Expedia Group, Inc. (“Expedia Group” or the “Company”) today

announced the results as of the Early Participation Date for its

previously announced cash tender offer (the “Offer”) for a portion

of its 6.250% Senior Notes due 2025 (the “Notes”). In connection

therewith, Expedia Group further announced that it is increasing

the maximum aggregate purchase price of Notes that it will accept

for purchase (as amended herein, the “Maximum Amount”), from the

previously announced amount of $950,000,000 to $1,130,000,000. The

Offer is being made pursuant to the terms and subject to the

conditions described in the Offer to Purchase, dated February 16,

2021, as amended by this press release (the “Offer to Purchase”).

Capitalized terms used but not defined in this announcement have

the meanings given to them in the Offer to Purchase. Except as

described in this announcement, all other terms and conditions of

the Offer as described in the Offer to Purchase remain unchanged,

including the Early Participation Date, Early Participation Amount,

Tender Offer Consideration, Total Consideration, Withdrawal Date

and Expiration Date.

The Offer is subject to, and conditioned upon, the satisfaction

or waiver of certain conditions described in the Offer to Purchase,

including Expedia Group receiving aggregate net proceeds from its

previously announced private offerings of $1,000,000,000 in

aggregate principal amount of 2.950% Senior Notes due 2031 and

$1,000,000,000 in aggregate principal amount of 0% Convertible

Senior Notes due 2026 (together, the “Financing Transaction”),

after the payment of any fees and expenses related to the Financing

Transaction, in an amount equal to no less than the sum of (i) the

Maximum Amount and (ii) the Redemption Price in connection with the

Company’s previously announced redemption for all of its

outstanding 7.000% Senior Notes due 2025 (the “Financing

Condition”). The Company reserves the right, subject to applicable

law, to: (i) waive any and all conditions to the Offer; (ii)

extend, terminate or withdraw the Offer; (iii) further increase the

Maximum Amount; or (iv) otherwise amend the Offer in any

respect.

As previously announced, the Early Participation Date for the

Offer was 5:00 p.m., New York City time, on March 1, 2021.

According to the information received from D.F. King & Co.,

Inc., the tender and information agent for the Offer, as of the

Early Participation Date, Expedia Group had received valid tenders

from holders of the Notes as set forth in the table below. The

Early Participation Date was not extended. Withdrawal rights for

the Offer expired at 5:00 p.m., New York City time, on March 1,

2021, and were not extended. Accordingly, Notes tendered in the

Offer may no longer be withdrawn.

Title of Security

CUSIP/ISIN

Aggregate Principal Amount

Outstanding

Aggregate Principal Amount

Tendered

Aggregate Principal Amount

Expected to be Purchased

Total Consideration

(1)(2)

Proration Factor(3)

6.250% Senior Notes due

2025

CUSIP: 30212PAS4 (144A) ISIN:

US30212PAS48 (144A) CUSIP: U3010DAH3 (Reg S) ISIN: USU3010DAH36

(Reg S)

$2,000,000,000

$1,704,655,000

$955,600,000

$1,182.50

56.1%

(1) Excludes accrued but unpaid interest on the Notes from, and

including, the most recent interest payment date for the Notes

prior to the applicable settlement date to, but not including, the

applicable settlement date (“Accrued Interest”). Holders whose

Notes are accepted will also receive Accrued Interest on such

Notes.

(2) The Total Consideration payable for the Notes includes the

Early Participation Amount and will be a price per $1,000 principal

amount of the Notes validly tendered in the Offer at or prior to

the Early Participation Date for the Offer and accepted for

purchase by the Company.

(3) Rounded to the nearest tenth of a percentage point.

The purchase of all Notes validly tendered and not validly

withdrawn in the Offer would cause Expedia Group to purchase Notes

that would represent an aggregate purchase price, excluding Accrued

Interest, in excess of the Maximum Amount. Accordingly, the Notes

will be purchased on a pro rata basis up to the Maximum Amount.

Although the Offer is scheduled to expire at 11:59 p.m., New York

City time, on March 15, 2021, because the Offer was fully

subscribed up to the Maximum Amount as of the Early Participation

Date, Expedia Group expects that no additional Notes will be

purchased in the Offer, and that there will be no Final Payment

Date for the Offer.

The payment date for Notes validly tendered and not validly

withdrawn at or prior to the Early Participation Date and accepted

for purchase (the “Early Payment Date”) is expected to be March 3,

2021, subject to the satisfaction or waiver of all conditions to

the Offer described in the Offer to Purchase, including the

Financing Condition. The Financing Condition is expected to be

satisfied on March 3, 2021, upon the closing of Expedia Group’s

previously announced offering of $1,000,000,000 in aggregate

principal amount of 2.950% Senior Notes due 2031. Holders of Notes

that were validly tendered and not validly withdrawn at or prior to

the Early Participation Date and have been accepted for purchase

pursuant to the Offer will receive the Total Consideration for each

series of Notes as set forth in the table above, which includes the

Early Participation Amount of $50 per $1,000 principal amount of

Notes, together with Accrued Interest on such Notes.

