China Car Sales Soar to Pre-Pandemic Levels--Update

09 Abril 2021 - 6:57AM

Noticias Dow Jones

By Trefor Moss

Auto sales in China recovered to pre-pandemic levels in the

first three months of 2021, though the world's largest car market

was subdued, with the exception of red-hot demand for electric

vehicles.

Passenger-vehicle sales increased 69% year over year to 5.09

million in the January-to-March period, the China Passenger Car

Association said Friday. That put sales back where they were two

years ago, still down significantly compared with 2018's record

March quarter, when 5.67 million cars were sold in China.

The country, a critical market for global auto makers because of

its unrivaled scale, is unlikely to regain the heights of the

previous decade's boom until around 2024, some analysts say. The

weak performance of local stock markets since February has sapped

Chinese consumers' appetite for buying new vehicles in recent

weeks, the association said.

Once a key source of growth, China has become a tough place for

U.S. auto makers in particular. General Motors Co. sold 780,200

vehicles in the January-to-March period, its worst first quarter in

China since 2012, not counting virus-hit 2020.

A long-term decline in Chevrolet sales has weakened GM's

position in its only major global market outside the U.S. Chevrolet

is one of several once-popular foreign brands to have been squeezed

by China's more competitive market conditions. Its sales of 64,800

in the March quarter were a fraction of the roughly 170,000

Chevrolets sold in China in the same period in 2015.

Ford Motor Co. has stabilized its China business after years of

dwindling sales. Its 153,822 sales for the quarter were an

improvement on the 136,279 vehicles it sold in the country in the

same period two years ago. The company sold more than twice as many

cars in the same period in 2016, its best year in China.

In contrast, premium auto makers have continued to thrive as

greater numbers of affluent Chinese consumers trade up from

mass-market brands, a trend that has chiefly benefited German auto

makers. BMW AG and Mercedes-Benz-maker Daimler AG both broke sales

records in the quarter, selling 229,748 and 222,520 cars in China,

respectively.

Electric-vehicle sales also surged in the quarter, with 437,000

units sold.

Tesla Inc. had by far its best month in China, selling 35,478

locally built Model 3 and Model Y cars, according to the

passenger-car association, suggesting that recent controversies

over quality issues and the potential for Tesla cars to spy on

Chinese government facilities have done little to dent the

company's local appeal. Of the vehicles sold last month, 25,327

were Model 3s and 10,151 were Model Ys, the association said.

The 69,280 vehicles Tesla sold in China during the first quarter

accounted for more than one-third of the EV maker's global Model 3

and Model Y sales during the period. Tesla started delivering the

made-in-China Model Y in January.

U.S.-listed Chinese EV startups Li Auto Inc., Nio Inc. and XPeng

Inc. all reported record quarterly sales, though their combined

tally of roughly 46,000 cars for the first quarter means they still

significantly lagged behind the market leaders in terms of

volume.

Raffaele Huang contributed to this article.

Write to Trefor Moss at Trefor.Moss@wsj.com

(END) Dow Jones Newswires

April 09, 2021 07:42 ET (11:42 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

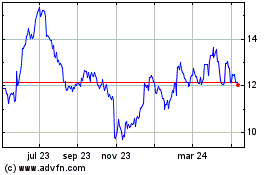

Ford Motor (NYSE:F)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

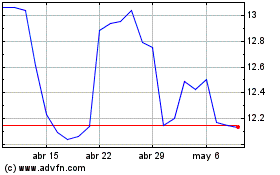

Ford Motor (NYSE:F)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024