TIDMTEM

RNS Number : 9262A

Templeton Emerging Markets IT PLC

04 June 2021

Stock Exchange Announcement

Statement of Annual Results

TEMPLETON EMERGING MARKETS INVESTMENT TRUST PLC

("TEMIT" or "the Company")

Legal Entity Identifier 5493002NMTB70RZBXO96

Company Overview

Launched in June 1989, Templeton Emerging Markets Investment

Trust PLC ("TEMIT" or the "Company") is an investment trust that

invests principally in emerging markets companies with the aim of

delivering capital growth to shareholders over the long term. While

the majority of the Company's shareholders are based in the UK,

shares are traded on both the London and New Zealand stock

exchanges.

TEMIT has a diversified portfolio of around 80 high quality

companies, actively selected for their long-term growth potential,

sustainable earnings and with due regard to environmental, social

and governance ("ESG") attributes. TEMIT's research-driven

investment approach and strong long-term performance has helped it

to grow to be the largest emerging markets investment trust in the

UK, with assets of GBP2.6 billion as at 31 March 2021. Since launch

to 31 March 2021, TEMIT's net asset value ("NAV") total return was

+4,629.5% compared to the benchmark total return of +1,930.4%.

The Company is governed by a Board of Directors who are

committed to ensuring that shareholders' best interests, taking

into account the wider community of stakeholders, are at the

forefront of all decisions. Under the guidance of the Chairman, the

Board of Directors is responsible for the overall strategy of the

Company and monitoring its performance.

TEMIT at a glance

For the year to 31 March 2021

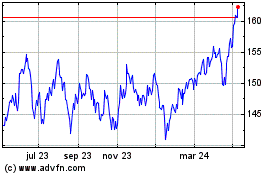

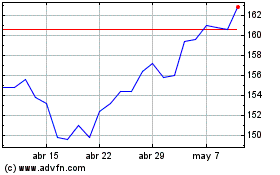

Total return for the year to 31 March 2021

Net asset value(a) Share price(a) Benchmark(a)(b)

54.5% 59.5% 42.8%

(2020: -11.2%) (2020: -12.1%) (2020: -13.2%)

--------------------------------- ----------------- ----------------

Dividends for the year to 31 March 2021(c)

Proposed total ordinary dividend Special dividend

19.00p 10.00p

(2020: 19.00p) (2020: 2.60p)

----------------------------------- ---------------------------------

(a) A glossary of alternative performance measures is included

on pages 112 and 113 of the full Annual Report.

(b) Source: MSCI. The Company's benchmark is the MSCI Emerging

Markets Index, with net dividends reinvested.

(c) An annual ordinary dividend of 19.00 pence per share for the

year ended 31 March 2021 has been proposed. This comprises the

interim dividend of 5.00 pence per share paid by the Company on 11

January 2021 and the proposed final dividend of 14.00 pence per

share. In addition, a special dividend of 10.00 pence per share was

paid by the Company on 11 January 2021.

Strategic Report

The Directors present the Strategic Report for the year ended 31

March 2021, which incorporates the Chairman's Statement, and has

been prepared in accordance with the Companies Act 2006.

The aim of the Strategic Report is to provide shareholders with

the ability to assess how the Directors have performed in their

duty to promote the success of the Company for shareholders'

collective benefit, and having regard for the interests of all

stakeholders, by bringing together in one place key information

about the Company's strategy, the risks it faces, how it is

performing and the outlook.

Financial Summary

2020-2021

Year ended Year ended Capital Total

31 March 31 March return return

2020-2021 Notes 2021 2020 % %

--------------------------------------- ------- ----------- ----------- -------- --------

Total net assets (GBP million) 2,591.3 1,775.7

------------------------------------------------ ----------- ----------- -------- --------

Net asset value (pence per share) (a) 1,096.9 732.3 50.9 54.5

--------------------------------------- ------- ----------- ----------- -------- --------

Highest net asset value (pence per

share) 1,177.8 971.4

------------------------------------------------ ----------- ----------- -------- --------

Lowest net asset value (pence per

share) 706.1 705.6

------------------------------------------------ ----------- ----------- -------- --------

Share price (pence per share) (a) 1,012.0 657.0 55.4 59.5

--------------------------------------- ------- ----------- ----------- -------- --------

Highest end of day share price (pence

per share) 1,072.0 876.0

------------------------------------------------ ----------- ----------- -------- --------

Lowest end of day share price (pence

per share) 636.0 578.0

------------------------------------------------ ----------- ----------- -------- --------

MSCI Emerging Markets Index 39.4 42.8

------------------------------------------------ ----------- ----------- -------- --------

Share price discount to net asset

value at year end (a) 7.7% 10.3%

--------------------------------------- ------- ----------- ----------- -------- --------

Average share price discount to net

asset value over the year 11.1% 10.7%

------------------------------------------------ ----------- ----------- -------- --------

Ordinary dividend (pence per share) (b) 19.00 19.00

--------------------------------------- ------- ----------- ----------- -------- --------

