TIDMKYGA

RNS Number : 0416X

Kerry Group PLC

29 April 2021

Date: 29 April 2021

KERRY GROUP

Q1 INTERIM MANAGEMENT STATEMENT 2021

Good business momentum through the first quarter

Kerry, the global taste & nutrition and consumer foods

group, reports business performance for the first quarter ended 31

March 2021. This statement is issued in conjunction with the

Group's Annual General Meeting which is being held today.

OVERVIEW

* Business volume growth 1.9%

* Taste & Nutrition 2.0%

* Consumer Foods 1.0%

* Pricing 0.5%

* Group trading margin (50bps)

* Full year EPS guidance issued

Edmond Scanlon, Chief Executive Officer

"We saw significant variability and highly dynamic market conditions

right across our end use markets, channels and regions. Against this

backdrop, I am very pleased with the business momentum we saw as we

moved through the quarter. Our performance reflected sustained strong

growth in the retail channel, while the foodservice channel continued

to be impacted by increased restrictions in many local markets, before

returning to growth in March. APMEA delivered strong growth throughout

the period, Europe was impacted across the region, while the Americas

had a strong finish to the quarter.

The good business momentum has been supported by an increase in the

level of innovation in a number of key markets. This momentum combined

with an overall improvement in market conditions, gives us increased

confidence in the full year outlook, where we are expecting to achieve

strong volume growth and are guiding adjusted earnings per share growth

of 11 - 15% in constant currency."

Markets and Performance

Market conditions remain highly variable as differences in

recovery paths are emerging across regions. A number of countries

are seeing increased mobility, substantial reopening activity and

increased consumer confidence, while others continue to adapt to

changing local conditions. Against this backdrop, the needs of

customers and consumers continue to evolve at pace across our

marketplace.

Global markets have seen at-home consumption remain elevated

with an evolution in work practices and daily routines. The overall

recovery in the foodservice channel slowed in the period before

showing good signs of recovery as many countries advanced their

vaccine roll-out programmes. Prevailing trends include a demand for

health and immunity enhancement, plant protein options, and

products addressing a diverse range of sustainability criteria.

In the period the Group had business volume growth of 1.9%, a

pricing increase of 0.5%, an adverse transaction currency impact of

0.2%, contribution from business acquisitions of 1.0%, and an

adverse translation currency impact of 6.7%, resulting in a

reported revenue decrease of 3.5%. Group trading margin decreased

by 50bps, reflecting ongoing COVID-related costs and an adverse

foreign exchange impact.

Business Reviews

Taste & Nutrition

Good growth in retail channel, with foodservice returning to

growth by the end of the quarter

> Overall volume growth of 2.0% driven by performance in APMEA

> Retail channel delivered 5.9% growth - led by Beverage, Snacks and Meals EUMs

> Foodservice channel volumes declined 8.2% - good

performance against backdrop of increased restrictions and a return

to overall growth in March

> Pricing of 0.5% reflecting increased input costs

> Trading margin decrease of 50bps principally driven by net COVID -- related costs

Taste & Nutrition continued its overall recovery trajectory,

led by performance in APMEA. The Americas began with a slow start

but finished strongly, while Europe remained challenged due to the

level of restrictions in place across the first quarter. In the

period we saw an increased level of local innovation, with a number

of launches incorporating Kerry's proactive nutrition portfolio,

helping our customers enhance their plant-based product ranges, and

significant engagement with customers supporting initiatives right

across the sustainable nutrition spectrum.

Business volumes in developing markets increased by 10.7% led by

strong performances in China and Brazil, while overall volumes in

developed markets decreased due to the impact of restrictions on

the foodservice channel.

Americas Region

> Overall volume growth of 0.4% with a strong finish to the period

> Retail channel delivered good growth led by Beverage, Snacks and Meals EUMs

> Foodservice performance impacted earlier in the period before a return to growth in March

Within the North American retail channel, Kerry's Beverage EUM

achieved very strong growth with increased demand for proactive

nutrition, wins with taste systems and natural extracts, and a

number of launches in plant-based beverages. Snacks delivered very

good growth through new savoury taste systems and healthier

snacking, while growth in the Meals EUM was supported by culinary

taste systems and health & wellness meals incorporating Kerry's

proactive nutrition portfolio. The foodservice channel was impacted

by restrictions earlier in the period before a return to growth in

March, supported by increased activity right across quick service

restaurants, fast casual and casual dining. The Group also

progressed the development of its new manufacturing facility in

Rome, Georgia in the period.

In LATAM, Brazil delivered strong growth, driven by performance

in Beverage and ice cream within the retail channel, while Mexico

returned to growth and CACAR remained challenged.

The global Pharma EUM delivered good growth, with excipients and

Kerry's Wellmune immunity enhancing technology performing well.

Europe Region

> Overall volume reduction of 2.4%, as recovery trajectory was impacted by restrictions

> Retail channel delivered overall growth led by Meat and Dairy EUMs

> Foodservice channel performance impacted by increased restrictions

The region delivered overall growth in the retail channel

against strong prior year comparatives. This was led by a very

strong performance in Kerry's Meat EUM, with significant new launch

activity in meat-free categories and good growth in meat systems.

