TIDMINCH

RNS Number : 2728Q

Inchcape PLC

25 February 2021

Results for the year to 31 December 2020

Encouraging second half performance - exciting future ahead

2020 highlights:

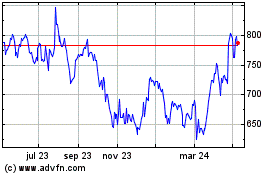

-- Group revenue GBP6.8bn, down 19% on an organic basis and 27%

reported. Q4 organic decline of 9% (Q3: (10)%)

-- Pre-exceptional PBT of GBP129m (2019: GBP326m); supported by

gross margin resilience in the second half (vs prior year)

-- Statutory loss before tax of GBP128m, reflecting GBP257m of

exceptional charges (largely non-cash)

-- Further strengthened our financial position: net cash of

GBP266m (Dec-19: GBP103m), with 2020 free cash flow of GBP177m

-- Returning to the dividend list: dividend of 6.9p proposed for

the year

-- Continued shift towards Distribution: signed four new

distribution agreements and made further Retail disposals

2020 2019 % change % change % change

reported constant organic(2)

FX(1)

====================================== ========== ========== ========== ========== ============

Key financials

Revenue GBP6,838m GBP9,380m (27)% (25)% (19)%

Operating profit (pre exceptionals)

(1) GBP166m GBP373m (56)% (54)%

Operating margin(1) 2.4% 4.0% (160)bps (150)bps

Profit before tax (pre exceptionals)

(1) GBP129m GBP326m (61)% (59)%

Basic EPS (pre exceptionals)

(1) 23.6p 59.9p (61)%

Dividend per share 6.9p 8.9p (22)%

Free cash flow (1) GBP177m GBP213m (17)%

Statutory financials

Operating (loss) / profit GBP(92)m GBP449m

(Loss) / Profit before tax GBP(128)m GBP402m

Basic EPS (35.6)p 79.0p

====================================== ========== ========== ========== ========== ============

1. These measures are Alternative Performance Measures, see note

13.

2. Organic growth is defined as sales growth in operations that

have been open for at least a year at constant foreign exchange

rates

Duncan Tait, Group CEO:

"Our 2020 results came in ahead of recently upgraded

expectations, supported by increased resilience of demand for both

Vehicles and Aftersales services in the fourth-quarter. The Group's

inherently cash-generative business model contributed to the

strengthening of our overall financial position during the second

half.

While the COVID-19 situation remains dynamic, as of today almost

all of our markets are open. In many markets where we are facing

restrictions, we are able to deliver vehicles, offer a

click-and-collect service and to continue to perform Aftersales

services. These capabilities helped our top-line performance in the

second half of 2020 and contributed to the operating margin

recovery from the first half.

In response to COVID-19, the Group implemented a significant

cost-restructuring programme. This is now substantially complete,

and we are leveraging our leaner structure to build a better

business for the future. In addition, we continued to rebalance our

portfolio towards the more attractive Distribution segment,

securing new distribution business in both Americas and Europe, and

further reducing our Retail business.

Inchcape has strong foundations, and the growth of Distribution

remains its central focus. As we enter the next phase of our

journey, we will be supercharging certain elements - in particular,

our use of data and digital - which will drive even faster growth

of our distribution core. At the same time, we see significant

opportunity to capture more of a vehicle's lifetime value - an area

that is underserved by us today. This will in turn drive growth

within our current footprint, and open up opportunities for even

faster expansion in new markets, with both existing and new OEM

partners. In setting the future direction we concluded that there

are plenty of opportunities for an ambitious Inchcape to thrive in

this new world of mobility, and established the goal to become the

undisputed distributor of choice for OEMs.

I am confident that the momentum we were seeing prior to the

pandemic will return, and that our focus on the long-term growth

opportunities in Distribution will create value for all our

stakeholders. As a result of our strengthened financial position

and confidence in the future, we are pleased to resume dividend

payments with a proposed final dividend of 6.9p for 2020."

Results presentation today

A presentation for analysts and investors will be held today,

Thursday 25(th) February, at 08:30 (UK time). To register please

contact Instinctif Partners at inchcape@instinctif.com . An

audiocast of the presentation will be available via the Company's

website, www.inchcape.com later today.

Financial calendar

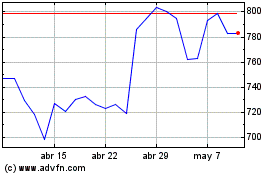

Q1 trading update 29(th) April 2021

Ex-dividend date for 2020 final dividend 13(th) May 2021

Annual general meeting 27(th) May 2021

Half year results 29(th) July 2021

Q3 trading update 28(th) October 2021

Contacts

Inchcape plc:

Raghav Gupta-Chaudhary Investor queries +44 (0)7933 395 investors@inchcape.com

158

+44 (0)20 7546

Finn Lawrence Media queries 0022

Instinctif Partners:

Mark Garraway +44 (0)7771 860 inchcape@instinctif.com

938

American Depository Receipts

Inchcape American Depositary Receipts are traded in the US on

the OTC Pink market: (OTC Pink: INCPY)

http://www.otcmarkets.com/stock/INCPY/quote

About Inchcape

Inchcape is the leading independent multi-brand Automotive

Distributor and Retailer, operating in 34 markets with a portfolio

of the world's leading automotive brands. Inchcape has diversified

multi-channel revenue streams including sale of new and used

vehicles, parts, service, finance and insurance. The Company has

been listed on the London Stock Exchange (INCH) since 1958, is

headquartered in London and employs around 15,000 people .

www.inchcape.com .

Operational review

Our results are stated at actual rates of exchange. However, to

enhance comparability we also present year-on-year changes in sales

and operating profit pre-exceptionals in constant currency, thereby

isolating the impact of translational exchange rate effects. Unless

otherwise stated, changes are expressed in constant currency and

figures are stated before exceptional items.

Key performance indicators

2020 2019 % change % change % change

reported constant organic(1)

FX(1)

===================================== ========= ========= ========== ========== ============

Revenue GBP6.8bn GBP9.4bn (27)% (25)% (19)%

Operating profit before exceptional

items(1) GBP166m GBP373m (56%) (54%)

Operating margin(1) 2.4% 4.0% (160)bps (150)bps

Profit before tax and exceptional

items(1) GBP129m GBP326m (61%) (59%)

Free cash flow(1) GBP177m GBP213m (17%)

Return on capital employed(1) 12% 22%

1. See note 13 for definition of Key Performance Indicators and

other Alternative Performance Measures.

Performance review: Full year 2020

2020 was a year with three distinct periods. We made an

encouraging start to the year, but in Q2 our operations were

materially impacted by COVID-19. While several markets faced

disruption in the second half, overall we observed an improving

trend across our New, Used and Aftersales revenue streams. The

trends we saw reflected to a certain extent pent-up demand, but

also less stringent lockdown conditions - with Aftersales allowed

to remain open, our ability to deliver vehicles to customers, and

the offer of click-and-collect services.

Over the course of the year, the Group generated revenue of

GBP6.8bn, operating profit pre-exceptionals of GBP166m and free

cash flow of GBP177m.

Group revenue of GBP6.8bn was down 27% year-on-year reported and

25% in constant currency. During the period we disposed of several

retail businesses, which further reduced our Retail revenue

exposure. We completed four Distribution deals - most notably the

acquisition of Daimler's distribution business in Colombia, and the

addition of the JLR distribution contract in Poland.

On an organic basis revenue declined 19% in 2020, as most of our

markets were weighed down by COVID-19. While the spread of the

virus continued to cause disruption, our organic performance

improved in the second half, falling 9% compared to the 29% decline

in the first half.

