Australian, NZ Dollars Decline Against Majors

09 Marzo 2021 - 9:05PM

RTTF2

The Australian and NZ dollars fell against their major

counterparts in the Asian session on Wednesday, as

better-than-expected inflation data from China raised concerns

about tightening of monetary policy.

Official data showed that the producer price index rose 1.7

percent in February, following a 0.3 percent rise in January.

The CPI fell 0.2 percent in February versus a 0.4 percent drop

expected by economists.

The U.S. House of Representatives will vote on Biden's COVID-19

relief package later in the day.

The package provides $1,400 in direct payments to most Americans

and $300 a week in jobless benefits through September 6.

The latest survey from Westpac Bank showed that consumer

confidence in Australia is picking up steam in March, rising 2.6

percent to a score of 111.8.

That follows the 1.9 percent gain in February to 109.1.

Data from the Australian Bureau of Statistics showed that

Australia building permits dropped a seasonally adjusted 19.4

percent on month in January - standing at 15,926.

That was in line with expectations following the 12.0 percent

gain in December.

The aussie dropped to 0.7669 against the greenback, 1.5478

against the euro and 83.48 against the yen, after rising to 0.7719,

1.5410 and 83.88, respectively in early deals. Next key support for

the aussie is likely seen around 0.75 against the greenback, 1.58

against the euro and 82.00 against the yen.

The Australian currency eased off to 1.0745 against the kiwi and

0.9724 against the loonie, off its early highs of 1.0760 and

0.9758, respectively. The aussie is poised to find support around

1.06 against the kiwi and 0.96 against the loonie.

The kiwi weakened to 77.65 against the yen, 0.7131 against the

greenback and 1.6644 against the euro, from its prior high of

78.02, 2-day high of 0.7183 and a 1-week high 1.6560, respectively.

On the downside, 76.00, 0.70 and 1.70 are possibly seen as the next

support levels for the kiwi against the yen, the greenback and the

euro, respectively.

Looking ahead, U.S. CPI for February will be published in the

New York session.

At 10:00 am ET, the Bank of Canada announces decision on

interest rates. Economists forecast the benchmark rate to hold at

0.25 percent.

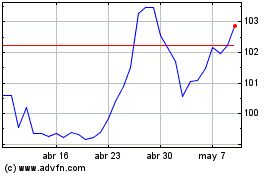

AUD vs Yen (FX:AUDJPY)

Gráfica de Divisa

De Mar 2024 a Abr 2024

AUD vs Yen (FX:AUDJPY)

Gráfica de Divisa

De Abr 2023 a Abr 2024