TIDMTIR

RNS Number : 1868S

Tiger Royalties and Investments PLC

15 March 2021

NOT FOR RELEASE, DISTRIBUTION OR PUBLICATION, DIRECTLY OR

INDIRECTLY, IN WHOLE OR IN PART, TO U.S. PERSONS OR IN OR INTO THE

UNITED STATES, CANADA, THE REPUBLIC OF SOUTH AFRICA OR JAPAN OR

THEIR RESPECTIVE TERRITORIES OR POSSESSIONS, OR INTO ANY OTHER

JURISDICTION WHERE IT IS UNLAWFUL TO DISTRIBUTE THIS ANNOUNCEMENT.

THE INFORMATION CONTAINED HEREIN DOES NOT CONSTITUTE OR FORM PART

OF ANY OFFER TO ISSUE OR SELL, OR ANY SOLICITATION OF ANY OFFER TO

SUBSCRIBE OR PURCHASE, ANY INVESTMENTS IN ANY JURISDICTION.

THIS ANNOUNCEMENT DOES NOT CONSTITUTE OR FORM PART OF, AND

SHOULD NOT BE CONSTRUED AS, AN OFFER FOR SALE OR SUBSCRIPTION OF,

OR SOLICITATION OF ANY OFFER TO SUBSCRIBE FOR OR TO ACQUIRE, ANY

ORDINARY SHARES IN AFRICAN PIONEER PLC ("AFRICAN PIONEER" OR "APP")

IN ANY JURISDICTION, INCLUDING IN OR INTO THE UNITED STATES,

CANADA, THE REPUBLIC OF SOUTH AFRICA OR JAPAN OR THEIR RESPECTIVE

TERRITORIES OR POSSESSIONS. INVESTORS SHOULD NOT SUBSCRIBE FOR OR

PURCHASE ANY ORDINARY SHARES REFERRED TO IN THIS ANNOUNCEMENT

EXCEPT ON THE BASIS OF INFORMATION IN THE PROSPECTUS (THE

"PROSPECTUS") IN ITS FINAL FORM, EXPECTED TO BE PUBLISHED BY

AFRICAN PIONEER IN CONNECTION WITH THE PROPOSED ADMISSION OF ITS

ORDINARY SHARES ("APP SHARES") TO THE OFFICIAL LIST (BY WAY OF

STANDARD LISTING UNDER CHAPTER 14 OF THE LISTING RULES) AND ON THE

LONDON STOCK EXCHANGE PLC'S MAIN MARKET FOR LISTED SECURITIES.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF THE UK MARKET ABUSE REGULATION (EU) 596/2014, AS IT

FORMS PART OF UK DOMESTIC LAW BY VIRTUE OF THE EUROPEAN UNION

(WITHDRAWAL) ACT 2018 AND OTHER IMPLEMENTING MEASURES ("UK

MAR").

For immediate release

15 March 2021

Tiger Royalties and Investments Plc

("Tiger" or "the Company")

Update on strategy for African Pioneer and its proposed Standard

Listing

and

US$500,000 investment in African Pioneer by Sandfire Resources

Limited, Related Party Transaction, Issue of Equity and TVR

Update on Strategy for African Pioneer

Tiger is pleased to provide the following update on its 50.75%

owned subsidiary, African Pioneer Plc ("African Pioneer" or "APP"),

which having identified suitable exploration assets in the mining

sector based in Zambia, Namibia and Botswana, is now looking to

take advantage of healthier resource markets to acquire these

assets and list African Pioneer on the Official List (by way of

Standard Listing under Chapter 14 of the Listing Rules) and on the

London Stock Exchange's Main Market for listed securities (the

"Standard Listing") in conjunction with a placing to raise approx.

GBP1.75m.

African Pioneer has been a subsidiary of Tiger since 22 August

2012 and Mr Colin Bird, Tiger's Chairman, as well as Mr Raju

Samtani, Tiger's Finance Director, are both directors of APP.

African Pioneer and its advisors are working on the proposed

Standard Listing and a further announcement regarding this will be

made in due course.

