TIDMKEYS

RNS Number : 9772W

Keystone Law Group PLC

29 April 2021

29 April 2021

Keystone Law Group plc

('Keystone' or the 'Group' or 'Company')

Full year results for the period ending 31 January 2021

Resilient financial performance supported by a differentiated

& scalable business model

Keystone Law Group plc (AIM: KEYS), the fast growing, UK Top

100, challenger law firm, today announces its full year results for

the year ended 31 January 2021 ('FY2021').

Financial Highlights

-- Revenue growth of 10.9% to GBP55.0 million (FY2020: GBP49.6million)

-- PBT of GBP5.4 million (FY2020: GBP5.2 million)

-- Adjusted PBT of GBP6.0 million, representing growth of 3.6% (FY2020: GBP5.8 million)

-- Basic EPS of 13.8 pence, up 3.8% from 13.3 pence

-- Adjusted EPS of 15.6 pence, up 4.0% from 15.0 pence

-- Strong operating cash conversion at 100% with cash generated

from operations of GBP6.6 million (FY2020: GBP4.9 million)

-- Maintained robust cash position of GBP7.4 million, remain debt free

-- Proposed final dividend of 10.6p (2020: Nil) taking full year

Ordinary DPS to 17.2p (2020: 3.2p Ordinary and 8.0p Special)

Strategic Highlights

-- Our unique model continues to drive strong organic growth

o Lawyer recruitment has remained robust, with qualified new

applicants up 6% to 253 (FY2020: 239) and accepted offers

increasing 25% to 70 (FY2020: 56)

o Lawyers have continued to grow their practices despite

Covid-19 having a negative effect on client demand, with 74 (FY

2020: 52) Pod members operating within 44 Pods

-- We actioned a swift and effective response to Covid-19,

supporting our people throughout with a strong focus on

wellbeing

o Seamlessly moved all staff to homeworking from 13 March 2020,

ahead of the first lockdown, for which we were well positioned due

to our strong IT infrastructure

o Did not furlough employees or defer tax payments

o We have undertaken a full programme of online events for our

lawyers to help support their health and happiness and enable them

to maintain their networks within the business

-- We continue to invest into our proprietary technology,

improving ease of access and lawyer utilisation of the system to

further facilitate remote working

-- Our model and strong supportive culture has received external

recognition - in 2020 we won the Law Firm of the Year at The Lawyer

awards, and in January this year we were awarded the Roll on Friday

'Firm of the Year', with Keystone scoring 94% satisfaction

rating

Current trading and outlook

-- The current financial year has started well, with good levels

of activity from our existing lawyers, and the number and quality

of new applicants gives us confidence in the year ahead

James Knight, Chief Executive Officer of Keystone Law,

commented:

The nature of Keystone's business model, whereby our 350+

lawyers were all well acquainted with remote working when lockdown

began, has undoubtedly made it easier for the firm to remain 100%

operationally efficient since March 2020. Nevertheless, I am

extremely proud of what the firm and our people have achieved in

the last year, not just for maintaining that efficiency but also

for delivering solid growth. I was particularly impressed with how

our central office team switched seamlessly to home working and

their collective performance since in supporting our lawyers has

been faultless.

I am excited about the year ahead, not least because the vast

majority of the legal profession has started to suspect something

that we have known for 20 years: if the right tools and

infrastructure are in place then lawyers, even when undertaking

complicated, multi-disciplinary transactions, can deliver a far

better service if they are given flexibility and autonomy while

enjoying a better work-life balance.

-S-

For further information please contact:

Keystone Law Group plc

James Knight, Chief Executive Officer

Ashley Miller, Finance Director +44 (0) 20 3319

www.keystonelaw.com 3700

Panmure Gordon (UK) Limited (Nominated Adviser

and Joint Broker)

Dominic Morley (Corporate Finance)

Erik Anderson (Corporate Broking) +44 (0) 20 7886

www.panmure.com 2500

Investec Bank plc (Joint Broker)

Carlton Nelson

James Rudd

www.investec.co.uk

+44 (0) 20 7597

Media enquiries: 5970

FTI Consulting

Laura Ewart +44 (0)7711 387

Shiv Talwar 085

keystonelaw@fticonsulting.com

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulation (EU) No. 596/2014 as it forms part of UK domestic law by

virtue of the European Union (Withdrawal) Act 2018 ("MAR").

Analyst Briefing

A meeting for analysts will be held virtually at 9.30am today,

29 April 2021. Analysts wishing to attend this event can register

via email at keystonelaw@ fticonsulting.com . Keystone's Full Year

2021 results announcement will also be available today on the

Group's website at www.keystonelaw.com .

Notes to editors

Keystone is an award-winning law firm, providing conventional

legal services to SMEs and high net worth individuals in a GBP9bn

addressable market.

Keystone has a scalable and unique model, with three defining

characteristics:

-- Our lawyers have freedom, flexibility and autonomy, and are

paid up to 75% of what they bill.

-- Our lawyers determine how, when and where they work, in

contrast to the conventional law firm model.

-- We offer lawyers full infrastructure and support via its

central office, bespoke user-friendly IT platform, and network of

colleagues and events.

Keystone is a full-service law firm, with 20 service areas and

more than 50 industry sectors delivered by over 350 high calibre

self-employed lawyers who work from their own offices.

In November 2020, Keystone was named Law Firm of the Year by The

Lawyer, the first time a 'new' law firm has won the award.

More information about Keystone can be found at

www.keystonelaw.co.uk .

CHAIRMAN'S STATEMENT

I am pleased to introduce Keystone Law's results for the year

ended 31 January 2021.

In what has been a very challenging year for all, our technology

and our culture have ensured that we have remained 100%

operationally effective, continuing to support our clients

throughout the year. COVID-19 and the resultant government

restrictions affected client demand, especially during the first

half of the year. In this context, the Group has had a good year,

with revenue increasing by 10.9% to GBP55.0m (2020: GBP49.6m) and

adjusted PBT* increasing by 3.6% to GBP6.0m, representing a 10.8%

margin (2020: GBP5.8m, 11.6% margin) (PBT increase of 3.4% to

GBP5.4m (9.8% margin) from GBP5.2m (10.5% margin).

