HBSC Sharpens Focus on Asia -- Update

23 Febrero 2021 - 12:14AM

Noticias Dow Jones

By Simon Clark and Quentin Webb

HSBC Holdings PLC, one of the world's largest banks, said it

would pour about $6 billion of extra investment into Asia in the

next five years, as it doubles down on its core business.

The London-based bank, which makes most of its profit in Hong

Kong and mainland China, said Tuesday that earnings fell 35% to

$3.9 billion last year as the coronavirus pandemic roiled the

global economy. HSBC set aside $8.82 billion in provisions for bad

loans last year versus less than $3 billion in 2019.

Chief Executive Noel Quinn is leading the reorganization of the

bank. Geopolitical tension between China and Western countries has

strained his ambition for the bank to be a financial bridge between

the most populous nation and the rest of the world. HSBC last year

supported China's imposition of a national security law in Hong

Kong, which the U.S. and British governments opposed.

"We plan to focus on and invest in the areas in which we are

strongest," Mr. Quinn said. In a presentation to investors, the

bank said it would invest an additional $6 billion in its

wealth-management and international wholesale businesses to drive

growth in Asia. HBSC will also spend more to digitize faster and

said it planned to build on its strengths in sustainable

finance.

The bank reported a return on tangible equity of 3.1%, down from

8.4% a year earlier, and dropped its previous goal of reaching a

10% to 12% return on this basis by 2022. Instead, it will target a

return of 10% or more in the medium term.

At the same time, HSBC said it may unload some retail

operations. HSBC said it was "exploring organic and inorganic

options" for its U.S. retail business and was in negotiations over

a sale in France, which is likely to generate a loss if

concluded.

HSBC, which has been considering disposing of its French retail

bank since at least 2019, is in talks with private-equity firms

about a sale, people familiar with the situation said. Its

expansion into France was built on the 2000 purchase of Credit

Commercial de France for $10.6 billion.

Founded in Hong Kong and Shanghai in 1865, HSBC expanded

world-wide in the 1990s and early 2000s through costly takeovers,

many of which it had to unwind. The bank took a big step into the

U.S. in 2003 with the $16 billion takeover of subprime consumer

lender Household International Inc., but the acquisition saddled

the bank with billions of dollars of soured mortgages and lawsuits

following the global financial crisis of 2008. HSBC sold its U.S.

credit-card business to Capital One Financial Corp. in 2012.

The U.S. expansion brought more trouble for HSBC when the

Justice Department accused it of laundering proceeds from drug

trafficking in Mexico and stripping data from transactions

involving sanctioned nations like Iran to avoid detection. The bank

paid a then-record $1.9 billion in 2012 to settle the allegations.

HSBC admitted wrongdoing but avoided a guilty plea or prosecutions

of its executives.

In the U.K., meanwhile, HSBC faces uncertainty caused by the

country's departure from the European Union.

HSBC's London-listed shares lost more than a third of their

value in 2020 but have risen 14% in the year through Monday. On

Tuesday in Hong Kong, its shares jumped more than 4% in early

afternoon trading.

HSBC said it would pay a dividend of 15 cents a share, following

an earlier indication it would make a conservative payout if

circumstances allowed. It had put dividend payments on hold to

comply with British regulatory demands, angering some shareholders

in Hong Kong. The Bank of England's Prudential Regulatory Authority

lifted the ban on U.K. banks paying dividends in December.

Write to Simon Clark at simon.clark@wsj.com and Quentin Webb at

quentin.webb@wsj.com

(END) Dow Jones Newswires

February 23, 2021 00:59 ET (05:59 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

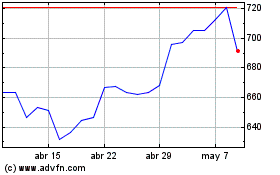

Hsbc (LSE:HSBA)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

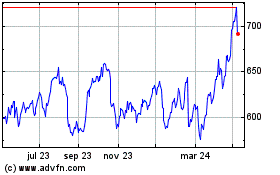

Hsbc (LSE:HSBA)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024