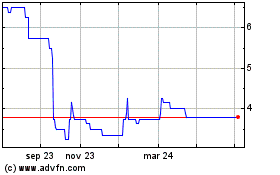

TIDMDBOX

RNS Number : 7178T

Digitalbox PLC

29 March 2021

--`3

29 March 2021

Digitalbox plc

("Digitalbox" or the "Group")

Final Audited Results for the year ended 31 December 2020

Digitalbox plc, the mobile-first digital media business, which

owns leading websites Entertainment Daily, The Daily Mash, and The

Tab, is pleased to announce its final audited results for the year

ended 31 December 2020.

Financial Highlights [1] :

-- Revenue of GBP2.2m (2019: GBP2.2m)

-- Gross profit of GBP1.7m (2019: GBP1.8m)

-- Gross margin of 76% (2019: 82%)

-- Adjusted EBITDA [2] of GBP0.3m (2019: GBP0.5m)

-- Adjusted EBITDA margin of 13.9% (2019: 23.4%)

-- Adjusted EBITDA per share of 0.3p (2019: 0.7p)

-- Loss before tax of GBP143k (2019: loss of GBP460k)

-- Gross cash of GBP1.9m as at 31 December 2020 (31 December

2019: GBP0.5m) including GBP500k of Government-backed Covid loans

[3]

Operational Highlights:

-- Encouraging progress across the portfolio despite challenging

market conditions. Users [4] who visited Digitalbox's websites are

up 76% to 67 million (2019: 38 million)

-- Completed acquisition of The Tab in October 2020 - Q4 traffic up 42% year on year.

-- Digitalbox's Graphene platform underpins The Tab's shift from

operating loss to a positive contribution

-- 88% of users are via mobile devices in line with Group

strategy of building a leading mobile-focused media business.

-- After a difficult third quarter due to disruptive social

media algorithm changes designed to counter COVID-19

disinformation, Group audience figures recovered to 12 million

monthly users in December 2020, with more than 250 million ad

impressions.

-- In 2020, Entertainment Daily saw 112% growth in Google/Direct

traffic, and The Daily Mash had 14% growth in visits per user.

-- Former Chief Executive of TI Media, Marcus Rich appointed

Non-executive Chairman in February 2021, post year-end.

Outlook:

-- Acquisitions of The Daily Mash and The Tab have proved the

potential of the Digitalbox operating model and its Graphene

platform, giving continued confidence in the Group's ability to

build a larger portfolio of successful, profitable digital

brands.

-- We are evaluating potential targets and, with a strong

balance sheet, have the flexibility to move on the right

opportunities at speed.

-- Advertising trends continue to be accelerated by the impact

of COVID-19, resulting in money rapidly moving into the mobile

sector. Combined with a strengthening economy, Digitalbox is well

placed for growth.

James Carter, CEO, Digitalbox plc, said: "Digitalbox delivered a

very positive performance in 2020. Despite challenging market

conditions, we thrived by taking advantage of the changing

landscape to deliver on our strategy of building a leading

mobile-focused media business by acquiring additional assets and

integrating them with our Graphene operating platform. This success

has been greatly aided by our agile approach enabling us to quickly

adapt to opportunities and challenges as they arise.

"The year saw a massively disrupted economic environment created

by the COVID-19 pandemic alongside some significant turbulence

within social media platforms as their algorithms struggled to

manage issues around misinformation. However, I am pleased to

report we have moved the business forward, ending the year

operating three significant brands and in a much stronger position

than we started it.

"2020 ended with the business having traded profitably on an

adjusted EBITDA basis, having brought on board a cornerstone

investor in Downing Strategic Micro-Cap Investment Trust plc, and,

importantly, having continued our buy and build plan in acquiring

The Tab at the beginning of October.

"We enter 2021 with cash at the bank, an expanded portfolio of

assets, a stronger investor base, a brighter advertising market and

a re-invigorated Board. We look forward to 2021 as a trading period

that will start to normalise and present more acquisition

opportunities as the reality of life begins to create pressures on

those businesses who were less able to navigate the economy in 2020

."

Footnotes:

[1] 2019 refers to 10 months of trading of The Daily Mash and

Entertainment Daily.

2 Adjusted EBITDA is defined as the loss from operations after

deducting depreciation, amortisation, share-based payments,

acquisition and listing costs, direct costs associated with

business combinations and capital restructure costs.

3 Government-backed CBILS scheme loan of GBP450k taken in

October 2020 and GBP50k Government-backed CBILS scheme loan taken

on as part of the acquisition of The Tab.

(4) Figures include full-year Google Analytics compound audience

figures for Entertainment Daily & The Daily Mash and

post-acquisition period Oct-Dec 2020 for The Tab and associated

social channels.

Investor Presentations

InvestorMeetCompany

The Company will provide a live presentation via the

InvestorMeetCompany platform today at 9:00am. Introduced by Company

Chairman, Marcus Rich and presented by CEO James Carter and the

executive team, the presentation is open to all existing and

potential shareholders. Questions can be submitted at any time

during the live presentation. Investors can sign up to Investor

Meet Company for free and add to meet DIGITALBOX PLC via:

https://www.investormeetcompany.com/digitalbox-plc/register-investor

MelloMonday

Furthermore, Digitalbox will also be attending MelloMonday today

from 5.00pm - 9.30pm via Zoom webinar. CEO James Carter and CFO

David Joseph will be presenting to participants and taking

questions during the event. If you would like to attend the webinar

as a shareholder, please get your ticket here using code SHVIP for

50% off.

Market abuse regulation:

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) No 596/2014 as it forms part of UK

domestic law by virtue of the European Union (Withdrawal) Act 2018

("MAR").

Enquiries:

Digitalbox c/o SEC Newgate

James Carter, CEO

Panmure Gordon (Nominated Adviser, Tel: +44 (0)20 7886 2500

Financial Adviser & Joint Broker)

Alina Vaskina / Sandy Clark (Corporate

Advisory)

Erik Anderson / Rupert Dearden (Corporate

Broking)

Alvarium Capital Partners (Joint Broker) Tel: +44 (0)20 7195 1400

Alex Davies / Hugh Kingsmill Moore

SEC Newgate (Financial PR) Tel: +44 (0)7540 106 366

Robin Tozer / Isabelle Smurfit Email: digitalbox@secnewgate.co.uk

About Digitalbox plc

Based in Bath, UK, Digitalbox is a 'pure-play' digital media

business with the aim of profitable publishing at scale on mobile

platforms.

Digitalbox operates three trading brands, "Entertainment Daily",

"The Tab" and "The Daily Mash". Entertainment Daily produces and

publishes online UK entertainment news covering TV, showbusiness

and celebrity news. The Daily Mash produces and publishes satirical

news content. The Tab is the UK's biggest youth culture site

fuelled by students.

Digitalbox generates revenue from the sale of advertising in and

around the content it publishes. The Group's optimisation for

mobile enables it to achieve revenues per session significantly

ahead of market norms for publishers on mobile.

CHAIRMAN'S STATEMENT

I am delighted to report that Digitalbox has successfully

navigated its way through the most challenging social and economic

period in recent history.

The business was confronted with not just the sudden and

dramatic economic downturn in Q2 2020 caused by COVID-19, but also

the disruption created by the social media giants in their efforts

to combat misinformation in the run-up to the US elections and

their ongoing difficulties combatting the same about COVID-19.