Exploration Assets being acquired by African Pioneer: The

directors of APP have now identified suitable exploration assets in

the mining sector based in Zambia, Namibia and Botswana and APP has

entered into share purchase agreements to acquire the following

three companies and their projects (the "Acquisitions"):

1. 100 per cent. of Zamcu Exploration Pty Ltd ("Zamcu"), which

via its subsidiaries Manmar Investments One Hundred & Twenty

Nine (Pty) Limited ("Manmar 129") and Manmar Investments One Three

Six (Pty) Limited ("Manmar 136") holds 70 per cent. interest in the

two Namibia Exclusive Prospecting Licenses ("EPLs") located within

the Matchless amphibolite Belt of central Namibia for a

consideration of GBP798,981 to be satisfied by the issue on

Standard Listing of; (i) 10,000,000 APP Shares to Zamcu

shareholders, (ii) a total of approximately 4,742,857 APP Shares to

Manmar 129 and Manmar 136 shareholders and (iii) approximately

4,900,000 APP Shares to Avanti Resources Pty Ltd as trustee for the

Marlow Family Fund pursuant to an introduction mandate agreement.

In addition, AUS$200,000 (GBP112,981) has already been paid to

Manmar 129 and Manmar 136 shareholders in cash;

2. 80 per cent. of African Pioneer Zambia Limited ("APZ"), which

holds 100 per cent. interest in the Zambian Prospecting Licenses

("Zambian PLs") located in two areas namely the Central Africa

Copperbelt (Copperbelt), which comprises four Zambian PLs and the

Zambezi area which comprises one Zambian PL for a consideration of

GBP1,925,000 to be satisfied by the issue on Standard Listing of

55,000,000 APP Shares; and

3. 100 per cent. of Resource Capital Partners Pty Ltd ("RCP"),

which holds 100 per cent. interest in the Botswana Prospecting

Licenses ("Botswana PLs") located in two areas namely (1) the

Kalahari Copperbelt (KC), which comprises six Botswana PLs and (2)

the Limpopo Mobile Belt (Limpopo), which comprises two Botswana PLs

("Botswanan Projects") for a total consideration of GBP350,000 to

be satisfied by the issue on Standard Listing of 10,000,000 APP

Shares to RCP shareholders. The Botswanan Projects are subject to

the Conditional Botswana Licence Sale Agreement, further details of

which are set out below.

The Acquisitions are conditional inter alia on Standard Listing.

In conjunction with the proposed Standard Listing African Pioneer

will be conducting a placing to raise approx. GBP1.75m (the

"Placing"). Additionally, GBP100,000 of Tiger's current outstanding

loan to African Pioneer will be converted into APP's Ordinary

Shares on Standard Listing (together the "Transaction"). As a

result of the Transaction, Tiger's interest in APP will be diluted

from 50.75% to 4.65% on Standard Listing.

Further details of Acquisitions; Further details of the

Acquisitions set out in the Appendix to this announcement.

Conditional sale of Botswana Projects by African Pioneer: on 12

March 2021 African Pioneer have entered into a conditional licence

sale agreement with ASX listed Sandfire Resources Limited (

ASX:SFR) ("Sandfire") (the "Conditional Botswana Licence Sale

Agreement") which provides for;

a) The Sale of licences: the sale to Sandfire of the 8 Botswana

licences (the "Licences") being acquired at Standard Listing by the

acquisition of Resources Capital Partners (Pty) Limited for an

aggregate consideration of US$1M (being a Guarantee Fee of

US$250,00 and a Licence Purchase Price of US$750,000) of which

US$0.5M will be paid in cash (the "Cash Consideration") and US$0.5M

by the issue by Sandfire of its ordinary shares to African Pioneer

(the "Consideration Shares") at an issue price per share based on

the 10 day VWAP of the Sandfire share price as at the date before

the signing of the Sandfire Conditional Botswana Licence Sale

Agreement;

b) An Exploration Commitment: Sandfire to spend US$1M on the

Licences (the "Exploration Commitment") within two years of

settlement (the "Exploration Period") and if the US$1M is not spent

any shortfall will be paid to African Pioneer;

c) A Success Payment: a success payment to be paid to African

Pioneer for the first ore reserve reported under JORC Code 2012

edition on the Licences which exceeds 200,000 tonnes of contained

copper (the "First Ore Reserve") in the range of US$10M to US$80M

depending on the copper ore in the First Ore Reserve (the "Success

Payment"). Sandfire have the option to elect to settle the Success

Payment , if due, by the issue of Sandfire shares based on the 10

day VWAP of Sandfire shares at the time of announcing an Ore

Reserve that triggers the Success Payment;

Given the limited exploration conducted on the Botswanan

Licences to date and the many years that it could take to establish

an Ore Reserve, there can be no guarantee that any such Success

Payment will be forthcoming.