Special dividend (pence per share) (c) 10.00 2.60

--------------------------------------- ------- ----------- ----------- -------- --------

Revenue earnings (pence per share) (d) 28.64 24.40

--------------------------------------- ------- ----------- ----------- -------- --------

Capital earnings (pence per share) (d) 363.65 (116.75)

--------------------------------------- ------- ----------- ----------- -------- --------

Total earnings (pence per share) (d) 392.29 (92.35)

--------------------------------------- ------- ----------- ----------- -------- --------

Net gearing (a) 0.5% 0.7%

--------------------------------------- ------- ----------- ----------- -------- --------

Ongoing charges ratio (a) 0.97% 1.02%

--------------------------------------- ------- ----------- ----------- -------- --------

Source: Franklin Templeton and FactSet.

(a) A glossary of alternative performance measures is included

on pages 112 and 113 of the Annual Report.

(b) An annual dividend of 19.00 pence per share for the year

ended 31 March 2021 has been proposed. This comprises the interim

dividend of 5.00 pence per share paid by the Company on 11 January

2021 and a proposed final dividend of 14.00 pence per share.

(c) Special dividend of 10.00 pence per share paid by the

Company on 11 January 2021.

(d) The revenue, capital and total earnings per share figures

are shown in the Statement of Comprehensive Income on page 80 of

the Annual Report and Note 7 of the Notes to the Financial

Statement.

Ten Year Record

2011-2021

--------- ----------- ---------

Revenue

earnings Ongoing

Year-end (pence charges

Total net NAV Share price discount(a) per ratio(a)

Annual

dividend

(pence (pence (pence

Year ended assets (GBPm) per share) per share) (%) share) per share) (%)

-------------- -------------- ------------ ------------ ------------ --------- ----------- ---------

31 March 2011 2,368.4 718.0 660.0 8.1 6.14 4.25 1.31

-------------- -------------- ------------ ------------ ------------ --------- ----------- ---------

31 March 2012 2,098.6 636.3 588.5 7.5 7.91 5.75 1.31

-------------- -------------- ------------ ------------ ------------ --------- ----------- ---------

31 March 2013 2,302.7 702.3 640.5 8.2 8.45 6.25 1.30

-------------- -------------- ------------ ------------ ------------ --------- ----------- ---------

31 March 2014 1,913.6 591.8 527.0 10.9 9.14 7.25 1.30

-------------- -------------- ------------ ------------ ------------ --------- ----------- ---------

31 March 2015 2,045.0 641.2 556.0 13.3 9.28 8.25 1.20

-------------- -------------- ------------ ------------ ------------ --------- ----------- ---------

31 March 2016 1,562.3 524.2 453.9 13.4 7.05 8.25 1.22

-------------- -------------- ------------ ------------ ------------ --------- ----------- ---------

31 March 2017 2,148.1 762.8 661.5 13.3 6.59 8.25 1.20

-------------- -------------- ------------ ------------ ------------ --------- ----------- ---------

31 March 2018 2,300.8 846.0 743.0 12.2 15.90 15.00 1.12

-------------- -------------- ------------ ------------ ------------ --------- ----------- ---------

31 March 2019 2,118.2 842.5 766.0 9.1 17.26 16.00 1.02

-------------- -------------- ------------ ------------ ------------ --------- ----------- ---------

31 March 2020 1,775.7 732.3 657.0 10.3 24.40 19.00(b) 1.02

-------------- -------------- ------------ ------------ ------------ --------- ----------- ---------

31 March 2021 2,591.3 1,096.9 1,012.0 7.7 28.64 19.00(c) 0.97

-------------- -------------- ------------ ------------ ------------ --------- ----------- ---------

Ten year growth record

(rebased to 100.0 at

31 March 2011)

2011-2021

---------

MSCI

Emerging

Year ended Market Revenue

Index earnings Ordinary

NAV total Share Share price total per share dividend

NAV return(a) price total return(a) return - undiluted per share

----------------- ------ ----------- ------- ----------------- --------- ------------ -----------

31 March 2011 100.0 100.0 100.0 100.0 100.0 100.0 100.0

----------------- ------ ----------- ------- ----------------- --------- ------------ -----------

31 March 2012 88.6 89.2 89.2 89.8 91.8 128.8 135.3

----------------- ------ ----------- ------- ----------------- --------- ------------ -----------

31 March 2013 97.8 99.1 97.0 98.8 98.8 137.6 147.1

----------------- ------ ----------- ------- ----------------- --------- ------------ -----------

31 March 2014 82.4 84.6 79.8 82.2 89.0 148.9 170.6

----------------- ------ ----------- ------- ----------------- --------- ------------ -----------

31 March 2015 89.3 92.8 84.2 87.9 100.8 151.1 194.1

----------------- ------ ----------- ------- ----------------- --------- ------------ -----------

31 March 2016 73.0 76.9 68.8 72.9 91.9 114.8 194.1

----------------- ------ ----------- ------- ----------------- --------- ------------ -----------

