TIDMTYMN

RNS Number : 7276V

Tyman PLC

16 April 2021

TYMAN PLC

("Tyman" or the "Group")

2020 Annual Report & Accounts and 2021 Annual General

Meeting (the "AGM")

Tyman plc, a leading international supplier of engineered

components and access solutions to the construction industry,

announces that the Annual Report & Accounts for the year ended

31 December 2020 ("2020 Annual Report") and the Notice of 2021 AGM

("Notice of Meeting"),which will be held on 20 May 2021, have been

posted or otherwise made available to shareholders today.

In accordance with LR 9.6.1R, electronic copies of each of these

documents have been submitted to the National Storage Mechanism via

the Electronic Submission System and will shortly be available for

inspection at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism .

The 2020 Annual Report and Notice of Meeting may also be viewed

on the Group's website at www.tymanplc.com .

The Company's preliminary results announcement published on 4

March 2021 included, in addition to the preliminary financial

results, the text of the Chief Executive's review (including the

Divisional reviews) and Chief Financial Officer's review, in each

case as contained in the 2020 Annual Report.

The appendix to this announcement sets out the disclosures

required pursuant to Disclosure & Transparency Rule 6.3.5R(2),

namely the Directors' Responsibility Statement, Principal Risks and

Uncertainties, and Related Party Transactions, in each case as

contained in the 2020 Annual Report. This information is not a

substitute for reading the full 2020 Annual Report.

Enquiries:

Tyman plc 020 7976 8000

Peter Ho - General Counsel & Company Secretary www.tymanplc.com

16 April 2021

APPIX

Directors' Responsibility Statement

The Directors consider that the 2020 Annual Report, taken as a

whole, is fair, balanced and understandable and provides the

information necessary for shareholders to assess the Group's and

the Company's position and performance, business model and

strategy.

Each of the Directors, whose names and functions are listed in

the Annual report and Accounts, confirms that, to the best of their

knowledge:

-- the Company financial statements, which have been prepared in

accordance with UK GAAP, give a true and fair view of the assets,

liabilities, financial position and profit of the Company;

-- the Group financial statements, which have been prepared in

accordance with IFRSs as adopted by the European Union and

applicable law, give a true and fair view of the assets,

liabilities, financial position and profit of the Group; and

-- the Directors' report includes a fair review of the

development and performance of the business and the position of the

Group and the Company, together with a description of the principal

risks and uncertainties that the Group faces.

Principal Risks and Uncertainties

Risk Risk description Mitigation Changes since

last Annual

report

1. Business The occurrence of an The Group has proactively The most

interruption event that may lead to managed its response significant

(including pandemic) a significant business, to the COVID-19 pandemic impact

supply chain or market throughout the year including throughout the

Trend after interruption. This extensive health measures year has been

mitigation includes at operations; temporary the global

Same events such as natural cost control measures; impact of the

Link to strategy disasters, pandemics ongoing review of demand COVID-19

Market expansion, (including COVID-19), and production levels, pandemic,

sustainable significant IT regular review of supply which was

growth, engaged interruption, chain ability to supply; reported

people, the loss of an operating reviewing stock levels as a watchlist

positive impact location or geo-political and responding; increased risk in

events including contact with remote working the last

significant team members and weekly Annual report

changes in trading COVID-19 case reviews. and then added

relationships More broadly the Group to the

such as Brexit or reviews business continuity Group's

US/China management, IT disaster principal

trade developments. This recovery, IT security risks

results in an inability as appropriate throughout at the half

to operate or meet the year. The Group also year. Given

customer ensures appropriate insurance the duration,

demand, a reduction in cover is maintained. uncertainty

market demand or poses and widespread

a health risk to impact

employees. of COVID-19,

this risk

has been

updated to a

broader

business

interruption

risk.

Risk

assessment

High

-------------------------- ------------------------------------------------------------ ---------------

2. Market conditions Demand in the building Whilst there is a high Markets have

products sector is degree of economic uncertainty, been disrupted

Trend after dependent in previous cyclical throughout the

mitigation on levels of activity downturns Tyman has proved year,

Same in new construction and effective in responding predominantly

Link to strategy RMI markets. This demand to events through: in H1 due

Sustainable growth is cyclical and can be to COVID-19.

unpredictable and the * monitoring of market conditions and macroeconomic The majority

Group has low visibility trends through both annual strategic planning of the Group's

of future orders from processes and regular performance / forecasting core markets

its customers. reviews; have rebounded

strongly

throughout H2

* maintaining appropriate headroom and tenor in the with leading

Group's available borrowing facilities; indicators

remaining

positive.

