TIDMBAF

British & American Investment Trust PLC

Annual Financial Report

for the year ended 31 December 2020

Registered number: 00433137

Directors Registered office

David G Seligman (Chairman) Wessex House

Jonathan C Woolf (Managing Director) 1 Chesham Street

Dominic G Dreyfus (Non-executive and Chairman of the Audit Telephone: 020 7201

Committee) 3100

Alex Tamlyn (Non-executive) Registered in

England

No.00433137

27 May 2021

This is the Annual Financial Report as required to be published under DTR 4 of

the UKLA Listing Rules.

Financial Highlights

For the year ended 31 December 2020

2020 2019

Revenue Capital Total Revenue Capital Total

return return return return

£000 £000 £000 £000 £000 £000

Profit/(loss) before tax - 879 (1,230) (351) 862 (1,461) (599)

realised

Profit before tax - - 1,388 1,388 - 1,657 1,657

unrealised

__________ __________ __________ __________ __________ __________

Profit before tax - total 879 158 1,037 862 196 1,058

__________ __________ __________ __________ __________ __________

Earnings per £1 ordinary

share - basic 2.23p 0.63p 2.86p 2.26p 0.78p 3.04p

__________ __________ __________ __________ __________ __________

Earnings per £1 ordinary

share - diluted 2.59p 0.45p 3.04p 2.61p 0.56p 3.17p

__________ _________ __________ __________ _________ __________

Net assets 6,720 6,504

__________ __________

Net assets per ordinary

share

- deducting preference

shares 19p 19p

at fully diluted net

asset value*

__________ __________

- diluted 19p 19p

__________ __________

Diluted net asset value per 21p

ordinary share at 21 May

2021

__________

Dividends declared or

proposed for the period:

per ordinary share

- interim paid 2.7p 2.7p

- final proposed 0.0p 0.0p

per preference share 1.75p 1.75p

Dividends declared after the

period:

per ordinary share - 1st 2.7p

interim

per preference share 1.75p

1st interim dividend declared for the year ended 31 December 2021 of 2.7 pence

per ordinary share payable on 24 June 2021 to shareholders on the register at

11 June 2021. A preference dividend of 1.75 pence will be paid to preference

shareholders on the same date.

*Basic net assets are calculated using a value of fully diluted net asset value

for the preference shares.

Chairman's Statement

I report our results for the year ended 31 December 2020. As announced on 22nd

April, we have delayed the release of these results by one month in accordance

with the current guidance of the Financial Conduct Authority (FCA) and the

Financial Reporting Council (FRC) concerning the reporting by listed companies

of their results in the context of the ongoing Covid-19 pandemic.

Our interim results to 30th June 2020 were reported on a delayed basis at the

end of October 2020 and at the time we explained in some detail the how the

Covid-19 pandemic was impacting our operations in various ways, including in

terms of the corporate reporting timetable, disruption to general business

activity, markets, investment valuations and dividends.

Revenue

The return on the revenue account before tax amounted to £0.9 million (2019: £

0.9 million), unchanged from 2019 but a significantly lower level from prior

years when higher levels of dividends from external investments were being

received. In 2020, dividend income was severely impacted by the Covid-19

pandemic as companies cut or skipped payments altogether; however, this impact

was partially reduced by dividends received from our subsidiary companies

during the year.

Gross revenues totalled £1.4 million (2019: £1.2 million). In addition, film

income of £84,000 (2019: £106,000) and property unit trust income of £14,000

(2019: £14,000) was received in our subsidiary companies. In accordance with

IFRS10, these income streams are not included within the revenue figures noted

above.

The total return before tax amounted to a profit of £1.0 million (2019: £1.1

million profit), which comprised net revenue of £0.9 million, a realised loss

of £1.2 million and an unrealised gain of £1.3 million. The revenue return per

ordinary share was 2.2p (2019: 2.3p) on an undiluted basis and 2.6p (2019:

2.6p) on a diluted basis.

Net Assets and Performance

Net assets at the year end were £6.7 million (2019: £6.5 million), an increase

of 3.3 percent, after payment of £0.9 million in dividends to shareholders

during the year. This compares to decreases in the FTSE 100 and All Share

indices of 14.3 percent and 12.5 percent, respectively, over the period. On a

total return basis, after adding back dividends paid during the year, our net

assets increased by 16.4 percent compared to decreases of 11.5 percent and 9.8

percent in the FTSE 100 and All Share indices, respectively.