The Group delivered an operating profit before exceptional items

of GBP166m, down 56% year-on-year reported and 54% in constant

currency. The decline reflects the profits lost as COVID-19 caused

disruption to our operations across the globe. This was evident in

the 120bps contraction of Group gross margins in the first half. In

the second half, while our operations continued to be impacted,

albeit to a lesser extent, gross margins remained stable. As a

direct response to COVID-19, the Group took prompt action to reduce

discretionary costs (e.g. marketing, office, travel), the Board /

senior management took a 20% reduction in fees / salary in the

second quarter and we accessed government support schemes in the

first half in some markets (predominantly the UK). Subsequently, at

the start of the third quarter we implemented a cost-restructuring

programme - targeting GBP90m of overheads reduction - which is now

substantially complete. These cost-mitigation measures have helped

support profitability during the year and created a leaner overhead

base for 2021. D uring the second half, the Board took the decision

not to claim further government support in respect of the period

from July onwards.

Profit before tax and exceptional items of GBP129m is down 61%

year-on-year reported and 59% in constant currency. The decline in

absolute terms is slightly below that observed at the operating

profit level, owing to a lower (GBP10m) interest charge versus the

prior year. This is a result of a combination of lower interest

rates and strict inventory discipline, which reduced the related

interest expenses.

During the period we booked exceptional charges of GBP257m,

largely non-cash, and primarily due to the impact of COVID-19. The

majority (GBP223m) of this relates to goodwill and site

impairments. As a result, the reported loss before tax was GBP128m,

compared to a profit before tax of GBP402m in 2019 - which was

supported by gains on disposal of our Retail assets.

In spite of the operational challenges, our free cash flow

generation remained extremely resilient, with GBP177m (2019:

GBP213m) generated over the 12 month period - this represents a

conversion of 107% (57% in 2019), significantly higher than the

long-term average of 60-70%. While operating profit

pre-exceptionals was significantly lower, we mitigated this by a

number of measures resulting in a meaningful improvement in the

Group's working capital position, a more disciplined approach to

capital expenditure programmes, and reduced tax and interest

payments.

Other notable elements of the cash flow bridge include: net

acquisitions and disposals, which amounted to an inflow of GBP40m

(acquisition of Daimler Colombia offset by proceeds from Retail

disposals), share buybacks (GBP31m of the GBP150m was completed

prior to termination) and the cancellation of the 2019 final

dividend in response to COVID-19.

The Group closed the reporting period in a net cash position of

GBP266m (excluding lease liabilities), which compares to GBP103m at

the end of December 2019, and GBP89m as at 30(th) June 2020. On an

IFRS 16 basis (including lease liabilities), we ended the period

with net debt of GBP67m (2019: GBP250m).

Return on capital employed over the period was 12%, compared to

22% for the equivalent period last year. The decline was driven by

the steep reduction in profits.

Fourth quarter 2020

Group revenue for the fourth quarter was GBP1.9bn, down 16%

reported. On an organic basis, revenue fell 9%, compared to a

decline of 10% in Q3.

In Distribution, revenue contracted 13% organically, following a

21% decline in Q3. Top-line performance improved sequentially

across most regions, with Asia, Australasia and the Americas all

posting their highest quarterly growth rate since Q1. Revenue in

Europe was held back by further COVID-19 related restrictions in

Belgium, Greece and Romania, while Africa was solid in the context

of a high prior year comparator.

In Retail, revenue contracted 2% organically (Q3: +5%; supported

by the bounce-back) as a second lockdown in the UK weighed on

sales. While the restrictions impacted performance, the

deterioration was less pronounced than we experienced during the

first lockdown, as we were able to continue delivering vehicles and

permitted to perform Aftersales services.

Strategic priorities

The Ignite strategy has laid strong foundations for the Group

and catalysed a shift towards the more attractive Distribution

segment. As we embark on the next phase of the Group's journey,

Distribution remains at the core of the business. In setting the

future direction we have reflected on the structural changes taking

place across the automotive industry, and how these provide

opportunity across our core competencies as a distributor of

mobility services in fast-growing markets.

We concluded that an ambitious Inchcape could benefit

significantly from and thrive in this new world, one where we can

both leverage our existing distribution infrastructure and drive

expansion across new markets and competencies.

Our new strategy will focus on two key growth pillars:

1. Distribution Excellence; and

2. Vehicle Lifecycle Services

In 'Distribution Excellence' we see an opportunity to take our

core Distribution business, and make it both better and bigger. In

'Vehicle Lifecycle Services' we believe there is significant

untapped potential, across all of our markets, that the business

has not fully realised in the past. In summary, we are putting more

emphasis on capturing the lifetime value, of both customers and

vehicles. We will approach our growth in a prudent and structured

manner, in close collaboration with our OEM partners.

We have identified three key enablers that will play an integral

role in making our strategy a success:

- People, Culture and Capabilities: attracting, developing and retaining talent to enable a high-performance innovation culture

- Digital, Data and Analytics: integrate data and analytics to

drive decision-making, and digitalise customer journeys

- Efficient Scale Operations: standardisation of processes regionally and globally

We are confident that this will drive growth within our current

geographic footprint and even faster expansion in new markets, with

both existing and new partners.

In conjunction with the development of our mid-term plan, we are

building a responsible business plan that is deeply connected to

our strategy and to all of our stakeholders. We will share the

details of our progress at our Capital Markets Day later in the

year.

Inchcape is a strong business, with significant unrealised

potential. With our strategy we are striving to create an excellent

business, with meaningful growth opportunities to deliver

shareholder value through organic growth, consolidation and cash

returns.

People

The Board and Management would like to express their sincere

gratitude to colleagues around the world for their dedication

during a very challenging year. Our better than expected

performance is credit, in no small part, to our people's spirit and

can-do attitude. Inchcape employs a diverse talent pool that will

be a major asset in the context of our evolving strategy. This is a

business that strongly believes in supporting people to grow in

their careers, just as they contribute to the growth of the

business. This approach will continue to drive how we attract,

develop and retain talented individuals as we look to support the

further development and implementation of the strategy.

Sector reclassification

Given the shift of the business towards distribution, the London

Stock Exchange reconsidered the appropriateness of Inchcape's

sector classification. As of 19(th) June 2020, the Group has been

classified within 'Business Support Services' (previously

'Speciality Retail').

Capital allocation

Our capital allocation policy remains unchanged and, in order,

our priorities are: to invest in the business to position it

strongly for the future; to make dividend payments; to conduct

value-accretive M&A; and, in the absence of appropriate

inorganic opportunities, consider share buyback programmes.

With a considerably strengthened financial position and

confidence in the future, the Board, having taken into account the

extraordinary circumstances that the business endured during the

year, and a broad stakeholder perspective, believes it is the right

time to resume dividends and has proposed a payment of 6.9p for

FY2020.

Investment proposition

Distribution is at the core of Inchcape. Given our geographic

footprint, with exposure to high growth markets and our diversified

revenue streams, the Group aims to deliver global GDP-plus organic

growth. The highly fragmented nature of distribution also provides

significant scope for inorganic expansion.

As the largest independent automotive distributor, we have a

unique opportunity to leverage our scale and efficiencies, which we

are doing today with our digital developments. In addition to the

attractive growth prospects, the business is asset-light with a

history of delivering a strong cash-conversion. Combined with a

disciplined approach to capital allocation we believe these should

enable the group to maintain its long track record of delivering

attractive shareholder value.

Looking ahead

We are excited to be entering the next phase of the Group's

distribution focused growth strategy, with an emphasis on greater

use of technology to improve our business for the benefit of our

consumers, our OEMs and our people.

As of today, the COVID-19 situation remains dynamic. While we

saw good momentum in the business in the second-half, volatility

and unpredictability is likely to continue throughout 2021. Our

operations are better equipped to continue to operate in this

rapidly changing environment, and we have materially reduced our

cost base. Absent any severe restrictions, in 2021 we expect

material growth in profits and an improved operating margin. This

takes account of a c.GBP15m translational currency headwind to

Group profits based on prevailing rates.

Looking beyond the short term, our vision is to both strengthen

and further broaden our OEM relationships and to continue to expand

our geographic reach - enabling us to bring mobility to the world's

communities.

We look forward to sharing more details about our vision for the

future at our Capital Markets Day later this year.