* its geographic spread providing a degree of market There remains

diversification; uncertainty

over medium

to long-term

* the ability to flex the Group's cost base in line market

with demand. conditions

due to wider

macroeconomic

As part of its process conditions.

for assessing the ongoing Risk

viability of the Group, assessment

the Board regularly stress Medium

tests Tyman's financial

and cash flow forecasts

over both a short- and

medium-term horizon.

-------------------------- ------------------------------------------------------------ ---------------

3. Loss of Loss of competitive Some of the Group's markets The overall

competitive advantage are relatively concentrated risk from

advantage may adversely affect with two or three key loss of

the Group financial players, while others competitive

Trend after performance are highly fragmented advantage

mitigation or reputation in the and offer significant across Tyman's

Same short to medium term. opportunities for consolidation global

Link to strategy The Group's ability to and penetration. portfolio

Sustainable growth, maintain its competitive Tyman continues to differentiate remains

market advantage is based on itself through its wide stable.

expansion a wide range of factors range of products, its The disruption

including the strength focus on customer service caused

of the Group's brands, including technical support, by COVID-19

the breadth and depth its geographical coverage, has put

of our portfolio, the innovation capabilities pressure

level of quality and and the reputation of on service

innovation reflected its brands. The Group levels across

in our products, our monitors the status of the industry.

supply chain flexibility, our competitive advantage The

excellent customer through feedback from flexibility

service customers and close review of the Group's

and technical support, of the market positioning manufacturing

and the depth of customer of our products. footprint

relationships we nurture, The Group aims to minimise allowed it

all supported by fair the impact of competitve to respond

and competitive pricing. pricing pressures by quickly to

Failure to perform on competitors through margin closure of

any one of these aspects expansion activities certain

may lead to erosion of including continual sourcing facilities,

competitive advantage review, innovation and delivering

over time, and in turn value engineering, as better service

to loss of customers well as building long-term levels than

to competition. relationships with its some

customers based on value competitors

creation, quality, service and enabling

and technical support. the Group

to take market

share.

Risk

assessment

Medium

-------------------------- ------------------------------------------------------------ ---------------

4. Foreign exchange The Group operates The Group denominates Sterling

risk internationally a proportion of its debt exchange rates

and is therefore exposed in foreign currency to remain

Trend after to transactional and align its exposure to volatile and

mitigation translational foreign the translational balance the

Same exchange movements in sheet risks associated Group

Link to strategy currencies other than with overseas subsidiaries. continues to

Market expansion sterling. In particular Ancillary bank facilities use

the Group's translated are utilised to manage hedging to

adjusted operating profit the foreign exchange mitigate some

is impacted by the transactional risks and of this risk.

sterling interest rate exposure This risk

exchange rate of the through the use of derivative is regarded as

US dollar and the euro. financial instruments. stable.

In 2020, 74% of the Where possible the Group Risk

Group's will recover the impact assessment

adjusted operating profit of adverse exchange movements Medium

was derived from North on the cost of imported

American operations which products and materials

are principally exposed from customers.

to the US dollar. The

Group is also exposed

to interest rate risks

on its bank borrowings.

-------------------------- ------------------------------------------------------------ ---------------

5. Liquidity and The Group must maintain The Group maintains adequate During the

credit sufficient capital and cash balances and credit year, the

risks financial resources to facilities with sufficient Group has made

finance its current headroom and tenor to good progress

Trend after financial mitigate credit availability in achieving

mitigation obligations and fund risk. The Group monitors its new

Down the future needs of its forecast and actual cash medium-term

Link to strategy growth strategy. flows to match the maturity leverage

Sustainable growth profiles of financial target of 1.0x

assets and liabilities. to 1.5x

In the medium term the adjusted

Group aims to operate EBITDA,

within its revised target finishing

leverage range of 1.0x the year at

to 1.5x adjusted EBITDA. 1.1x.

Risk

assessment

Low

-------------------------- ------------------------------------------------------------ ---------------

6. Information Information and data The Group continues to In August

security systems are fundamental develop and test disaster 2020, a Group

to the successful recovery plans for all Head of IT was

Trend after operation sites. The Group undertakes appointed

mitigation of Tyman's businesses. regular penetration testing with

Same The Group's digital of data systems and maintains responsibility

Link to strategy assets up-to-date versions of for

Market expansion, are under increasing software and firewalls. the Group's

sustainable risk from hacking, The Group periodically information

growth, engaged viruses reviews and improves security

people and 'phishing' threats. IT system controls. policies and

Sensitive employee, controls.

customer, Training and

banking and other data IT controls

may be stolen and improvements

distributed have continued

or used illegally. GDPR to be

increases the cost of implemented

any failure to protect during the

the Group's digital year.

assets. Risk

assessment

High

-------------------------- ------------------------------------------------------------ ---------------

7. Raw material Raw materials used in The Group continues to The Group has

costs the Group's businesses invest in and improve been

and supply chain include commodities that its sourcing and procurement successful

failures experience price capability with dedicated at recovering

volatility supply chain resources. input cost

Trend after (such as oil derivatives, The Group manages supply inflation and

mitigation steel, aluminium and chain risk through developing foreign

Up zinc). The Group's strong long-term relationships exchange

Link to strategy ability with its key suppliers, volatility.