This substantial outperformance in total return of 25 percent against the

benchmark indices was principally the result of gains of 12 percent in sterling

terms in the value of our largest US investment, Geron Corporation, and of 90

percent in our second largest US investment, Lineage Cell Therapeutics Inc (a

combination of two previously held regenerative medicine stem cell companies,

Biotime Inc and Asterias Biotherapeutics Inc). By contrast, our UK stock

investments declined in line with the widespread falls in the UK market due to

the unprecedented effects the Covid-19 pandemic felt throughout the year.

More generally, the economic shock of the Covid-19 pandemic completely

overshadowed all other considerations in 2020. In our last report in October,

we described in some detail the nature and extent of the damage which the

pandemic had caused globally to a vast array of activities worldwide. These

included corporate activity and profits, employment levels, working practices,

basic social interactions, GDP, government debt, economic stimulus measures and

interest rates.

At that time, the first wave of the pandemic had passed through most countries

and a second winter wave whose likely effect was not fully known was expected.

As reported, equity markets had begun to recover by the summer from the

precipitous declines of the first quarter and by the year end the US market had

regained its year-opening level, while in the UK almost half of the 35 percent

drop in March had been retraced.

The effect of the lockdowns in the first half on GDP was severe, with falls of

23 percent in the UK and 35 percent in the USA being recorded. As the economies

began to be opened up in the summer, these falls were reduced to 10 percent and

4 percent for the year as a whole, respectively. These are nevertheless

extremely large declines which have never before been experienced in peacetime

and in the UK not for 300 years. As a result, similarly unprecedented effects

were seen on other major economic metrics such as government borrowing and

levels of debt as governments introduced unprecedented measures to support

their citizenry and businesses. In the UK, total government borrowing jumped by

300 percent to £300 billion and debt rose to over £2 trillion, representing 100

percent of GDP, the highest level since the Second World War.

When it arrived at year-end, the winter wave of the pandemic, which was

augmented by more virulent variants of the virus, turned out to be even more

disruptive than the first wave with a series of lockdowns being imposed in most

developed countries. Numbers of infections and deaths spiked in the UK in the

first quarter of 2021 at levels considerably higher than in the first wave in

2020. Despite this, the periods of reopening in the second half of 2020, a

better understanding of how to manage the virus and the implementation of a

highly successful vaccination programme have allowed the UK economy to avoid

the damage of a double dip recession which supported equity markets through to

the New Year.

Dividend

Due to the unprecedented disruption caused to markets by the Covid-19 pandemic

in 2020 and the severe decline in dividends paid by companies last year, we do

not recommend the payment of a final dividend for the 2020 financial year.

We do, however, intend to pay a first interim dividend of 2.70 pence per

ordinary share for the year to 31st December 2021, payable on 24th June, which

is approximately the date on which a final dividend would have been paid. This

is to take account of the timing of income receipts this year into our

distributable reserves.

When added to the dividend of 2.70 pence paid in December 2020, this represents

a yield of approximately 18 percent on the ordinary share price averaged over a

period of 12 months.

Although we have regrettably not been able to continue for the time being the

policy of progressive dividend payments which we had followed for many years,

this level of yield has nevertheless sustained significant market interest in

our stock in recent months, with the shares trading at a significant premium to

NAV and higher than average daily volumes being seen.

As noted in last year's annual report, it is our intention to resume our normal

dividend payments as soon as possible, as and when circumstances permit. We

will also endeavour, through ad hoc interim payments not necessarily on our

normal dividend timetable, to catch up when and if possible on withheld or

reduced payments.

Recent events and outlook

Despite the severity of the winter phase of the pandemic during the first

quarter of 2021, equity markets in the USA and UK have risen steadily this

year, building on the positive momentum which followed the election of

President Biden in November, with the US market pulling steadily ahead of the

record high achieved in December 2020. For some time now, markets have been

looking forward to the economic recovery expected as the pandemic wanes and

lockdowns or restrictions are finally lifted or reduced. Company profits are

beginning to grow again and a very large retail savings balance has been built

up over the past year, ready to be spent when restrictions are lifted.