31 March 2017 106.2 113.7 100.2 108.1 124.3 107.3 194.1

----------------- ------ ----------- ------- ----------------- --------- ------------ -----------

31 March 2018 117.8 127.8 112.6 122.9 138.9 259.0 352.9

----------------- ------ ----------- ------- ----------------- --------- ------------ -----------

31 March 2019 117.3 130.0 116.1 130.3 139.0 281.1 376.5

----------------- ------ ----------- ------- ----------------- --------- ------------ -----------

31 March 2020 102.0 115.5 99.5 114.5 120.7 397.4 447.1

----------------- ------ ----------- ------- ----------------- --------- ------------ -----------

31 March 2021 152.8 178.3 153.3 182.6 172.4 466.4 447.1

----------------- ------ ----------- ------- ----------------- --------- ------------ -----------

Source: Franklin Templeton and FactSet.

(a) A glossary of alternative performance measures is included

on pages 112 and 113 of the Annual Report.

(b) Excludes the special dividend of 2.60 pence per share.

(c) An annual ordinary dividend of 19.00 pence per share for the

year ended 31 March 2021 has been proposed. This comprises the

interim dividend of 5.00 pence per share paid by the Company on 11

January 2021 and a final dividend of 14.00 pence per share. It

excludes the special dividend of 10.00 pence per share paid by the

Company on 11 January 2021.

Chairman's Statement

Market overview and investment performance

At the start of the 12 months under review, equity markets had

begun to recover from the initial shock of the COVID-19 pandemic

outbreak, and investment returns have subsequently been high.

TEMIT's NAV total return was very strong at +54.5%, which exceeded

the return of the benchmark index of +42.8% by a wide margin. This

is the fifth consecutive accounting year that our Investment

Manager has delivered an investment return in excess of the

benchmark, making TEMIT the best performing investment trust in its

peer group(a) over five years. I would like to record the Board's

thanks on behalf of shareholders for this excellent

performance.

(a) Peer group: Global Emerging Markets Investment Trusts.

Source AIC Interactive Statistics.

Revenue and dividend

In April 2020 we were informed by the UK tax authorities that

they agreed our claim for a substantial repayment amounting to 10.0

pence per share, relating to Corporation Tax levied some years ago

along with associated interest.

Excluding the tax repayment and interest, revenue earnings for

the 12 months under review were 17.5 pence per share, compared with

21.8 pence per share for the same period in the prior year (on a

like-for-like basis and excluding an extraordinary receipt of 2.6

pence per share in the prior year). The reduction in core revenue

earnings is largely a result of the COVID-19 pandemic but the

outcome is higher than may have been expected and demonstrates the

resilience of our investment portfolio.

An interim dividend of 5.0 pence per share was paid on 11

January 2021, along with a special dividend of 10.0 pence per share

to distribute the tax repayment to shareholders. The Board

recommends a final dividend of 14.0 pence per share, which is

unchanged from last year. TEMIT has large revenue reserves

amounting to 51.7 pence per share and the Board believes that it is

appropriate to use a small part of these reserves to maintain the

annual dividend at the same level as last year. As usual,

shareholders will be asked to approve the final dividend at the

Annual General Meeting ("AGM").

Asset allocation and borrowing

TEMIT has fixed borrowings of GBP100 million, and a revolving

credit facility under which up to GBP120 million may be drawn down.

During the period under review, in the light of the continuing

COVID-19 pandemic and likely market volatility, the Investment

Manager took a cautious approach and elected not to borrow under

the revolving credit facility and cash held in the portfolio

largely offset the fixed borrowing.

Proposed adjustments to investment policy

The Board is proposing certain amendments to TEMIT's investment

policy and shareholders will be asked to approve a revised policy

at this year's AGM. The key changes are:

(i) The maximum proportion of assets that may be invested in one

company to increase from 10% to 12%, measured at the time of

investment.

This proposed change recognises that there are a number of very

large and world-leading companies based in emerging markets that

have grown to become a significant part of the benchmark. In

proposing this change the Board is conscious that TEMIT should

maintain a portfolio with an appropriate level of

diversification.

We believe that it is in shareholders' best interests to provide

TEMIT this additional flexibility to enable it to hold active

positions in companies that reflect the Investment Manager's

conviction while being conscious of the balance between risk and

potential reward.

(ii) Up to 10% of assets may be invested in unlisted securities

with a limit of 2% per individual investment, measured at the time

of investment.

TEMIT's Investment Manager has recently been aware of a number

of opportunities to invest in unlisted securities, particularly

companies in the final stage of private funding before a planned

public listing. The majority of investments will remain in listed

companies but this proposed change provides a limited ability for

TEMIT to invest in unlisted securities.

(iii) Maximum gearing to increase from 10% to 20%, measured at

the time of borrowing.

While there is no current intention to increase gearing to 20%,

the Board is requesting that shareholders approve an increase in

gearing limits so that the Board and Investment Manager have

additional flexibility to capture future investment

opportunities.