Operating and financial review

Following an internal reorganisation of the management structure

we have redefined our regions. This has resulted in a

reclassification of our retail business in Russia from 'Emerging

Markets' to within 'UK & Europe', and 'Emerging Markets' has

been redefined as 'Americas & Africa'. We have also

consolidated our Asia and Australasia businesses to form a new

region; 'APAC'. Given Australasia's contribution to the overall

Group, we have decided to continue to disclose its results. We had

historically disclosed Central costs separately, which we now fully

allocate to each segment.

Distribution

The Distribution segment saw revenue down 21% year-on-year, with

performance significantly impacted by the spread of COVID-19 from

March onwards. While the top-line trend improved in the second

half, with fewer and less severe closures, several markets

continued to face disruption. In addition to our operational

improvements, our cost-mitigation measures supported the overall

result, particularly in the second half, culminating in an

operating profit(1) of GBP140m (2019: GBP333m). The operating

margin fell 310bps to 3.7%.

% change % change % change

reported constant organic

2020 2019 FX

---------- ---------- ---------

GBPm GBPm

-------- -------- ---------- ---------- ---------

Revenue

Asia 1,026.6 1,522.5 (33)% (32)% (32)%

Australasia 876.0 1,070.9 (18)% (17)% (17)%

APAC 1,902.6 2,593.4 (27)% (26)% (26)%

Europe 1,120.2 1,329.6 (16)% (17)% (17)%

Americas & Africa 797.1 993.5 (20)% (13)% (24)%

Total Distribution 3,819.9 4,916.5 (22)% (21)% (23)%

Operating profit (1)

Asia 78.8 168.7 (53)% (53)%

Australasia 1.2 58.0 (98)% (98)%

APAC 80.0 226.7 (65)% (64)%

Europe 25.3 41.7 (39)% (40)%

Americas & Africa 34.4 65.0 (47)% (42)%

Total Distribution 139.7 333.4 (58)% (57)%

Operating margin

Asia 7.7% 11.1% (340)bps (340)bps

Australasia 0.1% 5.4% (530)bps (530)bps

APAC 4.2% 8.7% (450)bps (450)bps

Europe 2.3% 3.1% (80)bps (80)bps

Americas & Africa 4.3% 6.5% (220)bps (210)bps

Total Distribution 3.7% 6.8% (310)bps (310)bps

---------------------- -------- -------- ---------- ---------- ---------

-- Asia revenue contracted 32%, and operating profit(1) was down

53%. We expected 2020 would be a challenging year in Asia prior to

COVID-19, forecasting volumes in both Singapore and Hong Kong would

decline 25% and 20%, respectively. The spread of the virus

exacerbated this decline, weighing on performance in all markets.

Singapore endured a prolonged closure from early April to mid-June

(resulting in the suspension of vehicle licence auctions), and upon

reopening the government announced it would phase missed licenses

over a 12 month period - as such the number of vehicle licences

available in 2021 is expected to exceed 2020. While our operations

in Hong Kong remained open, demand was clearly subdued, albeit we

observed an improving trend in the second half. In spite of the

challenges, we retained our triple crown status (for being the

number one in passenger cars, commercial vehicles and in the market

as a whole) in both Singapore and Hong Kong.

-- Australasia revenue contracted 17%, and operating profit(1)

was down 98%. It was the only region to see a weaker revenue trend

and margin result in the second half compared to the first half.

Having remained open throughout the first half, COVID-19 related

restrictions impacted the Australian operations in the third

quarter. Profitability was substantially lower as gross margins

came under pressure owing to lower volumes and competitive

pressures, but also unfavourable currency effects. The

transactional currency (AUD:JPY) headwind in the period was

cGBP15m. The launch of the new Outback (one of Subaru's most

popular models) in the first quarter of this year should support

the brand's market share performance in 2021.

-- Europe revenue contracted 17%, and operating profit(1) was

down 40%. It was the first of our regions to face widespread

COVID-19 enforced market closures, starting in mid-March and

peaking in April. All impacted markets had reopened in May,

although several markets did face subsequent restrictions following

a second wave of the virus in the fourth quarter. While the

environment was competitive, we gained market share across a number

of markets in the second half. The launch of the new Toyota Yaris,

an extremely popular model in several of our European markets,

should drive further outperformance in 2021.

-- Americas & Africa revenue contracted 13%, and operating

profit(1) was down 42%. Geographic diversification meant that there

were some pockets of good performance that helped offset challenges

elsewhere. The Americas was hardest hit in terms of number of our

markets forced to close, as governments tried to control the spread

of the virus. This weighed heavily during the first half, but as

markets began to reopen we noticed a meaningful improvement. In

Africa, our operations remained open throughout the year with

limited impact from COVID-19 and consequently made a significant

contribution to the segment's operating profit. All markets

remained open throughout the fourth quarter, and it was the

strongest quarter for the region. Looking ahead, given the low

penetration of vehicles per capita in the Americas & Africa

region, we are optimistic about the growth prospects of over the

medium and long term.

Retail

The Retail segment saw revenue down 30% year-on-year, or down

14% on an organic basis (adjusting for the Retail disposals over

the period). Prolonged shutdowns in both UK and Russia in the first

half weighed heavily on sales, although demand proved to be more

resilient in the second half. Operating profit(1) in the second

half was supported by gross margin improvement and our

cost-mitigation measures, resulting in a profit of GBP26m for the

year compared to GBP40m in 2019. The operating margin improved in

the second half, finishing the year flat overall.

% change % change % change

reported constant organic

2020 2019 FX

---------- ---------- ---------

GBPm GBPm

-------- -------- ---------- ---------- ---------

Revenue

Asia - 159.5 (100)% (100)%

Australasia 9.4 272.0 (97)% (96)%

APAC 9.4 431.5 (98)% (98)%

UK & Europe 3,008.5 4,031.7 (25)% (23)% (15)%

Total Retail 3,017.9 4,463.2 (32)% (30)% (14)%

Operating profit (1)

Asia - 8.7 (100)% (100)%

Australasia 0.4 (1.2) nmf nmf

APAC 0.4 7.5 (94)% (95)%

UK & Europe 25.4 32.2 (21)% (15)%

Total Retail 25.8 39.7 (35)% (31)%

Operating margin

Asia - 5.4% n/a n/a

Australasia 4.3% (0.4%) nmf nmf

APAC 4.3% 1.7% nmf nmf

UK & Europe 0.8% 0.8% 0bps 0bps

Total Retail 0.9% 0.9% 0bps 0bps

---------------------- -------- -------- ---------- ---------- ---------

nmf = not meaningful

-- UK and Europe is home to the Group's remaining Retail

operations in the UK, Russia and Poland. Revenue for the region was

down 23% year-on-year (down 15% on an organic basis), as closures

from late-March weighed on the performance of both the UK and

Russia businesses. We experienced a step-up in the second half,

with solid demand for New and Used Vehicles, as well as Aftersales

services. During the first half, the UK business received GBP23m of

government support (employment and business rates), but was

nevertheless still heavily loss-making. We have not accessed any

such support in the second half. Performance improved in the second

half as we experienced higher Vehicle gross margins and the benefit

from our cost-restructuring efforts. We finished the year with

operating profit(1) of GBP25m (vs GBP32m in the prior period, which

included profits from businesses disposed in December 2019,

including Inchcape Fleet Solutions), and slightly higher margins

than 2019.

-- Asia: the China Retail business (disposed in December 2019)

was reclassified from Distribution-Asia to Retail-Asia, and did not

provide any contribution to the region's performance in 2020.

-- Australasia: the majority of the Retail business in Australia

was sold during 2019. Two additional sites were sold in 2020, and

their contribution until the date of disposal has been included.

The comparative includes these two sites, and the rest of the

Australian Retail business that was sold in 2019. Following the

disposals, there will be no further contribution to this

segment.

Value drivers

We provide disclosure on the value drivers behind our gross

profit (pre-exceptional). This includes:

-- Gross profit attributable to Vehicles - New Vehicles, Used

Vehicles and the associated F&I (Finance & Insurance)

income; and

-- Gross profit attributable to Aftersales - Service and Parts.

