UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by

Rule 14a-6(e)(2))

|

|

☐

|

Definitive Proxy Statement

|

|

☒

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material Pursuant to § 240.14a-12

|

AVERY DENNISON CORPORATION

(Name of

Registrant as Specified in Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act

Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act

Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

2021 Proxy Season Stockholder Engagement

Spring 2021

Safe Harbor Statement Certain statements

contained in this document are "forward-looking statements" intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. These forward-looking statements, and financial or other business

targets, are subject to certain risks and uncertainties. We believe that the most significant risk factors that could affect our financial performance in the near-term include: (i) the impacts to underlying demand for our products and/or foreign

currency fluctuations from global economic conditions, political uncertainty, changes in environmental standards and governmental regulations, including as a result of the coronavirus/COVID-19 pandemic; (ii) competitors’ actions, including

pricing, expansion in key markets, and product offerings; (iii) the degree to which higher costs can be offset with productivity measures and/or passed on to customers through price increases, without a significant loss of volume; and (iv) the

execution and integration of acquisitions. Actual results and trends may differ materially from historical or anticipated results depending on a variety of factors, including but are not limited to, risks and uncertainties relating to the factors

shown below. COVID-19 International Operations – worldwide and local economic and market conditions; changes in political conditions; and fluctuations in foreign currency exchange rates and other risks associated with foreign operations,

including in emerging markets Our Business – changes in our markets due to competitive conditions, technological developments, environmental standards, laws and regulations, and customer preferences; fluctuations in demand affecting sales to

customers; execution and integration of acquisitions; selling prices; fluctuations in the cost and availability of raw materials and energy; the impact of competitive products and pricing; customer and supplier concentrations or consolidations;

financial condition of distributors; outsourced manufacturers; product and service quality; timely development and market acceptance of new products, including sustainable or sustainably-sourced products; investment in development activities and new

production facilities; successful implementation of new manufacturing technologies and installation of manufacturing equipment; our ability to generate sustained productivity improvement; our ability to achieve and sustain targeted cost reductions;

and collection of receivables from customers Income Taxes – fluctuations in tax rates; changes in tax laws and regulations, and uncertainties associated with interpretations of such laws and regulations; retention of tax incentives; outcome of

tax audits; and the realization of deferred tax assets Information Technology – disruptions in information technology systems, including cyber-attacks or other intrusions to network security; successful installation of new or upgraded

information technology systems; and data security breaches Human Capital – recruitment and retention of employees; fluctuations in employee benefit costs; and collective labor arrangements Our Indebtedness – credit risks; our ability to

obtain adequate financing arrangements and maintain access to capital; volatility of financial markets; fluctuations in interest rates; and compliance with our debt covenants Ownership of Our Stock – potential significant variability of our

stock price and amounts of future dividends and share repurchases Legal and Regulatory Matters – protection and infringement of intellectual property and impact of legal and regulatory proceedings, including with respect to environmental,

health and safety, anti-corruption and trade compliance Other Financial Matters – fluctuations in pension costs and goodwill impairment For a more detailed discussion of these factors, see “Risk Factors” and

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our 2020 Form 10-K, filed with the Securities and Exchange Commission on February 25, 2021. The forward-looking statements included in this

document are made only as of the date of this document, and we undertake no obligation to update these statements to reflect subsequent events or circumstances, other than as may be required by law.

Global scale; ~190 operating locations

Innovative materials science capabilities; vertically integrated in adhesives Innovative process technology Operational and commercial excellence Label and Graphic Materials (LGM) 2020 net sales of $4.7B (68% of total net sales) Largest global

provider of self-adhesive materials for packaged goods and variable information labeling Leading provider of graphic and reflective solutions Retail Branding and Information Solutions (RBIS) 2020 net sales of $1.6B (23% of total net sales) Largest

global provider of tickets, tags and labels, sustainable packaging, and RFID and other solutions for branding and information management purposes for retail and other end markets Industrial and Healthcare Materials (IHM) 2020 net sales of $0.6B (9%