While the near term prospects for markets and businesses appear favourable,

therefore, this may only be temporary until the longer term damage caused by

the pandemic in terms of permanently lost GDP and jobs becomes evident. While a

strong bounce in GDP is still forecast for 2021 despite the considerably longer

than expected duration of the pandemic, economic activity is unlikely to return

to its pre-2020 levels until 2022 and will not account for the lost production

in the meantime. Also, long term damage to jobs which for the time being has

been disguised by governments' emergency support schemes is likely to become

evident later in the year as these schemes are withdrawn.

For these reasons and their resulting effects on other important economic

indicators such as government deficits, borrowing levels, interest rates and

inflation, the medium term outlook for markets and investment looks very

uncertain.

Having trimmed some of our general sterling based investments over the last two

years which we do not expect to replace in the foreseeable future, our

portfolio has become more focused on our US biopharma investments which do not

tend to track general market movements and which we believe hold significant

investment promise as they progress steadily towards commercialisation of their

ground-breaking and valuable technologies.

As at 21 May 2021, our net assets had increased to £7.4 million, an increase of

9.6 percent since the beginning of the calendar year. This is equivalent to

21.0 pence per share (prior charges deducted at fully diluted value) and 21.0

pence per share on a diluted basis. Over the same period the FTSE 100 increased

8.6 percent and the All Share Index increased 9.0 percent.

David Seligman

27 May 2021

Managing Director's report

As reported above, equity markets in the USA and UK rebounded strongly by the

end of 2020 following precipitous drops at the end of the first quarter as

economies were shut down to combat the Covid-19 pandemic. In the USA, the

market rose 65 percent from its lows in March, regaining its year opening level

by September and reaching an all time high by year end, returning the market to

its 12 year bull run since the financial crisis of 2008/9.

US equity prices have continued to push forward strongly into 2021 following

the election of President Biden and the passing in Congress of his

multi-trillion dollar "American Rescue" and "American Family" plans to support

businesses and citizens out of the economic crisis caused by the pandemic.

Continued substantial and long-term monetary support from the Federal Reserve

through ultra-low interest rates and quantitative easing programmes have also

underpinned equities. Added to which, the rapid acceleration of the highly

successful vaccine programme in the first quarter has paved the way for a

re-opening of the economy with a major boost to corporate investment and retail

spending.

Consequently, equities look set to benefit for some time from a return to

normal activity, with the only major cloud on the horizon being the risk of

growing inflation indications leading to an earlier than expected end to the

highly accommodative monetary policy of recent years, which had been extended

over the past year by the pandemic. Recent comments from the new Secretary of

Finance, Janet Yellen, who used to be Federal Reserve Chairman did in fact

refer to just such an eventuality. As has been seen many times, long-term bull

markets based on monetary stimulus can react quite suddenly and violently to

even the discussion of such pivot points in interest rate trends, as was

notably the case in 2013 with the 'taper tantrum' in the bond markets when US

treasury yields surged abruptly. In recent months, yields in the US bond market

have also risen out of concern at the enormous government spending commitments

of the recovery plans and usually such movements eventually result in equity

market weakness as bond and equity yields rebalance, particularly so given the

continuing lower levels of dividends being paid by companies. This result may

take longer than usual to appear under current circumstances as the pent up

post-pandemic demand in the economy is released and the stimulus of the

administration's 'Build Back Better' infrastructure investment programme washes

through the economy. However, higher levels of equity market volatility in

recent weeks could presage the beginning of this process.

In the UK, the equity market followed a similar pattern in 2020, although it

did not enjoy a similar level of rebound from the March lows, regaining only 50

percent of its 35 percent drop by the third quarter and ending the year down by

14 percent. The market had drifted down during the second half as discussions

with the EU on a post Brexit trade agreement remained unresolved and then the

prospect of a second winter lockdown loomed as post-summer Covid-19 infection

rates began to rise considerably. It was not until November that this steady

decline reversed, rallying by 15 percent following the election of President

Biden and the strongly positive response shown by the US equities.

Since the year end, the UK market has risen a further 10 percent, an increase

of 35 percent since its 2020 low and now just 6 percent below its 2020 high.