In summary, these proposed changes are designed to increase

flexibility in managing the portfolio but shareholders should not

expect any fundamental change to our Investment Manager's

established approach to investment. A full description of the

proposed changes is included on pages 9 and 10 of the Annual Report

and shareholders will be asked to approve the revised investment

policy at the AGM.

The discount

In the Chairman's Statement at the half-year stage I noted that

the discount had been "stubbornly wide" with a relatively low level

of demand for the shares. Since then the position has improved and,

at the end of the financial year, the discount was 7.7%.

We continue to be active in promoting TEMIT's shares using a

variety of marketing tools with the aim of increasing demand for

the shares. We have a substantial annual marketing and

communications budget which is used to promote TEMIT to private

investors. In addition, our Investment Manager is very active in

meeting professional investors and in making information available

to all investors using electronic media, with a wide variety of

information published on our web site.

The Board regards share buybacks as a helpful tool in managing

the balance between supply and demand for the shares and TEMIT was

again active in buying back shares throughout the year. Trading in

the shares is very closely monitored and the Board receives a daily

report from our broker, Winterflood Securities, as well as regular

summaries of market conditions focused on investor demand for

global emerging markets funds. The information that we receive

provides compelling evidence that the driver of changes in the

discount is the balance between supply and demand for the shares.

At the half year stage, we reported that we had bought back

5,781,760 shares. In the second half of the year, in light of

increased interest from investors and a lower discount, the rate of

buybacks slowed and TEMIT purchased a further 456,648 shares. In

total over the year, GBP49.6 million was spent on share buybacks

and, as all buybacks were at a discount to the prevailing NAV, this

resulted in an increase to the NAV of 0.3% to the benefit of

remaining shareholders.

AIFM fee

With effect from 1 July 2020, the annual fee rate levied on

assets above GBP1 billion was cut to 0.80% from 0.85%. The fee rate

on assets below GBP1 billion is unchanged at 1.0%. Based on net

assets as at 31 March 2021, this results in an annual saving to the

Company of GBP0.8 million.

The Board

Gregory Johnson duly stepped down from the Board at the Annual

General Meeting on 9 July 2020.

Medha Samant joined the Board with effect from 1 October 2020.

Medha subsequently accepted a full time role at a financial

services company and resigned from the Board on 19 April 2021. The

Board would like to thank Medha for her contribution and wishes her

success in her future career. After going through a new recruitment

process the Board has appointed Magdalene Miller as a non-executive

Director of the Company, with effect from 10 May 2021.

Share split to improve marketability

The price of the Company's existing ordinary shares of 25 pence

each ("Existing Ordinary Shares") has more than doubled over the

last five years, from under 500 pence in March 2016 to over 1,000

pence as at the end of March 2021. To assist monthly savers,

shareholders who reinvest their dividends, and individuals wishing

to invest smaller amounts, the Directors are proposing the

sub-division of each Existing Ordinary Share into 5 new ordinary

shares of 5 pence each ("New Ordinary Shares") ("Share Split"). The

Directors believe that the Share Split may improve the liquidity

in, and affordability of, the Company's shares, which would benefit

all shareholders.

The Share Split will not affect the overall value of any

shareholder's holding in the Company, and we have made arrangements

to ensure that there will be no interruption in trading the shares

on the London and New Zealand stock exchanges when the Share Split

takes place.

The New Ordinary Shares will rank pari passu with each other and

will carry the same rights and be subject to the same restrictions

as the Existing Ordinary Shares, including the same rights to

participate in dividends paid by the Company. The Share Split

requires the approval of shareholders and, accordingly, resolution

10 in the Notice of AGM seeks such approval. The Share Split is

conditional on the New Ordinary Shares being admitted to the

Official List of the Financial Conduct Authority and to trading on

the London Stock Exchange's main market for listed securities. If

resolution 10 is passed, the Share Split will become effective on

admission of the New Ordinary Shares to the Official List.

Further details of the Share Split are set out in the Directors'

Report on pages 52 to 54 of the Annual Report and in the Notice of

AGM.

Operational resilience and the COVID-19 pandemic

The Board, and particularly the Audit and Risk Committee,

continues to monitor the Company's operations closely. I am pleased

to report that our Investment Manager and key service providers

have continued to provide a robust service, with good communication

and effective risk controls. While to date all of our key suppliers

have maintained business as usual, we remain alert to the risks

presented by prolonged absence from the office and unconventional

working practices.

Annual General Meeting

The AGM of the Company will take place on 8 July 2021 at

Barber-Surgeons' Hall in London. Our lead portfolio manager will

not be able to attend the AGM but we have a wide range of

information on our web site at www.temit.co.uk , which is regularly

updated. If you decide to join the meeting, shareholders must

review and follow the latest local COVID-19 restrictions applicable

to London and their return location. Voting on the resolutions to

be proposed will be conducted on a poll, and the Board encourages

shareholders to submit their forms of proxy, to ensure that their

vote counts. In light of the evolving situation, it may in any case

be necessary to change the arrangements for this year's Annual

General Meeting after the date of the Notice. Details of any

changes will be made available via an RNS and on the Company's

website. We have made arrangements for shareholders to submit

questions to the AGM. If you have any questions please send these

by email to temitcosec@franklintempleton.com or via the www.temit.

co.uk./investor/contact-us in advance of the meeting. All questions

received will be considered and responses will be provided on our

website www.temit.co.uk.