Cash generation has been particularly strong, with cash

generated from operations of GBP6.6m (2020 GBP4.9m) representing an

operating cash conversion of 100% (2020: 82%).

* Adjusted PBT for 2021 is calculated by adding share based

payment costs and amortisation to PBT (2020: calculated by adding

share based payment costs, amortisation and one off costs

associated with the property changes back to PBT). Details of these

calculations are shown in the Financial Review.

Dividend

As we announced in our Interim Statement, the Board believed

that it was appropriate to reinstate payments of dividends and

given the strong cash generation two interim dividends of 3.3p each

were declared, the first being an amount equivalent to

approximately half of that which would have been paid in respect of

the year ended 31 January 2020 had the pandemic not happened and

the second being in line with the Group's established dividend

policy. In light of the strong second half performance and taking

into account the strength of the balance sheet, the Board is

proposing to pay a final dividend for the year ended 31 January

2021 of 10.6p per share (2020: GBPNil). This dividend is comprised

of two amounts, the first being an amount of 3.5p per share which

is the remaining value which would have been paid in respect of 31

January 2020 had the pandemic not occurred and the balance of 7.1p

per share in accordance with the established dividend policy. This

brings the total dividend for the year to 17.2p per share (2020:

3.2p per share); 6.8p per share which would have been paid in

respect of the year ended 31 January 2020 were it not for the

pandemic and 10.4p per share in line with the Group's dividend

policy.

Board and Governance

I am happy to report that the Board has continued to operate

within the structures and governance requirements of the Quoted

Companies Alliance ("QCA") code as set out in the corporate

governance section of our annual report and accounts.

We were pleased to welcome Isabel Napper to the Board as

non-executive director during the year. Now that Peter Whiting is

stepping down, as previously announced, she will Chair the

Remuneration Committee. Also effective today, Simon Philips will

take over as Chair of the Audit Committee We would like to thank

Peter for his contribution to the Board since our IPO in 2017.

Our People and technology

Our people and our technology are two of the pillars on which

Keystone is built, and the strength and resilience of these has

been clearly demonstrated this year. Throughout the pandemic

ensuring the health and wellbeing of our people has been central to

our approach to dealing with the situation. In early March 2020,

ahead of the government's first lockdown, we moved all central

office staff to home working. The technology we use to provide the

lawyers the flexibility to work whenever and from wherever they

want ensured that this was a simple step and since then we have

continued to operate in this manner. As such our technology has

ensured that we have remained 100% operationally efficient

throughout the year whilst our corporate culture was already fully

adapted to supporting colleague working in a remote

environment.

Outlook

I am pleased to say that the current year has started well.

Whilst there remains some uncertainty as to how the economy will

respond as Government restrictions relax, as a Board, we are

confident in the Group's ability to continue to deliver on its

organic growth strategy, taking advantage of the sizeable market

opportunity which exists to continue to deliver strong results.

Robin Williams

Non-executive Chairman

28 April 2021

Chief executive's Review

Operational Review

Introduction and Highlights

I am very pleased to be able to report that, in spite of the

challenges faced by the COVID-19 pandemic, Keystone has had another

successful and award-winning year.

The business has continued to grow, with revenue up 10.9% to

GBP55m (2020: GBP49.6m) and adjusted PBT increasing by 3.6% to

GBP6.0m (2020: GBP5.8m) (PBT increase of 3.4% to GBP5.4m). The cash

generative nature of the model and thus its resilience has also

been strongly demonstrated this year, with operating cash generated

of GBP6.6m. This has given us the confidence not only to reinstate

dividends in line with our stated policy but also to "catch up" the

amount which would have been declared for the year ended 31 January

2020 had it not been for the outbreak of the pandemic.

Being 100% operational also meant that our recruitment

activities continued unabated throughout the year and as such the

number of Principals* increased from 328 to 369 and we saw the

number of Pod members increase from 54 to 74, as both new and

existing lawyers chose to expand their practice in this way.

In November we won what is arguably the most prestigious award

in the UK Legal Industry; The Lawyer Awards: Law Firm of the Year.

It is the first time that this award has been granted to a "new

law" firm and reasserts our belief that Keystone is now very much

recognised by the "establishment". This award recognises the best

in class when it comes to private practice legal services over the

past 12 months. Keystone was described by the award givers as, the

firm which had "rethought the model", which was "light years ahead

of everyone on virtual working" and was "big on work life

balance".

We also won Firm of the Year 2021 in the Roll on Friday awards.

This award is given to the "happiest firm" in the UK, based on a

satisfaction survey run by Rollonfriday.com of lawyers and support

staff in law firms across the UK. Keystone won by some margin, with

a 94% satisfaction rating across such categories as pay, career

development, work / life balance and culture.

We are tremendously proud of these two awards as they go to the

very heart of what Keystone is; a business which enables lawyers to

deliver high quality legal services to clients whilst providing a

culture which delivers support, well-being and happiness to our

people; both elements of which we believe are fundamental to the

success of Keystone.

* Principal lawyers are the senior lawyers who own the service

company ("Pod") which contracts with Keystone. The relationship

between Keystone and its lawyers is governed by two agreements: a

service agreement (which governs the commercial terms and is

between the Pod and Keystone) and a compliance agreement (which

governs the behaviour of lawyers and is between each lawyer and

Keystone). Pods can employ more than one fee earner. A junior

lawyer who is employed by a Pod is, to all intents and purposes, a

Keystone lawyer and presented to the outside world in much the same

way as a conventional law firm would present a conventionally

employed junior lawyer. Junior lawyers are properly interviewed and

vetted by the recruitment team in Central Office to ensure that

they are of the requisite quality and calibre. As is the case for

the Principal lawyers, these juniors sign a compliance agreement

with Keystone and are required to comply with all rules and

regulations governing the professional conduct of Keystone's

lawyers.