d) Conditions Precedents: The conditions precedent to be

completed (unless indicated otherwise) by the long stop date of 31

July 2021 are;

a. The parties having executed the Convertible Loan Note Share Subscription Agreement;

b. African Pioneer providing, at least 5 Business Days prior to the Settlement Date:

i. ministerial consent for the transfer of the Licences;

ii. all ASX and LSE regulatory approvals;

iii. bank details for the payment of the Licence Purchase Price

and the Guarantee Fee;

iv. approval of the acquisition of the Licences by the

Competition Authority of Botswana (or confirmation from such

authority or from either party's Botswana legal counsel that such

approval is not required); and

v. duly executed transfer applications for the Licences in the

form required by the Mining Act or the Department under which a

100% interest in the Licences may be transferred to the

Purchaser.

c. the Standard Listing having occurred by 30 June 2021. If

Standard Listing has not occurred by 30 June 2021 then the initial

long stop date of 31 July 2021 shall automatically be extended to

31 December 2021 (the "Long Stop Date") and the Cash Consideration

shall not be payable.

e) Completion and Standard Listing not occurring by Long Stop

Date. If both i) completion of the Conditional Botswana Licence

Sale Agreement and ii) Standard Listing have not occurred, by the

Long Stop Date then African Pioneer will be due to pay Sandfire

US$500,000 by way of a cancellation fee.

Rationale for Conditional Botswana Licence Sale Agreement:

African Pioneer has seen this as an opportunity for Sandfire to

take over ownership and responsibility for the exploration stage of

the Botswanan Projects whilst allowing African Pioneer to share in

the potential upside should the exploration ultimately be

successful in establishing a mineable reserve. Sandfire has the

in-country infrastructure and technical expertise and financial

resources to accelerate the rate of expenditure on the Botswanan

Projects by agreeing to fund a minimum of US$1 million of

expenditure (compared to the APP's 18 month budget of $176,000) and

the proceeds from the sale to Sandfire will allow African Pioneer

to concentrate its increased financial resources and its management

capabilities on its remaining two projects in Namibia and Zambia.

In addition, as part of the relationship with Sandfire, they have

agreed to make a US$500,000 cornerstone investment in African

Pioneer (further details of which are set out below).

Sandfire's US$500,000 Investment into African Pioneer: In

connection with its intended Standard Listing, on 1 1 March 2021

African Pioneer entered into a US$500,000 Convertible Loan Note

Share Subscription Agreement (the "Sandfire Investment Agreement")

with Sandfire which provides for Sandfire to subscribe for

US$500,000 of interest free unsecured loan notes ("Sandfire

Investment Notes") automatically convertible upon Standard Listing

into APP Shares constituting 15% of the African Pioneer's enlarged

share capital on Standard Listing. Pursuant to the Sandfire

Investment Agreement, upon conversion, Sandfire has the right to

nominate a director to the Board of African Pioneer whilst their

shareholding remains at or above 15% of the issued share capital of

African Pioneer; the appointment will be subject to customary due

diligence, although Sandfire has not indicated that they will take

up this right and has not identified a candidate to date;

additionally, Sandfire will have the right to participate in all

future share offerings by African Pioneer as subscribers so as to

maintain its African Pioneer shareholding at 15%, irrespective of

any disapplication or non-application of pre-emption rights. The

APP Shares issued to Sandfire at Standard Listing will be subject

to a 12 month lock-in during which the APP Shares are not permitted

to be sold, followed by a 12 month orderly markets period during

which Sandfire are required to work with the APP's broker for 10

days prior to making any sale.

Consequence of Standard Listing not occurring by 30 June 2021.

If African Pioneer has not listed by 30 June 2021, then the

Sandfire Investment Notes shall be automatically and immediately

cancelled and the US$500,000 invested by Sandfire will not be

repayable by African Pioneer.

Proposed Placing by African Pioneer : It is intended that

African Pioneer will undertake a placing in conjunction with its

Standard Listing, Novum Securities Ltd the Company's existing

Broker, will act as broker to African Pioneer in connection with

the proposed placing details of which will be announced in due

course.