Thanks to swift decision-making by an alert management team the

business took immediate action in 'right-sizing' the cost base in

order to soften the blow of the sudden and inevitable reduction in

revenues.

Further, management shored up the balance sheet by availing

itself of the Government-backed CBILS scheme, taking on a loan of

GBP450k in October and at the same time securing an injection of

GBP1.2m of fresh capital from a new cornerstone investor Downing

Strategic Micro-Cap Investment Trust plc ("Downing") through the

issue of shares.

Management did not let the prevailing challenging economic

conditions get in the way of progressing its buy and build

strategy. On 1(st) October 2020 Digitalbox announced it had

successfully acquired Tab Media Limited ('The Tab') adding it to

the portfolio alongside Entertainment Daily and The Daily Mash. The

Tab is now profitable (being loss making under previous ownership)

and has benefitted from being integrated onto the group's

proprietary tech platform Graphene.

Our efficient and expert content creation married to our

cutting-edge technology creates value with The Tab being a strong

proof point for our buy and build plan.

This combination of mitigating activity and delivery of strategy

meant year-on-year revenue impact was successfully contained at

only a 2.4% reduction and the business generated a robust GBP305k

of adjusted EBITDA compared to GBP525k in 2019.

Digitalbox begins 2021 with GBP1.9m cash reserves and a stronger

investor base. The three brands in our portfolio are seeing the

disruption in the ecosystems of the social media giants beginning

to dissipate and we are successfully diversifying our traffic

sources. In addition, Group M industry forecasters are predicting

double-digit year-on-year advertising growth for the UK led by

programmatic display on mobile.

Whilst the impacts of the pandemic are far from over, our

mobile-first business is in excellent shape to continue to

grow.

We remain highly cash generative, have healthy cash reserves and

we see further opportunities for both organic growth from the

existing brands and complementary acquisitions in 2021.

Marcus Rich

Chairman

26 March 2021

CHIEF EXECUTIVE'S STATEMENT

Digitalbox delivered a very positive performance in FY2020.

Despite challenging market conditions, we thrived by taking

advantage of the changing landscape to deliver on our strategy of

building a leading mobile-focused media business through the

acquisition of an additional asset and integrating it with our

operating platform. This success has been greatly aided by our

agile approach, which enables us to quickly adapt to opportunities

and challenges as they arise.

The year saw a massively disrupted economic environment created

by the COVID-19 pandemic alongside some significant turbulence

within social media platforms as their algorithms struggled to

manage issues around misinformation, but I am pleased to report we

have been able to move the business forwards, ending the year

operating three significant brands and in a much stronger position

than we started it.

2020 ended with the business having traded profitably on an

adjusted EBITDA basis, having brought on board a cornerstone

investor in Downing, availing ourselves of a Government-backed loan

under the CBILS scheme during October and, importantly, having

continued our buy and build plan in acquiring The Tab at the end of

September.

We enter 2021 with GBP1.9m cash at the bank, an expanded

portfolio of assets, a stronger investor base, a brighter

advertising market and a re-invigorated Board. We look forward to

2021 as a trading period that will start to normalise and present

more acquisition opportunities as the reality of life begins to

create pressures on those businesses who were less able to navigate

the economy in 2020.

Financial review

As with most businesses, Digitalbox suffered from the economic

impact created by the global COVID-19 pandemic. Advertising markets

declined sharply, and ongoing uncertainty meant recovery took time.

This heavily impacted our revenue expectation for Q2, and it wasn't

until late into Q3 that advertising markets started to return to

normal.

Further, the social media giants made changes to their content

algorithms in order to counter misinformation attached to COVID-19,

Black Lives Matter campaigns and also the US presidential

elections. Changes within some of the ecosystems had some

unforeseen negative impacts on legitimate sites and content that

the platforms continue to try and rectify. The result of this saw a

negative impact to traffic and revenues in Q3 and a recovery

beginning in Q4 for Digitalbox.

Despite these dual challenges, thanks to swift and decisive

action, we quickly adapted the business to mitigate the revenue

shortfall as much as possible and, more importantly, ensuring the

business maintained its cash reserves.

The Group therefore ended the year with virtually flat revenues

of GBP2.2m, which the Board consider a significant achievement

under the circumstances. These revenues are for the full 12 months

of trading to 31(st) December 2020 versus 10 months of trading in

2019, but the outcome is a reassuring indicator of the resilience

of the Digitalbox business model.

Gross profit of GBP1.7m (2019: GBP1.8m) also suffered a margin

percentage decline due to the advertising rates falling during the

sudden and dramatic global advertising market reduction, but still

delivering healthy gross margins of 76% (2019: 82%).

Adjusted EBITDA for the year was GBP305k (2019: GBP525k), and

our adjusted EBITDA margin was 13.9% (2019: 23.4%).

Digitalbox has a low capital expenditure requirement and is not

working capital hungry. This, together with the successful GBP1.2m

placing in October to a cornerstone investor and the securing of a

CBILS loan of GBP450k in the same month, ensured that the business

strengthened its balance sheet and cash reserves, ending the year

with GBP1.9m of cash (2019: GBP0.5m).

Operating review

The Group's three current trading brands are Entertainment

Daily, The Daily Mash and the newly acquired site, The Tab.

Entertainment Daily produces and publishes online UK entertainment

news covering TV, showbiz and celebrities. The Daily Mash produces

and publishes online satirical news articles in its own distinctive

style, and The Tab is the UK's largest student and youth culture

site fuelled by a network of 33 local university sites. All three

brands generate revenue from the sale of advertising in and around

the content they publish.

Content and technology remain at the core of the Digitalbox

offering. Article length, page speed, server set-up and advertising

auctions are all refined for the mobile journey as we obsess about

delivering the optimal user experience.

Our user base has grown 76% year-on-year as we have been

successful in broadening our horizons through additional sites and

content verticals and extended our reach of UK adults. Our growth

reflects our focus; unlike many media companies we are not

distracted by the need to manage declining print assets but instead

are free to concentrate on consumer habits and profitability.

Mobile is the device of choice for consumers and advertisers alike,

and we know how to engage audiences and monetise them better than

much of the UK market through this channel.

As with many of the trends that have been accelerated by

COVID-19, we have clearly seen disproportionate advertising market

growth benefitting the mobile audience segment.

Proprietary technology continues to evolve within Digitalbox,

and our Graphene technology stack now powers Entertainment Daily,

The Daily Mash and The Tab, ensuring the fastest experience for

users and advertisers alike.

Our interest in making acquisitions remains strong, and The Tab

has proved to be a great success since its acquisition at the end

of September 2020. The disruption brought to the market by the

pandemic created opportunities, and as time progresses we envisage

seeing more businesses increasingly challenged and being made

available to interested parties. Overlaying our model on two

acquisitions so far has proved successful and we remain focused on

repeating this to grow the business.

The Digitalbox team and infrastructure maintain capacity for

further growth and acquisitions to deliver further expansion while

operational efficiencies remain strong.

Mobile-first strategy

Our strategy to establish a mobile-first platform business with

diversified brands that engage consumers at scale is clearly

working with 85% of our audience on Entertainment Daily, The Daily

Mash and The Tab being accessed through these devices. Having grown

to more than 12m monthly unique users, we present a significant

scale when compared to the more traditional UK publishing houses

and our primary objective is to continue this expansion.

Mobile ad spending worldwide was growing well ahead of the wider

digital market prior to the pandemic and the impact of COVID-19

only looks to have accelerated this trend. As part of our

technology supporting our mobile-first strategy, we have built a

proprietary video player called BOB. The BOB player is built to

ensure optimal mobile performance and efficiency. Both

Entertainment Daily and The Tab are presenting 'must-see TV

previews' on their sites.