The highly effective and world-beating vaccine rollout of the last few months,

resulting in substantially lower levels of Covid-19 infections,

hospitalisations and deaths has significantly boosted confidence of a gradual

return to normality and equity markets have reacted accordingly. Businesses,

particularly in the travel and retail sectors, are also preparing for

substantially higher levels of activity in the months to come as the high

levels of savings built up over the past year are expected to be drawn down in

a retail spending boom.

Comments made above in relation to the medium term prospects for equities in

the USA are likely to apply also to the UK. The question for the medium term,

assuming the virus is kept under control through vaccinations, is how the

various balances in returning the economy and business to normal will play out

over the coming years. The sizeable pent up demand and relief will boost

business activity significantly in the short term and UK GDP is now thought

likely to return to pre-pandemic levels somewhat earlier than expected.

However, pressure will be put on prices, as is already beginning to be seen in

the USA, presaging a return to more normal levels of interest rates which would

be negative for equities.

At the same time, however, as the government removes its emergency support and

stimulus measures later in the year, the true extent of the damage wreaked by

the pandemic over the last year on businesses and employment is likely to be

revealed, placing downward pressure on the economy and sentiment. Further such

pressure is also likely to arrive in the form of additional taxes yet to be

announced to repair the historically high levels of deficit and debt run up by

the government to combat the pandemic. As in the USA, however, the UK

government has a long term programme of infrastructure renewal and investment,

in the UK's case its 'Levelling up' programme, which should add substantial

stimulus to the economy as a whole. This may be sufficient over the medium

term to counterbalance the permanently lost growth of the past 18 months due to

the pandemic. Thus, an overall picture of short-term strength in equity markets

followed by a period of retrenchment and weakness can realistically be

envisaged.

As noted above, our portfolio strongly outperformed the benchmarks in 2020,

primarily due to our long term investments in US biotech stocks, despite a

headwind presented by a weaker US dollar over the year.

In the case of Geron, the ongoing recovery in Geron's share price reflected the

company's efforts to demonstrate that its clinical oncology drug programme

remains on track with ever improving results. During 2020, a number of positive

developments occurred, including the announcement of FDA agreement for a second

Phase 3 trial in Myelofibrosis (MF), which has now commenced enrolment, to add

to its continuing Phase 3 trial in Myelodysplastic Syndrome (MDS) and the

completion of a $140 million equity fundraising in which leading biotech sector

investment funds took large positions. In addition, over the past year, further

high level technical personnel hires have been made from leading pharma

companies, including from previous partner Johnson & Johnson, accompanied by

the award of substantial new employee inducement shares, which are an

indication of the confidence such new employees have in Geron's future

prospects.

In the case of Lineage Cell Therapeutics Inc, our second largest US

biotechnology investment, its share price has now risen by over 200 percent

since the beginning of 2020, recovering to its pre-2019 levels when it combined

with our previously third largest biotechnology investment, Asterias

Biotherapeutics Inc, both being stem cell based regenerative medicine

companies. At the same time, it spun off a third smaller company, Agex

Therapeutics Inc, in which we remain invested. The market has re-rated this

stock following the re-organisation and favourable Phase 2 clinical trial

results which have improved the prospects for its two principal stem cell

programmes. The first in spinal cord injury repair which was acquired with

Asterias Biotherapeutics and the second, its own trial in Dry AMD, a widespread

degenerative condition of the retina causing blindness with no currently

approved or effective treatment.

Jonathan Woolf

27 May 2021

Income statement

For the year ended 31 December 2020

2020 2019

Revenue Capital Total Revenue Capital Total

return return return return

£ 000 £ 000 £ 000 £ 000 £ 000 £ 000

Investment income (note 2) 1,372 - 1,372 1,243 - 1,243

Holding gains on investments 1,388 1,388 1,657 1,657

at fair value through profit - -

or loss

Losses on disposal of

investments at fair value - (960) (960) - (1,113) (1,113)

through profit or loss*

Foreign exchange (losses)/ (44) (13) (57) 53 (57) (4)

gains

Expenses (400) (242) (642) (381) (242) (623)

________ ________ ________ ________ ________ ________

Profit before finance costs 928 173 1,101 915 245 1,160

and tax

Finance costs (49) (15) (64) (53) (49) (102)

________ ________ ________ ________ ________ ________

Profit before tax 879 158 1,037 862 196 1,058

Tax 29 - 29 52 - 52

________ ________ ________ ________ ________ ________

Profit for the year 908 158 1,066 914 196 1,110

________ ________ ________ ________ ________ ________

Earnings per share

Basic - ordinary shares 2.23p 0.63p 2.86p 2.26p 0.78p 3.04p

________ ________ ________ ________ ________ ________

Diluted - ordinary shares 2.59p 0.45p 3.04p 2.61p 0.56p 3.17p

________ ________ ________ ________ ________ ________

The company does not have any income or expense that is not included in the

profit for the year. Accordingly, the 'Profit for the year' is also the 'Total

Comprehensive Income for the year' as defined in IAS 1 (revised) and no

separate Statement of Comprehensive Income has been presented.

