NZ Dollar Drops After Weak China Data; Nonfarm Payrolls Eyed

02 Junio 2021 - 10:23PM

RTTF2

The NZ dollar fell against its major counterparts in the Asian

session on Thursday, as China's service sector activity slowed in

May and investors awaited key U.S. economic data that could set the

tone of policy.

Data from IHS Markit showed that China's services sector

expanded at a slower pace in May.

The Caixin services Purchasing Managers' Index dropped to 55.1

in May from a four-month high of 56.3 in April. Nonetheless, the

score remained firmly above the neutral 50.0 level to suggest a

marked growth in activity.

ADP private payrolls data and initial jobless claims are due

later in the day, followed by monthly jobs report on Friday. The

data could offer more clues on economic recovery and whether the

rebound will accelerate inflation, triggering a tightening of

monetary policy.

The Federal Reserve's announcement to begin gradually selling

corporate bond holdings purchased through an emergency lending

facility introduced last year served as a signal of termination in

pandemic support.

The kiwi depreciated to a 9-day low of 0.7208 against the

greenback, pulling away from its early high of 0.7242. On the

downside, 0.70 is possibly found as its next support level.

The kiwi declined to 8-day lows of 79.15 against the yen, 1.6909

against the euro and 1.0720 against the aussie, after rising to

79.39, 1.6855 and 1.0694, respectively in early deals. The kiwi is

seen locating support around 76.00 against the yen, 1.70 against

the euro and 1.09 against the aussie.

Looking ahead, PMI reports from major European economies are due

in the European session.

U.S. ADP private payrolls data for May is scheduled for release

at 8:15 am ET.

The U.S. weekly jobless claims for the week ended May 29 and ISM

services PMI for May will be released in the New York session.

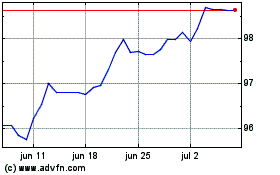

NZD vs Yen (FX:NZDJPY)

Gráfica de Divisa

De Mar 2024 a Abr 2024

NZD vs Yen (FX:NZDJPY)

Gráfica de Divisa

De Abr 2023 a Abr 2024