PROJECTED GLOBAL DIGITAL / MOBILE AD SP

2019 2020 2021 2022 2023 2024

Global Digital Ad

Spend $bn* 318 348 397 438 466 507

----- ----- ----- ----- ----- -----

Mobile % of total** 73% 76% 78% 79% 80% -

----- ----- ----- ----- ----- -----

*Group M Global End-of-Year-Forecast 2020 / ** Pubmatic 2020

Global Ad Trends/eMarketer (excludes 2024)

Portfolio expansion

Digitalbox is a highly cash-generative business enabling us to

continue with this strategy despite the impact of COVID-19. As part

of the development of our acquisition strategy, the Group acquired

Tab Media Limited during the year.

Tab Media Limited operated the UK's most successful student and

youth culture site, The Tab. The site was founded by three students

at Cambridge in 2009 as a reaction to out-of-touch student papers.

Since then it has exploded into one of the biggest youth media

sites in Britain, speaking directly to Generation Z and engaging

with over six million users a month.

Content is driven by a core team based in London who work with

student journalists on 33 subsites across UK campuses. Not only is

this an incredible opportunity to engage with this influential

demographic, it also opens up a pool of smart journalist talent who

may well be interested in getting involved in the broader

Digitalbox business.

Growth from the existing portfolio

During the year, Entertainment Daily saw continued growth of its

user-base, averaging 4.5m unique users per month which was up from

3.3m in 2019. The site continues to diversify its traffic sources

as it builds out on other platforms, most notably Google. In

addition to the growth seen from Google search traffic, we have

experienced a continued rise in Google Discover traffic that in

many ways, provides a similar user experience to Facebook Newsfeed.

These channels combined saw growth of more than 100%

year-on-year.

The Daily Mash was impacted in the year by Facebook's

increasingly sensitive 'misinformation' algorithms repeatedly

failing to identify and understand satirical content correctly and

therefore reducing reach on our articles. We have seen consistently

high levels of engagement when users are presented with our

content, and a high proportion of The Daily Mash traffic comes from

direct visits which increasingly offsets the issue. Dialogue

continues with Facebook to help them understand and address the

issue.

Also, the Daily Mash saw a big increase in audience for its TV

show The Mash Report in Q2. With studio access closed, the show was

delivered from the homes of our presenters through video conference

facilities and grew its weekly viewer levels from 800k to well over

1m.

Technology

Our proprietary tech stack, named Graphene, is a key part of our

success. As a mobile-first business, we have shaped Graphene to

ensure we deliver the fastest page speeds across our sites along

with the most efficient advertising transactions.

Graphene allows audience scale to build rapidly with the least

resistance from the technology and is a significant contributing

factor as to why we were able to turn a loss-making site (The Tab)

to profitability within the first quarter of ownership.

COVID-19

Our main focus has been to protect our staff and stakeholders

and in keeping with our regular operating model, we have used

technology to best navigate the challenges brought by the pandemic.

From the middle of March 2020, we took a strong steer from

Alphabet's response to the developing issue and moved all staff to

working from home ahead of the UK Government's enforced

lockdown.

Additionally, as a precaution, we acted quickly in 2020 to

access a CBILS loan of GBP0.45m to enable us to continue trading

and delivering our strategy for growth even if the outcomes of the

pandemic were more severe than expected, but this has yet to be

needed.

In fact, the Group has performed well during the COVID-19

period; as detailed earlier in the report, after a dramatic

downturn in Q2, advertising session values increased significantly

as the year unfolded.

Culture and people

When we joined AIM, we said: 'We work in the ways that deliver

the best results most efficiently. Rather than harbouring

traditional views of office culture or adopting a one-size-fits-all

approach, we mix office-based roles and home working arrangements,

full-time and part-time positions, staff and freelance contributor

agreements to marry the needs of the business with those of our

people.'

This nimble approach meant we were better placed than many to

adapt to the challenges of 2020. Our teams fully shifted to

remote-working early and have been outstanding; adapting quickly

and continuing to deliver. Good communication and a sense of

inclusion are important to us, and so to adapt to the reduction in

contact time, we have increased communication frequency through

monthly newsletters and weekly leadership meetings alongside daily

team meetings. We have also more recently introduced company-wide

discussion groups via Zoom.

Recruiting and retaining the best people is crucial to the

success of Digitalbox. We have had great success hiring younger

talent on Entertainment Daily through its apprentice programme, we

have recruited a tranche of new contributing writers on The Daily

Mash, and the acquisition of The Tab brings an entirely new

opportunity. With the local network of University sites having

already proved a fantastic gateway to great staff on The Tab, we

aim to make broader opportunities across our growing portfolio

available to this amazing talent pool.

We aim to ensure our staff are rewarded fairly and have

opportunities to progress within the business. All staff benefit

from the company's life assurance scheme. All staff and their

immediate families are able to access a free wellbeing &

support programme including personalised healthy eating and

exercise plans, mental health support, legal and medical advice and

ways to prevent burnout. Senior staff also have access to a share

options scheme.

I would like to thank all staff for their fantastic hard work

during the last year and their valuable contribution to these

results and promise a summer party for all in Bath when the law

allows.

Outlook

Digitalbox has continued to develop its profitable UK platform

business positioned directly in the mobile space and our buy and

build strategy is enabling us to deliver our vision of creating a

market-leading, mobile-first digital media business for the 21st

century.

Since joining the AIM, we have seen the successful integration

of The Daily Mash, and, more recently The Tab. Both of these

acquisitions have proved the potential of our model, and give us

continued confidence in our ability to build a larger portfolio of

successful, profitable digital brands with this approach. We are

actively evaluating potential targets on an ongoing basis and with

cash at the bank and the ability to raise funds via the market, we

have the flexibility to move on the right opportunities at

speed.

We clearly all hope that the worst of the COVID-19 pandemic is

now behind us, and as the vaccines roll out globally, economies

will bounce back. With the UK set well with its vaccine program, we

can look forward to a more positive market than we have experienced

over the last 12 months. We firmly believe that with advertising

trends continuing to be accelerated by the COVID-19 impact

resulting in money moving into the mobile sector at a rapid pace,

combined with a strengthening economy, we are perfectly placed to

grow over the coming years.

James Carter

Chief Executive

26 March 2021

STRATEGIC REPORT

The Digitalbox Vision

We set out to build a new digital media business; one driven by

profit and efficiency delivering high quality, engaging content to

users at scale.

Our aim continues to be to acquire and transform digital media

assets with potential through the application of the Digitalbox

model.

Free from legacy issues, we have a proven ability to grow at

speed by focusing on current and future trends; rapidly adapting to

the habits of our audience and the needs of our commercial

partners.

Consumer media habits

Our formative approach was informed by our recognition of the

growth of 'push media' consumption, especially on mobile - where

the most highly engaging and relevant content from publishers is

pushed into users' feeds based on trending topics, article

performance and their own behaviours and interests.

The content-surfacing algorithms will continue to be refined,

delivering better user experience and higher rates of engagement

and generating further growth of this type of consumption.

The major platforms (chiefly Facebook and Google) are

continually competing for consumer time, and it is publishers of

the most engaging content that will continue to benefit. In the

last couple of years Google has developed its push content strategy

via its Discover feed which is now making billions of content

suggestions its 800m global mobile users.