% change % change

reported constant

2020 2019 FX

---------- ----------

GBPm GBPm

------ -------- ---------- ----------

Gross Profit

Vehicles 516.9 772.3 (33)% (31)%

Aftersales 372.5 499.8 (25)% (23)%

Total 889.4 1,272.1 (30)% (28)%

-------------- ------ -------- ---------- ----------

Weighed down by the effects of market closures caused by the

spread of COVID-19, over the reporting period we saw a 31% decrease

in Vehicles gross profit, while Aftersales gross profit was more

resilient, decreasing 23%.

We operate across the automotive value chain and during 2020, we

generated 42% of gross profit through Aftersales, compared to 39%

in the prior year.

Other financial items

Government support schemes: The Group has recognised an amount

of GBP30m as a credit against employee costs and GBP3m as a credit

against other operating expenses. These have been presented net

within operating costs before exceptional items and the majority

(GBP23m) was received by the UK Retail business. In some cases

salaries were paid in excess of the amount received under the

government support schemes, and these schemes were utilised instead

of other cost reduction measures that would have adversely impacted

employees (e.g. redundancies). During the second half of the year,

the Board took the decision not to claim further government

support. Due to the nature of the government support schemes,

amounts claimed prior to the Board decision totalling GBP11m from

governments in Australia and the UK have been recognised as a

liability as at 31 December 2020 as they have not yet been repaid.

The Group has also benefitted from the deferral of tax payments due

to governments amounting to GBP7m as at 31 December 2020.

Exceptional items: Exceptional charges in 2020 amounted to

GBP257m, arising primarily as a result of COVID-19. Goodwill and

site impairments totalled GBP223m, with the majority attributable

to the Retail segment and booked in the first half. With the

pandemic continuing to cause disruption in the second half, the

impairment review resulted in a cGBP37m write-off of intangible

assets related to our acquisition of Grupo Rudelman (in 2018).

Management remain confident about the attractiveness of the

business in the medium term. In July we announced GBP70m of future

restructuring costs linked to our cost-restructuring programme, of

which cGBP40m has been incurred in 2020, with the balance falling

into 2021. We also incurred a GBP10m charge relating to the write

down of inventory, and a net cost of GBP2m relating to acquisitions

and disposals. We benefited from an GBP8m gain, relating to the

recycling of foreign exchange gains previously recognised in other

comprehensive income, following the liquidation of a subsidiary. In

2019, the Group benefited from a GBP76m exceptional operating gain

which reflected a GBP109m gain largely relating to the disposal of

our UK fleet and China Retail businesses, offset by some

restructuring costs and asset impairments relating to those

disposals, as well as acquisition costs. Further details in note

3.

Net financing costs: Net finance costs were GBP37m (2019:

GBP47m). The decrease is largely due to a reduction in the cost of

financing inventory following the retail disposals in Australia,

the UK and China in 2019, further disposals in 2020 and the overall

reduction in inventory and associated inventory financing in

response to the COVID-19 pandemic. The interest charge is stated on

an IFRS 16 basis, and excluding interest relating to leases, our

net finance charge was GBP23m compared to GBP28m in 2019. We expect

net financing costs in 2021 will amount to cGBP40m.

Tax: The Group's effective tax rate for the year is 26% before

exceptional items (2019: 23%). The increase compared to the prior

year primarily arose because the Group was not able to recognise

the tax benefit associated with losses in certain markets. This

impact was partially offset by the release of a provision

associated with the European Commission State Aid issue. We believe

an effective tax rate of c25% is appropriate for the mid-term.

Non-controlling interests: Profits attributable to our

non-controlling interests were GBP3m (2019: GBP6m). The Group's

non-controlling interests comprise a 33% minority holding in UAB

Vitvela in Lithuania, a 30% share in NBT Brunei, a 10% share of

Subaru Australia and 6% of the Motor Engineering Company of

Ethiopia.

Dividend: The Board recommends a final ordinary dividend of 6.9p

per ordinary share which is subject to the approval of shareholders

at the 2021 Annual General Meeting. In reaching its decision, the

Board has taken into account the extraordinary circumstances that

the business endured during the year, and a broad range of

stakeholder perspectives. If approved, t he dividend will be paid

on 21 June 2021 to all shareholders on the register on 14 May

2021.

Cash flow and net debt: The Group generated free cash flow of

GBP177m (2019: GBP213m) driven primarily by an improvement in the

level of working capital. After the acquisition of four

Distribution businesses, as well as the proceeds received from our

Retail disposals, and GBP32m of share buybacks, the Group had net

cash excluding lease liabilities of GBP266m (2019: GBP103m).

Including lease liabilities (IFRS 16), our net debt stood at GBP67m

(2019: GBP250m).

Capital expenditure: During 2020, the Group incurred net capital

expenditure of GBP41m compared to GBP54m in 2019. The year-on-year

reduction reflects lower investment in tangible assets in response

to the economic uncertainty following the outbreak of the COVID-19

pandemic partially offset by lower disposal proceeds. Key 2020

projects included investments around our development of an

omnichannel proposition and capacity investments in Ethiopia. In

2021, we expect net capital expenditure of cGBP70m.

Financing: During the year, the Group was confirmed as an

eligible issuer under the UK Government's COVID Corporate Financing

Facility (CCFF). GBP100m was issued under this facility in May 2020

and repaid on 17 July 2020. As at 31 December 2020, the committed

funding facilities of the Group comprised a syndicated revolving

credit facility of GBP700m (2019: GBP700m) and sterling Private

Placement loan notes totalling GBP210m (2019: GBP210m). As at 31

December 2020, none of the GBP700m syndicated revolving credit

facility was drawn (2019: GBP60m).

Pensions: At the end of 2020, the IAS 19 net post-retirement

surplus was GBP20m (2019: GBP10m), with the increase driven largely

by a higher value of plan assets and changes in demographic

assumptions which were partially offset by changes in financial

assumptions. In line with the funding programme agreed with the

Trustees, the Group made additional cash contributions to the UK

pension schemes amounting to GBP4m (2019: GBP3m). Discussions with

the Trustees of the Inchcape Motors Pension Scheme in respect of

the actuarial valuation as at 5 April 2019 have been finalised and

the Group has agreed to contribute an additional GBP3m per annum to

the scheme over the next seven years.

Acquisitions and disposals: During 2020, the Group acquired the

Mercedes-Benz passenger car and private vans distribution

operations in Colombia from Daimler Colombia S.A. The business was

acquired to strengthen the Group's partnership with

Daimler-Mercedes-Benz in South America. In the second half of 2020,

the Group acquired the Daimler distribution business in El

Salvador, the MINI distribution business in Chile and the MINI and

Motorrad distribution businesses in Peru. The aggregate cash

consideration for these businesses was GBP32m.

During the year, the Group has continued to optimise its retail

portfolio and has disposed of 13 retail sites in the UK and two

retail sites in Australia generating aggregate net disposal

proceeds of GBP64m. The Group has also received GBP8m of deferred

consideration relating to the disposal of retail operations in

China in 2019.

Clarifying our financial metrics

The following table shows the key profit measures that we use

throughout this report to most accurately describe operating

performance and how they relate to statutory measures.