OUR RESPONSE TO COVID-19

Our response to the pandemic has focused on two things, keeping

our people safe and maintaining 100% operational efficiency. The

health, well-being and happiness of our people is, and always has

been, at the heart of the Keystone culture and this drove our

decision to move our central office team to homeworking ahead of

the first government lockdown. Having the technology stack already

designed to support remote working meant that we were able to

implement this decision swiftly without impacting on the quality of

support that our lawyers receive.

During the short periods through the pandemic, when the

government guidance encouraged a reopening of elements of society,

we enabled lawyers to use our client meeting rooms when this was

necessary. Ensuring that this was done in a COVID secure manner was

a key priority and we therefore, encouraged the lawyers to only use

the facilities where it was unavoidable, reduced meeting room

capacity significantly and provided all the additional cleaning and

other sanitary facilities necessary to protect anyone who was on

site.

Maintaining Keystone's culture, a culture built on social

interaction and cohesion has presented a new set of challenges this

year. In normal times, we dedicate substantial time and energy to

ensuring that our people are well connected to one another and to

the central team. This is usually achieved thanks to the number of

physical events which we run, be it Continuing Professional

Development events, sector / lawyer lunches, sports or cultural

events. All of these bring our lawyers together in a social

environment which enables them to network both personally and

professionally. It is this aspect of the Keystone experience which

has been most challenged by the government response to COVID-19. In

the absence of physical events, we have had to take a more creative

approach by replicating traditional networking events using online

alternatives. Accordingly, we have continued to run an extensive

number of events online which have evolved and varied over the

period in order to keep them fresh and attractive to our people and

have even launched our very own online pub; "The Keystone Arms"

which hosted around 350 Keystone lawyers at the opening night.

Treating our lawyers as valued personnel rather than commodities is

one of the pillars upon which our culture is built and is essential

to Keystone's success. A myriad of thoughtful initiatives such as

sending champagne for every lawyer birthday or creating special

Keystone colouring-in books to help reduce the pain of home

schooling, have genuinely helped Keystone's personnel remain upbeat

and effective throughout this challenging year.

From a financial perspective, we decided that the strength of

our balance sheet and the resilient nature of our business model,

made it inappropriate for Keystone to take advantage of the

government schemes that were put in place to support struggling

businesses. As such, we did not furlough any employees or defer any

tax payments.

SCALABLE MODEL DRIVING ORGANIC GROWTH

Our clear, simple strategy for growth remains unchanged; organic

growth through the recruitment of high calibre lawyers in the UK

legal services market.

In furtherance of this strategy we actively encourage and

support Principals to grow their own Pods by recruiting juniors to

work with them. In this way, Principal lawyers are able to build

larger practices, thus increasing the average revenue per

Principal, and by doing so, further leverage the value of their

client relationships. To the extent that Principals need junior

support but do not have a permanent need, or do not wish to build

their own Pod, we also employ a number of junior lawyers within the

Central office team whose role it is to provide the necessary ad

hoc support to the whole lawyer base.

Our model offers an attractive proposition for experienced

lawyers as it gives them control to develop their practice on their

own terms, concentrating exclusively on client development and the

delivery of legal work. They enjoy the ability to work when and

where they want and they appreciate the user-friendly bespoke

technology with access to over 365 experienced colleagues to

service their clients. Meanwhile an efficient central office team

provides them with the full range of logistical support they need.

All this comes together with the ability to earn more money for the

work they do whilst enjoying an improved work / life balance and a

culture which is open, friendly and collegiate whilst remaining

highly professional.

In the twelve months ended 31 January 2021, the size and nature

of the market remained essentially unchanged. The government

restrictions on movement meant that this year all UK lawyers have

had to work from home for long periods of time and whilst many will

have struggled with their firm's technology there has been a clear

structural shift in the attitude towards remote working. This

change has undoubtedly served to further erode any erroneous

perceptions, which some lawyers working in traditional firms may

still have held, regarding the ability of lawyers to work in this

way and as such will have further extended the reach of the

Keystone model. Winning "Law Firm of the Year" at the Lawyer Awards

clearly demonstrates this change and confirms that Keystone is now

firmly accepted by the mainstream legal establishment.

2021 has been another strong year for recruitment with the

number of qualified new applicants increasing 6% to 253 and the

number of offers accepted by candidates increasing by 25% to 70.

The shape of the year has been unusual insofar as the "ordinary"

triggers which drive recruitment peaks, notably the post holiday

return to work, have been largely absent and it has been other

events driving candidates desire for change. This was very apparent

during the first lock down which created a significant level of

uncertainty across the legal industry and coincided with an uptick

in the number of qualified new applicants, especially from the

recruitment agencies. The second half saw further disruption as the

restrictions were first relaxed through the summer period before

once again escalating, albeit in something of a patchwork manner,

during the rest of the year. The uncertainty created by these

changes impacted on both the overall number, but also the timing,

of qualified new applicants which ebbed and flowed in response to

the changing picture. The start of the 2022 financial year has seen

a fair but variable start with events continuing to evolve as we

move from full lockdown to the start of the relaxation of

restrictions in line with the government's roadmap.

In spite of the negative effect that COVID-19 had on client

demand, most notably during the first half of the year, our lawyers

have continued to grow their practices by recruiting juniors and

colleagues into their Pods and as of 31 January 2021 we had 74

(2020: 56) Pod members operating within 44 Pods (2020: 31). This

growth has been driven by a combination of new and existing

Principals and further endorses the strength and flexibility of the

model.

continuing Investment in IT

The investment made over many years in our IT infrastructure

meant that we started the year in a strong position and as such

COVID-19 had only a limited effect on the focus of the IT team this

year. As always we continued to develop and enhance our core

systems to ensure that they remain "best in class", always seeking

to provide the best user experience and to drive ever greater

operational efficiencies. Over and above this, IT security

continues to be a key focus for the team and having rolled out a

number of security enhancements to the estate last year, we

continued to enhance the security environment as well as stepping

up the awareness programme on cybersecurity.