of total net sales) Leading provider of tapes, fasteners and medical pressure-sensitive adhesive based materials and products Business Segments Highlights Sustainable competitive advantages 32K+ Employees 50+ Countries with operations $14.9B Market

cap(1) $7.0B 2020 Net sales (1)As of March 15, 2021 Company Overview We are a global materials manufacturer of branding and information labeling solutions and functional materials for the consumer goods, apparel, food, logistics, industrial and

healthcare industries

Response to COVID-19 We responded to

COVID-19 by prioritizing the health, safety and well-being of our employees, followed immediately by delivering for our customers; we also supported our communities and protected our operations and financial position Serving Our Customers Protecting

Our Employees Supporting Our Communities We implemented a number of measures to help keep our workplaces safe and provide support for our employees, including the following: Early in pandemic, ensured that employees continued to receive full pay

Extended salary continuation in jurisdictions with weaker social safety nets Provided supplemental payments to express gratitude to frontline workers, with ~84% of employees (all below manager level) receiving these payments Continually adapted

rigorous site safety protocols based on continuously evolving health information and governmental regulations We recognize the importance of delivering for our customers, even in times of crisis. To satisfy customer needs, we: Adapted quickly to

manage demand in label materials and address lockdowns impacting RBIS customers Leveraged operational excellence to maximize production capacity in label materials Developed and rapidly commercialized N95 masks primarily for sale to customers

Continued to successfully execute large RFID rollouts We are committed to supporting our local communities and took the following actions in response to the pandemic: Made $10 million contribution to Avery Dennison Foundation to significantly

increase scope and pace of its support of communities in which we operate Shifted resources to produce personal protective equipment and hand sanitizer to donate to local communities Donated face masks and other needed materials to local hospitals

Avery Dennison Foundation made nearly $3 million in grants to bolster rapid community response; also established employee assistance fund (supplemented by employee donations) to support team members who were furloughed, laid off, suspended or

terminated due to COVID-19 Mitigating Supply Chain Risk We play a critical role in the flow of essential goods. We experienced negligible supply chain disruptions throughout the pandemic due to the following actions: Maintained strong relationships

with suppliers and customers, which helped keep supply chains open for essential businesses Selectively built strategic inventory Leveraged global footprint with dual sourcing or readily available alternatives for most commodities Maintaining

Financial Flexibility We took the following steps to maintain our strong balance sheet: Drew down $500 million under revolving credit facility in Q1 to mitigate dependence on then-unavailable commercial paper markets; promptly repaid in Q2

Temporarily suspended share repurchases in March; resumed repurchases in Q3 Increased dividend rate by 7% in October, after having maintained it earlier in year Heightened focus on working capital management

2025 Goals 2020 Results 3% absolute GHG

reduction every year (26% cumulative by 2025)(1) 45% cumulative(2) 100% certified paper 70% Forest Stewardship Council (FSC)-certified face paper 92% certified 83% FSC (face paper) 95% landfill-free 75% waste recycled 94% landfill-free 67%

recycled(2) 70% elimination of matrix and linear waste (LPM only) 53% recycled (paper) 39% recycled (PET) 70% of revenues from sustainability-driven products LGM: 44% RBIS: 55% 40% women in manager level and above 34% Maintain world-class safety and

employee engagement scores 0.21 Recordable Incident Rate (RIR) 82% engagement Publicly commit to goals/report progress Published ESG Download and Integrated Report Committed to Operating in an Environmentally and Socially Responsible Manner We

create long-term stakeholder value through innovations and operations that positively impact our people and planet. We continue to make progress against our 2025 sustainability goals, and recently announced more ambitious 2030 goals (1) GHG baseline

and actual data are from Q3 YTD comparisons (Q3 2015 to Q3 2020). (2) As of 9/30/20. 2030 Goals 2030 Targets Reduce the environmental impact in our operations and supply chain Reduce emissions by 70% (against 2015 baseline) and work with our supply

