Barclays Beat Expectations as Impairments Charges Fall Sharply

30 Abril 2021 - 1:56AM

Noticias Dow Jones

By Pietro Lombardi

Barclays PLC is the latest U.K. bank that beat first-quarter

expectations, and once again provisions for soured loans played a

key role.

The bank posted Friday a quarterly pretax profit of 2.40 billion

pounds ($3.35 billion). This compares with GBP913 million a year

earlier and analysts' expectations of GBP1.76 billion.

Impairments charges dropped sharply to GBP55 million from

GBP2.12 billion. Analysts had expected provisions of GBP503

million.

Results released this week by U.K. peers NatWest Group and

Lloyds Banking Group also beat expectations, as the banks released

some of the money they had stowed away for potential soured

loans.

Net profit at Barclays rose to GBP1.70 billion from GBP605

million, while revenue fell 6%, hit by a 21% decline in net

interest income.

The bank confirmed its medium-term targets. As for this year, it

expects higher costs, while impairments charges should be

significantly below last year's levels. It also expects to reduce

the impairment provision level.

Barclays has accrued an ordinary dividend of 0.75 pence in the

first quarter, but said that this shouldn't be taken as a guidance

for future capital distribution.

Write to Pietro Lombardi at pietro.lombardi@wsj.com;

@pietrolombard10

(END) Dow Jones Newswires

April 30, 2021 02:41 ET (06:41 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

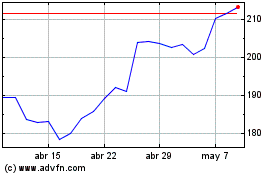

Barclays (LSE:BARC)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

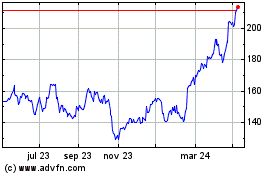

Barclays (LSE:BARC)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024