The one area where COVID-19 did affect the IT team was in the

take up and usage of video conferencing platforms as a primary tool

for client meetings as well as internal interaction with

colleagues. We had all the necessary tools in place prior to the

pandemic although usage levels were low with most people favouring

more conventional means of meeting. Once again, having the tools

available ahead of the outbreak meant that we were well-placed to

ensure a seamless transition from physical meetings to online

meetings and the IT team worked extremely well to educate Keystone

personnel on the availability and functionality of Microsoft

Teams.

Ongoing Investment in the Central office team

Once again this year, the Central office team has demonstrated

the "positive and can do" attitude of which I have become so proud

over the years. It is worth noting that the Central Office team

have previously only worked from our offices in Chancery Lane but

with the outbreak of the pandemic they immediately switched to

remote working. Their positive attitude to this seismic shift in

the working environment ensured that we could continue to support

our lawyers without interruption and deliver the "best in class"

service to which they have become accustomed. This year has

demonstrated the flexibility and adaptability of all aspects of the

Keystone model and as ever the Central office team has played a key

part in delivering this. I would like to take this opportunity to

thank all of the Central office team for their hard work and

enthusiasm.

Looking ahead

The current year has started well. The activity of the existing

lawyers is strong and both the number and quality of qualified new

applicants provide confidence in the year ahead. With the

government roadmap in place and progress being made towards the

relaxation and hopefully end to lockdown restrictions, it is to be

hoped that the general economic outlook will improve. Having

performed well in spite of the restrictions last year, the Group is

well positioned to take advantage of the improving position this

year and deliver another strong performance.

James Knight

Chief Executive

28 April 2021

Financial Review and Strategic Report

Key Performance Indicators (KPI s)

The following KPIs are used by the management to monitor the

financial performance of the Group.

Revenue growth: 10.9% increase (2020: 16.3%)

Adjusted PBT growth: 3.6% increase (2020: 12.0%)

Adjusted PBT margin: 10.8% (2020 11.6%)

PBT growth: 3.4% increase (2020: 10.1%)

PBT margin: 9.8% (2020: 10.5%)

Operating cash conversion %: 100% (2020: 81%)

Trade debtor days: 38 (2020: 36)

Net Assets: GBP16.6m (2020: GBP14.1m)

The calculation of adjusted PBT is shown below.

Income Statement

I am pleased to report revenue for the year of GBP55.0m, an

increase of 10.9% on the prior year. As previously reported, whilst

the pandemic caused significant disruption to client demand in the

first half of the year, we experienced a return to pre Covid-19

levels during the second half. This is clearly demonstrated by the

relative growth rates experienced in each period: year on year

growth in the first half was 6.5% whereas the second half revenue

was up 14.7%. Revenue growth has been driven by the lawyers

recruited last year contributing a full year of productivity as

well as contributions from the lawyers who have been recruited

during this year, with principal lawyer numbers increasing from 328

to 369.

Gross Profit

The gross profit margin of the business has fallen this year to

25.9% (2020: 26.7%). The key reason for this this reduction has

been driven by two factors, both of which affect the level of

profitability generated by our employed junior lawyers. The first

of these causes has been the pandemic and the resultant impact on

client demand, especially in the first half of the year. The second

is, rather perversely, a reflection of the successful evolution of

the Pod concept. The Pod concept has developed quite substantially

over the last couple of years to the extent that it is now a

generally accepted means by which Keystone lawyers develop their

practice. As such, it does mean that certain circumstances which

historically would have resulted in exceedingly high utilisation of

the employed juniors are now less likely to occur. One such example

scenario is where a Principal lawyer is involved in a large case

which requires full time junior support over a prolonged period of

time; historically such a situation would have resulted in

additional gross margin through the employed lawyers, whereas with

the evolution of the Pod concept it is far more common that a

Principal in this position would recruit a junior into their Pod

such that we would benefit from the revenue at the standard gross

margin.

Administrative Expenses

Administrative expenses have increased by 6.7% to GBP7.7m (2020:

GBP7.2m). The largest single component of this is staff costs which

increased by 15.2% to GBP3.3m (2020: GBP2.9m), with support staff

increasing from an average of 44 in 2020 to 47 in 2021. At the

start of the pandemic, the Board decided that given the financial

strength and resilience of the Group, it would be inappropriate to

take advantage of government schemes aimed at supporting those in

need and as such we did not furlough any staff during the period.

That said, whilst the average number of support staff increased

year on year, support staff headcount remained flat across the

year. Other administrative costs increased by 1.2% to GBP4.42m

(2020: GBP4.36m).

Other costs

During 2020, the Group entered into new lease arrangements in

respect of our principal office at 48 Chancery Lane and 2021 was

the first full year that these arrangements came into effect. As

such the charge for amortisation of right of use assets increased

by 11% and depreciation increased by 51% to GBP0.1m as the charge

in respect of the investment made in leasehold improvements last

year also took full effect. The charge in respect of share based

payments increased from GBP0.13m to GBP0.2m as a new grant was made

and the cost of all historic grants continued to be charged to the

income statement, whilst finance income was negligible in the year

as interest rates fell close to Nil.

PBT, Adjusted PBT and PBT MARGINS

Adjusted PBT is calculated as follow:

2021 2020

GBP GBP

----------------------------------- --------- ---------

Profit before tax 5,405,135 5,225,891

Amortisation 350,884 350,884

Share based payments 208,671 128,286

One off impact of property changes - 51,547

Adjusted PBT 5,964,690 5,756,608

----------------------------------- --------- ---------

PBT Margin 9.8% 10.5%

----------------------------------- --------- ---------

Adjusted PBT Margin 10.8% 11.6%

----------------------------------- --------- ---------

The decline in both PBT and adjusted PBT margins this year (0.7%

and 0.8% respectively) has been principally driven by the reduction

in gross profit margin, which was caused by a lower level of

utilisation of the centrally employed junior lawyers as explained

above. With interest rates falling almost to nil, finance income

fell by GBP0.1m contributing a further 0.3% decline in the margin.

