TIDMBHP

RNS Number : 9760Y

BHP Group PLC

18 May 2021

Issued by: BHP Group Plc

Date: 18 May 2021

To: London Stock Exchange

JSE Limited

For Release: Immediately

Authorised for lodgement Stefanie Wilkinson

by: Group Company Secretary

------------------------------------ ------------------------------------

BHP - Bank of America Metals, Mining and Steel Conference Presentation

--------------------------------------------------------------------------

Financial Conduct Authority Submissions

The following document has today been submitted to the FCA

National Storage Mechanism and will shortly be available for

inspection at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism:

- BHP Bank of America Metals, Mining and Steel Conference Presentation

BHP CEO, Mike Henry, will present at the Bank of America Metals,

Mining and Steel Conference today.

A copy of the speech is attached.

The presentation and speech are available on BHP's website at:

https://www.bhp.com/investor-centre/investor-presentations-and-briefings/

The webcast of the presentation will be available at:

http://www.veracast.com/webcasts/bofa/globalmetalsminingandsteel2021/id8I309l.cfm

BHP Group Plc Registration number 3196209

LEI 549300C116EOWV835768 Registered in England and Wales

Registered Office: Nova South, 160 Victoria Street, London SW1E

5LB United Kingdom

A member of the BHP Group which is headquartered in

Australia

Positioned for the future

Thank you. It's great to have the opportunity to join you

again.

Just before I turn to the main topics I am going to speak to

today, I want to start by saying how pleased I am with how the

company is performing.

We are safer and delivering more reliable performance. This,

coupled with the quality of our assets and our disciplined cost

control, is allowing us to secure maximum benefit from the record

high iron ore and copper prices.

We have delivered a number of major projects in the past twelve

months - the 185 thousand tonne per annum expansion at the Spence

copper asset, Atlantis Phase 3 and the Ruby project in Petroleum,

and in the next few days we will announce first production at the

80 million tonne per annum South Flank iron ore project, with its

higher grade and lump fraction. All brought in on time and on

budget in spite of COVID-19, and perfectly timed given where copper

and iron ore prices are at.

We had the counter-cyclical acquisition of an extra stake in the

Shenzi asset in Petroleum. And we have secured more exploration

partnerships and early stage growth opportunities in copper and

nickel. Finally, we have made marked progress on our efforts to

reduce operational emissions and have signed a number of

partnerships with others in the value chain targeted at reducing

Scope 3 emissions. So overall, the company is really going well at

the moment.

Building upon this strong near term performance though, today I

want to talk about two things:

- Firstly, the critical need for resources in meeting the

world's decarbonisation challenge and to support global economic

growth and development.

- And secondly, BHP's commitment to playing a leading role in

ensuring these demands get met sustainably.

We are optimistic for the future. We believe the world can both

decarbonise and achieve the higher living standards that people

aspire to. We are at the centre of both these aims.

R ecent times have seen greater uncertainty and volatility in

markets and geopolitics, and growing expectations on the part of

shareholders, communities and broader society. In addition, there

are increasing technical and financial challenges in finding and

developing the fresh supply required in some commodities.

Successful companies will be those with a clear strategy and

sense of purpose, who are exceptional operators and allocators of

capital, are in tune with the changing world around them and who

focus on bringing this all together to create long-term value for

all their stakeholders. This is BHP. We have built the

organisational capability, relationships and balance sheet strength

to allow us to thrive in this environment.

The outlook for our commodities is compelling.

Government stimulus and pro-growth agendas, which are expected

to remain in place for an extended period, are anticipated to lead

to robust growth, a lift in inflation and solid demand for mineral

resources and oil and gas.

This is occurring at a time when our industry's capital

discipline and decline in exploration success over a number of

years means there are fewer high quality growth projects in the

industry pipeline to meet this demand.

The drive to more rapidly decarbonise the globe may also

accelerate demand for many of the products we produce. A growing

number of governments are committing to tackling climate change

with greater ambition and are cooperating to do so.

A transition to a world where warming is limited to no more than

1.5 degrees above pre-industrial levels is positive for BHP and

would allow us to create significant value.

In a Paris-aligned scenario (1), we expect a more than doubling

of the amount of primary copper and a quadrupling of the amount of

primary nickel demand over the next 30 years, as was produced over

the last 30. Demand for steel will almost double on this basis, and

potash will be vital for more efficient agricultural practices. And

as the shift to cleaner energy sources occurs, the world will still

need oil and gas to power mobility and everyday life on its pathway

to decarbonisation.

The world is going to need more supply of some commodities in

order to continue to grow and to make the transition to cleaner

energy.

The level of global effort, innovation and coordination to limit

warming to 1.5 degrees is massive. However, the commitment and

intention for the future is becoming clearer.

At BHP for over 130 years we have been reliably providing our

customers with high quality supply of the commodities they need and

for the world to grow. Like our purpose says, we have been bringing

people and resources together to build a better world.