Targeting consumers via an array of distribution channels is one

thing but operating effectively enough to ensure maximum engagement

is where the real skillset lies.

Whilst the tech duopoly continue to evolve their models,

consumers continue to support other push media sources too, signing

up to notifications, subscriptions and emails from their favourite

media brands. We continue to see growth in all three of these

areas.

Our approach

We believe in order to be successful in today's media

environment a business, its brands and its people

must be:

ENGAGING - The internet is dominated by platforms that compete

for engagement and media brands that deliver the highest levels

will prosper. Our teams' passion for their subjects, understanding

of their audiences and expertise in producing truly compelling

content consistently deliver market-leading levels of

engagement.

AGILE - The landscape is constantly changing, and we are always

ready to adapt, to seize opportunities and address challenges,

taking effective tactical steps to deliver on strategy.

EFFICIENT - Efficiency matters because we regard profitable

operation as the key to longevity. The digital market has seen many

long bets against models that fail the profit test. Our teams use

every tool to maximise their impact and efficiency.

Relevance

Our business is currently built around a UK audience focus which

brings distinct benefits across our key disciplines:

-- Our editorial content resonates strongly with our audiences,

keeping our readers coming back again and again.

-- Our key advertiser relationships all have a significant

presence in our local market which is one of the world's most

advanced marketing economies and they place the greatest value on

high-quality UK traffic.

The addition of The Tab at the end of September 2020 with its

hyper-local university sites adds even more depth to this element

of our strategy.

Growth through acquisition

On our admission to AIM in February 2019, Digitalbox outlined a

strategy to make investments in acquisitions to grow the portfolio.

In particular we intended to identify targets from three distinct

categories; Legacy Publisher, First Wave Digital and Bedroom

Start-Ups. In our view, each of these categories continue to face

challenges around monetisation, operating profitability, audience

growth and technology performance which can be addressed through

the application of the Digitalbox model.

The completion of The Tab acquisition marked our second

acquisition after The Daily Mash in 2019 as part of this plan and

we continue to evaluate further potential targets.

In particular, we will identify assets that best align with our

processes and enhance our existing portfolio to deliver the

strategic vision. We will continue to seek out content verticals

that offer the opportunity to scale against larger media

organisations who are struggling to operate profitably at

scale.

Growing valuable audiences

Entertainment Daily reaches a core demographic of 25-55 year old

UK women; the power brokers of UK shopping. Being frequently in

charge of the household budget they are passionate about the

territory they control. They love brands that provide status and

are always on the look-out for great deals they can share with

their friends. Our audience has evolved to more than 4m per month

and our channel diversification saw significant growth from Google

sourced users.

The Daily Mash is consumed by savvy UK independent thinkers.

These educated professionals respond to the brand's pitch-perfect

skewering of the rich and infamous and its inventive and surreal

takes on the absurdity of modern life. Influential among their

peers thanks to their own finely-tuned view of the world, they are

seen as selective and discerning. These 25-44 year olds are

power-sharers of digital media who even in these challenging times

continue to spread a smile.

The Tab was founded by three students at Cambridge in 2009 as a

reaction to out-of-touch student papers. Since then it has exploded

into one of the biggest youth media sites in Britain, speaking

directly the UK's 15-24 year olds. They are the generation tasked

with more responsibility than any other in the last 50 years. It

will be their reinvention that heals the planet, that creates new

ways of working and cares for our ageing population. The leaders of

tomorrow, the global citizens who need to think in a more measured

and considered fashion.

The three audiences have further scope for growth and

cross-fertilisation as they continue to demonstrate increasing

levels of engagement.

Mobile-optimised tech platform

We are able to quickly on-board new brands and businesses onto

our mobile-first Graphene platform. This tech stack consists of a

blend of technologies allowing our websites to flourish through an

efficient, light touch commercial approach designed to maximise

mobile profitability.

Graphene is a highly scalable and dynamic platform that assists

content delivery at the highest speeds. This brings significant

advantages to how our sites are experienced by users and also

ranked by the key power brokers - especially Google and Facebook -

as they evaluate the preferred destinations for users. Graphene

also enables us to realise tech and serving costs on the

acquisitions we make.

Graphene will continue to evolve via our tech roadmap for

2021.

Product development

While profitability is key, we continue to invest in the

existing business. 2021 will see additional investment across

Entertainment Daily, The Tab and The Daily Mash as we aim to

deliver further meaningful growth from diversification of our key

routes to audiences.

Pandemic Coverage

Our brands delivered coverage of the impacts of the pandemic

each in a unique tone tuned to their respective audience.

Entertainment Daily kept readers abreast of the impact on

production of their favourite shows and popular celebrities

personal struggles with the virus. The Tab launched its You Matter

campaign highlighting mental health and loneliness issues facing

students caused by the pandemic and The Daily Mash delivered

winning satirical coverage with stories including Five Smug

Middle-Class Social Isolation Activities and its take on panic

buying Waitrose Limits Food Sales To People With Detached

Houses.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME FOR THE YEARED

31 DECEMBER 2020

Year ended Year ended

31 December 31 December

2020 2019

Note GBP'000 GBP'000

Revenue 7 2,187 2,240

Cost of sales (529) (394)

------------ ------------

Gross profit 1,658 1,846

Administrative expenses (1,823) (2,303)

Other operating income 8 24 -

-------------- --------------

Operating loss 8 (141) (457)

Memorandum:

Adjusted EBITDA(1) 305 525

Depreciation (30) (11)

Amortisation (149) (133)

Share based payments (140) (149)

Acquisition & listing costs - (689)

Direct costs of business combinations (98) -

Capital restructure costs (29) -

-------------- --------------

Loss from Operations (141) (457)

--------------------------------------- ----- --------------- ---------------

Finance costs 10 (2) (3)

------------ ------------

Loss before taxation and attributable

to equity holders of the parent (143) (460)

Taxation 11 (48) 23

------------ ------------

(191) (437)

Loss after tax ------------ ------------

All losses after taxation arise from

continuing operations.

There was no other comprehensive income for 2020 (2019: GBPNIL).

(1) Adjusted EBITDA is defined as the loss from operations after

deducting depreciation, amortisation, share based payments,

acquisition and listing costs, direct costs associated with

business combinations and capital restructure costs.

GBP GBP

Loss per share

Basic (continuing) 12 (0.00198) (0.00571)

====== ======

Loss per share

Diluted (continuing) 12 (0.00198) (0.00571)

====== ======

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY FOR THE YEARED

31 DECEMBER 2020

Share based Retained

Share Share payment (deficit)/ Total

capital premium earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 January 2019 20,488 19,164 32 (39,399) 285

Shares issued 843 10,710 - - 11,553

Share issue costs - (117) - - (117)

Equity settled share-based

payments - - 149 - 149

Loss after tax - - - (437) (437)

-------------- -------------- -------------- -------------- --------------

Balance at 31 December

2019 21,331 29,757 181 (39,836) 11,433

-------------- -------------- -------------- -------------- --------------

Shares issued 260 976 - - 1,236

Share issue costs - (84) - - (84)

Capital reduction (20,428) (19,500) - 39,928 -

Equity settled share-based

payments - - 140 - 140

Loss after tax - - - (191) (191)