These movements were partly offset because administrative expenses,

net of other operating income, fell as a percentage of revenue by

0.4% reflecting the continuing benefits of operational gearing in

the business.

Taxation

The effective tax rate of 19.9% is higher than the standard rate

and lower than that of the prior year (20.3%). Due to the nature of

our business and the investment we make in providing networking

opportunities in social environments for our lawyers, the tax rate

of the business is always likely to be slightly higher than the

standard rate as these costs are disallowable for corporation tax

purposes. Compared to the previous year, the level of disallowable

expenses was lower as we were unable to hold a number of lawyer

events due to the restrictions imposed on social interaction.

Earnings Per Share

Basic earnings per share increased from 13.3p to 13.8p, with the

dilution effect from shares awarded under LTIP being negligible.

Adjusted earnings per share (calculated by making the same

adjustments to earnings as has been made in calculating adjusted

PBT and divided by the average shares in circulation this year) has

increased by 4% to 15.6p (2020: 15.0p).

Statement of Financial Position

Cash

The Group's business model is strongly cash generative because

its most significant cost, the fees paid to lawyers, is only paid

once Keystone has been paid for the work it has delivered.

Operating cash conversion for the year was particularly strong this

year at 100% (2020: 81%) generating cash from operations of GBP6.6m

(2020: GBP4.9m). Last year's cash conversion had been somewhat

depressed by an increase in the level of client disbursements which

had been paid by the Group and not yet recovered from clients at

the year end, this position unwound during this financial year with

the level of disbursement funding falling this year. Furthermore,

the growth in accrued income this year has been slower than in the

prior year (net GBP0.1m) due to the disruption caused by the

pandemic. Capital expenditure was GBP0.05m (2020: GBP0.4m) having

returned to the normal run rate within the business having incurred

the costs associated with fitting out the new floor of offices

taken in Chancery Lane last year. Corporation tax payments were

GBP1.0m (2020: GBP0.8m). Net interest received (ex the interest

portion of lease payments) of GBP0.02m (2020: GBP0.14m) has fallen

substantially as interest base rates have fallen to almost Nil

whilst the interest element of lease payments was GBP0.1m (2020:

GBP0.08m). Lease repayments of GBP0.4m reflect the normal run rate

of payments under our existing leases (2020: GBP0.2m benefitted

from rent free periods at the start of the new leases). As such,

cash generated by the business in the year, being net cash flow pre

dividend payments, was GBP5.0m (2020: GBP3.6m). The Group paid

dividends of GBP2.1m (2020: GBP5.5m), which included two ordinary

interim dividends of 3.3p per share each. This left closing cash of

GBP7.4m (2020: GBP4.4m) and no debt.

Net Assets

The net assets of the Group have increased from GBP14.1m to

GBP16.6m, with retained earnings of profits of GBP4.3m less the

dividends of GBP2.1m. This leaves the business with a strong

balance sheet.

Section 172 Companies Act Statement

The statements below address the reporting requirements of the

Board under Section 172 of the Companies Act and the Companies

(Miscellaneous Reporting) Regulations 2018.

The Directors of the company have a duty to promote the success

of the company. A director of the company must act in the way they

consider, in good faith, to promote the success of the company for

the benefit of its members, and in doing so have regard (amongst

other matters) to:

-- the likely consequences of any decision in the long term;

-- the interests of the Company's employees;

-- the need to foster the Company's operations on the community and the environment;

-- the desirability of the Company to maintain a reputation for

high standards of business conduct and

-- the need to act fairly between members and the Company.

The Directors are committed to developing and maintaining a

governance frameworks that is appropriate to the business and

supports effective decision making coupled with robust oversight of

risks and internal controls.

Keystone has a clearly stated long term organic growth strategy

and as such all significant business decisions consider both the

short and long term impact in the process. Key to delivering this

strategy is to continue to recruit and retain high calibre lawyers.

In order to be an attractive place for high calibre lawyers to

work, it is essential that Keystone maintains its reputation for

delivering work to the highest professional standards. Central to

the success of the business is the development and maintenance of

its open, welcoming and collegiate culture and we invest

significant time and resources to ensure that these facets are

maintained and developed for the benefit of all those involved with

the Company.

Keystone's primary asset is its people, be it the central office

staff, the lawyers, the clients or third party suppliers with whom

we work (such as counsel, experts and other professionals). As a

business, we dedicate substantial time, effort and resources in

working to develop and maintain strong relationships from which all

parties benefit. As a people business, the impact of business

decisions on our principal stakeholders is always central to the

decision making process.

The nature of the Group's business is fundamentally low impact

to the environment, we have an extremely small office footprint and

the use of technology across the business further reduces the

environmental impact as our lawyers have no need to commute to

work.

The Directors treat all members of the Company fairly and

consistently, as required by both professional standards and in

compliance with various pieces of legislation. We provide

information to all shareholders and other third parties on an equal

basis.

Dividend

In light of the strength of the second half performance and

taking into account the strength of the balance sheet, the Board is

proposing to pay a final dividend for the year ended 31 January

2021 of 10.6p per share (2020: nil). This dividend is comprised of

two elements, the first being an amount of 3.5p per share which is

the remaining value which would have been paid in respect of 31

January 2020 had the pandemic not occurred and the balance of 7.1p

per share in accordance with the established dividend policy. This

brings the total dividend for the year to 17.2p per share (2020:

11.2p per share (3.2p Ordinary and 8.0p Special)); 6.8p per share

which would have been paid in respect of the year ended 31 January

2020 were it not for the pandemic and 10.4p per share in line with

the Group's dividend policy.