The total column of this statement represents the Income Statement, prepared in

accordance with IFRS. The supplementary revenue return and capital return

columns are both prepared under guidance published by the Association of

Investment Companies. All items in the above statement derive from continuing

operations.

All profit and total comprehensive income is attributable to the equity holders

of the company.

*Losses on disposal of investments at fair value through profit or loss include

Losses on sales of £613,000 (2019 - £1,274,000 losses) and Losses on provision

for liabilities and charges of £347,000 (2019 - £161,000 gains).

Statement of changes in equity

For the year ended 31 December 2020

Share Capital Retained Total

capital reserve earnings

£ 000 £ 000 £ 000 £ 000

Balance at 31 December 2018 35,000 (28,802) 1,721 7,919

Changes in equity for 2019

Profit for the period - 196 914 1,110

Ordinary dividend paid (note 4) - - (2,175) (2,175)

Preference dividend paid (note 4) - - (350) (350)

________ ________ ________ ________

Balance at 31 December 2019 35,000 (28,606) 110 6,504

Changes in equity for 2020

Profit for the period - 158 908 1,066

Ordinary dividend paid (note 4) - - (675) (675)

Preference dividend paid (note 4) - - (175) (175)

________ ________ ________ ________

Balance at 31 December 2020 35,000 (28,448) 168 6,720

________ ________ ________ ________

Registered number: 00433137

Balance Sheet

At 31 December 2020

2020 2019

£ 000 £ 000

Non-current assets

Investments - fair value through 6,436 6,704

profit or loss

Subsidiaries - fair value through 5,719 5,335

profit or loss

__________ __________

12,155 12,039

Current assets

Receivables 1,605 1,588

Cash and cash equivalents 394 2,504

__________ __________

1,999 4,092

__________ __________

Total assets 14,154 16,131

__________ __________

Current liabilities

Trade and other payables 3,003 3,617

Bank loan 687 2,635

__________ __________

(3,690) (6,252)

__________ __________

Total assets less current liabilities 10,464 9,879

__________ __________

Non - current liabilities (3,744) (3,375)

__________ __________

Net assets 6,720 6,504

__________ __________

Equity attributable to equity holders

Ordinary share capital 25,000 25,000

Convertible preference share capital 10,000 10,000

Capital reserve (28,448) (28,606)

Retained revenue earnings 168 110

__________ __________

Total equity 6,720 6,504

__________ __________

Approved: 27 May 2021

Cash flow statement

For the year ended 31 December 2020

Year ended Year ended

2020 2019

£ 000 £ 000

Cash flows from operating activities

Profit before tax 1,037 1,058

Adjustments for:

Gains on investments (428) (544)

Proceeds on disposal of investments at fair 2,619 16,316

value through profit and loss

Purchases of investments at fair value through (2,415) (14,521)

profit and loss

Finance costs 64 102

__________ __________

Operating cash flows before movements in working 877 2,411

capital

Decrease in receivables 34 2,417

Decrease in payables (192) (363)

__________ __________

Net cash from operating activities before 719 4,465

interest

Interest paid (31) (97)

__________ __________

Net cash from operating activities 688 4,368

Cash flows from financing activities

Dividends paid on ordinary shares (675) (1,778)

Dividends paid on preference shares (175) (175)

Bank loan (1,948) (155)

__________ __________

Net cash used in financing activities (2,798) (2,108)

__________ __________

Net (decrease)/increase in cash and cash (2,110) 2,260

equivalents

Cash and cash equivalents at beginning of year

2,504 244

__________ __________

Cash and cash equivalents at end of year

394 2,504

__________ __________

Purchases and sales of investments are considered to be operating activities of

the company, given its purpose, rather than investing activities.