Whether you intend to attend the meeting in person or not, you

are strongly encouraged to submit your votes on the AGM resolutions

in advance of the meeting. Submitting votes by proxy does not

preclude you attending the meeting or changing your vote if you

attend the AGM but ensures your votes will be counted if

restrictions preventing attendance at the AGM are introduced at

short notice.

If we are required to change the AGM arrangements we will write

to shareholders, make an announcement via the London and New

Zealand stock exchanges and post information on www.temit.co.uk.

Full information on the AGM is contained in the Notice of Meeting

on page 102 of the Annual Report.

Outlook

There are a number of challenges facing the world including

continuing trade tensions, the potential for inflation rates to

continue to edge up and, of course, the risk of continuing

outbreaks of COVID-19. Against this background, we are experiencing

an earnings-led recovery and this environment is one in which our

Investment Manager's approach to stock picking with a focus on

sustainable earnings should continue to lead to attractive

investment returns.

Paul Manduca

Chairman

4 June 2021

Strategy and Business Model

Company objective, purpose and culture

TEMIT's purpose is to provide both private and institutional

investors with the opportunity for capital appreciation via a

professionally managed vehicle focused on listed equity investments

in emerging markets.

The objective of TEMIT is to provide long-term capital

appreciation for private and institutional investors seeking

exposure to global emerging markets, supported by a culture of both

strong customer service and corporate governance.

Investment policy

The Board is proposing a number of changes to the investment

policy. These changes have been reviewed and approved by the UK

Financial Conduct Authority ("FCA") and are now subject to

shareholder approval at this year's AGM.

Explanation of proposed changes to the investment policy

The revised investment policy as set out below is designed to

provide additional flexibility to the Investment Manager in

achieving TEMIT's aims. While adjustments to the investment policy

are proposed, there will be no fundamental change to the investment

philosophy and approach.

The key proposed changes are:

-- The maximum proportion of assets that may be invested in one

company to increase from 10% to 12%, measured at the time of

investment: This proposed change recognises that there are a number

of very large and world-leading companies based in emerging

markets. In proposing this change the Board is conscious that TEMIT

should maintain a portfolio with an appropriate level of

diversification;

-- Up to 10% of assets may be invested in unlisted securities,

with a maximum of 2% in any one unlisted security at the time of

investment: The majority of investments will remain in listed

companies but this proposed change allows some additional

flexibility to allow TEMIT to participate as and when private

equity opportunities arise. All investments will follow TEMIT's

existing investment philosophy, and the balance of risk and reward,

along with contribution to the overall portfolio, will be carefully

considered for any private investments;

-- Maximum gearing to increase from 10% to 20%: While there is

no current intention to increase gearing to 20%, the Board is

requesting that shareholders approve an increase in gearing limits

so that the Board and Investment Manager have additional

flexibility should suitable investment opportunities occur in the

future; and

-- No more than 10%, in aggregate, of the value of the Company's

assets will be invested in other listed closed-ended investment

funds: The UK Listing Rules set out limits to an investment trust's

ability to invest in other listed closed end funds. This statement

is included to confirm compliance with the listing rules and there

is no current intention to invest in other listed closed end

funds.

Current investment policy

The Company seeks long-term capital appreciation through

investment in companies listed in emerging markets or companies

which earn a significant amount of their revenues in emerging

markets but are listed on stock exchanges in developed

countries.

It is intended that the Company will normally invest in equity

instruments. However, the Investment Manager may invest in

equity-related investments (such as convertibles) where it believes

it is advantageous to do so. The portfolio may frequently be

overweight or underweight in certain investments compared with the

MSCI Emerging Markets Index and may be concentrated in a more

limited number of sectors, geographical areas or countries than the

benchmark. Investments may also be made in companies outside the

benchmark that meet the investment criteria. The Company may also

invest a significant proportion of its assets in the securities of

one issuer, securities domiciled in a particular country, or

securities within one industry. No more than 10% of the Company's

assets will be invested in the securities of any one issuer at the

time of investment.

The Board has agreed that TEMIT may borrow up to a limit of 10%

of its net assets.

Revised investment policy - subject to approval at this year's

AGM

The Company seeks long-term capital appreciation through

investment in companies in emerging markets or companies which earn

a significant amount of their revenues in emerging markets but are

domiciled in, or listed on, stock exchanges in developed countries

("Emerging Markets Companies").

It is expected that the majority of investments will be in

listed equities. However, up to 10% of the Company's assets may be

invested in unlisted securities. In addition, while it is intended

that the Company will normally invest in equity instruments, the

Investment Manager may invest in equity-related investments (such

as convertibles or derivatives) where it believes that it is

advantageous to do so.