Related Party Transaction in relation to Tiger : Mr Colin Bird

and Mr Raju Samtani, both Directors of Tiger and African Pioneer,

are also co-vendors of APZ and as a result each of Mr Colin Bird

and Mr Raju Samtani will receive 15,000,000 APP Shares on Standard

Listing and Campden Park Trading, a company owned and controlled by

Mr Colin Bird, will receive 5,000,000 of APP Shares on Standard

Listing carrying a value of GBP1,225,000 upon Standard Listing.

Accordingly, taking into account the fact that African Pioneer

is currently a 50.75% subsidiary of Tiger, this is considered to be

a related party transaction by Tiger pursuant to Rule 13 of the AIM

Rules for Companies. The independent directors of the Company, Mr

Alex Borrelli and Mr Michael Nolan consider, having consulted with

the Company's Nominated Adviser, Beaumont Cornish Limited, that the

terms of the proposed transaction between African Pioneer and

aforementioned co-vendors of APZ are fair and reasonable in so far

as the Company's shareholders are concerned.

In forming this view, the Independent Directors have considered

the assessment of the Company's geologists of the APZ assets, the

overall effect of the proposed African Pioneer Transaction and the

positive effect which it would have on the value of Tiger's holding

in African Pioneer and the validation of the involvement of

Sandfire as regards both the investment in and arrangements over

certain assets of African Pioneer. The current valuation of Tiger's

interest in African Pioneer is close to GBPNil given African

Pioneer's negative net worth at 31 December 2020. In addition, as

at the date of this announcement the Company is owed GBP231,112 by

African Pioneer, GBP100,000 of which will be converted into APP

Shares upon African Pioneer's Standard Listing whilst GBP131,112

will be repaid in cash when African Pioneer has the available funds

to settle this outstanding amount.

Issue of Equity by Tiger : The Company also announces that it

has separately agreed to settle a corporate creditor through the

issuance 8,500,000 new ordinary shares of 0.1p each at an issue

price of 0.53p per ordinary share ("Settlement Shares"). The

Settlement Shares will rank pari passu with the existing Ordinary

Shares and application is being made for the 8,500,000 Settlement

Shares to be admitted to trading on AIM ("Admission"). It is

expected that Admission will become effective and dealings in the

Settlement Shares will commence at 8.00 a.m. on or around 18 March

2021.

Total Voting Rights of Tiger: Following the issue of the

Settlement Shares, the Company's total issued share capital will

consist of 447,942,308 Ordinary Shares with voting rights. The

Company also holds 4,500,000 Ordinary Shares in treasury but there

are no voting rights in respect of these treasury Shares. On

Admission, the abovementioned figure of 439,942,308 Ordinary Shares

may be used by shareholders in the Company as the denominator for

the calculations by which they will determine if they are required

to notify their interest in, or a change to their interest in Tiger

under the Financial Conduct Authority's Disclosure Guidance and

Transparency Rules.

For further information, please contact:

Tiger Royalties and Investments

Plc Colin Bird +44 (0)20 7581 4477

Beaumont Cornish Limited Roland Cornish

(Nomad) Felicity Geidt +44 (0)20 7628 3369

Novum Securities Limited

(Broker) Jon Belliss +44 (0)20 7399 9425

Appendix - Further information on the African Pioneer assets on

completion of the Acquisitions

Table below sets out African Pioneer's interest in the various

licences

following completion of the Acquisitions:

Licence Licence Licence Mineral Groups Area Expiry APP %

No. Name Holder (km(2) interest

) on Standard

Listing

NAMIBIA

Matchless Belt Projects

Manmar Base and

Investments Rare Metals,

129 Pty Precious

EPL 5772 Ongombo Ltd Metals 120.9 8-March-2023 70%

(2(nd) renewal)

============================================================= ======== ================= =============

Manmar Base and

Investments Rare Metals,

136 Pty Precious

EPL 6011 Ongeama Ltd Metals 81.2 27-Oct-2021 70%

=========== ============== ===================== ======== ================= =============

(2(nd) renewal)

=========== ============== ===================== ======== ================= =============

ZAMBIA

Central African Copperbelt Projects

African

Pioneer

27771 Luamata Zambia Co, Cu, Au

HQ-LEL South Ltd and Ni 902.0 4-Nov-2024 80%

=========== ============== ===================== ======== ================= =============

African Co, Cu, Au,

Pioneer Fe, Pb, Limestone,

27770 Samuteba Zambia Mn, Ni, Ag

HQ-LEL East Ltd and Zn 779.0 4-Nov-2024 80%

=========== ============== ===================== ======== ================= =============