1 Basis of preparation and going concern

The financial information set out above contains the financial information of

the company for the year ended 31 December 2020. The company has prepared its

financial statements under IFRS. The financial statements have been prepared on

a going concern basis adopting the historical cost convention except for the

measurement at fair value of investments, derivative financial instruments and

subsidiaries.

The information for the year ended 31 December 2020 is an extract from the

statutory accounts to that date. Statutory company accounts for 2019, which

were prepared under IFRS as adopted by the EU, have been delivered to the

registrar of companies and company statutory accounts for 2020, prepared under

IFRS as adopted by the EU, will be delivered in due course.

The auditors have reported on the 31 December 2020 year end accounts and their

reports were unqualified and did not include references to any matters to which

the auditors drew attention by way of emphasis without qualifying their reports

and did not contain statements under section 498(2) or (3) of the Companies Act

2006.

The directors, having made enquiries, consider that the company has adequate

financial resources to enable it to continue in operational existence for the

foreseeable future. Accordingly, the directors believe that it is appropriate

to continue to adopt the going concern basis in preparing the company's

accounts.

2 Income

2020 2019

£ 000 £ 000

Income from investments

UK dividends 221 938

Overseas dividends - 173

Dividend from subsidiary 1,066 74

_________ __________

1,287 1,185

Other income 85 58

_________ __________

Total income 1,372 1,243

_________ __________

Total income comprises:

Dividends 1,287 1,185

Other interest 85 58

_________ __________

1,372 1,243

_________ __________

Dividends from investments

Listed investments 221 1,111

Unlisted investments 1,066 74

_________ __________

1,287 1,185

_________ __________

Of the £1,287,000 (2019 - £1,185,000) dividends received, £90,000 (2019 - £

879,000) related to special and other dividends received from investee

companies that were bought after the dividend announcement. There was a

corresponding capital loss of £324,000 (2019 - £1,027,000), on these

investments.

Under IFRS 10 the income analysis is for the parent company only rather than

that of the consolidated group. Thus film revenues of £84,000 (2019 - £106,000)

received by the subsidiary British & American Films Limited and property unit

trust income of £14,000 (2019 - £14,000) received by the subsidiary BritAm

Investments Limited are shown separately in this paragraph.

3 Earnings per ordinary share

The calculation of the basic (after deduction of preference dividend) and

diluted earnings per share is based on the following data:

2020 2019

Revenue Capital Total Revenue Capital Total

return return return return

£ 000 £ 000 £ 000 £ 000 £ 000 £ 000

Earnings:

Basic 558 158 716 564 196 760

Preference

dividend 350 - 350 350 - 350

__________ __________ __________ __________ __________ __________

Diluted 908 158 1,066 914 196 1,110

__________ __________ __________ __________ __________ __________

Basic revenue, capital and total return per ordinary share is based on the net

revenue, capital and total return for the period after tax and after deduction

of dividends in respect of preference shares and on 25 million (2019: 25

million) ordinary shares in issue.

The diluted revenue, capital and total return is based on the net revenue,

capital and total return for the period after tax and on 35 million (2019: 35

million) ordinary and preference shares in issue.

4 Dividends

2020 2019

£ 000 £ 000

Amounts recognised as distributions to equity

holders in the period

Dividends on ordinary shares:

Final dividend for the year ended 31 December 2019

of 0.0p - 1,500

(2018: 6.0p) per share

Interim dividend for the year ended 31 December

2020 of 2.7p 675 675

(2019: 2.7p) per share

__________ __________

675 2,175

__________ __________

Proposed final dividend for the year ended 31

December 2020 of 0.0p (2019: 0.0p) per share - -

__________ __________

Dividends on 3.5% cumulative convertible

preference shares:

Preference dividend for the 6 months ended 31

December 2019 of 0.00p (2018: 1.75p) per share - 175

Preference dividend for the 6 months ended 30 June

2020 of 1.75p (2019: 1.75p) per share 175 175

__________ __________

175 350

__________ __________

Proposed preference dividend for the 6 months

ended 31 December 2020 of 0.00p (2019: 0.00p) per - -

share

__________ __________

We have set out below the total dividend payable in respect of the financial

year, which is the basis on which the retention requirements of Section 1158 of

the Corporation Tax Act 2010 are considered.

