Shares in Treasury. Therefore, the total number of

voting rights in the company is 136,012,462. This figure may be

used by shareholders as the denominator for the calculations by

which they will determine if they are required to notify their

interest in, or a change to their interest in, the Company under

the Financial Conduct Authority's Disclosure and Transparency

Rules.

Enquiries:

Trifast plc

Lyndsey Case

Company Secretary

Tel: +44(0)1825 769696

www.trifast.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

STRFLFVLFTIFLIL

(END) Dow Jones Newswires

February 12, 2021 06:41 ET (11:41 GMT)

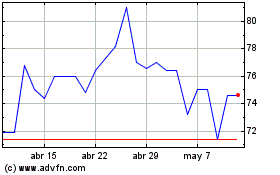

Trifast (LSE:TRI)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Trifast (LSE:TRI)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024