African

Pioneer

27768 Samuteba Zambia Co, Cu, Au,

HQ-LEL West Ltd Ni and Ag 361.1 4-Nov-2024 80%

=========== ============== ===================== ======== ================= =============

African

Pioneer

27767 Samuteba Zambia Co, Cu, Au,

HQ-LEL Central Ltd Ni and Ag 324.2 4-Nov-2024 80%

=========== ============== ===================== ======== ================= =============

Zambezi Belt Project

African

Pioneer

27769 Zambia Bi, Cu, Au,

HQ-LEL Chumbwe Ltd Pt 436.0 4-Nov-2024 80%

=========== ============== ===================== ======== ================= =============

BOTSWANA: Subject to Conditional Botswana Licence Sale Agreement

Kalahari Copperbelt Projects

PL96/2020 Karakubis Resource Metals 636.8 30-Sep-2023 100%*

Capital

Partners

Pty Ltd

=========== ============== ===================== ======== ================= =============

(1(st) renewal)

============================================================= ======== ================= =============

PL98/2020 Junction Resource Metals 217.2 30-Sep-2023 100%*

Capital

Partners

Pty Ltd

=========== ============== ===================== ======== ================= =============

(1(st) renewal)

============================================================= ======== ================= =============

PL100/2020 Ghanzi Resource Metals 395.0 30-Sep-2023 100%*

Capital

Partners

Pty Ltd

=========== ============== ===================== ======== ================= =============

(1(st) renewal)

============================================================= ======== ================= =============

PL101/2020 Kuke Resource Metals 180.3 30-Sep-2023 100%*

Capital

Partners

Pty Ltd

=========== ============== ===================== ======== ================= =============

(1(st) renewal)

============================================================= ======== ================= =============

PL102/2020 Kalahari Resource Metals 347.5 30-Sep-2023 100%*

Capital

Partners

Pty Ltd

=========== ============== ===================== ======== ================= =============

(1(st) renewal)

============================================================= ======== ================= =============

PL103/2020 Maun Resource Metals 169.0 30-Sep-2023 100%*

Capital

Partners

Pty Ltd

=========== ============== ===================== ======== ================= =============

(1(st) renewal)

============================================================= ======== ================= =============

Limpopo Mobile Belt Projects

PL97/2020 Serule Resource Metals 636.8 30-Sep-2023 100%*

Capital

Partners

Pty Ltd

=========== ============== ===================== ======== ================= =============

(1(st) renewal)

============================================================= ======== ================= =============

PL99/2020 Phikwe Resource Metals 217.2 30-Sep-2023 100%*

Capital

Partners

Pty Ltd

(1(st) renewal)

============================================================= ======== =================

*The Botswanan Licences will be 100% owned by APP via its wholly

owned subsidiary, Resources Capital Partners Pty Ltd, on Standard

Listing, following which, all the Botswanan Licences are intended

to be sold by APP to Sandfire in accordance with the Conditional

Botswana Licence Sale Agreement

Deascription of the African Pioneer Projects

1. Namibian Projects

Matchless Belt Projects

The two adjacent EPLs are located in central Namibia, 5 and 10

km respectively to the northeast of Windhoek, the capital of

Namibia. Together, these comprise the Ongombo and Ongeama

projects.

Both the Ongombo and Ongeama projects (EPLs 5772 and 6011) are

geologically located within the Matchless Member of the Kuiseb

Formation, a conspicuous assemblage of lenses of foliated

amphibolites, chlorite-amphibolite schist, talc schist and

metagabbro. This belt, up to 5 km wide in the Otjihase Mine (in

care and maintenance) area, stretches 350 km east-northeastwards

within the Southern Zone of the Damara Orogen from the Gorob - Hope

area in the south, towards Steinhausen in the north. The belt hosts

copper-gold mineralisation which has been in past production at two

localities (Otjihase - and Matchless Mines owned by Weatherly

International plc).

Both EPLs are accessed via the B6 road leading eastwards towards

Hosea Kutako International Airport. EPL 6011 (Ongeama) is accessed

via the D1527 road lading northwards towards the Weatherly

International plc Otjihase Mine (now under administration), while

the D2102 (branching from the D1510) district road provides access

to EPL 5772 (Ongombo). The international airport is approximately

12 km east of the combined EPLs area. Labour will be available from

the city of Windhoek. Potential tailings storage areas, waste

disposal areas, heap leach pads and potential processing plant

sites can only be supplied after an Environmental Impact Assessment

has been completed. Windhoek should also be able to supply most

exploration requirements and comply with all sustenance

supplies.

