BMO Com Pty Tst Ltd Trading update and NAV release

23 Abril 2021 - 1:00AM

UK Regulatory

TIDMBCPT

To: Company Announcements

Date: 23 April 2021

Company: BMO Commercial Property Trust Limited

LEI: 213800A2B1H4ULF3K397

Subject: Trading update and NAV release for BMO Commercial Property

Trust Ltd (the "Company")

Headlines

* Net Asset total return of 2.6 per cent for the quarter ended 31 March 2021

* Share Price total return of -10.2 per cent for the quarter ended 31 March

2021

* Combined rent collection received to date for Q2 2020 to Q1 of 2021 at 87.6

per cent

* Rent collection currently received to date for Q 2 2021 of 84.3 per cent

* As at 31 March 2021, the void rate was 2.4 per cent (2.9 per cent as at 31

December 2020)

Net Asset Value

The unaudited net asset value ('NAV') per share of the Company as at 31 March

2021 was 119.5 pence. This represents an increase of 1.7 per cent from the

audited NAV per share as at 31 December 2020 of 117.5 pence and a NAV total

return for the quarter of 2.6 per cent.

The NAV has been calculated under International Financial Reporting Standards

('IFRS'). It is based on the external valuation of the Company's property

portfolio which has been prepared by CBRE Limited.

The NAV includes all income to 31 March 2021 and is calculated after deduction

of all dividends paid prior to that date. The EPRA Net Tangible Assets (NTA)

per share as at 31 March 2021, which is adjusted to remove the fair value of

the interest rate swap, was 119.6 pence.

Analysis of Movement in NAV

The following table provides an analysis of the movement in the unaudited NAV

per share for the period from 31 December 2020 to 31 March 2021 (including the

effect of gearing):

% of

Pence opening

per NAV per

£m share share

NAV as at 31 December 2020 939.6 117.5

Unrealised increase in valuation of 11.6 1.4 1.2

property portfolio

Movement in fair value of interest rate 0.1 - -

swap

Other net revenue 12.7 1.6 1.4

Dividends paid (8.4) (1.0) (0.9)

NAV as at 31 March 2021 955.6 119.5 1.7

Valuation

The capital value of the Company's portfolio increased by 1.14 per cent over

the quarter. The industrial and logistics sector of the portfolio achieved

another quarter of strong performance, increasing by 7.1 per cent. This not

only reflected strong evidence of further yield compression, but also the

completion of two significant asset management initiatives. The lease of the

logistics unit at DIRFT, Daventry was assigned from Mothercare to CEVA

logistics, the improved covenant resulting in 23.2 per cent increase in value.

At Speke, Liverpool a vacant 47,000sq ft unit has been let to on-line retailer

Kokoon Rugs, resulting in a 16.4 per cent uplift in value.

The retail warehouse sector recorded its second successive quarter of

increasing values with more liquidity and evidence of transactional activity in

the capital markets. There has also been continued value enhancing asset

management activity in the portfolio which included a 20,000sq ft letting to

Home Bargains at Newbury.

Retail, hospitality and leisure sectors continued to be marked down having been

in lockdown for the entire quarter. The valuation falls on the London assets

were lower than in recent quarters with St Christopher's Place falling by 0.7

per cent, mitigated by a number of successful new lettings, and Wimbledon

Broadway falling by 0.9 per cent. These decreases reflect a further outward

adjustment in yields as well as adjustments to estimated rental values.

The valuation of the office portfolio fell marginally during the quarter, with

positive returns from the West End being offset by valuation falls in the south

east and regions, specifically on properties with shorter lease terms.

Share Price

As at 31 March 2021, the share price was 70.8 pence per share, which

represented a discount of 40.8 per cent to the NAV per share. The share price

total return for the quarter to 31 March 2021 was -10.2 per cent. There has

been an increase in the share price since the quarter end with the shares

currently trading at 78 pence at the time of writing, a discount of 34.7 per

cent.

Rent Collection

We summarise below our current rent collection outcome since the impact of

Covid-19 came into full force, for Q2 2020 to Q1 2021 as well as providing an

update on collection for Q2 of 2021.