Metric GBPm Use of Metric

------------------------------------- ------- -------------------------------

Gross Profit 877.8 Direct profit contribution from

Value Drivers (e.g. Vehicles

and Aftersales)

Add back: Exceptional items

charged to gross profit 11.6

------------------------------------- ------- -------------------------------

Gross Profit (before exceptional

items)(1) 889.4

Less: Segment operating expenses (723.9)

------------------------------------- ------- -------------------------------

Operating Profit (before exceptional 165.5 Profit generated by the Group

Items)(1)

------------------------------------- ------- -------------------------------

Less: Exceptional items (257.1)

------------------------------------- ------- -------------------------------

Operating Loss (91.6) Statutory measure of Operating

Profit

------------------------------------- ------- -------------------------------

Less: Net Finance Costs and

JV profit (36.6)

------------------------------------- ------- -------------------------------

Loss before Tax (128.2) Statutory measure of profit

after the costs of financing

the Group

------------------------------------- ------- -------------------------------

Add back: Exceptional Items 257.1

Profit Before Tax & Exceptional

Items(1) 128.9

------------------------------------- ------- -------------------------------

1. APM (alternative performance measure), see note 13

Reconciliation of free cash flow(1)

2020 2020 2019 2019

GBPm GBPm GBPm GBPm

---------------------------------------------- ------ ------ ------ ------

Net cash generated from operating activities 254.8 327.2

Add back: Payments in respect of exceptional

items 24.3 10.5

---------------------------------------------- ------ ------ ------ ------

Net cash generated from operating activities,

before exceptional items 279.1 337.7

Purchase of property, plant and equipment (27.4) (44.9)

Purchase of intangible assets (20.1) (24.7)

Proceeds from disposal of property, plant

and equipment 6.7 15.7

---------------------------------------------- ------ ------ ------ ------

Net capital expenditure (40.8) (53.9)

---------------------------------------------- ------ ------ ------ ------

Net payment in relation to leases (56.7) (65.1)

------ ------ ------ ------

Dividends paid to non-controlling interests (4.3) (5.8)

------ ------ ------

Free cash flow 177.3 212.9

---------------------------------------------- ------ ------ ------ ------

Included within free cash flow are movements in cash balances

where prior approval is required to transfer funds abroad, as

described in note 9

Return on capital employed(1)

2020 2019

GBPm GBPm

-------------------------------------------- ------- -------

Operating Profit (before exceptional items) 165.5 373.1

-------------------------------------------- ------- -------

Net assets 1,083.7 1,298.6

Add net debt 66.5 249.9

-------------------------------------------- ------- -------

Capital employed 1,150.2 1,548.5

-------------------------------------------- ------- -------

Effect of averaging 199.2 129.6

-------------------------------------------- ------- -------

Average capital employed 1,349.4 1,678.1

-------------------------------------------- ------- -------

ROCE 12.3% 22.2%

-------------------------------------------- ------- -------

1. APM (alternative performance measure), see note 13

Appendix - business models

APAC

At the heart of the Asia region, we are the Distributor and

exclusive Retailer for Toyota, Lexus, Hino and Suzuki and operate

Distribution and exclusive Retail for Jaguar Land Rover in Hong

Kong with additional Distribution and Retail franchises across the

region. In Australasia we are the distributor for Subaru.

Country Route to market Brands

----------- ------------------------ ----------------------------------------

Hong Kong Distribution & Exclusive Toyota, Lexus, Hino, Jaguar, Land Rover,

Retail Maxus

Macau

----------- ------------------------ ----------------------------------------

Singapore Distribution & Exclusive Toyota, Lexus, Hino, Suzuki

Retail

----------- ------------------------ ----------------------------------------

Brunei Distribution & Exclusive Toyota, Lexus

Retail

----------- ------------------------ ----------------------------------------

Guam Distribution & Exclusive Toyota, Lexus, BMW, Chevrolet

Retail

----------- ------------------------ ----------------------------------------

Saipan Distribution & Exclusive Toyota

Retail

----------- ------------------------ ----------------------------------------

Thailand Distribution & Exclusive Jaguar, Land Rover

Retail

----------- ------------------------ ----------------------------------------

Australia Distribution & Retail Subaru, Peugeot, Citroen

----------- ------------------------ ----------------------------------------

Retail VW, Isuzu, Kia, Mitsubishi, Jeep

----------- ------------------------ ----------------------------------------

New Zealand Distribution Subaru

----------- ------------------------ ----------------------------------------

UK & Europe

We have scale Retail operations across the UK focused on premium

and luxury brands. Our European operations are centred on Toyota

and Lexus Distribution and Retail in Belgium, Greece and the

Balkans, and both Distribution and Retail businesses across

Northern Europe focused on BMW, Jaguar Land Rover and other

brands.

Country Business Model Brands

---------- -------------- -------------------------------------------

UK Retail Toyota, Lexus, Audi, BMW, MINI, Jaguar,

Land Rover, Mercedes-Benz, VW, Porsche,

Smart

---------- -------------- -------------------------------------------

Belgium Distribution & Toyota, Lexus

Retail

-------------- -------------------------------------------

Luxembourg

-------------- -------------------------------------------

Greece

Romania

Bulgaria

Macedonia

---------- -------------- -------------------------------------------

Finland Distribution & Jaguar, Land Rover, Mazda

Retail

Estonia Distribution & Jaguar, Land Rover, Mazda, BMW, MINI

Retail

Latvia Distribution & BMW, MINI, Ford, Jaguar, Land Rover, Mazda,

Retail

Lithuania Distribution & Jaguar, Land Rover, Mazda, Ford, Hyundai,

Retail BMW, MINI, Rolls Royce

Poland Distribution & BMW, MINI, Jaguar Land Rover

Russia Retail Toyota, Audi, BMW, Jaguar, Land Rover,

Retail Lexus, MINI, Rolls-Royce, Volvo

---------- -------------- -------------------------------------------

Americas & Africa

In South America, we have BMW Distribution and Retail businesses

in Chile and Peru as well as Subaru operations across these

markets, Colombia and Argentina. We also hold the Distribution

contracts and operate Retail for Daimler across four markets in the

region, and Suzuki in Costa Rica, Panama and Argentina. Our

business in Ethiopia is centred on Distribution and exclusive

Retail for Toyota, while in Kenya we are the distributor and

retailer for premium marques Jaguar Land Rover and BMW.

Country Business Model Brands

------------ ------------------------ ---------------------------------------

Ethiopia Distribution & Exclusive Toyota, Daihatsu, Komatsu, New Holland,

Djibouti Retail Hino, BMW

Distribution Toyota, BMW, Komatsu

Kenya Distribution & Retail Jaguar, Land Rover, BMW, BMW Motorrad

Chile Distribution & Retail BMW, BMW Motorrad, MINI, Subaru, Rolls

Royce, Hino, DFSK,

Peru Distribution & Retail BMW, BMW Motorrad, MINI, Subaru, DFSK,

BYD

Colombia Distribution & Retail Subaru, Hino, Jaguar, Land Rover, DFSK,

Mack, Doosan, Dieci, Mercedes-Benz

Argentina Distribution & Retail Subaru, Suzuki

Costa Rica Distribution & Retail Suzuki, JAC, Changan, Kubota

Panama Distribution & Retail Suzuki

Uruguay Distribution & Retail Mercedes-Benz, Freightliner and Fuso

Ecuador Distribution & Retail Mercedes-Benz

El Salvador Distribution & Retail Mercedes-Benz

------------ ------------------------ ---------------------------------------

Consolidated income statement

For the year ended 31 December 2020

Exceptional Exceptional

items items

Before Before

exceptional (note exceptional (note

items 3) Total items 3) Total

2020 2020 2020 2019 2019 2019

Notes GBPm GBPm GBPm GBPm GBPm GBPm

--------------------------------- ----- ------------- ----------- --------- ------------- ----------- ---------

Revenue 2 6,837.8 - 6,837.8 9,379.7 - 9,379.7

Cost of sales (5,948.4) (11.6) (5,960.0) (8,107.6) - (8,107.6)

--------------------------------- ----- ------------- ----------- --------- ------------- ----------- ---------

Gross profit 889.4 (11.6) 877.8 1,272.1 - 1,272.1

Net operating expenses (723.9) (245.5) (969.4) (899.0) 75.5 (823.5)

--------------------------------- ----- ------------- ----------- --------- ------------- ----------- ---------

2,

Operating profit / (loss) 3 165.5 (257.1) (91.6) 373.1 75.5 448.6

Share of profit after tax of

joint ventures and associates - - - 0.3 - 0.3

--------------------------------- ----- ------------- ----------- --------- ------------- ----------- ---------

Profit / (loss) before finance

and tax 165.5 (257.1) (91.6) 373.4 75.5 448.9

Finance income 4 14.4 - 14.4 24.1 - 24.1

Finance costs 5 (51.0) - (51.0) (71.2) - (71.2)

--------------------------------- ----- ------------- ----------- --------- ------------- ----------- ---------