Dividends proposed for the period

2020 2019

£ 000 £ 000

Dividends on ordinary shares:

Interim dividend for the year ended 31 December

2020 of 2.7p 675 675

(2019: 2.7p) per share

Proposed final dividend for the year ended 31

December 2020 of 0.0p (2019: 0.0p) per share - -

__________ __________

675 675

__________ __________

Dividends on 3.5% cumulative convertible

preference shares:

Preference dividend for the year ended 31 December

2020 of 1.75p (2019: 1.75p) per share 175 175

Proposed preference dividend for the year ended 31

December 2020 of 0.00p (2019: 0.00p) per share - -

__________ __________

175 175

__________ __________

The non-payment in December 2019 and in December 2020 of the dividend of 1.75

pence per share on the 3.5% cumulative convertible preference shares,

consequent upon the non-payment of a final dividend on the ordinary shares for

the year ended 31 December 2019 and for the year ended 31 December 2020, has

resulted in arrears of £350,000 on the 3.5% cumulative convertible preference

shares.

1st interim dividend declared for the year ended 31 December 2021 of 2.7 pence

per ordinary share payable on 24 June 2021 to shareholders on the register at

11 June 2021. A preference dividend of 1.75 pence will be paid to preference

shareholders on the same date.

5 Net asset values

Net asset

value per share

2020 2019

£ £

Ordinary shares

Diluted 0.19 0.19

Undiluted 0.19 0.19

Net asset

attributable

2020 2019

£ 000 £ 000

Total net assets 6,720 6,504

Less convertible preference shares at (1,920) (1,858)

fully diluted value

__________ __________

Net assets attributable to ordinary 4,800 4,646

shareholders

__________ __________

The undiluted and diluted net asset values per £1 ordinary share are based on

net assets at the year end and 25 million (undiluted) ordinary and 35 million

(diluted) ordinary and preference shares in issue.

Principal risks and uncertainties

The principal risks facing the company relate to its investment activities and

include market risk (other price risk, interest rate risk and currency risk),

liquidity risk and credit risk. The other principal risks to the company are

loss of investment trust status and operational risk. These will be explained

in more detail in the notes to the 2020 Annual Report and Accounts, but remain

unchanged from those published in the 2019 Annual Report and Accounts.

Related party transactions

The company rents its offices from Romulus Films Limited, and is also charged

for its office overheads.

The salaries and pensions of the company's employees, except for the three

non-executive directors and one employee are paid by Remus Films Limited and

Romulus Films Limited and are recharged to the company.

During the year the company entered into the investment transactions to sell

stock for £nil (2019 - £540,141) to British & American Films Limited and for £

455,000 (2019 - £ nil) to BritAm Investments Limited.

There have been no other related party transactions during the period, which

have materially affected the financial position or performance of the company.

Capital Structure

The company's capital comprises £35,000,000 (2019 - £35,000,000) being

25,000,000 ordinary shares of £1 (2019 - 25,000,000) and 10,000,000 non-voting

convertible preference shares of £1 each (2019 - 10,000,000). The rights

attaching to the shares will be explained in more detail in the notes to the

2020 Annual Report and Accounts, but remain unchanged from those published in

the 2019 Annual Report and Accounts.

Directors' responsibility statement

The directors are responsible for preparing the financial statements in

accordance with applicable law and regulations. The directors confirm that to

the best of their knowledge the financial statements prepared in accordance

with the applicable set of accounting standards, give a true and fair view of

the assets, liabilities, financial position and the (loss)/profit of the

company and that the Chairman's Statement, Managing Director's Report and the

Directors' report include a fair review of the information required by rules

4.1.8R to 4.2.11R of the FSA's Disclosure and Transparency Rules, together with

a description of the principal risks and uncertainties that the company faces.

Annual General Meeting

This year's Annual General Meeting has been convened for Tuesday 29 June 2021

at 12.15pm at Wessex House, 1 Chesham Street, London SW1X 8ND.

END

(END) Dow Jones Newswires

May 27, 2021 06:09 ET (10:09 GMT)

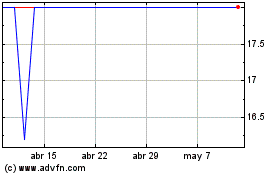

British & American Inves... (LSE:BAF)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

British & American Inves... (LSE:BAF)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024