Q2 2020 to Q1 2021 Collection (billed between 26 March 2020 and 1 March 2021)

Overall collection for the twelve-month period is at 87.6 per cent and the

breakdown is detailed below:

Rent Billed Collected

(£m) (%)

Quarter 2 2020 16.3 85.6

Quarter 3 2020 16.5 87.5

Quarter 4 2020 16.4 91.6

Quarter 1 2021 16.5 85.6

Total 65.7 87.6

Collection by sector:

Rent Billed Collected

(£m) (£m) (%)

Industrial 13.2 13.1 99.2

Offices 28.1 27.0 96.3

Retail Warehouse 7.8 6.5 83.0

Retail 12.2 7.4 61.1

Alternatives 4.4 3.5 78.9

Total 65.7 57.5 87.6

Breakdown of uncollected rent:

Total Outstanding Rent Billed

(£m) (%)

Agreed deferments 1.3 2.0

Rent waived 2.4 3.5

Bad Debts 0.2 0.3

Monthly payments* 0.2 0.3

Unresolved / in 4.1 6.3

discussion

Uncollected Rent 8.2 12.4

* tenants who have been billed for the quarter but are paying in monthly

instalments.

Whilst collection rates from the industrial and office portfolios have been

strong, there continues to be a significant proportion of uncollected rent from

the retail and leisure tenants at St Christopher's Place Estate and Wimbledon,

who have suffered particularly badly from the lockdown. A collaborative and

supportive approach continues to be adopted with the occupiers affected, which

has been vital to ensure they weather the ongoing, challenging trading

environment caused by the Covid-19 pandemic.

As lock down restrictions continue to ease, there is an air of optimism, shared

by new and returning customers and occupiers re-opening for business after the

long period of enforced closure and initial footfall levels are positive.

Q2 2021 Collection (due to be billed between 25 March 2021 and 1 June 2021)

The total quarterly rental payments for Quarter 2 amount to c.£16.5 million.

The Company has billed £9.6m of its Quarter 2 rent due from 25 March to date

and has collected 84.3 per cent of this total amount (compared to 81.3 per cent

after the equivalent number of days in the previous quarter). The balance of

rent will be billed on the relevant due dates during the course of April and

May.

Collection by sector:

Rent Billed Collected

(£m) (£m) (%)

Industrial 2.7 2.6 95.7

Offices 3.7 3.6 96.8

Retail Warehouse 0.5 0.3 59.8

Retail 1.8 0.9 53.7

Alternatives 0.9 0.7 71.4

Total 9.6 8.1 84.3

Breakdown of uncollected rent:

Total Outstanding Rent Billed

(£m) (%)

Rent waived 0.0 0.2

Monthly payments* 0.2 1.7

Outstanding 1.3 13.8

Uncollected Rent 1.5 15.7

* tenants who have been billed for the quarter but are paying in monthly

instalments.

Trading Activity

St Christopher's Place Estate

Following the easing of lock down restrictions on 12th April, permitting the

re-opening of non-essential shops and restaurants for outdoor dining, 21 shops

and 16 food and beverage businesses have re-opened across the estate. The

early indicators are positive, with a stronger re-opening than those following

previous lockdowns and the number of daily visitors to the estate has exceeded

an average pre-pandemic day.

The temporary closure of James Street to vehicles has been extended, providing

the opportunity for restaurant occupiers to maximise their outdoor dining areas

and to support social distancing requirements.

A further boost to footfall and trade is anticipated when additional

restrictions are expected to be relaxed on 17th May. This will permit food and

beverage businesses to trade indoors, significantly increasing the number of

covers. This key date coincides with a number of new store openings. These

include Emma Hyacinth following relocation to a larger site, and new

restaurants on James Street; Chrome, Papa-dum and Sidechick.

Retail Parks

There was positive news at the Company's retail parks where shoppers returned

in large numbers on 12th April 2021. Over the first full week of being

reopened, car counters have recorded that the number of vehicles entering the

main car parking areas at Newbury Retail Park was up 20 per cent compared with

the same period in 2019. Although this is only a small sample period, these

numbers compare favourably with those experienced just prior to the December

2020 pre-Christmas lock-down period. This is despite there being extensive

works currently underway in units 3 and 4 and with two other retail units

currently vacant and being re-marketed to let. Similarly, Solihull Retail Park

has experienced a very strong first week.

Industrial and Logistics

As referenced in the Company's Annual Results, two significant events completed

over the quarter. In March, Mothercare assigned their lease on the 360,000 sq

ft logistics unit at Daventry to CEVA Logistics. In February, a new letting of

Hurricane 47, Estuary Business Park , Speke contracted to on-line rug retailer,

Kukoon Rugs, who entered into a 15-year lease (tenant break at 10 years) at a

rent of £290,000 per annum with 6 months' rent free and a further 6 months by

way of 12 months at half rent.

Capital Expenditure

Uncommitted capital expenditure continues to be deferred for the time being.