chain to reduce Scope 3 emissions by 30% (against our 2018 baseline) by 2030 – with an ambition of net zero by 2050 Source 100% of paper fiber from certified sources, focusing on a deforestation-free future Divert 95% of waste away from

landfills, with a minimum of 80% of our waste recycled and the remainder either reused, composted or sent to energy recovery Deliver innovations that advance the circular economy Satisfy the recycling, composting or reuse requirements of all

single-use consumer packaging and apparel with our products and solutions Metrics: RBIS: 100% of core product categories meet our third-party verified ClearIntent Standard LGM: 100% of standard label products contain recycled or renewable content;

all regions will have labels that enable circularity of plastics Make a positive social impact by enhancing the livelihood of our people & communities Foster an engaged team and inclusive workplace by ensuring our employees represent the

community in which they live and work Metrics: 85% inclusion index, 82%+ employee engagement, 40% women in manager level or above positions, 0.2 RIR Support employee participation in Avery Dennison Foundation grants and foster the well-being of

local communities In November 2020, we joined the UN Global Compact and will be disclosing our progress later this year. We also made commitments to the UN Sustainable Development Goals and aligned our most material sustainability topics with these

goals.

Board Composition and Diversity Lead

Independent Director Primary Responsibilities: Preside over executive sessions of independent directors and Board meetings where Chairman/CEO is not present Serve as liaison between Chairman/CEO and independent directors Approve Board meeting

agendas and schedules Call meetings of independent directors Consult and meet with our stockholders Independent, Diverse and Balanced Director Nominees Ensure Robust Oversight Our Board oversees, counsels and ensures management is serving the best

interests of our company and stockholders, with the goal of maximizing the performance of our businesses and delivering long-term value for all our stakeholders Mitchell Butier Chairman, President & CEO, Avery Dennison Patrick Siewert Managing

Director & Partner, The Carlyle Group Bradley Alford Retired Chairman & CEO, Nestlè USA Anthony Anderson Retired Vice Chair & Managing Partner, Ernst & Young Mark Barrenechea Vice Chair, CEO & CTO, OpenText Ken Hicks

Chairman, President & CEO, Academy Sports + Outdoors Andres Lopez President & CEO, O-I Glass Julia Stewart Chair & CEO, Alurx Martha Sullivan Retired CEO, Sensata Technologies 8/9 (89%) of director nominees are independent Regular Board

refreshment and succession planning Age Tenure Diversity Avg. 62 Years Avg. 9.5 Years Over 60

* Information as of March 2021. Governance

Guidelines criteria defined on page 11 of 2021 Proxy Statement. GOVERNANCE GUIDELINES CRITERIA* Independent ü ü ü ü ü ü ü ü Senior Leadership Experience ü ü ü ü ü ü ü ü

Industry Experience ü ü ü ü ü ü ü ü Global Exposure ü ü ü ü ü ü ü ü ü Board Experience ü ü ü ü ü ü ü ü Financial Experience

ü ü ü INDUSTRY EXPERIENCE Retail/Dining ü ü Packaging ü ü Consumer Goods ü ü ü Industrial Goods/Technology ü ü ü DEMOGRAPHIC BACKGROUND Tenure (years)* 11 8 2 4 13 4 15 18 8 Age* 64 65

56 49 68 58 65 65 64 Female ü ü Male ü ü ü ü ü ü ü Race/Ethnicity Black or African American ü Hispanic or Latino ü White ü ü ü ü ü ü ü ü Native American

or Alaska Native ü Veteran ü Lives/Has Lived Abroad ü ü ü ü ü Matrix of Director Nominee Skills, Qualifications and Backgrounds Our director nominees bring a balance of skills, qualifications and backgrounds to our

company. Our Board regularly evaluates its composition to ensure it continues to advance our business strategies and serve the interests of all our stakeholders. Alford Sullivan Anderson Barrenechea Butier Hicks Lopez Siewert Stewart