-------------- -------------- -------------- -------------- --------------

Balance at 31 December

2020 1,163 11,149 321 (99) 12,534

-------------- -------------- -------------- -------------- --------------

CONSOLIDATED STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER 2020

31 December 31

2020 December

2019

ASSETS Note GBP'000 GBP'000

Non-current assets

Property, plant and equipment 14 19 49

Intangible fixed assets 15 10,839 10,248

----------------- -----------------

Total non-current assets 10,858 10,297

Current assets

Trade and other receivables 16 1,047 1,407

Cash and cash equivalents 17 1,853 477

----------------- -----------------

Total current assets 2,900 1,884

----------------- -----------------

Total assets 13,758 12,181

========= =========

LIABILITIES

Current liabilities

Trade and other payables 18 (449) (488)

Lease liabilities 18 (2) (24)

Bank loans 18 (25) -

Corporation tax 18 (51) (98)

----------------- -----------------

Total current liabilities (527) (610)

----------------- -----------------

Non-current liabilities

Other payables 18 - (8)

Lease liabilities 18 - (2)

Bank loans 19 (465) -

Deferred tax liability 20 (232) (128)

------------------ ------------------

(697) (138)

------------------ ------------------

Total liabilities (1,224) (748)

------------------ ------------------

Total net current assets 2,373 1,274

------------------ ------------------

Total net assets 12,534 11,433

========= =========

Capital and reserves attributable

to owners

of the parent

Share capital 22 1,163 21,331

Share premium 24 11,149 29,757

Share based payment reserve 24 321 181

Retained deficit 24 (99) (39,836)

------------------ ------------------

Total equity 12,534 11,433

========= =========

CONSOLIDATED STATEMENT OF CASH FLOWS FOR THE YEARED 31 DECEMBER

2020

Year ended Year ended

31 December 31 December

2020 2019

GBP'000 GBP'000

Cash flows from operating activities

Loss from ordinary activities

Adjustments for: (191) (437)

Income tax expense 48 -

Share based payments 140 149

Depreciation on property plant and

equipment 30 11

Amortisation of intangible assets 149 133

Finance costs 2 22

Income tax paid (109) -

----------------- -----------------

Cash flows from operating activities

before changes 69 (122)

in working capital

Decrease / (increase) in trade and

other receivables 518 (86)

Decrease in trade and other payables (205) (100)

----------------- -----------------

Cash generated/(used in) in operations 382 (308)

Investing activities

Purchase of property, plant and

equipment - (13)

Acquisition of subsidiary (841) (993)

Cash on acquisition 269 433

----------------- -----------------

Net cash (used in)/generated from

investing activities (572) (573)

Financing activities

Finance costs (2) (22)

New loans and finance leases 440 33

Loan repayments (24) (7)

Issue of new share capital 1,236 1,240

Costs on issue of shares (84) (117)

----------------- -----------------

Net cash from financing activities 1,566 1,127

----------------- -----------------

Net increase in cash and cash equivalents 1,376 246

Cash and cash equivalents at beginning

of the period 477 231

------------------ ------------------

Cash and cash equivalents at end

of the period 1,853 477

========= =========

CONSOLIDATED STATEMENT OF CASH FLOWS FOR THE YEARED 31 DECEMBER

2020

Reconciliation of net cash flow to movement

in net funds: Year ended Year ended

31 December 31 December

2020 2019

GBP000 GBP000

Net increase in cash and cash equivalents 1,376 246

New loans and finance leases (440) (33)

Loans acquired in business combinations (50) -

Repayment of loans 24 7

----------------- -----------------

Movement in net funds in the year 910 220

Net funds at 1 January 451 231

----------------- ------------------

Net funds at 31 December 1,361 451

========= =========

Breakdown of net funds

Cash and cash equivalents 1,853 477

Lease liabilities (2) (26)

Bank loans (490) -

----------------- ------------------

Net funds at 31 December 1,361 451

========= =========

NOTES FORMING PART OF THE CONSOLIDATED FINANCIAL STATEMENTS FOR

THE YEARED 31 DECEMBER 2020

1. GENERAL INFORMATION

Digitalbox plc is a public limited company incorporated and

domiciled in the United Kingdom. The address of the registered

office 2-4 Henry Street, Bath, England, BA1 1JT. The Company is

listed on AIM of the London Stock Exchange.

The principal activity of the Group during the year was the

production of publishing content and the sale of advertising

space.

These financial statements are presented in pounds sterling

because that is the currency of the primary economic environment in

which the Group operates. Foreign operations are included in

accordance with the policies set out in note 4.

2. STANDARDS, AMMENTS AND INTERPRETATIONS ADOPTED IN THE CURRENT

FINANCIAL YEARED 31 DECEMBER 2020

The accounting policies adopted are consistent with those of the

previous financial year except for the following new and amended

standards and interpretations during the year that are applicable

to the Group.

Definition of a Business (Amendments to IFRS 3)

Amendments to IFRS 3 were mandatorily effective for reporting

periods beginning on or after 1 January 2020. The Group has applied

the revised definition of a business for acquisitions occurring on

or after 1 January 2020 in determining whether an acquisition is

accounted for in accordance with IFRS 3 Business Combinations. The

amendments do not permit the Group to reassess whether acquisitions

occurring prior to 1 January 2020 met the revised definition of a

business. See note 13 for disclosures relating to the Group's

business combination occurring during the year ended 31 December

2020.

Other standards

New standards that have been adopted in the annual financial

statements for the year ended 31 December 2020, but have not had a

significant effect on the Group are:

-- IAS 1 Presentation of Financial Statements and IAS 8

Accounting Policies, Changes in Accounting Estimates and Errors

(Amendment - Disclosure Initiative - Definition of Material);

and

-- Revisions to the Conceptual Framework for Financial Reporting.

3. NEW AND REVISED IFRS STANDARDS IN ISSUE BUT NOT YET EFFECTIVE

There are a number of standards, amendments to standards, and

interpretations which have been issued by the IASB that are

effective in future accounting periods that the group has decided

not to adopt early.

The following amendments are effective for the period beginning

1 January 2022:

-- Onerous Contracts - Cost of Fulfilling a Contract (Amendments to IAS 37);

-- Property, Plant and Equipment: Proceeds before Intended Use (Amendments to IAS 16);

-- Annual Improvements to IFRS Standards 2018-2020 (Amendments

to IFRS 1, IFRS 9, IFRS 16 and IAS 41); and

-- References to Conceptual Framework (Amendments to IFRS 3).

In January 2020, the IASB issued amendments to IAS 1, which

clarify the criteria used to determine whether liabilities are

classified as current or non-current. These amendments clarify that

current or non-current classification is based on whether an entity

has a right at the end of the reporting period to defer settlement

of the liability for at least twelve months after the reporting

period. The amendments also clarify that 'settlement' includes the

transfer of cash, goods, services, or equity instruments unless the

obligation to transfer equity instruments arises from a conversion

feature classified as an equity instrument separately from the

liability component of a compound financial instrument. The

amendments were originally effective for annual reporting periods

beginning on or after 1 January 2022. However, in May 2020, the

effective date was deferred to annual reporting periods beginning

on or after 1 January 2023.

The Group does not expect any of the standards issued by the

IASB, but not yet effective, to have a material impact on the

group.

4. ACCOUNTING POLICIES

Principal accounting policies

The Group is a public Group incorporated and domiciled in the

United Kingdom. The principal accounting policies applied in the

preparation of these consolidated financial statements are set out

below. These policies have been consistently applied to all the

periods presented, unless otherwise stated.