The proposed final dividend will be payable on 9 July 2021 to

shareholders on the register at the close of business on 11 June

2021.

On behalf of the Board

Ashley Miller

Finance Director

28 April 2021

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

YEARED 31 JANUARY 2021

2021 2020

Note GBP GBP

-------------------------------------------- ---- ------------ ------------

Revenue 55,027,227 49,630,634

Cost of sales (40,770,513) (36,402,826)

-------------------------------------------- ---- ------------ ------------

Gross profit 14,256,714 13,227,808

Depreciation and amortisation 3 (874,110) (794,658)

Share based payments 3 (208,671) (128,286)

Administrative expenses 3 (7,706,481) (7,219,826)

Other operating income 11,285 75,227

-------------------------------------------- ---- ------------ ------------

Operating profit 5,478,737 5,160,265

-------------------------------------------- ---- ------------ ------------

Finance income 4 39,515 151,991

Finance costs 4 (113,117) (86,365)

-------------------------------------------- ---- ------------ ------------

Profit before tax 5,405,135 5,225,891

Corporation tax expense (1,076,094) (1,063,271)

-------------------------------------------- ---- ------------ ------------

Profit and total comprehensive income for

the year attributable to equity holders of

the Parent 4,329,041 4,162,620

-------------------------------------------- ---- ------------ ------------

Basic and diluted EPS (p) 6 13.8 13.3

-------------------------------------------- ---- ------------ ------------

The above results were derived from continuing operations.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 31 JANUARY 2021

2021 2020

Note GBP GBP

-------------------------------------- ---- ---------- ----------

Assets

Non-current assets

Property, plant and equipment

- Owned assets 323,940 385,000

- Right-of-use assets 1,335,297 1,746,157

-------------------------------------- ---- ---------- ----------

Total property, plant and equipment 1,659,237 2,131,157

Intangible assets 6,108,606 6,459,490

Other assets 13,628 13,628

-------------------------------------- ---- ---------- ----------

7,781,471 8,604,275

-------------------------------------- ---- ---------- ----------

Current assets

Trade and other receivables 7 18,108,298 16,561,439

Cash and cash equivalents 7,371,300 4,386,586

-------------------------------------- ---- ---------- ----------

25,479,598 20,948,025

-------------------------------------- ---- ---------- ----------

Total assets 33,261,069 29,552,300

-------------------------------------- ---- ---------- ----------

Equity and liabilities

Equity

Share capital 62,548 62,548

Share premium 9,920,760 9,920,760

Share based payments reserve 380,162 171,491

Retained earnings 6,223,096 3,958,134

-------------------------------------- ---- ---------- ----------

Equity attributable to equity holders

of the Parent 16,586,566 14,112,933

-------------------------------------- ---- ---------- ----------

Non-current liabilities

-------------------------------------- ---- ---------- ----------

Lease liabilities 8 1,015,924 1,499,900

Deferred tax liabilities 266,821 336,999

-------------------------------------- ---- ---------- ----------

1,282,745 1,836,899

-------------------------------------- ---- ---------- ----------

Current liabilities

Trade and other payables 8 14,032,341 12,500,318

Lease liabilities 8 538,544 497,791

Corporation tax liability 719,445 541,892

Provisions 101,428 62,467

-------------------------------------- ---- ---------- ----------

15,391,758 13,602,468

-------------------------------------- ---- ---------- ----------

Total liabilities 16,674,503 15,439,367

-------------------------------------- ---- ---------- ----------

Total equity and liabilities 33,261,069 29,552,300

-------------------------------------- ---- ---------- ----------

A Miller

Director

Keystone Law Group Plc

Registered No. 09038082

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

YEARED 31 JANUARY 2021

Attributable to equity holders of the Parent

Share based

Share Share payments Retained

capital premium reserve earnings Total

GBP GBP GBP GBP GBP

---------------------------- -------- --------- ----------- ----------- -----------

At 31 January 2019 62,548 9,920,760 43,205 5,331,002 15,357,515

Profit for the year and

total comprehensive income - - - 4,162,620 4,162,620

Dividends paid in the year - - - (5,535,488) (5,535,488)

Share based payments - - 128,286 - 128,286

----------------------------- -------- --------- ----------- ----------- -----------

At 31 January 2020 62,548 9,920,760 171,491 3,958,134 14,112,933

Profit for the year and

total comprehensive income - - - 4,329,041 4,329,041

Dividends paid in the year - - - (2,064,079) (2,064,079)

Share based payments - - 208,671 - 208,671

----------------------------- -------- --------- ----------- ----------- -----------

At 31 January 2021 62,548 9,920,760 380,162 6,223,096 16,586,566

----------------------------- -------- --------- ----------- ----------- -----------

CONSOLIDATED STATEMENT OF CASH FLOWS

YEARED 31 JANUARY 2021

2021 2020

Note GBP GBP

----------------------------------------------------- ---- ----------- -----------

Cash flows from operating activities

Profit before tax 5,405,135 5,225,891

Adjustments to cash flows

Depreciation and amortisation 3 874,110 794,658

Share based payments 3 208,671 128,286

Finance income 4 (39,515) (151,991)

Finance costs 4 113,117 86,365

----------------------------------------------------- ---- ----------- -----------

6,561,518 6,083,209

Working capital adjustments

Increase in trade and other receivables (1,546,859) (2,050,713)

Increase in trade and other payables 1,532,023 925,257

Increase / (decrease) in provisions 38,962 (31,646)

----------------------------------------------------- ---- ----------- -----------

Cash generated from operations 6,585,644 4,926,107

Interest paid (17,826) (8,710)

Interest portion of lease liability (95,291) (77,655)

Corporation taxes paid (968,719) (801,849)

----------------------------------------------------- ---- ----------- -----------