Annual Long-Term 86% Performance-Based

Annual fixed-cash compensation Generally around market median Drives performance consistent with our company’s financial goals for the year 100% Financial Performance 60% Adjusted EPS 20% Adjusted Sales Growth 20% Free Cash Flow Individual

performance modifier based on achievement against predetermined strategic objectives (generally capped at 100%) 100% Financial Performance 50% Relative TSR(1) 50% Cumulative EVA(2) Three-year cliff vesting Relative TSR payout capped at 100% if

absolute TSR is negative 100% Financial Performance 100% Absolute TSR(3) Vest over four-years based on one-, two-, three-, and four-year performance periods Average 2.5-year performance period Base Salary (14%) Annual Incentive Plan (AIP) Award

(18%) Performance Units (PUs) (34%) Market-Leveraged Stock Units (MSUs) (34%) CEO Compensation 2020 Overview and 2021 Approach (1) Relative TSR compares our TSR to the TSR of companies in a peer group satisfying objective criteria for industry

classification and revenue size, the names of which are disclosed on page 69 of our 2021 proxy statement (2) Economic Value Added (EVA) is a measure of financial performance calculated by deducting the economic cost associated with the use of

capital (weighted average cost of capital multiplied by average invested capital) from after-tax operating profit (3) Absolute TSR measures the return that we provided our stockholders, including stock price appreciation and dividends paid (assuming

reinvestment of dividends) In February 2020, after extensive discussions and in consideration of and our CEO’s consistent execution and value creation over his tenure and stockholder feedback, the Compensation Committee determined to eliminate

annual increases to Mr. Butier’s total target direct compensation (TDC) in favor of a longer-term approach that would hold his TDC constant for three years Those changes were initially approved for 2020; however, in light of COVID-19, our CEO

recommended that the Committee postpone the changes, resulting in his forfeiture of equity grants worth ~$1.3M In February 2021, the Committee determined to reinstate its longer-term approach. The Committee plans to evaluate the CEO’s and

company’s performance and market conditions after three years to determine the appropriate level of go-forward compensation Change in Approach for CEO Compensation

Annual election of directors Majority

voting in director elections Single class of outstanding voting stock Current directors 90% independent; director nominees 89% independent Robust Lead Independent Director role Regular director succession planning and Board refreshment Continuous

executive succession planning and leadership development Annual Board evaluations Mandatory director retirement policy Governance Guidelines Strong Committee governance Direct access to management and experts Market-standard proxy access No

supermajority voting requirements No poison pill No exclusive forum or fee-shifting bylaws Stockholder Rights Board Governance Executive Compensation Commitment to Strong Corporate Governance Practices Our corporate governance program reflects our

values and facilitates our Board's independent oversight of our company, and our executive compensation program aligns with our long-term financial goals and business strategies 86% of CEO 2020 target TDC tied to company performance 68% of CEO 2020

target TDC equity-based to incent delivery of long-term stockholder value Rigorous stock ownership policy; requires CEO ownership of ~6x base salary, with 50%+ held in vested shares Double-trigger equity vesting requires termination of employment

after change of control Compensation clawback in event of accounting restatement Independent compensation consultant retained and serving at direction of Compensation Committee No NEO employment contracts No guaranteed AIP awards; NEO AIP awards

based on company or business performance No tax gross-ups on perquisites No re-pricing of stock options without stockholder approval No payout of MSU dividend equivalents until vesting No supplemental retirement benefits

Appendix A: Financial

Highlights

Net Cash Provided by Operating

Activities Free Cash Flow (In millions) 2018 2019 2020 Reported Earnings Per Share (EPS) Adjusted EPS 2018 2019 2020 Reported Sales Change Sales Change Ex. Currency 2018 2019 2020 Drive outsized growth in high-value categories Focus relentlessly on

productivity Effectively allocate capital Grow profitability in our base businesses Sustainable Value Creation through Consistent Execution of Core Strategies In a challenging year due to the impact of COVID-19, we focused on minimizing the impact

of the pandemic, while continuing to invest in the long-term success of our company Lead in an environmentally and socially responsible manner We remained resilient despite the negative impact of COVID-19 on sales in 2020, growing EPS and free cash

flow and significantly expanding operating margins

Disciplined Capital Allocation Driving

Long-Term Stockholder Value Capital Allocation Over the last five years, we have allocated over $900 million to acquisitions and venture investments and nearly $2 billion to dividends and share repurchases We have invested in our businesses to

support organic growth and pursued complementary and synergistic acquisitions We raised our quarterly dividend rate by approximately 7% in October 2020, after having maintained it earlier in the year due to the impact of COVID-19 Total Stockholder

