SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

F O R M 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT

TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of

March 2021

Commission File Number 001-36258

Crescent Point Energy Corp.

(Name of Registrant)

Suite 2000,

585-8th Avenue S.W.

Calgary, Alberta, T2P 1G1

(Address of Principal Executive Office)

Indicate by check mark whether the registrant files or

will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☐ Form

40-F ☒

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Indicate by check mark whether by furnishing the information

contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b)

under the Securities Exchange Act of 1934.

Yes

☐ No ☒

If "Yes" is marked, indicate below the file

number assigned to the registrant in connection with Rule 12g3-2(b): 82- ________

DOCUMENTS FILED AS PART OF THIS FORM 6-K:

|

Exhibit No.

99.1 |

Description

News Release dated March 5, 2021 |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Crescent Point Energy Corp. |

|

| |

(Registrant) |

|

| |

|

|

|

| |

By: |

/s/ Ken Lamont |

|

| |

Name: |

Ken Lamont |

|

| |

Title: |

Chief Financial Officer |

Date: March 5, 2021

EXHIBITS

Exhibit 99.1

Crescent

Point Receives Approval for Normal Course Issuer Bid

CALGARY, AB,

March 5, 2021 /CNW/ - Crescent Point Energy Corp. ("Crescent Point" or the "Company") (TSX: CPG) (NYSE: CPG)

is pleased to announce the Toronto Stock Exchange ("TSX") has accepted its notice to implement a normal course issuer

bid ("NCIB") to purchase, for cancellation, up to 26,462,509 common shares, or five percent of the Company's public

float, as at February 26, 2021. The NCIB is scheduled to commence on March 9, 2021 and is due to expire on March 8, 2022.

Purchases of

Crescent Point's common shares under the NCIB may be made through the facilities of the TSX, the New York Stock Exchange (the

"NYSE") and alternative trading systems by means of open market transactions or by such other means as may be permitted

by the Canadian Securities Administrators (the "CSA") and under applicable securities laws, including by private agreement

pursuant to issuer bid exemption orders issued by applicable securities regulatory authorities. The price the Company will pay

for any common shares will be the market price at the time of purchase or such other price as may be permitted by the CSA. Any

private purchase made under an exemption order issued by a securities regulatory authority will generally be at a discount to

the prevailing market price.

In connection

with the NCIB, Crescent Point will enter into an automatic purchase plan ("Plan") with its designated broker to allow

for purchases of its common shares during internal blackout periods. Such purchases would be at the discretion of the broker based

on parameters established by the Company prior to any blackout period or any period when it is in possession of material undisclosed

information. Outside of these periods, common shares will be repurchased in accordance with management's discretion, subject to

applicable law. The Plan has been reviewed by the TSX and may be terminated by Crescent Point or its broker in accordance with

its terms or will terminate on the expiry of the NCIB.

As of February

26, 2021, the Company had a public float of 529,250,180 common shares and 530,364,516 common shares issued and outstanding.

Crescent Point will not acquire, through the facilities of the TSX, more than 1,049,003 common shares during a trading day, being

25 percent of the average daily trading volume of the Company's common shares on the TSX for the six calendar months prior to

the date of approval of the NCIB by the TSX (being 4,196,012 common shares), and, in addition, will not acquire per day on the

NYSE more than 25 percent of the average daily trading volume for the four calendar weeks preceding the date of purchase, subject

to, in both cases, certain exceptions for block purchases.

The actual number

of common shares that will be repurchased under the NCIB, and the timing of any such purchases, will be determined by Crescent

Point on management's discretion, subject to applicable securities laws. There cannot be any assurances as to how many common

shares, if any, will ultimately be acquired by the Company.

Crescent Point

has repurchased a total of approximately 26.2 million common shares under prior NCIBs first initiated on January 25, 2019. The

Company did not repurchase any shares under its existing NCIB, which expires March 8, 2021, due to weak market conditions. Such

share repurchases are evaluated as a form of returning capital to further enhance shareholder value and are evaluated in the context

of the Company's capital allocation framework and leverage targets.