The world is continuing to evolve and it is doing so in a way

that plays to BHP's strengths.

We are running our operations exceptionally well. We are safer,

more reliable, and more productive than ever before. We have now

had almost two and a half years fatality free, an exceptional

result. And our two largest assets, Western Australia Iron Ore and

our Escondida copper mine, have continued to set production and

throughput records, while delivering excellent cost

performance.

We remain hungry to improve. We have redoubled our focus on

becoming even safer. We are systematically unlocking even greater

performance from our equipment and infrastructure. We are enabling

our people and are investing in capability - be it in trade skills,

through our FutureFit Academy and Operations Services, or technical

skills, through our centres of excellence. And we are underpinning

this by ensuring we have an inclusive and diverse workforce.

Our portfolio is well-positioned. We produce commodities

essential to everyday life, global economic growth and the energy

transition. Around 60 per cent (2) of our production is in

commodities that support steel-making, which we anticipate will see

strong demand as the world decarbonises.

Around one quarter (2) of our portfolio is currently in 'future

facing commodities', which for us are copper, nickel and potash,

and we expect to grow this over the coming years. This includes an

increase in average copper production over the next five years of

more than 300 thousand tonnes per annum (3), equivalent to adding

another Spence to the portfolio.

Given our rock-solid foundations of a strong balance sheet and

disciplined approach to capital allocation, we are positioned well

to be able to continue to pursue new opportunities for growth.

As we have done for over a century, we will continue to meet the

world's changing and growing demand for commodities.

There is though an obvious tension between the world's need for

more resources and the need to make the world more sustainable:

both for people and for the environment. It is essential that both

are achieved. Growing demand must be met ever more sustainably.

This requires alignment between resources companies like BHP,

investors and society on how best to navigate this tension. Better

alignment will enable the transition to be achieved more

sustainably, quickly and cost effectively. Conversely, a lack of

alignment will result in poorer sustainability outcomes, and slower

and more costly progress on the energy transition.

BHP is committed to continuing to create value for shareholders

and all of its stakeholders. We will continue to demonstrate

leadership on sustainability, including on climate change.

We have been taking real action on climate for decades. Most of

our assets are already at the lower end of their respective

emissions intensity curves, and we are working to lower them

further.

Consistent with our commitment to reduce operational emissions

by at least 30 per cent by 2030 (4) and be net zero by 2050, a

number of our assets are on the way to having a substantial

portion, or even all, their electricity provided by renewables.

Beyond greening our electricity supplies, we will decarbonise

our mining equipment, through displacing diesel. This is a much

more complex task but we are partnering with industry and equipment

manufacturers to drive this transition.

Outside our operations, we are working with others in our value

chain to develop solutions for hard-to-abate emissions.

For example, we are working with some of the world's leading

steel makers, and with technology start-ups, to identify pathways

and develop technologies to reduce steel-making emissions. Over the

past six months, we have established partnerships with three major

steelmakers in China and Japan, whose combined output equates to

around 10 per cent of global steel production - more than that

produced in all of Europe.

And, as one of the world's largest bulk freight charterers, we

are working with the maritime industry to support greener freight.

We have pioneered the world's first tender for LNG-fuelled bulk

carriers; successfully completed a trial of marine biofuels; and,

just last month, were the only resources company to become a

founding member of the Maritime Decarbonisation Centre to be set up

in Singapore.

These actions are aligned with our commitment to addressing

climate change by reducing our own emissions and by working with

partners to reduce emissions in the value chains in which we

operate.

We believe the future is increasingly clear and our strategy,

portfolio, capabilities and approach to social value position us to

play an important role in meeting the twin objectives of an

accelerated energy transition, and continued economic development

and improvement in living standards. We are committed to doing so

sustainably. And we are well-placed to generate great returns and

value for shareholders and to support others to grow and

prosper.

Thank you.

(1) This speech should be read in conjunction with the BHP

Climate Change Report 2020 available at bhp.com which details our

planning cases and portfolio analysis under a 1.5degC Paris-aligned

Scenario.

(2) Based on FY20 copper equivalent production at FY20 average

realised prices.

(3) Represents average copper production from our existing

operations over the next five years, relative to mid-point of FY21

guidance.

(4) FY2020 baseline will be adjusted for any material

acquisitions and divestments based on greenhouse gas emissions at

the time of the transaction. Carbon offsets will be used as

required.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCGPUMUAUPGUMR

(END) Dow Jones Newswires

May 18, 2021 03:09 ET (07:09 GMT)

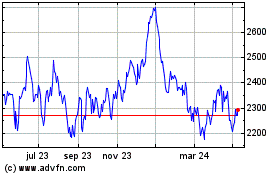

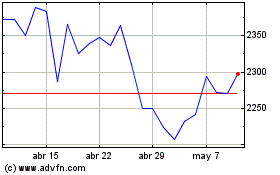

Bhp (LSE:BHP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Bhp (LSE:BHP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024