Expedia Group has appointed BofA Securities, Goldman Sachs &

Co. LLC and J.P. Morgan Securities LLC to act as dealer managers

for the Offer, and has retained D.F. King & Co., Inc. to serve

as the tender agent and information agent. Requests for documents

may be directed to D.F. King & Co., Inc. by email at

expe@dfking.com or by telephone at +1 212-269-5550 (banks and

brokers) or +1 800-829-6551. Questions regarding the Offer may be

directed to BofA Securities at (980) 387-3907, Goldman Sachs &

Co. LLC at (212) 357-1452 and J.P. Morgan Securities LLC at (917)

808-9154.

This announcement is not (i) an offer to sell or purchase, or a

solicitation of an offer to purchase or sell, any securities,

including the notes offered in the Financing Transaction or (ii) a

notice of redemption or an obligation to issue a notice of

redemption. The Offer is being made solely by Expedia Group

pursuant to the Offer to Purchase. The Offer is not being made to,

nor will Expedia Group accept tenders of Notes from, holders in any

jurisdiction in which the Offer or the acceptance thereof would not

be in compliance with the securities or blue sky laws of such

jurisdiction.

Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995. These forward-looking statements reflect the views of our

management regarding current expectations and projections about

future events and are based on currently available information.

Actual results could differ materially from those contained in

these forward-looking statements for a variety of reasons,

including, but not limited to, those discussed in the section

entitled “Risk Factors” in our Annual Report on Form 10-K for the

year ended December 31, 2020, as well as those discussed elsewhere

in our public filings with the Securities and Exchange Commission

(“SEC”). COVID-19, and the volatile regional and global economic

conditions stemming from it, and additional or unforeseen effects

from the COVID-19 pandemic, could also give rise to or aggravate

these risk factors, which in turn could materially adversely affect

our business, financial condition, liquidity, results of operations

(including revenues and profitability) and/or stock price. Further,

COVID-19 may also affect our operating and financial results in a

manner that is not presently known to us or that we currently do

not consider to present significant risks to our operations. Other

unknown or unpredictable factors also could have a material adverse

effect on our business, financial condition and results of

operations. Accordingly, readers should not place undue reliance on

these forward-looking statements. The use of words such as

“anticipates,” “believes,” “could,” “estimates,” “expects,” “goal,”

“intends,” “likely,” “may,” “plans,” “potential,” “predicts,”

“projected,” “seeks,” “should” and “will,” or the negative of these

terms or other similar expressions, among others, generally

identify forward-looking statements; however, these words are not

the exclusive means of identifying such statements. In addition,

any statements that refer to expectations, projections or other

characterizations of future events or circumstances are

forward-looking statements. These forward-looking statements are

inherently subject to uncertainties, risks and changes in

circumstances that are difficult to predict. We are not under any

obligation to, and do not intend to, publicly update or review any

of these forward-looking statements, whether as a result of new

information, future events or otherwise, even if experience or

future events make it clear that any expected results expressed or

implied by those forward-looking statements will not be realized.

Please carefully review and consider the various disclosures made

in this press release and in our reports filed with the SEC that

attempt to advise interested parties of the risks and factors that

may affect our business, prospects and results of operations.

Disclaimer

This announcement must be read in conjunction with the Offer to

Purchase. This announcement and the Offer to Purchase (including

the documents incorporated by reference therein) contain important

information which must be read carefully before any decision is

made with respect to the Offer. If any holder of Notes is in any

doubt as to the action it should take, it is recommended to seek

its own legal, tax, accounting and financial advice, including as

to any tax consequences, immediately from its stockbroker, bank

manager, attorney, accountant or other independent financial or

legal adviser. Any individual or company whose Notes are held on

its behalf by a broker, dealer, bank, custodian, trust company or

other nominee or intermediary must contact such entity if it wishes

to participate in the Offer. None of Expedia Group, the dealer

managers, the tender and information agent, or any person who

controls or is a director, officer, employee or agent of such

persons, or any affiliate of such persons, makes any recommendation

as to whether holders of Notes should participate in the Offer.

About Expedia Group

Expedia Group, Inc. (NASDAQ: EXPE) companies power travel for

everyone, everywhere through our global platform. Driven by the

core belief that travel is a force for good, we help people

experience the world in new ways and build lasting connections. We

provide industry-leading technology solutions to fuel partner

growth and success, while facilitating memorable experiences for

travelers. The Expedia Group family of brands includes: Expedia®,

Hotels.com®, Expedia® Partner Solutions, Vrbo®, Egencia®, trivago®,

Orbitz®, Travelocity®, Hotwire®, Wotif®, ebookers®, CheapTickets®,

Expedia Group™ Media Solutions, Expedia Local Expert®,

CarRentals.com™, and Expedia Cruises™.

© 2021 Expedia, Inc., an Expedia Group company. All rights

reserved. Trademarks and logos are the property of their respective

owners. CST: 2029030-50

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210302005465/en/

Investor Relations ir@expediagroup.com Communications

press@expediagroup.com

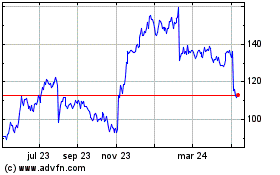

Expedia (NASDAQ:EXPE)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

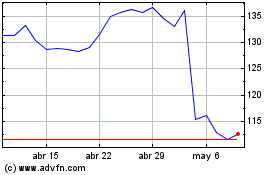

Expedia (NASDAQ:EXPE)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024