Cash and Borrowings

The Company had approximately £37.7 million of available cash as at 31 March

2021. There is long-term debt in place with L&G which does not need to be

refinanced until December 2024. The Company also has a Barclays £50 million

term loan along with an undrawn £50 million revolving credit facility which is

available upon the satisfaction of the relevant conditions to drawdown. The

Barclays facility expires on 31 July 2022, with the option of two further

one-year extensions. As at 31 March 2021, the Company's net loan to value

('LTV') was 22.2 per cent.

Dividend

The Company paid three monthly dividends at a rate of 0.35 pence per share

during the quarter. The Company expects to continue to pay monthly dividends at

this rate for the foreseeable future. There is currently an improving outlook

and the Board will monitor rental receipts and earnings closely and keep the

dividend under review.

Portfolio Analysis - Sector Breakdown

Portfolio % of % like for

Value portfolio as like capital

£m at value shift

31 March 2021 (excl

transactions)

Offices 516.0 41.5 -0.4

West End 208.4 16.7 0.9

South East 73.9 6.0 -1.8

South West 31.1 2.5 -1.0

Rest of UK 183.0 14.7 -1.3

City 19.6 1.6 -0.6

Retail 224.4 18.1 -1.0

West End 164.5 13.3 -1.2

South East 28.6 2.3 -1.3

Rest of UK 31.3 2.5 0.0

Industrial 251.5 20.3 7.1

South East 29.0 2.3 1.0

Rest of UK 222.5 18.0 7.9

Retail 124.2 10.0 1.6

Warehouse

Alternatives 125.8 10.1 0.0

Total Property 1241.9 100.0 0.9

Portfolio

Portfolio Analysis - Geographic Breakdown

Market % of portfolio

Value as at

£m 31 March 2021

West End 434.3 35.0

South East 247.9 20.0

Midlands 165.9 13.3

Scotland 161.1 13.0

North West 159.7 12.8

South West 31.1 2.5

Eastern 22.3 1.8

Rest of London 19.6 1.6

Total Property Portfolio 1,241.9 100.0

Top Ten Investments

Sector

Properties valued in excess of £250 million

London W1, St Christopher's Place Estate * Mixed

Properties valued between £100 million and £150

million

London SW1, Cassini House, St James's Street Office

Properties valued between £50 million and £70

million

Newbury, Newbury Retail Park Retail Warehouse

Solihull, Sears Retail Park Retail Warehouse

Properties valued between £40 million and £50

million

London SW19, Wimbledon Broadway ** Mixed

Winchester, Burma Road Alternative

Properties valued between £30 million and £40

million

Manchester, 82 King St Office

Crawley, Leonardo House, Manor Royal Office

Aberdeen, Unit 2 Prime Four Business Park, Office

Kingswells

Daventry, Site E4, DIRFT Industrial

* Mixed use property of retail, office, food/beverage and residential space.

** Mixed use property of retail, food/beverage and leisure space.

Summary Balance Sheet

£m Pence % of

per Net

share Assets

Property Portfolio 1,241.9 155.4 130.1

Adjustment for lease incentives (24.4) (3.1) (2.6)

Fair Value of Property Portfolio 1,217.5 152.3 127.5

Trade and other receivables 34.7 4.3 3.6

Cash and cash equivalents 37.7 4.7 3.9

Current Liabilities (24.0) (3.0) (2.5)

Total Assets (less current liabilities) 1,265.9 158.3 132.5

Non-Current liabilities (1.7) (0.2) (0.2)

Interest rate swap (0.1) 0.0 0.0

Interest-bearing loans (308.5) (38.6) (32.3)

Net Assets at 31 March 2021 955.6 119.5 100.0

The next quarterly valuation of the property portfolio will be conducted by

CBRE Limited during June 2021 and it is expected that the unaudited NAV per

share as at 30 June 2021 will be announced in July 2021.

Important information

The information contained within this announcement is deemed by the Company to

constitute inside information as stipulated under the Market Abuse Regulations

(EU) No. 596/2014. Upon the publication of this announcement via Regulatory

Information Service this inside information is now considered to be in the

public domain.

Enquiries:

Richard Kirby

BMO REP Asset Management plc

Tel: 0207 499 2244

Graeme Caton

Winterflood Securities Limited

Tel: 0203 100 0268

END

(END) Dow Jones Newswires

April 23, 2021 02:00 ET (06:00 GMT)

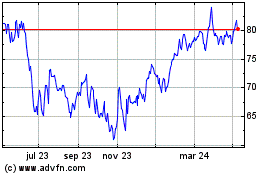

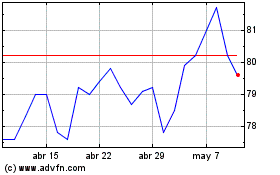

Balanced Commercial Prop... (LSE:BCPT)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Balanced Commercial Prop... (LSE:BCPT)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024