Return Stockholder Value Creation Over the last 5 years, we have created significant stockholder value, outperforming the S&P 500 and S&P Industrials and Materials indices on a cumulative TSR basis We experienced strong TSR in 2020 despite

the uncertain macroeconomic environment during most of the year as a result of COVID-19, delivering TSR of over 20% and outperforming the S&P 500 and S&P Industrials and Materials indices (1) Amounts for acquisitions include investments in

unconsolidated businesses. (2) Based on median of companies in both subsets as of December 31, 2020. AVY S&P 500 S&P Indus. & Mats.(2) 2016 15% 12% 21% 2017 67% 22% 28% 2018 (20)% (4)% (14)% 2019 49% 32% 34% 2020 21% 18% 17% 3-Year TSR

43% 49% 32% 5-Year TSR 173% 103% 116%

Appendix B: Reconciliation of Non-GAAP

Financial Measures from GAAP

Use of Non-GAAP Financial Measures This

presentation contains certain non-GAAP financial measures as defined by SEC rules. We report our financial results in conformity with accounting principles generally accepted in the United States of America, or GAAP, and also

communicate with investors using certain non-GAAP financial measures. These non-GAAP financial measures are not in accordance with, nor are they a substitute for or superior to, the comparable GAAP financial measures. These

non-GAAP financial measures are intended to supplement the presentation of our financial results that are prepared in accordance with GAAP. Based upon feedback from investors and financial analysts, we believe that the supplemental

non-GAAP financial measures we provide are useful to their assessments of our performance and operating trends, as well as liquidity. Our non-GAAP financial measures exclude the impact of certain events, activities or decisions. The

accounting effects of these events, activities or decisions, which are included in the GAAP financial measures, may make it difficult to assess our underlying performance in a single period. By excluding the accounting effects, positive

or negative, of certain items (e.g., restructuring charges, legal settlements, certain effects of strategic transactions and related costs, losses from debt extinguishments, gains or losses from curtailment or settlement of pension obligations,

gains or losses on sales of certain assets, gains or losses on investments, and other items), we believe that we are providing meaningful supplemental information that facilitates an understanding of our core operating results and liquidity

measures. While some of the items we exclude from GAAP financial measures recur, they tend to be disparate in amount, frequency, or timing. We use these non-GAAP financial measures internally to evaluate trends in our underlying

performance, as well as to facilitate comparison to the results of competitors for a single period and full year. We use the following non-GAAP financial measures in this presentation: Sales change ex. currency refers to the increase or

decrease in net sales, excluding the estimated impact of foreign currency translation, and, where applicable, an extra week in our fiscal year, currency adjustment for transitional reporting of highly inflationary economies, and the

reclassification of sales between segments. The estimated impact of foreign currency translation is calculated on a constant currency basis, with prior period results translated at current period average exchange rates to exclude the effect of

currency fluctuations. Organic sales change refers to sales change ex. currency, excluding the estimated impact of product line exits, acquisitions and divestitures. We believe that sales change ex. currency and organic sales change assist

investors in evaluating the sales change from the ongoing activities of our businesses and enhance their ability to evaluate our results from period to period. Adjusted tax rate refers to the full-year GAAP tax rate, adjusted to exclude certain

unusual or infrequent events that are expected to significantly impact that rate, such as our U.S. pension plan termination, effects of certain discrete tax planning actions, impacts related to the enactment of the U.S. Tax Cuts and Jobs Act