Basis of preparation

The financial statements have been prepared in accordance with

International Financial Reporting Standards, International

Accounting Standards and Interpretations (collectively IFRS) issued

by the International Accounting Standards Board (IASB) as adopted

by the European Union ("adopted IFRSs") and those parts of the

Companies Act 2006 which apply to companies preparing their

financial statements under IFRSs. The financial statements are

presented to the nearest round thousand (GBP'000) except where

otherwise indicated.

Basis of Consolidation

The Group comprises a holding company, dormant subsidiaries and

a trading company. All of

these have been included in the consolidated financial

statements in accordance with the principles of acquisition

accounting as laid out by IFRS 3 Business Combinations.

Going concern

Notwithstanding the loss generated during the year of GBP191k

(2019: GBP437k), the Group had closing net assets of GBP12,534k

(2019: GBP11,433k), net current assets of GBP2,373k (2019:

GBP1,274k) and cash at bank

and in hand of GBP1,853k (2019: GBP477k).

The Group generated cash inflows from operating activities of

GBP382k during the year, also benefitting from net cashflows from

share issues amounting to GBP1,152k. The Group has remained cash

generative during a difficult economic period which saw the

profound impact of COVID-19.

In considering going concern, the Directors consider the current

financial position and performance of

the business, as well as reviewing financial information for a

period of at least 12 months from the date

of approval of the financial statements. Given the financial

performance of the Group, the successful acquisition and

integration of Tab Media and the expectations from forecast

financial information, the Directors have a reasonable expectation

that the Group has adequate resources to continue in operational

existence for the foreseeable future.

The Directors believe that they can continue to mitigate the

impact of COVID-19 as has been demonstrably achieved in the year

ended 31 December 2020, and accordingly continue to adopt the

going concern basis in preparing the financial statements.

Business combinations and goodwill

Acquisitions of subsidiaries and business are accounted for

using the acquisition method. The assets and liabilities and

contingent liabilities of the subsidiaries are measured at their

fair value at the date of acquisition. Any excess of acquisition

over fair values of the identifiable net assets acquired is

recognised as goodwill. Goodwill arising on consolidation is

recognised as an asset and reviewed for impairment at least

annually. Any impairment is recognised immediately in profit or

loss accounts and is not subsequently reversed. Acquisition related

costs are recognised in the income statement as incurred.

Transactions between wholly owned group members involving the

hive-up or hive-across of trade and / or assets and liabilities are

outside the scope of IFRS 3 on the grounds that they represent

common control business combinations. The group has elected to

apply IFRS 3 in accounting for all such transactions, which

involves a full fair value exercise at the date of the transaction.

This accounting policy has been consistently applied to all such

transactions and has been chosen on the grounds that the nature of

these transactions is the amalgamation of acquired businesses into

the existing trading business, which generally takes place shortly

after the original acquisition.

Revenue recognition

Revenue is recognised to the extent that it is probable that the

economic benefits will flow to the Group and the revenue can be

reliably measured. Revenue is measured as the fair value of the

consideration received or receivable, excluding discounts, rebates,

value added tax and other sales taxes. The following criteria must

also be met before revenue is recognised:

The Group does not expect to have any contracts where the period

between the transfer of the promised goods or services to the

customer and payment exceeds one year. As a consequence, the

Company does not adjust any of the transaction prices for the time

value of money.

The Group monitors the performance obligations in accordance

with IFRS 15 considering that the performance obligations are met

upon the Group delivering the advertisement to the customer.

A receivable is recognised when the services are delivered at

this is the point in time that the consideration is unconditional

because only the passage of time is required before the payment is

due.

Rendering of services

Revenue from providing services is recognised in the accounting

period in which the services are rendered.

Revenue from the sale of advertising space is recognised upon

the advertisement being generated and the Group delivering the

advertisement to the customer. The Group recognises revenue when

the amount of revenue can be reliably measured, it is probable

future economic benefits will flow to the entity and the Group has

satisfied the performance obligations. Revenue is not received in

advance and therefore the Group does not account for contract

liabilities.

Leases

The Company assesses whether a contract is or contains a lease,

at inception of a contract. The Company recognises a right-of-use

asset and a corresponding lease liability with respect to all lease

agreements in which it is the lessee, except for short-term leases

(defined as leases with a lease term of 12 months or less) and

leases of low value assets. For these leases, the Company

recognises the lease payments as an operating expense on a

straight-line basis over the term of the lease unless another

systematic basis is more representative of the time pattern in

which economic benefits from the leased asset are consumed.

The lease liability is initially measured at the present value

of the lease payments that are not paid at the commencement date,

discounted by using the rate implicit in the lease. If this rate

cannot be readily determined, the Group uses its incremental

borrowing rate. The Group assesses its discount rate using its

incremental borrowing rate.

Lease payments included in the measurement of the lease

liability comprise:

a) Fixed lease payments (including in-substance fixed payments), less any lease incentives.

The lease liability is included in Payables in the Statement of

Financial Position.

The lease liability is subsequently measured by increasing the

carrying amount to reflect interest on the lease liability (using

the effective interest method) and by reducing the carrying amount

to reflect the payments made.

The right-of-use assets comprise the initial measurement of the

corresponding lease liability, lease payments made at or before the

commencement day and any initial direct costs. They are

subsequently measured at cost less accumulated depreciation and

impairment losses.

Right-of-use assets are depreciated over the shorter period of

lease term and useful life of the underlying asset. If a lease

transfers ownership of the underlying asset or the cost of the

right-of-use asset reflects that the Group expects to exercise a

purchase option, the related right-of-use asset is depreciation

over the useful life of the underlying asset. The depreciation

starts at the commencement date of the lease.

The right-of-use assets are included in the tangible fixed

assets in the Statement of Financial Position.

The Group applies IAS 36 to determine whether a right-of-use

asset is impaired and accounts any identified impairment

losses.

Foreign currency

The individual financial statements of each group company are

presented in the currency of the primary economic environment in

which it operates (its functional currency). For the purpose of the

consolidated financial statements, the results and financial

position of each group company are expressed in pound sterling,

which is the functional currency of the Group, and the

presentational currency for the consolidated financial

statements.

In preparing the financial statements of the individual

companies, transactions in currencies other than the Group

Company's functional currency (foreign currencies) are recorded at

rates of exchange prevailing on the dates of the transactions. At

the reporting date, monetary assets and liabilities that are

denominated in foreign currencies are retranslated at the rates

prevailing on the reporting date. Non-monetary items carried at

fair value that are denominated in foreign currencies are

translated at the rates prevailing at the date when the fair value

was determined. Non-monetary items that are measured in terms of

historical cost in foreign currency are not retranslated. Exchange

differences arising on the settlement of monetary items, and on the

retranslation of monetary items, are included in profit or loss for

the period. Exchange differences arising on the retranslation of

non-monetary items carried at fair value are included in profit or

loss for the period except for differences arising on the

retranslation of non-monetary items in respect of which gains and

losses are recognised directly in equity. For such non-monetary

items, any exchange component of the gain or loss is also

recognised directly in equity.

For the purpose of presenting consolidated financial statements,

the assets and liabilities of the Group's foreign operations are

translated at exchange rates prevailing on the reporting date.

Income and expense items are translated at the average exchange

rates for the period, unless exchange rates fluctuate significantly

during the period, in which case the exchange rates at the date of

transactions are used. Exchange differences arising, if any, are

classified as equity and transferred to the Group's translation

reserve. Such translation differences are recognised as income and

expense in the period in which the operation is disposed of.