Cash generated from operating activities 5,503,808 4,037,893

----------------------------------------------------- ---- ----------- -----------

Cash flows from/(used in) investing activities

Interest received 39,515 151,991

Purchases of property, plant and equipment (51,306) (403,501)

----------------------------------------------------- ---- ----------- -----------

Net cash used in investing activities (11,791) (251,510)

----------------------------------------------------- ---- ----------- -----------

Cash flows from financing activities

----------------------------------------------------- ---- ----------- -----------

Lease repayments (443,224) (207,946)

Dividends paid in year (2,064,079) (5,535,488)

----------------------------------------------------- ---- ----------- -----------

Net cash (used in) financing activities (2,507,303) (5,743,434)

----------------------------------------------------- ---- ----------- -----------

Net increase/(decrease) in cash and cash equivalents 2,984,714 (1,957,051)

Cash at 1 February 4,386,586 6,343,637

----------------------------------------------------- ---- ----------- -----------

Cash at 31 January 7,371,300 4,386,586

----------------------------------------------------- ---- ----------- -----------

Notes to the Financial Statements

1. General Information

The Company was incorporated as Keystone Law Group Limited on 13

May 2014 under the Companies Act 2006 (registration no. 09038082)

and subsequently used as the vehicle to acquire Keystone Law

Limited (the main trading company in the Group) and its

subsidiaries on 17 October 2014. The Company was re-registered as a

Public Limited Company on 10 November 2017. The Company was

incorporated and is domiciled in England and Wales. The principal

activity of the Group is the provision of legal services.

The address of its registered office is:

48 Chancery Lane

London

WC2A 1JF

The Financial Statements are presented in Pounds Sterling, being

the functional currency of the Group.

2. Accounting policies

Statement of compliance

The Financial Statements have been prepared in accordance with

International Accounting Standards in conformity with the

requirements of the Companies Act 2006.

Summary of significant accounting policies and key accounting

estimates

The principal accounting policies applied in the preparation of

the Financial Statements are set out below. These policies have

been consistently applied to all the years presented, unless

otherwise stated.

Basis of preparation

The preliminary announcement does not constitute full financial

statements for the years ended 31 January 2021 or 2020.

The results for the year ended 31 January 2021 included in this

preliminary announcement are extracted from the audited financial

statements for the year ended 31 January 2021 which were approved

by the Directors on 28 April 2021. The auditor's report on those

financial statements was unqualified. It did not include a

statement under Section 498(2) or 498(3) of the Companies Act

2006.

The 2021 annual report will be posted to shareholders and

included within the investor relations section of our website in

due course and will be considered at the Annual General Meeting to

be held on 5 July 2021. The financial statements for the year ended

31 January 2021 have not yet been delivered to the Registrar of

Companies.

The auditor's report on the consolidated financial statements of

Keystone Law Group plc for the period ended 31 January 2020 was

unqualified and did not include a statement under Section 498(2) or

498(3) of the Companies Act 2006. The financial statements for the

period ended 31 January 2020 have been delivered to the Registrar

of Companies.

Going concern

The Group and Company financial statements have been prepared on

a going concern basis as the Directors have a reasonable

expectation that the Group has adequate resources to continue in

operational existence for the foreseeable future. The Group is cash

positive, has no debt, has a model which is strongly cash

generative and has, to date, a strong trading performance. The

Group's forecasts and projections show that the Group has

sufficient resources for both current and anticipated cash

requirements.

3. Expenses by nature

Expenses are comprised of:

2021 2020

GBP GBP

----------------------------------- --------- ---------

Depreciation 112,366 74,276

Amortisation - intangible assets 350,884 350,884

Amortisation - right of use assets 410,860 369,498

Share based payments 208,671 128,286

Staff costs 3,790,848 3,414,691

Other administrative expenses 4,417,034 4,364,920

----------------------------------- --------- ---------

9,290,663 8,702,555

----------------------------------- --------- ---------

Included within staff costs above are the costs of employed fee

earners who are included within cost of sales (2021: GBP501,401;

2020: GBP559,785).

4. Finance income and costs

2021 2020

GBP GBP

------------------------------------------- --------- --------

Finance income

Interest income on bank deposits 39,515 151,991

Finance costs

Interest on bank overdrafts and borrowings (17,826) (8,710)

Interest on leases for own use (95,291) (77,655)

------------------------------------------- --------- --------

Total finance costs (113,117) (86,365)

------------------------------------------- --------- --------

Net finance costs (73,602) 65,626

------------------------------------------- --------- --------

5. Staff costs

The aggregate payroll costs (including Directors' remuneration)

were as follows:

2021 2020

GBP GBP

------------------------------------------- --------- ---------

Wages and salaries 3,307,043 2,984,228

Social security costs 360,521 322,025

Pension costs, defined contribution scheme 123,284 108,438

------------------------------------------- --------- ---------

3,790,848 3,414,691

------------------------------------------- --------- ---------

The average number of persons employed by the Group (including

Directors) during the year, analysed by category was as

follows:

2021 2020

GBP GBP

--------------------------- ---- ----

Fee Earners 9 10

Administration and support 47 44

--------------------------- ---- ----

Total 56 54

--------------------------- ---- ----

The Company does not employ any employees and as such has no

staff costs.

6. EARNINGS PER SHARE

The calculations of earnings per share are based on the

following profits and number of shares:

2021 2020

GBP GBP

-------------------------------------------- --------- ---------

Profit attributable to owners of the Parent 4,329,041 4,162,620

-------------------------------------------- --------- ---------

Amortisation 350,884 350,884

-------------------------------------------- --------- ---------

Share based payments 208,671 128,286

-------------------------------------------- --------- ---------

One off impact of property changes - 51,547

-------------------------------------------- --------- ---------

Adjusted earnings 4,888,596 4,693,247

-------------------------------------------- --------- ---------

2021

No of 2020

shares No of shares

-------------------------------------- ---------- -------------

Weighted average number of shares

For basic earnings per share 31,273,941 31,273,941

Dilutive effect of grants under LTIP 205,143 135,227

-------------------------------------- ---------- -------------

For diluted earnings per share 31,479,084 31,409,168

-------------------------------------- ---------- -------------

Basic earnings per share (p) 13.8 13.3

Diluted earnings per share (p) 13.8 13.3

-------------------------------------- ---------- -------------

Adjusted basic earnings per share (p) 15.6 15.0

-------------------------------------- ---------- -------------

Adjusted basic earnings per share is calculated by taking

adjusted earnings and dividing it by undiluted average shares for

the year.