("TCJA"), where applicable, and other items. Adjusted net income refers to income before taxes, tax-effected at the adjusted tax rate, and adjusted for tax-effected restructuring charges and other items. Adjusted net income per common share,

assuming dilution (adjusted EPS) refers to adjusted net income divided by weighted average number of common shares outstanding, assuming dilution. We believe that adjusted net income and adjusted EPS assist investors in understanding our core

operating trends and comparing our results with those of our competitors. Free cash flow refers to cash flow provided by operating activities, less payments for property, plant and equipment, software and other deferred charges, plus

proceeds from sales of property, plant and equipment, plus (minus) net proceeds from insurance and sales (purchases) of investments. Free cash flow is also adjusted for, where applicable, the cash contributions related to the termination of

our U.S. pension plan. We believe that free cash flow assists investors by showing the amount of cash we have available for debt reductions, dividends, share repurchases, and acquisitions.

ORGANIC SALES CHANGE ($ in millions)

2018 2019 2020 Net sales $7,159.0 $7,070.1 $6,971.5 Reported sales change 8.2% (1.2)% (1.4)% Foreign currency translation (1.4)% 3.3% 0.9% Extra week impact – – (1.3)% Sales change ex. currency (non‑GAAP)(1) 6.9% 2.0% (1.7)%

Acquisitions/divestiture (1.4)% – (1.7)% Organic sales change (non‑GAAP)(1) 5.5% 2.0% (3.4)% The adjusted tax rates were 25.0%, 24.6% and 24.1% for 2018, 2019 and 2020, respectively. (1) Includes restructuring charges, transaction and

related costs, Argentine peso remeasurement transition loss, net gain on investments, net gain on sales of assets, reversal of acquisition-related contingent consideration, and other items. (2) In the fourth quarter of 2018, we finalized our

provisional amounts as defined under SEC Staff Accounting Bulletin No. 118 related to the TCJA. (1) Totals may not sum due to rounding and other factors. ADJUSTED EARNINGS PER SHARE (EPS) 2018 2019 2020 As reported net income per common

share, assuming dilution $5.28 $3.57 $6.61 Non‑GAAP adjustments per common share, net of tax: Restructuring charges and other items(1) 0.68 0.47 0.48 Pension plan settlements and related charges 0.84 3.12 0.01 Tax benefit

from discrete foreign tax structuring and planning transactions (0.35) (0.56) – TCJA provisional amounts and subsequent adjustments(2) (0.39) – – Adjusted net income per common share, assuming dilution (non‑GAAP) $6.06 $6.60

$7.10 Reconciliation of Non-GAAP Financial Measures from GAAP FREE CASH FLOW ($ in millions) 2018 2019 2020 Net cash provided by operating activities $457.9 $746.5 $751.3 Purchases of property, plant and equipment (226.7) (219.4) (201.4) Purchases

of software and other deferred charges (29.9) (37.8) (17.2) Proceeds from sales of property, plant and equipment 9.4 7.8 9.2 Proceeds from insurance and sales (purchases) of investments, net 18.5 4.9 5.6 Contributions for U.S. pension plan

termination 200.0 10.3 – Free cash flow (non‑GAAP) $429.2 $512.3 $547.5

© 2020 Avery Dennison Corporation.

All rights reserved. Avery Dennison and all other Avery Dennison brands, product names and codes are trademarks of Avery Dennison Corporation. All other brands or product names are trademarks of their respective owners. Fortune 500® is a

trademark of Time, Inc. Branding and other information on any samples depicted is fictitious. Any resemblance to actual names is purely coincidental.

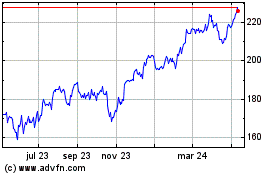

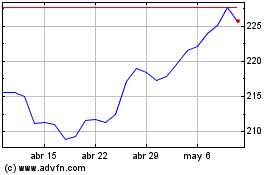

Avery Dennison (NYSE:AVY)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Avery Dennison (NYSE:AVY)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024