FORWARD-LOOKING

STATEMENTS AND OTHER MATTERS

Certain statements

contained in this press release constitute "forward-looking statements" within the meaning of section 27A of the Securities

Act of 1933 and section 21E of the Securities Exchange Act of 1934 and "forward-looking information" for the purposes

of Canadian securities regulation (collectively, "forward-looking statements"). The Company has tried to identify such

forward-looking statements by use of such words as "could", "should", "can", "anticipate",

"expect", "believe", "will", "may", "intend", "projected", "sustain",

"continues", "strategy", "potential", "projects", "grow", "take advantage",

"estimate", "well-positioned" and other similar expressions, but these words are not the exclusive means of

identifying such statements.

In particular,

this press release contains forward-looking statements pertaining, among other things, to the Company's normal course issuer bid,

the use of cash flow to fund purchases under the NCIB, the process the Company plans to follow to evaluate purchases under the

NCIB, and the expected benefits to shareholders associated with the NCIB and the Plan and its operation.

All forward-looking

statements are based on Crescent Point's beliefs and assumptions based on information available at the time the assumption was

made. The Company believes that the expectations reflected in these forward-looking statements are reasonable but no assurance

can be given that these expectations will prove to be correct and such forward-looking statements included in this report should

not be unduly relied upon. By their nature, such forward-looking statements are subject to a number of risks, uncertainties and

assumptions, which could cause actual results or other expectations to differ materially from those anticipated, expressed or

implied by such statements, including those material risks discussed in the Company's Annual Information Form for the year ended

December 31, 2020 under "Risk Factors," and in our Management's Discussion and Analysis for the year ended December

31, 2020, under the headings "Risk Factors" and "Forward-Looking Information".

Additional information

on these and other factors that could affect Crescent Point's operations or financial results are included in Crescent Point's

reports on file with Canadian and U.S. securities regulatory authorities. Readers are cautioned not to place undue reliance on

this forward-looking information, which is given as of the date it is expressed herein or otherwise. Crescent Point undertakes

no obligation to update publicly or revise any forward-looking statements, whether as a result of new information, future events

or otherwise, unless required to do so pursuant to applicable law. All subsequent forward-looking statements, whether written

or oral, attributable to Crescent Point or persons acting on the Company's behalf are expressly qualified in their entirety by

these cautionary statements.

FOR MORE

INFORMATION ON CRESCENT POINT ENERGY, PLEASE CONTACT:

Brad Borggard, Senior

Vice President, Corporate Planning and Capital Markets, or

Shant Madian, Vice President, Investor Relations and Corporate Communications

Telephone: (403) 693-0020 Toll-free (US and Canada): 888-693-0020 Fax: (403) 693-0070

Address: Crescent Point Energy Corp. Suite 2000, 585 - 8th Avenue S.W. Calgary AB T2P 1G1

www.crescentpointenergy.com

Crescent Point

shares are traded on the Toronto Stock Exchange and New York Stock Exchange under the symbol CPG.

SOURCE Crescent

Point Energy Corp.

View original

content: http://www.newswire.ca/en/releases/archive/March2021/05/c2424.html

%CIK: 0001545851

CO: Crescent

Point Energy Corp.

CNW 08:00e 05-MAR-21

This regulatory filing also includes additional resources:

ex991.pdf

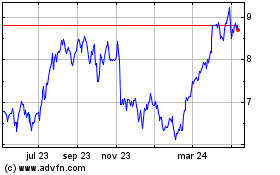

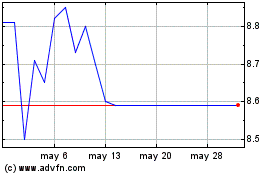

Crescent Point Energy (NYSE:CPG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Crescent Point Energy (NYSE:CPG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024