Pennon Group PLC Results Announcement for Pennon notes due 2022 (3946T)

24 Marzo 2021 - 10:26AM

UK Regulatory

TIDMPNN

RNS Number : 3946T

Pennon Group PLC

24 March 2021

Pennon Group plc announces results of its Tender Offer

for its GBP100,000,000 Variable Rate Notes due 2022

THIS ANNOUNCEMENT RELATES TO THE DISCLOSURE OF INFORMATION THAT

QUALIFIED OR MAY HAVE QUALIFIED AS INSIDE INFORMATION FOR THE

PURPOSES OF ARTICLE 7 OF THE MARKET ABUSE REGULATION (EU) 596/2014

AS IT FORMS PART OF DOMESTIC LAW BY VIRTUE OF THE EUROPEAN UNION

(WITHDRAWAL) ACT 2018.

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN OR INTO OR TO

ANY PERSON LOCATED OR RESIDENT IN THE UNITED STATES OF AMERICA, ITS

TERRITORIES AND POSSESSIONS (INCLUDING PUERTO RICO, THE U.S. VIRGIN

ISLANDS, GUAM, AMERICAN SAMOA, WAKE ISLAND AND THE NORTHERN MARIANA

ISLANDS), ANY STATE OF THE UNITED STATES OF AMERICA OR THE DISTRICT

OF COLUMBIA OR IN OR INTO ANY OTHER JURISDICTION WHERE IT IS

UNLAWFUL TO RELEASE, PUBLISH OR DISTRIBUTE THIS ANNOUNCEMENT.

24 March 2021. Pennon Group plc(1) (the Company) announces today

the results of its invitation to holders of its GBP100,000,000

Variable Rate Notes due 2022 (ISIN: XS0311717929) (the Notes) to

tender such Notes for purchase by the Company for cash (such

invitation, the Offer).

The Offer was announced on 16 March 2021 and was made on the

terms and subject to the conditions contained in the tender offer

memorandum dated 16 March 2021 (the Tender Offer Memorandum).

Capitalised terms used in this announcement but not defined have

the meanings given to them in the Tender Offer Memorandum.

The Expiration Deadline for the Offer was 4.00 p.m. (London

time) on 23 March 2021. As at the Expiration Deadline,

GBP70,000,000 in aggregate principal amount of the Notes were

validly tendered for purchase pursuant to the Offer.

The Company announces that it has decided to accept for purchase

all Notes validly tendered pursuant to the Offer, at a cash

purchase price determined at or around 2.00 p.m. (London time) on

24 March 2021 (the Pricing Time) in the manner described in the

Tender Offer Memorandum by reference to the sum (expressed as a

percentage rounded to the third decimal place (with 0.0005 being

rounded upwards)) (such sum, the Purchase Yield) of (i) the

purchase spread of 25 bps (determined on a semi-annual basis) (the

Purchase Spread) and (ii) the Benchmark Security Rate.

The Purchase Price has been determined in accordance with market

convention and is expressed as a percentage of the principal amount

of the Notes accepted for purchase pursuant to the Offer (rounded

to the nearest 0.001 per cent., with 0.0005 per cent. rounded

upwards), and is intended to reflect a yield to the scheduled

maturity date of the Notes on the Settlement Date equal to the

Purchase Yield. Specifically, the Purchase Price equals (a) the

value of all remaining payments of principal and coupon amounts on

the Notes up to and including maturity, discounted to the

Settlement Date at a discount rate equal to the Purchase Yield,

minus (b) the Accrued Coupon Amount.

A summary of the final results of the Offer appears below:

Principal

Benchmark Amount of

Description ISIN / Common Security Purchase Purchase Purchase Notes accepted

of the Notes Code Rate Spread Yield Price for purchase

--------------- -------------- --------------------- ------------------ ----------- ----------- ----------------

0.50 per

cent. UK 25 basis

GBP100,000,000 Treasury points

Variable Gilt due (determined

Rate Notes XS0311717929 July 2022 on a semi-annual 0.239 103.980

due 2022 / 031171792 (ISIN: GB00BD0PCK97) basis) per cent. per cent. GBP70,000,000

Settlement of the purchase of the relevant Notes pursuant to the

Offer is expected to take place on 26 March 2021. The Company

intends to cancel those Notes accepted for purchase pursuant to the

Offer and such Notes will not be re-issued or re-sold. Following

settlement of the Offer, GBP30,000,000 in aggregate principal

amount of the Notes will remain outstanding.

Barclays Bank PLC (Telephone: +44 20 3134 8515; Attention:

Liability Management Group; Email: eu.lm@barclays.com) is acting as

Dealer Manager and Lucid Issuer Services Limited (Telephone: +44 20

7704 0880; Attention: Owen Morris; Email: pennon@lucid-is.com) is

acting as Tender Agent.

This announcement is released by Pennon Group plc and contains

information that qualified or may have qualified as inside

information for the purposes of Article 7 of the Market Abuse

Regulation (EU) 596/2014 as it forms part of domestic law by virtue

of the European Union (Withdrawal) Act 2018 (UK MAR), encompassing

information relating to the Offer described above. For the purposes

of UK MAR and Article 2 of Commission Implementing Regulation (EU)

2016/1055 as it forms part of domestic law by virtue of the

European Union (Withdrawal) Act 2018, this announcement is made by

Simon Pugsley, Group General Counsel and Company Secretary at

Pennon Group plc.

DISCLAIMER This announcement must be read in conjunction with

the Tender Offer Memorandum. No offer or invitation to acquire any

securities is being made pursuant to this announcement. The

distribution of this announcement and the Tender Offer Memorandum

in certain jurisdictions may be restricted by law. Persons into

whose possession this announcement and/or the Tender Offer

Memorandum comes are required by each of the Company, the Dealer

Manager and the Tender Agent to inform themselves about, and to

observe, any such restrictions.

(1) LEI: 213800V1CCTS41GWH423

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCDKQBBABKDPNB

(END) Dow Jones Newswires

March 24, 2021 12:26 ET (16:26 GMT)

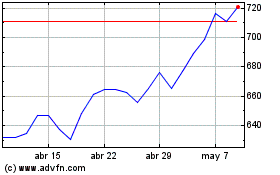

Pennon (LSE:PNN)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

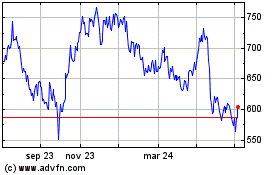

Pennon (LSE:PNN)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024