7. Trade and other receivables

Company Group

2021 2020 2021 2020

GBP GBP GBP GBP

---------------------------------------------- --------- --------- ----------- -----------

Trade receivables - - 10,381,433 10,084,511

Provision for impairment of trade receivables - - (2,976,731) (2,659,483)

---------------------------------------------- --------- --------- ----------- -----------

Net trade receivables - - 7,404,702 7,425,028

Receivables from related parties 7,453,426 4,744,973 - 10,360

Accrued income - - 7,519,042 6,642,950

Prepayments 13,742 29,785 1,592,149 1,036,900

Other receivables - - 1,592,405 1,446,201

---------------------------------------------- --------- --------- ----------- -----------

Total current trade and other receivables 7,467,168 4,774,758 18,108,298 16,561,439

---------------------------------------------- --------- --------- ----------- -----------

Trade receivables stated above include amounts due at the end of

the reporting period for which an allowance for expected credit

loss has not been recognised as the amounts are still considered

recoverable and there has been no significant change in credit

quality.

The provision for impairment of trade receivables (analysed

below) is the difference between the carrying value and the present

value of the expected proceeds.

2021 2020

2021 2021 Expected 2020 2020 Expected

Gross Provision Loss Rate Gross Provision Loss Rate

GBP GBP % GBP GBP %

--------------- ---------- ---------- ---------- ---------- ---------- ----------

0 to 30 days 3,438,200 - 0.0 3,612,605 - 0.0

31 to 60 days 1,814,914 - 0.0 1,634,222 - 0.0

61 to 90 days 875,870 - 0.0 1,024,966 - 0.0

91 to 120 days 599,953 - 0.0 589,719 - 0.0

4 to 6 months 344,544 - 0.0 292,601 26,757 9.1

6 months to 1

year 1,297,737 966,516 74.5 1,348,970 1,051,298 77.9

Over 1 year 2,010,215 2,010,215 100.0 1,581,428 1,581,428 100.0

--------------- ---------- ---------- ---------- ---------- ---------- ----------

10,381,433 2,976,731 28.7 10,084,511 2,659,483 26.4

--------------- ---------- ---------- ---------- ---------- ---------- ----------

The Directors consider that the carrying value of trade and

other receivables approximates to fair value.

8. Trade and other payables

Company Group

2021 2020 2021 2020

GBP GBP GBP GBP

----------------------------------- ------ ------ ---------- ----------

Trade payables - - 6,936,732 6,483,907

Accrued expenses 30,450 24,171 6,945,752 5,782,595

Amounts owed to group undertakings - - - -

Social security and other taxes - - 149,857 233,816

Other payables - - - -

----------------------------------- ------ ------ ---------- ----------

Total trade and other payables 30,450 24,171 14,032,341 12,500,318

----------------------------------- ------ ------ ---------- ----------

Included within the above accrued expenses is the liability for

lawyer fees associated with the accrued income (2021 GBP5,585,486,

2020: GBP4,922,086).

The Group's exposure to market and liquidity risks related to

trade and other payables is show below. The Group pays its trade

payables on terms and as such trade payables are not yet due at the

balance sheet dates.

Financial liabilities

0 to 6 7 to 12 1 to 5 Pay when

months months years paid Total

GBP GBP GBP GBP GBP

------------------- --------- --------- --------- ---------- ----------

Trade payables 328,054 433,703 - 6,174,975 6,936,732

Accrued expenses 795,266 565,000 - 5,585,486 6,945,752

Lease liabilities 269,272 269,272 1,015,924 - 1,554,468

------------------- --------- --------- --------- ---------- ----------

At 31 January 2021 1,392,592 1,267,975 1,015,924 11,760,461 15,436,952

------------------- --------- --------- --------- ---------- ----------

0 to 6 7 to 12 1 to 5 Pay when

months months years paid Total

GBP GBP GBP GBP GBP

------------------- ------- ------- --------- ---------- ----------

Trade payables 274,918 - - 6,208,989 6,483,907

Accrued expenses 480,509 380,000 - 4,922,086 5,782,595

Lease liabilities 228,519 269,272 1,499,900 - 1,997,691

------------------- ------- ------- --------- ---------- ----------

At 31 January 2020 983,946 649,272 1,499,900 11,131,075 14,264,193

------------------- ------- ------- --------- ---------- ----------

Financial liabilities are held at amortised cost. There is no

significant difference between the fair value and carrying value of

financial instruments.

Amounts shown as pay when paid above principally reflect amounts

payable in respect of lawyers' fees, as well as values payable to

third party counsel and experts whose fees have been incurred on

behalf of the Groups clients as disbursements.

The Company had accrued expenses of GBP30,450 (2020: 24,171) all

of which would fall within the 0 to 6 months category above.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR PPUPWCUPGGQR

(END) Dow Jones Newswires

April 29, 2021 02:00 ET (06:00 GMT)

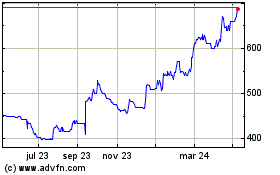

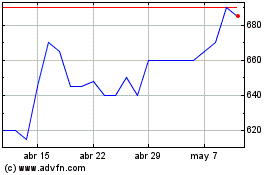

Keystone Law (LSE:KEYS)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Keystone Law (LSE:KEYS)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024