Profit / (loss) before tax 128.9 (257.1) (128.2) 326.3 75.5 401.8

Tax 6 (33.2) 24.2 (9.0) (75.6) 2.5 (73.1)

--------------------------------- ----- ------------- ----------- --------- ------------- ----------- ---------

Profit / (loss) for the year 95.7 (232.9) (137.2) 250.7 78.0 328.7

--------------------------------- ----- ------------- ----------- --------- ------------- ----------- ---------

(Loss) / profit attributable

to:

* Owners of the parent (140.1) 322.9

* Non-controlling interests 2.9 5.8

--------------------------------- ----- ------------- ----------- --------- ------------- ----------- ---------

(137.2) 328.7

--------------------------------- ----- ------------- ----------- --------- ------------- ----------- ---------

Basic (loss) / earnings per

share (pence) 7 (35.6)p 79.0p

Diluted (loss) / earnings per

share (pence) 7 (35.6)p 78.4p

--------------------------------- ----- ------------- ----------- --------- ------------- ----------- ---------

Consolidated statement of comprehensive income

For the year ended 31 December 2020

2020 2019

GBPm GBPm

---------------------------------------------------------- ------- -------

(Loss) / profit for the year (137.2) 328.7

Other comprehensive (loss) / income:

Items that will not be reclassified to the consolidated

income statement

Changes in the fair value of equity investments at

fair value through other comprehensive income (2.7) -

Defined benefit pension scheme remeasurements 14.8 (71.7)

Current tax recognised in consolidated statement of -

comprehensive income -

Deferred tax recognised in consolidated statement

of comprehensive income (2.5) 10.1

----------------------------------------------------------- ------- -------

9.6 (61.6)

Items that may be or have been reclassified subsequently

to the consolidated income statement

Cash flow hedges (3.2) (25.9)

Exchange differences on translation of foreign operations (51.5) (98.6)

Current tax recognised in consolidated statement of

comprehensive income 0.3 -

Deferred tax recognised in consolidated statement

of comprehensive income (0.9) 7.0

----------------------------------------------------------- ------- -------

(55.3) (117.5)

---------------------------------------------------------- ------- -------

Other comprehensive loss for the year, net of tax (45.7) (179.1)

----------------------------------------------------------- ------- -------

Total comprehensive (loss) / income for the year (182.9) 149.6

----------------------------------------------------------- ------- -------

Total comprehensive (loss) / income attributable to:

* Owners of the parent (186.2) 146.8

* Non-controlling interests 3.3 2.8

----------------------------------------------------------- ------- -------

(182.9) 149.6

---------------------------------------------------------- ------- -------

Consolidated statement of financial position

As at 31 December 2020

2020 2019

Notes GBPm GBPm

----------------------------------------------------------- ------ --------- ---------

Non-current assets

Intangible assets 450.2 577.9

Property, plant and equipment 569.8 695.1

Right-of-use assets 257.3 313.3

Investments in joint ventures and associates 2.4 4.3

Financial assets at fair value through other comprehensive

income 3.6 6.9

Trade and other receivables 49.2 38.7

Deferred tax assets 68.6 58.3

Retirement benefit asset 101.0 78.7

----------------------------------------------------------- ------ --------- ---------

1,502.1 1,773.2

Current assets

Inventories 1,216.2 1,566.9

Trade and other receivables 369.6 512.3

Financial assets at fair value through other comprehensive

income 0.2 0.2

Derivative financial instruments 13.3 16.2

Current tax assets 20.6 21.6

Cash and cash equivalents 9 481.2 423.0

----------------------------------------------------------- ------ --------- ---------

2,101.1 2,540.2

Assets held for sale and disposal group 31.2 149.4

----------------------------------------------------------- ------ --------- ---------

2,132.3 2,689.6

----------------------------------------------------------- ------ --------- ---------

Total assets 3,634.4 4,462.8

----------------------------------------------------------- ------ --------- ---------

Current liabilities

Trade and other payables (1,610.3) (1,996.4)

Derivative financial instruments (42.4) (27.4)

Current tax liabilities (65.0) (82.4)

Provisions (26.8) (23.0)

Lease liabilities (58.5) (56.8)

Borrowings (6.1) (50.1)

----------------------------------------------------------- ------ --------- ---------

(1,809.1) (2,236.1)

Liabilities directly associated with the disposal

group (7.7) (106.1)

----------------------------------------------------------- ------ --------- ---------

(1,816.8) (2,342.2)

Non-current liabilities

Trade and other payables (69.3) (77.2)

Provisions (19.8) (12.9)

Deferred tax liabilities (79.1) (96.7)

Lease liabilities (274.3) (296.0)

Borrowings (210.0) (270.0)

Retirement benefit liability (81.4) (69.2)

----------------------------------------------------------- ------ --------- ---------

(733.9) (822.0)

----------------------------------------------------------- ------ --------- ---------

Total liabilities (2,550.7) (3,164.2)

----------------------------------------------------------- ------ --------- ---------

Net assets 1,083.7 1,298.6

----------------------------------------------------------- ------ --------- ---------

Equity

Share capital 39.4 40.0

Share premium 146.7 146.7

Capital redemption reserve 141.2 140.6

Other reserves (248.5) (190.4)

Retained earnings 985.6 1,141.4

----------------------------------------------------------- ------ --------- ---------

Equity attributable to owners of the parent 1,064.4 1,278.3

Non-controlling interests 19.3 20.3

----------------------------------------------------------- ------ --------- ---------

Total equity 1,083.7 1,298.6

----------------------------------------------------------- ------ --------- ---------

Duncan Tait, Gijsbert de Zoeten,

Group Chief Executive Chief Financial Officer

Consolidated statement of changes in equity

For the year ended 31 December 2020

Total

equity

attributable

Capital to owners Non- Total

Share Share redemption Other Retained of the controlling shareholders'

capital premium reserve reserves earnings parent interests equity

Notes GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

-------------------------------- ----- ------- ------- ---------- -------- -------- ------------ ----------- -------------

At 1 January 2019 41.6 146.7 139.0 (75.9) 1,093.1 1,344.5 23.3 1,367.8

Profit for the year - - - - 322.9 322.9 5.8 328.7

Other comprehensive loss

for the year - - - (114.5) (61.6) (176.1) (3.0) (179.1)

------- ------- ---------- -------- -------- ------------ ----------- -------------

Total comprehensive income

for the year - - - (114.5) 261.3 146.8 2.8 149.6

Share-based payments,

net of tax - - - - 6.8 6.8 - 6.8

Share buyback programme (1.6) - 1.6 - (100.0) (100.0) - (100.0)

Net purchase of own shares

by the Inchcape Employee

Trust - - - - (9.3) (9.3) - (9.3)

Dividends:

* Owners of the parent 8 - - - - (110.5) (110.5) - (110.5)

* Non-controlling interests - - - - - - (5.8) (5.8)

-------------------------------- ----- ------- ------- ---------- -------- -------- ------------ ----------- -------------

At 1 January 2020 40.0 146.7 140.6 (190.4) 1,141.4 1,278.3 20.3 1,298.6

(Loss) / profit for the

year - - - - (140.1) (140.1) 2.9 (137.2)

Other comprehensive loss for

the year - - - (58.1) 12.0 (46.1) 0.4 (45.7)

------- ------- ---------- -------- -------- ------------ ----------- -------------

Total comprehensive loss for

the year - - - (58.1) (128.1) (186.2) 3.3 (182.9)

Share-based payments,

net of tax - - - - 3.7 3.7 - 3.7

Share buyback programme (0.6) - 0.6 - (31.4) (31.4) - (31.4)

Dividends:

* Owners of the parent 8 - - - - - - - -

* Non-controlling interests - - - - - - (4.3) (4.3)

-------------------------------- ----- ------- ------- ---------- -------- -------- ------------ ----------- -------------

At 31 December 2020 39.4 146.7 141.2 (248.5) 985.6 1,064.4 19.3 1,083.7

-------------------------------- ----- ------- ------- ---------- -------- -------- ------------ ----------- -------------

Share-based payments include a net tax credit of GBP0.4m

(current tax charge of GBPnil and a deferred tax credit of

GBP0.4m)

(2019 - net tax credit of GBP0.7m (current tax charge of GBPnil

and a deferred tax credit of GBP0.7m)).