2. Zambian Projects

Central African Copperbelt Project

The APZ licences are located on the western edge of the

fold-thrust belt of the Lufilian Arc. The Lufilian Arc is a

Pan-African fold-and-thrust belt that extends over 800 km in an

east-west direction, curving to the northeast. It originates in

Luanshya (Zambia), extending through Kolwezi (Democratic Republic

of the Congo) and terminates in south-eastern Angola. The Lufilian

Arc comprises metasedimentary rocks of the Katanga Supergroup,

which hosts the Central African Copperbelt. The Central African

Copperbelt is the largest and most prolific mineralized sediment-

hosted copper province known on Earth. In Zambia, the Lufilian Arc

unconformably overlies the basement, which consists of older

metamorphosed gneisses, schists, migmatites, amphibolites and

granitoids. The geology within the African Pioneer projects

predominantly comprises supracrustal metasedimentary rocks of the

Nguba and Kundulungu Groups. Although exact stratigraphic placement

of these lithologies is difficult on site, mostly due to the

structural complexity of the area and limited outcrop, the regional

geological setting of the area points towards similarities with the

Ivanhoe Mines Ltd Kamoa-Kakula deposits in the adjacent Democratic

Republic of the Congo ("DRC").

Zambezi Belt Project

The Zambezi licence located within the Zambezi Belt of southern

Zambia, hosts a lower Katanga Supergroup succession which, although

less studied than its northern counterpart, also hosts a number of

Copperbelt-style occurrences. The Mwembeshi Shear Zone forms the

northern boundary of the Zambezi Belt, separating it from the

Lufilian Arc. The Mwembeshi Shear Zone, which comprises multiple

strands over a width of kilometres, has been interpreted to

continue as the Matchless Belt in the Damara Supergroup of

Namibia.

3. Botswanan Projects: Subject to Conditional Botswana Licence Sale Agreement

The Botswana Prospecting Licences ("PLs") are located in two

areas namely:

1. The Kalahari Copperbelt Projects ("KC") - comprise six

licenses (PLs 96, 98 and 100 to 103 / 2020) and are located in

western Botswana near the towns of Ghanzi and Maun. The

northeast-trending Meso- to Neoproterozoic belt, approximately

1,000 km long by up to 250 km wide, stretches discontinuously from

western Namibia into northern Botswana along the northwestern edge

of the Palaeoproterozoic Kalahari Craton. The belt contains

copper-silver mineralisation which is generally stratabound and

hosted in metasedimentary rocks that have been folded, faulted and

metamorphosed to greenschist facies during the Damara Orogeny.

2. The Limpopo Mobile Belt Project ("Limpopo") - comprises two

licenses (PLs 97 and 99 / 2020) and is located in eastern Botswana

within 30 km of the town of Selebi Phikwe. The Selebi Phikwe

regional area in eastern Botswana (comprising PLs 97 and 99 / 2020)

is underlain by rocks of the Archaean basement which regionally

forms part of the Azanian Craton, a fragment of Archaean

continental crust comprising, from south to north, the Kaapvaal

Craton, the Limpopo Belt and the Zimbabwe Craton. The Limpopo

Project is set within the Motloutse Complex of eastern Botswana, a

transitional boundary between the Zimbabwe Craton to the north and

the Limpopo Mobile Belt to the south.

As stated above, the Botswanan Projects are subject to the

Conditional Botswana Licence Sale Agreement under which African

Pioneer guaranteed the sale to Sandfire following Standard Listing

of the Botswanan Licences. If the conditions of the Conditional

Botswana Licence Sale Agreement are met by its long stop date of 31

July 2021 or such later date agreed by the parties then African

Pioneer will no longer own the Botswana Projects owned by RCP.

Assets, liabilities and trading results of the Acqusitions:

There are no significant assets, liabilities or trading results

attached to any of the Acquisitions.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDJIMMTMTTBTJB

(END) Dow Jones Newswires

March 15, 2021 03:00 ET (07:00 GMT)

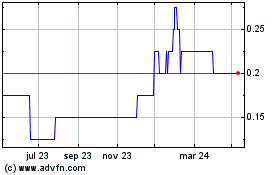

Tiger Royalties And Inve... (LSE:TIR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Tiger Royalties And Inve... (LSE:TIR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024