The portfolio may frequently be overweight or underweight in

certain investments compared with the MSCI Emerging Markets Index

(the "Benchmark") and may be concentrated in a more limited number

of sectors or geographical areas than the Benchmark. Investments

may be made in Emerging Markets Companies outside the Benchmark

that meet the investment criteria.

Whilst there are no specific restrictions on investment in any

one sector or geographic area, the portfolio will be managed in a

way which aims to spread investment risk. The portfolio will

typically contain between 50 and 100 individual stocks but may, at

times, contain fewer or more than this range. No more than 12% of

the Company's assets will be invested in the securities of any one

issuer at the time of investment, save that any investment in

unlisted securities of any one issuer will be limited to no more

than 2% of the Company's assets, measured at the time of

investment.

The maximum borrowing will be limited to 20% of the Company's

net assets, measured at the time of borrowing.

No more than 10%, in aggregate, of the value of the Company's

assets will be invested in other listed closed- ended investment

funds.

In accordance with the Listing Rules, the Company will not make

any material change to its published investment policy without the

prior approval of the FCA and the approval of its shareholders by

ordinary resolution. Such an alteration would be announced by the

Company through a Regulatory Information Service.

Distribution policy

The Company will ensure that its total annual dividends will be

paid out of the profits available for distribution under the

provisions of the relevant laws and regulations and will be at

least sufficient to enable it to qualify as an investment trust

under the UK Income and Corporation Taxes Act. If the Company has

received an exceptional level of income in any accounting year, the

Board may elect to pay a special dividend.

The primary focus of the investment policy is on generating

capital returns, the Company does not target a particular level of

income and there is no guarantee that dividend levels will be

maintained from one year to the next.

The Company will normally pay two dividends per year, an interim

dividend declared at the time that the half yearly results are

announced, and a final dividend declared at the time that the

annual results are announced. The final dividend will be subject to

shareholder approval at the Annual General Meeting each year.

Dividends will be paid by cheque or by direct transfer to a

shareholder's bank account. For UK shareholders holding shares in

their own name on the Company's main register, the dividend

payments can be used to purchase further shares in the Company

under the Dividend Reinvestment Plan, detailed on page 111 of the

Annual Report.

The Company may also distribute capital by means of share

buybacks when the Board believes that it is in the best interests

of shareholders to do so. The share buy back programme will be

subject to shareholder approval at each Annual General Meeting.

Business model

The Company has no employees and all of its Directors are

non-executive. The Company delegates its day-to- day activities to

third parties.

At least quarterly, the Board reviews with Franklin Templeton

International Services S.à r.l. ("FTIS", "AIFM" or the "Manager")

and Franklin Templeton Emerging Markets Equity ("FTEME" or the

"Investment Manager"), a wide range of risk factors that may impact

the Company. Further analysis of these risks is described on pages

17 to 19 of the Annual Report. A full risk and internal controls

review is held every September at the Audit and Risk Committee

meeting.

Due to the nature of the Company's business, investment risk is

a key focus and is reviewed on an ongoing basis by the Investment

Manager as part of every investment decision. Further information

on this process is detailed on pages 30 and 31 of the Annual

Report.

The Board is responsible for all aspects of the Company's

affairs, including the setting of parameters for the monitoring of

the investment strategy and the review of investment performance

and policy. It also has responsibility for overseeing all strategic

policy issues, namely dividend, gearing, share issuance and

buybacks, share price and discount/premium monitoring, corporate

governance matters and engagement with all of the Company's

stakeholders.

Strategy

In setting the Company's overall strategy, the Directors have

taken due note of the requirements of Section 172 of the Companies

Act 2006. This section sets out a duty to promote the overall

success of the company, while taking account of the interests of

its various stakeholders. Further details are provided on pages 13

to 15 of the Annual Report. The Company seeks to achieve its

objective by following a strategy focused on the following:

Performance

At the heart of the strategy is the appointment and retention of

capable investment management professionals, who will identify

value and achieve superior growth for shareholders. The Investment

Manager, under the leadership of Chetan Sehgal, continues to apply

the same core investment philosophy that has driven TEMIT's

performance since the Company's launch. The investment team aims to

achieve long-term capital appreciation for shareholders by

investing in companies that they believe offer long-term

sustainable growth and good value, combined with strong management

and sound governance. See pages 24 to 31 of the Annual Report for

details of the investment process.

Liquidity

The shares issued by the Company are traded on the London and

New Zealand stock exchanges. The Company has engaged Winterflood

Securities as Financial Adviser and Stockbroker, and to act as a

market maker in the shares of the Company.

Gearing

On 31 January 2020, the Company entered into a five-year GBP100

million loan at a fixed rate of 2.089% with Scotiabank Europe PLC,

and a three-year GBP120 million unsecured multi-currency revolving

loan facility with The Bank of Nova Scotia, London Branch. The

GBP100 million fixed term loan is denominated in pounds sterling.

