Crédit Agricole CIB Supported Chile’s Inaugural Formosa Bonds in a Sustainable Format, Becoming First Sovereign Issuer in ...

15 Abril 2021 - 8:07AM

Business Wire

The Republic of Chile has successfully issued US$1.5 billion of

sustainability bonds. Dual listed on Taipei Exchange and London

Stock Exchange, this is Chile’s first sustainability bonds issuance

and first Formosa bond, and the Formosa market’s first

sustainability bond transaction by a foreign issuer. The active

participation of Taiwanese investors in this issuance highlights

the success of the issuer’s effort in diversifying its investor

base, and reflects the increasing appetites for sustainable finance

in Taiwan. Crédit Agricole CIB is a joint bookrunner and the lead

manager in this transaction.

The issuance of these Formosa bonds and the participation of

Taiwan investors are the successful result of Chile’s

diversification strategy to broaden their investor base, and

reaffirmed the issuer’s leadership on the market of thematic bonds,

which represent 15.5% of the Central Government’s outstanding debt

stock.

“Crédit Agricole CIB is proud to create value on a transaction

for a sophisticated issuer like the Republic of Chile,” said Gordon

Kingsley, the Head of Latin America Debt Capital Markets at Crédit

Agricole CIB. “The transaction has demonstrated the Bank’s top

sustainable banking credentials and the ability to deliver

high-quality transactions for our clients with a strong global

capital markets platform.”

The bonds leverage Chile’s Sustainability Bond Framework, which

lays out eligible green and social expenditures and guides the

issuance of Chile’s Social, Green, and Sustainability Bonds. Jorge

Ramírez, Senior Country Officer of Crédit Agricole CIB Chile said,

“For the third consecutive year, we are very pleased to have

advised the Republic of Chile with an innovative transaction,

helping Chile to further consolidate its leadership and pioneering

role in thematic bonds in the Americas.” Chile has been the most

active sovereign ESG issuer in the Americas. In total, the Republic

of Chile has issued approximately USD14.4 billion in thematic

bonds, of which 54% are green, 36% are social and, as of March

30th, 10% are sustainable. This issue also marked the first

sovereign sustainability bond in Taiwan market, since the

promulgation of related regulations by Taipei Exchange in October

2020.

Taiwan has been engaging with sustainable finance practices

since 2017, when the Taipei Exchange rolled out the first green

bonds scheme in Taiwan. Benjamin Lamberg, Chief Executive Officer

of Crédit Agricole CIB Taipei Branch, added, “From our perspective

Taiwan is well positioned for the development of this sector. With

increasing numbers of local institutional investors answering the

call of responsible investments, demand for sustainable bonds have

picked up quickly and the strong appetites for this Chile issuance

affirms this trend.”

Crédit Agricole CIB developed its deep knowledge and presence in

this market with its 40 years of operations in Taiwan. The Bank has

been an active underwriter and issuer in sustainable bonds, being

the first foreign issuer to issue green bonds in Taiwan, and in

2020 it took a step further by issuing two series of TWD

denominated green bonds to support its lending activities in Taiwan

directly. Crédit Agricole CIB believes that the consistent

regulatory framework and efficient execution process in Taiwan will

attract more market players.

About Crédit Agricole Corporate and Investment Bank (Crédit

Agricole CIB)

Crédit Agricole CIB is the corporate and investment banking arm

of Crédit Agricole Group, the 12th largest banking group worldwide

in terms of tier 1 capital (The Banker, July 2020). Nearly 8,400

employees across Europe, the Americas, Asia-Pacific, the Middle

East and Africa support the Bank's clients, meeting their financial

needs throughout the world. Crédit Agricole CIB offers its large

corporate and institutional clients a range of products and

services in capital markets activities, investment banking,

structured finance, commercial banking and international trade. The

Bank is a pioneer in the area of climate finance, and is currently

a market leader in this segment with a complete offer for all its

clients.

For more information, please visit www.ca-cib.com

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210415005628/en/

For media enquiries:

Crédit Agricole Corporate and Investment Bank

Kurtis Sze Assistant Manager, Communications, Asia-Pacific

Email: kurtis.sze@ca-cib.com Tel: +852 2826 1055

Lilian Kung Head of Communications, Asia-Pacific Email:

lilian.kung@ca-cib.com Tel: +852 2826 1052

Jenna Lee Head of Communications, Americas Email:

jenna.lee@ca-cib.com Tel: +1 212 261 7328

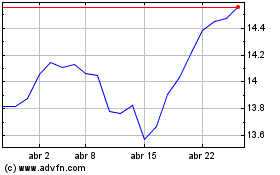

Credit Agricole (EU:ACA)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

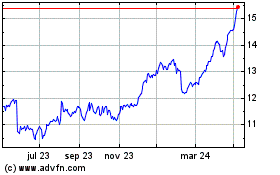

Credit Agricole (EU:ACA)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024