Goodwill and fair value adjustments arising on the acquisition of a

foreign entity are treated as assets and liabilities of the foreign

entity and translated at the closing rates.

Intangible assets

Intangible assets include goodwill arising on the acquisition of

subsidiaries and represents the difference between the fair value

of the consideration payable and the fair value of the net assets

that have been acquired. The residual element of Goodwill is not

being amortised but is subject to an annual impairment review.

Also included within intangible assets are various assets

separately identified in business combinations (such as brand

value) to which the Directors have ascribed a commercial value and

a useful economic life. The ascribed value of these intangible

assets is being amortised on a straight-line basis over their

estimated useful economic life, which is considered to be 7

years.

Other intangible assets purchased by the Group are initially

recognised at cost. After recognition, under the cost model,

intangible assets are measured at cost less any accumulated

amortisation and any accumulated impairment losses. Amortisation is

recognised so as to write off the cost less their residual values

over their useful lives, which is considered to be 3 years straight

line.

Financial instruments

The Group classifies financial instruments, or their component

parts, on initial recognition as a financial asset, a financial

liability or an equity instrument.

Contract liabilities

Contract liabilities comprise payments in advance of revenue

recognition and revenue deferred due to contract performance

obligation not being completed. They are classified as current

liabilities if the contract performance obligations payments are

due to be completed within one year or less (or in the normal

operating cycle of the business if longer). If not, they are

presented as non-current liabilities. Contract liabilities are

recognised initially at fair value and subsequently at amortised

cost.

Trade and other receivables

Trade and other receivables are measured at initial recognition

at fair value, and subsequently measured at amortised cost using

the effective interest method. A provision is established when

there is objective evidence that the Group will not be able to

collect all amounts due. The amount of any provision is recognised

in profit or loss.

The Group always recognises lifetime expected credit losses

(ECL) for trade receivables and amounts due on contracts with

customers. The expected credit losses on these financial assets are

estimated based on the Group's historical credit loss experience,

adjusted for facts that are specific to the debtors, general

economic conditions and an assessment of both the current as well

as the forecast director of conditions at the reporting date,

including time value of money where appropriate. Lifetime ECL

represents the expected credit losses that will result from all

possible default events over the expected life of a financial

instrument.

Cash and cash equivalents

Cash and cash equivalents are recognised as financial assets.

They comprise cash held by the Group and short-term bank deposits

with an original maturity date of three months or less. Loss

recognised previously in equity is included in profit or loss for

the period.

Trade payables

Trade payables are initially recognised as financial liabilities

measured at fair value, and subsequent to initial recognition

measured at amortised cost.

Equity instruments

An equity instrument is any contract that evidences a residual

interest in the assets of an entity after deduction of all its

liabilities. Equity instruments issued by the Group are recorded at

the proceeds received net of direct issue costs.

Share based payments

Where share options are awarded to employees, the fair value of

the options at the date of grant is charged to the statement of

comprehensive income on a straight-line basis over the vesting

period.

Non-market vesting conditions are taken into account by

adjusting the number of options expected to vest at each statement

of financial position date so that, ultimately, the cumulative

amount recognised over the vesting period is based on the number of

options that eventually vest. Market vesting conditions are

factored into the fair value of the options granted. The cumulative

expense is not adjusted for failure to achieve a market vesting

condition.

Fair value is calculated using the Black-Scholes model, details

of which are given in note 23.

Pensions

The pension schemes operated by the Group are defined

contribution schemes. The pension cost charge represents the

contributions payable by the Group.

Property, plant and equipment

Property, plant and equipment are stated at cost net of

accumulated depreciation and provision for impairment. Depreciation

is provided on all property plant and equipment, at rates

calculated to write off the cost less estimated residual value, of

each asset on a straight-line basis over its expected useful life.

The residual value is the estimated amount that would currently be

obtained from disposal of the asset if the asset were already of

the age and in the condition expected at the end of its useful

economic life.

The method of depreciation for each class of depreciable asset

is:

Fixtures and fittings - 25% straight line

Office equipment - 25% reducing balance

Right-of-Use asset - over term of lease

Impairment of Assets

Impairment tests on goodwill are undertaken annually at the

balance sheet date. The recoverable value of goodwill is estimated

on the basis of value in use, defined as the present value of the

cash generating units with which the goodwill is associated. This

is computed by applying an appropriate discount rate to the

estimated value of future cash flows. When value in use is less

than the book value, an impairment is recorded and is

irreversible.

Other non-financial assets are subject to impairment tests

whenever circumstances indicate that their carrying amount may not

be recoverable. Where the carrying value of an asset exceeds its

estimated recoverable value (i.e. the higher of value in use and

fair value less costs to sell), the asset is written down

accordingly. Where it is not possible to estimate the recoverable

value of an individual asset, the impairment test is carried out on

the asset's cash-generating unit. The carrying value of property,

plant and equipment is assessed in order to determine if there is

an indication of impairment. Any impairment is charged to the

statement of comprehensive income. Impairment charges are included

under administrative expenses within the consolidated statement of

comprehensive income.

Taxation and deferred taxation

Corporation tax payable is provided on taxable profits at

prevailing rates.

Deferred tax assets and liabilities are recognised where the

carrying amount of an asset or liability in the balance sheet

differs from its tax base, except for differences arising on:

-- the initial recognition of goodwill; and

-- the initial recognition of an asset or liability in a

transaction which is not a business combination and at the time of

the transaction affects neither accounting nor taxable profit.

Recognition of deferred tax assets is restricted to those

instances where it is probable that future taxable profit will be

available against which the asset can be utilised. The amount of

the asset or liability is determined using tax rates that have been

enacted or substantively enacted by the balance sheet date and are

expected to apply when the deferred tax liabilities/(assets) are

settled/(recovered).

Deferred tax assets and liabilities are offset when the Group

has a legally enforceable right to offset current tax assets and

liabilities and the deferred tax assets and liabilities relate to

taxes levied by the same tax authority on either:

-- the same taxable Group company; or

-- different Group entities which intend either to settle

current tax assets and liabilities on a net basis, or to realise

the assets and settle the liabilities simultaneously, in each

future period in which significant amounts of deferred tax assets

or liabilities are expected to be settled or recovered.

Segmental reporting

Operating segments are reported in a manner consistent with the

internal reporting provided to the Executive Directors, who are

responsible for allocating resources and assessing performance of

the operating segments.

A business segment is a group of assets and operations, engaged

in providing products or services that are subject to risks and

returns that are different from those of other operating

segments.

A geographical segment is engaged in providing products or

services within a particular economic environment that are subject

to risks and returns that are different from those of segments

operating in other economic environments. The Executive Directors

assess the performance of the operating segments based on the

measures of revenue, profit before taxation (PBT) and profit after

taxation (PAT). Central overheads are not allocated to business

segments.

Government grants

Government grants are recognised when there is reasonable

assurance that the grant conditions will

be met and the grants will be received, and are recognised as a

separate component of other operating income, rather than being

offset against the costs to which they relate.

5. CRITICAL ACCOUNTING ESTIMATES AND JUDGEMENTS

In the application of the Group's accounting policies, which are

described in note 4, the Directors are required to make judgements,

estimates and assumptions about the carrying amounts of assets and

liabilities that are not readily apparent from other sources. The

estimates and associated assumptions are based on experience and

other factors considered to be relevant. Actual results may differ

from these estimates.