Drawings under the GBP120 million revolving credit facility may be

in sterling, US dollars or Chinese renminbi ("CNH"). The total

amount which may be drawn down in CNH is 45% of the combined limit

of the fixed rate loan and of the revolving loan facility. The

fixed rate loan was drawn down on 31 January 2020 and will remain

in place until 31 January 2025. At the year end, the revolving loan

facility has not been utilised (2020: not utilised). The Company

has no other debt. The Investment Manager has been granted

discretion by the Board to draw down the revolving loan facility as

investment opportunities arise, subject to overall supervision by

the Board, and subject to the overall gearing limit in TEMIT's

investment policy.

The Company's net gearing position was 0.5% (net of cash in the

portfolio) at the year-end (2020: 0.7%).

The Board continues to monitor the level of gearing and

currently considers gearing of up to 10% to be appropriate. To

provide further flexibility, assuming that shareholders approve the

changes to the investment policy to be proposed at this year's AGM,

the maximum borrowing will increase from 10% to 20% of TEMIT's net

assets at the time of entering into any new or replacement debt

facility.

Affirmation of shareholder mandate

In accordance with the Company's Articles of Association, the

Board must seek shareholders' approval every five years for TEMIT

to continue as an investment trust. This allows shareholders the

opportunity to decide on the long-term future of the Company. The

last continuation vote took place at the 2019 AGM, when 99.95% of

the votes cast were registered as votes in favour. The next

continuation vote will take place at the 2024 AGM. The Board has

agreed that it will hold a performance-related conditional tender

offer (the "Conditional Tender Offer"). There will be no tender

offer in the event that the Company's net asset value total return

continues to exceed the benchmark total return (MSCI Emerging

Markets Index total return) over the five year period from 31 March

2019 to 31 March 2024. However, if over the five year period the

Company's net asset value total return fails to exceed the

benchmark total return the Board will put forward proposals to

shareholders to undertake a tender offer for up to 25 per cent of

the issued share capital of the Company at the discretion of the

Board. Any such tender offer will be at a price equal to the then

prevailing net asset value less two per cent (less the costs of the

tender offer). Any tender offer will also be conditional on

shareholders approving the continuation vote in 2024 and would take

place following the Company's 2024 AGM.

Stability

The Company has powers to buy back its shares as a discount

control mechanism when it is in the best interests of the Company's

shareholders and in 2019 introduced a Conditional Tender Offer. The

share price and discount are discussed under Key Performance

Indicators on page 16 of the Annual Report.

Communication

The Board works to ensure that investors are informed regularly

about the performance of TEMIT and emerging markets through clear

communication and updates.

TEMIT seeks to keep shareholders updated on performance and

investment strategy through the regular annual and half yearly

reports, along with monthly factsheets. These are available on the

TEMIT website (www.temit.co.uk) which also contains portfolio

holdings information, updates from the Investment Manager and other

important documents that will help shareholders understand how

their investment is managed. We also communicate via @TEMIT on

Twitter and continue to develop the Company's presence on social

media.

TEMIT has an active public relations programme. Our Investment

Manager provides comments to journalists and publishes articles on

issues relevant to investing in emerging markets.

The Investment Manager meets regularly with professional

investors and analysts and hosts interactive webinars each quarter.

At each AGM the Investment Manager makes a presentation with the

opportunity for all shareholders to ask questions. Our lead

portfolio manager will not be able to attend the AGM but we have a

wide range of information on our web site at www.temit.co.uk ,

which is regularly updated.

The Chairman regularly meets major shareholders to discuss

investment performance and developments in corporate governance. We

try to engage with a wide spectrum of our shareholders, not only

the major shareholders and try to address their concerns as far as

practically possible. Shareholders are welcome to contact the

Chairman and the Chairman of the Audit and Risk Committee at any

time at temitcosec@ franklintempleton.com.

The Board is fully committed to TEMIT's marketing programme.

There is a substantial annual marketing and communication budget

and expenditure by TEMIT is matched by a contribution to costs from

the Manager.

Service providers

The Board conducts regular reviews of the Company's principal

service providers, as discussed on page 55 of the Annual Report, to

ensure that the services provided are of the quality expected by

TEMIT. The Directors also ensure that the Company's principal

service providers have adopted an appropriate framework of

controls, monitoring and reporting to enable the Directors to

evaluate risk.

Promoting the success of the Company

The Companies (Miscellaneous Reporting) Regulations 2018 require

directors to explain more fully how they have discharged their

duties under section 172(1) of the Companies Act 2006 in promoting

the success of their companies for the benefit of "members as a

whole" and having regard for all stakeholders.

The Board considers the main stakeholders in the Company to be

its shareholders and its service providers, the principal one of

which is its Manager, along with its investee companies. A summary

of the key areas of engagement undertaken by the Board with its

main stakeholders in the year under review and how Directors have

acted upon this to promote the long-term success of the Company are

set out in the following table.