Market expansion, to meet customer demands regular risk assessment The Group

sustainable depends on obtaining and audit of suppliers continues to

growth timely supplies of including logistics providers, proactively

high-quality review of make or buy manage supply

components and raw strategies, dual-sourcing chain risks,

materials where appropriate and with current

on competitive terms. maintaining adequate focus in

Products or raw materials safety stocks throughout particular on

may become unavailable the supply chain. Where global

from a supplier due to commodity and other material shipping

events beyond the Group's cost increases materialise, bottlenecks

control. the Group seeks to recover and UK/EU

the incremental cost supply chain

through active price disruption.

management. Risk

assessment

Medium

-------------------------- ------------------------------------------------------------ ---------------

8. Key executives The Group's future The Group mitigates the Significant

and success risk of losing key personnel attention

personnel is substantially through robust succession has been paid

dependent planning, strong recruitment to employee

Trend after on the continued services processes, employee engagement wellbeing and

mitigation and performance of its and retention initiatives, engagement

Same senior management and and long-term management through the

Link to strategy its ability to continue incentives. COVID-19

Sustainable growth, to attract and retain pandemic,

engaged highly skilled and recognising

people qualified the additional

personnel at Group, strains

divisional this has put

and site level. on our

workforce

and in

particular on

management

teams.

Risk

assessment

Low

-------------------------- ------------------------------------------------------------ ---------------

9. Compliance with A lack of understanding Key mitigations include: Whilst added

laws or non-compliance with as a Group

and regulations laws and regulations * A comprehensive and engaging Code of Business Ethics principal

in any jurisdiction in and associated training risk, there

Trend after which the Group operates is no

mitigation could lead to significant year-on-year

Same financial penalty and/or * Supporting policies and standards that set out the change

Link to strategy severe damage to the compliance requirements in detail in the level

Market expansion, Group's reputation. Legal of unmitigated

sustainable and regulatory risk. A Group

growth, engaged requirements * A group-wide 'SpeakUp' whistleblowing mechanism General

people, can be complex and are Counsel was

positive impact constantly evolving, appointed

requiring ongoing * Risk framework to identify, assess and monitor for the first

monitoring business and compliance risks time in

and training. 2020. The

General

* Specific legal and compliance matters reviewed by the Counsel

Group General Counsel as required led a process

to develop

a new Code of

Business

Ethics which

will be

deployed in a

series

of discussion

sessions

to all

employees in

H1

2021.

Risk

assessment

Low

-------------------------- ------------------------------------------------------------ ---------------

10. Execution of The Group has a range Oversight mechanisms Whilst added

major of change management to track the progress as a Group

programmes programmes and strategic of all strategic programmes principal risk

initiatives underway takes place on a monthly there

Trend after to support our 'Focus, basis at Group and divisional remains no

mitigation Define, Grow' Strategy. levels. In addition, year-on-year

Same Failure to effectively each programme has established change in the

Link to strategy execute these programmes project governance disciplines level of

Market expansion, could adversely affect in place including project unmitigated

sustainable the Group's ability to managers for each programme. risk.

growth, engaged deliver on key elements Risk

people, of our strategy. assessment

positive impact Medium

-------------------------- ------------------------------------------------------------ ---------------

Related Party Transactions

The following transactions were carried out with related parties

of Tyman plc (please see Note 30, on page 174 of the 2020 Annual

Report):

Subsidiaries

Transactions between the Company and its subsidiaries, which are

related parties, are eliminated on consolidation. There were no

transactions between the Company and its subsidiaries made during

the year other than intercompany loans.

Key management compensation

The Group considers its Directors to be the key management

personnel. Compensation for Directors who have the sole

responsibility for planning, directing and controlling the Group

are set out in the Remuneration report on pages 100 to 121.

Full details of individual Directors' remuneration are given in

the Remuneration report on page 105.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NOADKABPFBKKQQD

(END) Dow Jones Newswires

April 16, 2021 04:56 ET (08:56 GMT)

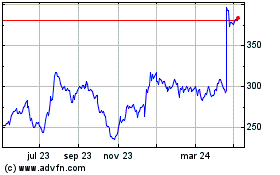

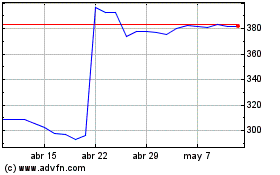

Tyman (LSE:TYMN)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Tyman (LSE:TYMN)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024