The estimates and underlying assumptions are reviewed on an

ongoing basis. Revisions to accounting estimates are recognised in

the period in which the estimate is revised if the revision affects

only that period, or in the period of the revision and future

periods if the revision affects both current and future

periods.

The following are the critical judgements and estimations that

the Directors have made in the process of applying the Company's

accounting policies and that have the most significant effect on

the amounts recognised in the financial statements.

Critical accounting judgements

Impairment of goodwill

Impairment of the valuation of the goodwill relating to the

acquisition of subsidiaries is considered annually for indicators

of impairment to ensure that the asset is not overstated within the

financial statements. The annual impairment assessment in respect

of goodwill requires estimates of the value in use (or fair value

less costs to sell) of subsidiaries to which goodwill has been

allocated. This requires the Directors to estimate the future cash

flows and an appropriate discount factor, in order that the net

present value of those cash flows can be determined. Discounted

cash flow forecasts give due consideration to the impact of

COVID-19 on the future cash flows, and are stress tested under a

range of scenarios. In all instances, the headroom is sufficient to

satisfy the Directors that there are no indicators of impairment

based on circumstances that were present or could be reasonably

foreseen at the reporting date.

Critical accounting Estimates

Amortisation of intangible assets

The periods of amortisation adopted to write down capitalised

intangible assets requires judgements to be made in respect of

estimating the useful lives of the intangible assets to determine

an appropriate amortisation rate. Domain names and website costs

are being amortised on a straight-line basis over the period during

which the economic benefits are expected to be received, which has

been estimated at 3 years. Intangible assets recognised in relation

to the brand names are being amortised straight-line over 7

years.

Depreciation

The useful economic lives of tangible fixed assets are based on

management's judgement and experience. When management identifies

that actual useful economic lives differ materially from the

estimates used to calculate depreciation, that charge is adjusted

retrospectively.

Share based payments expense

Non-market performance and service conditions are included in

the assumptions about the number of options that are expected to

vest. At the end of each reporting period the Group revises its

estimates of the number of options that are expected to vest based

on the non-market vesting conditions. It recognises the impact of

the revision to the original estimates, if any, in the consolidated

statement of comprehensive income, with a corresponding adjustment

to equity.

This requires a judgement as to how many options will meet the

future vesting criteria as well as the judgements required in

estimating the fair value of the options.

IFRS 16 discount rates

The Group estimates an appropriate discount rate based on an

incremental rate of borrowing for the calculation of the IFRS 16

right-of-use assets. This requires judgement as to an appropriate

discount rate.

Provision for bad and doubtful debts

The Group applies the IFRS 9 simplified approach to measuring

expected credit losses using a lifetime expected credit loss

provision for trade receivables. To measure expected credit losses

on a collective basis, trade receivables are grouped based on

similar ageing. The expected loss rates are based on the Group's

historical credit losses experience over the twelve month period

prior to the period end. Forward looking issues have been

considered, including in relation to the ongoing impact of the

COVID-19 pandemic. This has had an immaterial effect on the

expected credit loss rate.

6. SEGMENTAL INFORMATION

A segmental analysis of revenue and expenditure is as

follows:

2020 Entertainment The Daily The Head Total

Daily Mash Tab Office 2020

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue 1,641 334 208 4 2,187

Cost of sales (307) (192) (30) - (529)

Administrative

expenses* (447) (40) (71) (819) (1,377)

Other operating

income - - - 24 24

-------------- -------------- -------------- --------------

Adjusted EBITDA 887 102 107 (791) 305

Amortisation - - - (149) (149)

Depreciation - - - (30) (30)

Acquisition

costs - - - (98) (98)

Capital restructure

costs - - - (29) (29)

Share based

payments - - - (140) (140)

Finance costs - - - (2) (2)

Tax - - - (48) (48)

------------- ------------- ------------- ------------- -------------

Profit/(loss)

for the year 887 102 107 (1,287) (191)

====== ====== ====== ====== ======

6. SEGMENTAL INFORMATION (continued)

2019 Entertainment The Daily Head Total

Daily Mash Office 2020

GBP'000 GBP'000 GBP'000 GBP'000

Revenue 1,864 358 18 2,240

Cost of sales (263) (131) - (394)

Administrative

expenses* (288) (60) (973) (1,321)

Other operating

income - - - -

-------------- -------------- --------------

Adjusted EBITDA 1,313 167 (955) 525

Amortisation - - (133) (133)

Depreciation - - (11) (11)

Acquisition

and listing

costs - - (689) (689)

Share based

payments - - (149) (149)

Finance costs - - (3) (3)

Finance income - -

Tax - - 23 23

------------- ------------- ------------- -------------

Profit/(loss)

for the year 1,313 167 (1,917) (437)

====== ====== ====== ======

*Administrative expenses exclude depreciation, amortisation,

share based payments and acquisition and listing costs.

The segmental analysis above reflects the parameters applied by

the Board when considering the Group's monthly management

accounts.

External revenue by Total assets by Net tangible capital

location of customer location expenditure by location

31 December 31 December 31 December 31 December 31 December

2020 31 December 2020 2019 2020 2019

Continuing 2019 Continuing

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

United Kingdom 1,024 1,434 13,475 11,953 - 13

Europe 704 612 103 135 - -

Rest of

World 459 194 180 93 - -

------------- ------------- ------------- ------------- ------------- -------------

2,187 2,240 13,758 12,181 - 13

====== ====== ====== ====== ====== ======

7. REVENUE

2020 2019

Revenue by stream is split: GBP'000 GBP'000

Advertising space 2,187 2,240

------------- -------------

2,187 2,240

Revenue by location is split:

United Kingdom 1,024 1,434

Europe 594 612

Rest of world 569 194

------------- -------------

2,187 2,240

====== ======

The Group had three customers whose revenue individually represented

10% or more of the Group's total revenue, being 23.3%, 17.5% and

10.0% respectively.

8. LOSS FROM OPERATIONS

2020 2019

GBP'000 GBP'000

This is arrived at after charging/(crediting):

Continuing operations

Staff costs (see note 9) 1,078 953

Acquisition and listing costs - 689

Direct costs of business combinations 98 -

Depreciation of property, plant & equipment 30 11

Amortisation of intangible fixed assets 149 133

Operating lease expense - property 24 17

Foreign exchange differences (27) 19

Government grants (24) -

====== ======

Auditors' remuneration in respect of the

Company 18 13

Audit of the Group and subsidiary undertakings 33 23

Auditors' remuneration - non-audit services

- accounting service fees - 9

Auditors' remuneration - non-audit services

- taxation fees - 5

Auditors' remuneration - transaction related

services 25 124

------------- -------------

76 174

====== ======

In 2020, government grants of GBP24k were received as part of

the Government's initiatives to provide immediate financial support

as a result of the COVID-19 pandemic. There are no future related

costs associated with these grants which were received solely as

compensation for costs incurred in the year.

9. STAFF COSTS

2020 2019

GBP'000 GBP'000

Staff costs for all employees, including

Directors consist of:

Wages and salaries 838 716

Social security costs 90 79

Pensions 10 9

----------- -----------

938 804

Share based payment charge 140 149

----------- -----------

1,078 953

===== =====

2020 2019

The average number of employees of the Number Number

group during the year was as follows:

Directors 6 6

Management and administration 3 4

Content 11 9

----------- -----------

20 19

===== = ===== =

Directors' Detailed Emoluments

Details of individual Directors' emoluments for the year are as

follows:

Salary Consultancy Bonus Pension Total Total

2020 2020 2020 2020 2020 2019

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000