Prudential PLC Mulls $2.5 Billion-$3.0 Billion Equity Raise; 2020 Pretax Profit Rises -- Update

03 Marzo 2021 - 4:04AM

Noticias Dow Jones

--Prudential said 2020 earnings were boosted by Asia, offsetting

a fall in the U.S.

--The Jackson spinoff is expected to complete in the second

quarter

--The company declared a second interim dividend of 10.73 cents

a share

By Ian Walker

Prudential PLC said Wednesday that it is considering an equity

raising of $2.5 billion to $3 billion once the demerger of its U.S.

business has completed, as it reported a 9.3% rise in net profit

for 2020.

The insurance-and-investment business said any equity raising

will be through a global offering to institutional and Hong Kong

retail investors. The extra funds will boost the company's

financial flexibility and de-lever its balance sheet.

"As an Asia-focused company, the group believes there are clear

benefits from increasing both its Asian shareholder base and the

liquidity of its shares in Hong Kong. The allocation of any

offering will take into account a number of criteria including the

interests of existing shareholders," Chief Executive Mike Wells

said.

Prudential expects to complete the demerger of Jackson Financial

Inc. in the second quarter of this year. The company previously

said it plans to spin off the U.S. business in the second quarter

of this year and list it on the New York Stock Exchange.

"The proposed demerger [of Jackson] will complete Prudential's

structural shift from a diversified global group to a growth

business focusing exclusively on the unmet health, financial

protection and savings needs of people in Asia and Africa," Mr.

Wells said.

Under the demerger shares in Jackson will be distributed to

Prudential shareholders, although no terms have been disclosed yet.

Prudential expects to own a 19.9% shareholding in Jackson after it

lists, which it plans to sell over time.

Prudential made an IFRS net profit from continuing operations of

$2.12 billion for the year ended Dec. 31, compared with $1.94

billion for 2019.

Adjusted operating profit--one of the company's preferred

metrics, which strips out exceptional and other one-off items--was

$5.51 billion compared with $5.31 billion. Prudential said the rise

reflects the continued growth of its Asia businesses, offset by

lower U.S. profits.

Asia adjusted operating profit rose to $3.67 billion from $3.28

billion, while U.S. operating profit fell to $2.80 billion from

$3.07 billion.

Group LCSM shareholder surplus--a key measure of balance-sheet

strength--was estimated at $11.0 billion, equivalent to a ratio of

328%, compared with a ratio of 309% at Dec. 31, 2019. Local capital

summation method, or LCSM, has been agreed with the Hong Kong

Insurance Authority, Prudential said.

Gross premiums earned were $42.52 billion compared with $45.06

billion a year earlier.

The board declared a dividend of 10.73 cents a share, taking the

total payout to 16.10 cents.

Shares in London at 0925 GMT were up 15.5 pence, or 1%, at

1,499.5 pence.

Write to Ian Walker at ian.walker@wsj.com

(END) Dow Jones Newswires

March 03, 2021 04:49 ET (09:49 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

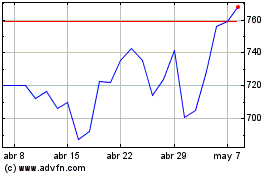

Prudential (LSE:PRU)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

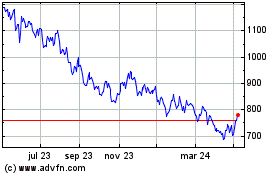

Prudential (LSE:PRU)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024