Consolidated statement of cash flows

For the year ended 31 December 2020

2020 2019

Notes GBPm GBPm

-------------------------------------------------------- ----- ------- -------

Cash generated from operating activities

Cash generated from operations 9a 338.8 445.9

Tax paid (51.8) (74.1)

Interest received 13.9 22.0

Interest paid (46.1) (66.6)

-------------------------------------------------------- ----- ------- -------

Net cash generated from operating activities 254.8 327.2

-------------------------------------------------------- ----- ------- -------

Cash flows from investing activities

Acquisition of businesses, net of cash and overdrafts

acquired 10 (31.5) (41.2)

Net cash inflow from sale of businesses 10 71.8 230.4

Net cash inflow from disposal of investments in joint

ventures and associates 2.0 0.1

Purchase of property, plant and equipment (27.4) (44.9)

Purchase of intangible assets (20.1) (24.7)

Proceeds from disposal of property, plant and equipment 6.7 15.7

Proceeds from disposal of intangible assets 0.2 -

Receipt from sub-lease receivables 0.7 0.6

Net cash generated from investing activities 2.4 136.0

-------------------------------------------------------- ----- ------- -------

Cash flows from financing activities

Share buyback programme (32.1) (99.3)

Net purchase of own shares by the Inchcape Employee

Trust - (9.3)

Cash inflow from Covid Corporate Financing Facility 99.6 -

Repayment of Covid Corporate Financing Facility (99.6) -

Repayment of Private Placement loan notes - (75.4)

Net cash outflow from other borrowings (66.1) (122.0)

Payment of capital element of lease liabilities (57.4) (65.7)

Equity dividends paid 8 - (110.5)

Dividends paid to non-controlling interests (4.3) (5.8)

-------------------------------------------------------- ----- ------- -------

Net cash used in financing activities (159.9) (488.0)

-------------------------------------------------------- ----- ------- -------

Net increase / (decrease) in cash and cash equivalents 97.3 (24.8)

Cash and cash equivalents at beginning of the period 379.2 463.4

Effect of foreign exchange rate changes (0.2) (59.4)

-------------------------------------------------------- ----- ------- -------

Cash and cash equivalents at the end of the year 476.3 379.2

-------------------------------------------------------- ----- ------- -------

Cash and cash equivalents consist of:

* Cash at bank and cash equivalents 9 378.5 321.5

* Short-term deposits 9 102.7 101.5

* Bank overdrafts (6.1) (43.8)

* Cash at bank and cash equivalents included in

disposal groups held for sale 1.2 -

-------------------------------------------------------- ----- ------- -------

476.3 379.2

-------------------------------------------------------- ----- ------- -------

Notes to the financial statements

1 Basis of preparation and accounting policies

The consolidated financial statements have been prepared in

accordance with International Financial Reporting Standards (IFRS)

as adopted by the European Union and International Financial

Reporting Interpretation Committee (IFRIC) interpretations and with

those parts of the Companies Act 2006 applicable to companies

reporting under IFRS.

The condensed set of financial information presented for the

years ended 31 December 2019 and 2020 do not constitute statutory

accounts within the meaning of Section 434 of the Companies Act

2006. The Group's published consolidated financial statements for

the year ended 31 December 2019 have been reported on by the

Group's auditors and filed with the Registrar of Companies. The

report of the auditors was unqualified and did not contain an

emphasis of matter paragraph or a statement under Section 498 of

the Companies Act 2006. The financial information for the year

ended 31 December 2020 and the comparative information have been

extracted from the audited consolidated financial statements for

the year ended 31 December 2020 prepared under IFRS, which have not

yet been approved by the shareholders and have not yet been

delivered to the Registrar. The report of the auditors on the

consolidated financial statements for 2020 was unqualified and did

not contain a statement under Section 498 (2) or (3) of the

Companies Act 2006.

Accounting policies

The condensed set of consolidated financial information have

been prepared using accounting policies consistent with those in

the Group's Annual Report and Accounts 2019 with the exception of

the following standards, amendments and interpretations which have

been newly adopted from 1 January 2020:

Newly adopted accounting policies

From 1 January 2020, the following standards became effective in

the Group's consolidated financial statements:

-- Amendments to References to the Conceptual Framework in IFRS Standards;

-- Amendments to IAS 1 and IAS 8 - Definition of Material;

-- Amendments to IFRS 3 - Definition of a Business;

-- Amendments to IFRS 9, IAS 39 and IFRS 7 - Interest rate benchmark reform; and

-- Amendment to IFRS 16 in relation to COVID-19 Related rent concessions

The accounting policies have been applied consistently

throughout the reporting period, other than in respect of the

amendment to IFRS 16, which has been newly adopted. The other

standards that became applicable for the current period did not

have any impact on the Group's accounting policies and did not

require adjustments.

The Group has not early adopted other standards, amendments to

standards or interpretations that have been issued but are not yet

effective.

Amendment to IFRS 16 - COVID-19 Related Rent Concessions

The amendment provides lessees with relief in the form of an

optional exemption from assessing whether a rent concession related

to COVID-19, and that meets certain conditions, is a lease

modification. Lessees can elect to account for qualifying rent

concessions in the same way as they would if they were not lease

modifications. In applying the practical expedient a lessee would

generally account for a forgiveness or waiver of lease payments as

a variable lease payment, and recognise the concession in the

period in which the event or condition that triggers those payments

occurs. The lessee also makes a corresponding adjustment to the

lease liability, in effect derecognising the part of the lease

liability that has been forgiven or waived. On adoption of the

amendment, the Group has recognised a credit of GBP1.1m in the

consolidated income statement.

Standards not effective at the balance sheet date

The following standards were in issue but were not yet effective

at the balance sheet date. These standards have not yet been early

adopted by the Group, and will be applied for the Group's financial

years commencing on or after 1 January 2021:

-- Amendments to IFRS 9, IAS 39, IFRS 7, IFRS 4 and IFRS 16 -

Interest Rate Benchmark Reform - Phase 2;

-- Annual Improvements to IFRS Standards 2018-2020;

-- Amendments to IAS 16 - Property, Plant and Equipment - Proceeds before Intended Use;

-- Amendments to IAS 37 - Onerous Contracts - Cost of Fulfilling a Contract;

-- Amendments to IFRS 3 (May 2020) - Reference to the Conceptual Framework;

-- IFRS 17 - Insurance Contracts; and

-- Amendments to IAS 1 - Classification of liabilities as current or non-current;

Management are currently reviewing the new standards to assess

the impact that they may have on the Group's reported position and

performance. Management do not expect that the adoption of the

standards listed above will have a material impact on the financial

statements of the Group.

Going concern

Based on the Group's cash flow forecasts and projections, the

Board is satisfied that the Group will be able to operate within

the level of its committed facilities for the foreseeable future.

For this reason, the Board continues to adopt the going concern

basis in preparing its financial statements. In assessing whether

the Group is a going concern, the implications of COVID-19 have

been considered together with measures taken to mitigate its impact

on the Group. In making this assessment the Group has considered

available liquidity in relation to net debt and committed

facilities, the Group's latest forecasts for 2021 and 2022 cash

flows together with COVID-19 adjusted scenarios. The forecasts used

reflected the likely economic downturn triggered by COVID-19, with

a key emphasis on the Board approved operating plan for 2021 and a

forecast for 2022 based on a set of reasonably defined forecast

principles.

Given the global political and economic uncertainty resulting

from the COVID-19 pandemic, we expect to see volatility, business

disruption and the impact of economic downturns in the markets in

which the Group operates during 2021 and into 2022. During 2020 and

the early part of 2021, the business has been impacted by

government action to control the COVID-19 pandemic with a number of

the Group's businesses suffering restricted trading from

time-to-time and to a greater or lesser extent.