Growth in the Dairy EUM in the region was led by innovations within

ice cream. In the period, the foodservice channel saw dine-in

restaurants in many markets closed or operating at reduced capacity

as a result of increased restrictions across the region.

Russia and Eastern Europe delivered a good performance, led by

Snacks and Meat EUMs. In the period the Group announced its

intention to acquire the Spanish company Biosearch Life. This

acquisition is expected to finalise in the second quarter of the

year.

APMEA Region

> Volume growth of 11.7% led by performance in China

> Retail channel delivered strong growth driven by Beverage, Snacks and Bakery EUMs

> Foodservice channel achieved overall growth in the quarter

Overall growth in the region was driven by performances in

China, the Middle East and Australia, while South East Asia

continued to be impacted by ongoing restrictions. In the retail

channel, excellent growth was achieved in the Beverage EUM across

tea, coffee and refreshing beverage. The Snacks and Bakery EUMs

also delivered very strong growth through performance with regional

leaders. Growth in the foodservice channel was led by Beverage and

Meals EUMs, supported by increased LTO activity and a number of new

launches.

The Group made good progress in the development of its new taste

facility in Durban, which will be commissioned later this year. The

construction of a new taste manufacturing facility in Indonesia was

also announced, catering for a wide range of technologies. This

facility will include a new RD&A centre and is expected to be

operational by the end of 2022.

Consumer Foods

Strong underlying volume growth

> Volume growth of 1.0% - led by strong growth in meat snacking

> Pricing of 0.4% reflecting increases in input costs

> Trading margin +20bps primarily due to enhanced product mix

Growth in the division reflected a strong underlying performance

given an estimated 3% customer stocking benefit in the previous

quarter. This was driven by strong growth in snacking primarily

through the Fridge Raiders range, with Cheestrings delivering a

solid performance given school closures, while Oakhouse Foods

continued to have excellent growth in the period.

Richmond had a good performance across the meat sausage range,

while Kerry's plant-based meat-free ranges continued to achieve

excellent growth supported by strong innovation and new launch

activity. Spreadable butter performed well, while sliced meats were

impacted by reduced deli counter operations. Volumes in frozen

meals were initially affected by customer stocking in the previous

quarter, before delivering a strong finish to the period. Chilled

meals achieved strong growth throughout, supported by health &

wellness and plant-based launches.

Financial Review

At the end of March net debt decreased slightly to EUR1.9

billion. The Group's consolidated balance sheet remains strong

which will facilitate the continued organic and acquisitive growth

of Group businesses. As announced on 16 February, the Group has

proposed a final dividend of 60.6 cent per share for approval at

the Annual General Meeting.

Board Changes

The Board has approved the appointment of Mr. Michael Kerr as a

non-Executive Director with effect from 3 May 2021. Michael has

over 36 years of investment management experience having recently

retired after a long and successful career with Capital Group, one

of the world's oldest and largest investment management

organisations. He will bring to the Board a detailed knowledge of

the global equity capital markets, extensive business leadership

skills and insights into the North American market.

Ms. Joan Garahy, having served as a Director for nine years,

will retire from the Board of Directors effective from the

conclusion of the Annual General Meeting to be held later today.

Joan will be succeeded by Dr. Hugh Brady as Senior Independent

Director and by Mr. Tom Moran as Chair of the Remuneration

Committee with effect from 29 April 2021.

Future Prospects

Within Taste & Nutrition, we see strong growth prospects in

the retail channel, with continued recovery in foodservice,

underpinned by a very good innovation pipeline and strong customer

engagement. Our Consumer Foods business has a good growth outlook

supported by continued innovation and the strength of our

brands.

We will continue to invest for growth and enablement of our

business model, while continuing to pursue M&A opportunities

aligned to our strategic growth priorities. The strategic review of

our dairy-related businesses in Ireland and the UK is ongoing.

The Group expects to deliver strong volume growth and adjusted

earnings per share growth in 2021 of 11% to 15% on a constant

currency basis.

Disclaimer: Forward Looking Statements

This Announcement contains forward looking statements which

reflect management expectations based on currently available data.

However actual results may differ materially from those expressed

or implied by these forward looking statements. These forward

looking statements speak only as of the date they were made, and

the Company undertakes no obligation to publicly update any forward

looking statement, whether as a result of new information, future

events or otherwise.

CONTACT INFORMATION

=============================================

Media

Catherine Keogh , Chief Corporate

Affairs Officer

+353 45 930188 | corpaffairs@kerry.com

Investor Relations

Marguerite Larkin , Chief Financial

Officer

+353 66 7182292 | investorrelations@kerry.ie

William Lynch , Head of Investor

Relations

+353 66 7182292 | investorrelations@kerry.ie

Website

www.kerrygroup.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

QRFSEASIUEFSEEL

(END) Dow Jones Newswires

April 29, 2021 02:00 ET (06:00 GMT)

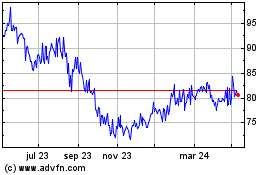

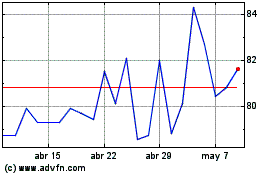

Kerry (LSE:KYGA)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Kerry (LSE:KYGA)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024