During 2020, action was taken to strengthen the Group's

resilience to the trading volatility and liquidity position in

light of the environment and circumstance. These actions

included:

-- initiation of a major cost-restructuring programme to

rationalise the Group's footprint, a reduction in the global

workforce and re-negotiation of third-party expenditure;

-- temporary reduction in advertising and promotional

expenditure, reducing executive pay for four months, freezing other

pay and recruitment and reductions in operating expenditure;

-- in the first half of 2020, the utilisation of government

support measures such as the UK job retention scheme combined with

UK business rates suspension and international government support

measures, where available;

-- collaborating closely with OEMs and banks to manage inventory and inventory financing levels;

-- suspending the share buyback programme; and

-- cancelling the final dividend for 2019 and not declaring an interim dividend for 2020.

Committed bank facilities and Private Placement borrowings

totalling GBP910m, of which GBP210m was drawn at 31 December 2020,

are subject to the same interest cover covenant based on an

adjusted EBITA measure to interest on consolidated borrowings

measured on a trailing 12 month basis at June and December. While

the UK Government's Covid Corporate Financing Facility (CCFF)

scheme remains available to the Group, the CCFF is not considered

to be a committed facility for the purposes of the going concern

assessment.

The Board approved operating plan for 2021 and the Group's

forecast for 2022 indicate that the Group is expected to be

compliant with this covenant throughout the forecast period and to

have sufficient liquidity to continue in operation throughout that

period.

A range of sensitivities has been applied to the forecasts to

assess the Group's compliance with its covenant requirements over

the forecast period. These sensitivities included:

-- further periods of COVID-19 restrictions similar in nature

and impact to those seen in the second half of 2020, impacting half

of the Group's markets simultaneously throughout 2021;

-- an overall reduction in gross margins;

-- an appreciation in Sterling against the Group's main trading companies; combined with

-- working capital sensitivities.

In a scenario where all of the above sensitivities occur at the

same time, the Group has modelled the possibility of the interest

cover covenant being breached in 2021. With the interest cover

covenant measured on a trailing 12 month basis, the sensitised

forecasts indicate that the Group is not expected to breach any

covenants and would be compliant with the interest cover

requirements at December 2021 and throughout the forecast period.

Additionally, under these circumstances, the Group expects to have

sufficient funds to meet cash flow requirements. In a scenario

where such restrictions impacted half of the group markets

simultaneously for a period of 24 months, the Group is forecasted

to be compliant with the interest cover covenant.

Reverse stress test scenario analysis has been applied to the

forecasts to assess particular scenarios in which the Group would

breach its covenant or have insufficient funds to meet cash flow

requirements. One such scenario was to model more severe trading

restrictions in all markets simultaneously with the impact

comparable to those experienced in a few markets in H1 2020, which

amounts to a material cessation in operations and revenue. Under

this scenario, the Group could sustain such restrictions for a

period of approximately five months before breaching the interest

cover covenant, but even in this circumstance, would still have

sufficient liquidity. We deem this circumstance to be highly

unlikely due to the geographic diversity of the Group's operations

and our increased ability to trade digitally through the trading

restrictions.

The Board therefore concluded that the Group will be able to

operate within the level of its committed facilities for the

foreseeable future and the Directors consider it appropriate to

adopt the going concern basis of accounting in preparing the

financial statements for the year ending 31 December 2020.

Critical accounting judgements and sources of estimation

uncertainty

The preparation of financial statements in accordance with

generally accepted accounting principles requires the use of

estimates and assumptions that affect the reported amounts of

assets and liabilities at the date of the financial statements and

the reported amounts of revenues and expenses during the reporting

period. Although these estimates are based on management's best

knowledge, actual results may ultimately differ from those

estimates. The estimates and underlying assumptions are reviewed on

an ongoing basis. The Directors have made a number of estimates and

assumptions regarding the future, and made some significant

judgements in applying the Group's accounting policies. These are

discussed below:

Sources of estimation uncertainty

The key assumptions about the future, and other key sources of

estimation uncertainties at the reporting period end that may have

a significant risk of causing a material adjustment to the carrying

amount of assets and liabilities within in the next period are

discussed below:

Impairment of goodwill and other indefinite life intangible

assets

Distribution Distribution

Goodwill agreements Total Goodwill agreements Total

2020 2020 2020 2019 2019 2019

Reporting segment CGU group GBPm GBPm GBPm GBPm GBPm GBPm

--------------------- ----------------------- -------- ------------ ----- -------- ------------ -----

UK and Europe

Retail UK Retail - - - 80.2 - 80.2

--------------------- ----------------------- -------- ------------ ----- -------- ------------ -----

UK and Europe

Distribution Baltics - BMW 6.2 28.9 35.1 5.8 27.4 33.2

--------------------- ----------------------- -------- ------------ ----- -------- ------------ -----

Americas and

Africa Distribution Americas - Daimler 4.4 27.7 32.1 3.8 13.8 17.6

---------------------

Americas - Hino/Subaru 47.2 137.8 185.0 45.7 134.6 180.3

Americas - Suzuki 37.6 52.2 89.8 44.8 85.3 130.1

Kenya 1.1 - 1.1 1.2 - 1.2

--------------------------------------------- -------- ------------ ----- -------- ------------ -----

APAC Distribution Singapore 22.5 - 22.5 22.8 - 22.8

---------------------

Australia Retail - - - 9.6 - 9.6

Peugeot Citroën

Australia - - - 1.8 - 1.8

--------------------------------------------- -------- ------------ ----- -------- ------------ -----

119.0 246.6 365.6 215.7 261.1 476.8

--------------------------------------------- -------- ------------ ----- -------- ------------ -----

In accordance with the Group's accounting policy, goodwill and

other indefinite-life intangible assets are tested at least

annually for impairment and whenever events or circumstances

indicate that the carrying amount may not be recoverable.

Impairment tests were performed for all CGU groups during the year

ended 31 December 2020.

The recoverable amounts of all CGU groups were determined based

on the higher of the fair value less costs to sell and value in use

calculations. The recoverable amount is determined firstly through

value in use calculations. Where this is insufficient to cover the

carrying value of the relevant asset being tested, fair value less

costs to sell is also determined.

If the carrying amount of a CGU or CGU group exceeds its

recoverable amount, an impairment loss is recognised and allocated

between the assets of the unit to reduce the carrying amount. This

allocation is initially applied to any site-based assets within a

CGU based on the results of impairment testing performed over

individual site CGUs and then to any indefinite-life intangible

assets. If a further impairment charge still remains, then to the

carrying amount of any goodwill is allocated to the CGU or CGU

group.

The value in use calculations mainly use cash flow projections

based on five-year financial forecasts prepared by management. The

key assumptions for these forecasts are those relating to volumes,

revenue, gross margins, overheads, the level of working capital

required to support trading and capital expenditure.

Forecast revenue is based on past experience and expectations

for near-term growth in the relevant markets. Key assumptions used

to determine revenue are expectations of market size, represented

by Total Industry Volume (TIV), Units in Operation (UIO) and market

share. Operating profits are forecast based on historical

experience of gross and operating margins, adjusted for the impact

of changes to product mix and cost-saving initiatives that had been

implemented at the reporting date. Cash flows are forecast based on

operating profit adjusted for the level of working capital required

to support trading and capital expenditure.

The assumptions used in the value in use calculations are based

on past experience, recent trading and forecasts of operational

performance in the relevant markets including the impact of

COVID-19 and the UK trading arrangements with the European Union.

They also reflect expectations about continuing relationships with

key brand partners and the impact climate change may have on its

operations. Whilst at this stage there is significant uncertainty

regarding what the long-term impact of climate change initiatives

may be on the markets in which we operate, the forecasts reflect

our best estimate.

For CGU groups in the Americas and Africa reporting segment,

cash flows after the five-year period are extrapolated for a

further five years using declining growth rates which reduces the

year five growth rate down to the long-term growth rate appropriate

for each CGU or CGU group, to better reflect the medium-term growth

expectations for those markets. A terminal value calculation is

used to estimate the cash flows after year ten using these