Stakeholders Area of Engagement Consideration Engagement Outcome

------------------ ------------------- ------------------------ ------------------------- ------------------------

Shareholders, Company objective Delivering on the The Company's objective The Investment

investors Company's objective and investment Manager's

and potential to shareholders policy are set report starting on

investors over the long term. out on page 9 of page 23 of the Annual

the Annual Report. Report gives a full

The Board took commentary on the

into consideration Company's portfolio

views expressed as well as on the

by shareholders approach and

in deciding on considerations

the proposed revisions undertaken by the

to the investment Investment Manager

policy. The share for stock selection

split was proposed within the portfolio.

because the Board The proposed changes

felt that this to the investment

would be in the policy and the proposed

best interests share split are

of smaller shareholders believed

and major shareholders to be in the best

expressed support interests of

for this initiative. shareholders

The Company's performance as a whole, taking

against its objective account of the views

is regularly reviewed of shareholders.

by the Board, taking A continuation vote

account of views took place at the

expressed by 2019 AGM, with 99.95%

shareholders. of votes cast in

The Company holds favour.

a continuation The next continuation

vote every five vote is scheduled

years to allow to take place at the

shareholders to AGM in 2024.

decide on the long-term

future of the Company.

------------------ ------------------- ------------------------ ------------------------- ------------------------

Shareholders, Dividend The objective of The Board reviews Dividend payments

investors the Company is regularly the level are discussed in the

and potential to provide long of dividends, taking Chairman's Statement.

investors term capital account of the In the year under

appreciation, income generated review the Board decided

however the Board by the Company's to pay a special

recognises the portfolio and the dividend.

importance of regular availability of

dividend income reserves.

to many shareholders. In considering

the sustainability

of the dividend

and of the Company,

the Board reviews

the models supporting

the going concern

assessment and

viability statement.

In this review

it factored in

the Corporation

Tax repayment received

during the year,

which was distributed

as a special dividend

at the half year

stage. However,

future ordinary

dividends have

been modelled in

line with the

distribution

policy.

------------------ ------------------- ------------------------ ------------------------- ------------------------

Shareholders, Communication The Board understands Working closely Full details of all

investors with shareholders the importance with the Manager Board and Manager

and potential of communication the Board ensures communication are

investors with its shareholders that there is a included on page 108

and maintains open variety of regular of the Annual Report.

channels of communication

communication with shareholders. Shareholders are invited

with shareholders. to submit questions

for the Board to address

at the Company's Annual

General Meeting.

------------------ ------------------- ------------------------ ------------------------- ------------------------

Shareholders, Discount management To smooth the volatility The Board monitors TEMIT continues to

investors in the discount. closely the discount adopt an active buy

and potential and discusses discount back policy and in

investors strategy with the 2019 announced a

Investment Manager Conditional

and the Company's Tender Offer. Details

stockbroker of this can be found

at every regular on page 12 of the

Board meeting. Annual Report.

The stockbroker

provides a summary Further details of

of the discount the current discount

and market conditions and discount management

to the Board and are detailed in the

Investment Manager Chairman's Statement

at the close of on page 6 of the Annual

each trading day Report.

in London.

The Board also

meets with the

Investment Manager

to discuss the

Company's marketing

strategy to ensure

effective communication

with existing

shareholders

and to consider

strategies to create

additional demand

for the Company's

shares.

------------------ ------------------- ------------------------ ------------------------- ------------------------

Manager Communication The relationship The Manager attends The Board operates

between the of the Board with all Board meetings in a supportive and

Board and the the Manager is where it reviews open manner, challenging

Manager very important. and discusses performance the activity of the

reports, changes Manager and its results.

in the portfolio The Board

composition and believes that the

risk matrix. The Company is well managed

Board receives and the Board places

timely and accurate great value on the

information from experience of the

the Manager and Investment Manager

engages with the to deliver superior

Investment Manager returns from investments

and the secretary and on the other

between meetings functions

as well with other of the Manager to

representatives fulfil their roles

of the Manager effectively.

as and when it

is deemed necessary.

------------------ ------------------- ------------------------ ------------------------- ------------------------

Third-party Engagement with The Board acknowledges As an investment The Manager maintains

service providers service providers the importance company all services the overall day-to-day

of ensuring that are outsourced relationship with

the Company's service to third-party the service providers

providers are providing providers. and the Board undertakes

a suitable level The Board considers an annual review of

of service, that the support provided the performance of

the service level by its service providers.

is services providers This review also

sustainable and including the quality includes

that they are fairly of the service, the level of fees

remunerated for succession planning paid. The Board meets

their service. and any potential with the depositary

interruption of at

service or other least annually and

potential risks. with other service

providers as and when

considered necessary.

------------------ ------------------- ------------------------ ------------------------- ------------------------

Investee companies Engagement with The relationship The Board discusses The Investment Manager

investee companies between the Company stock selection has a dedicated research

and the investee and asset allocation team that is employed

companies is very on a quarterly in making investment

important. basis. On behalf decisions and when

of the Company voting at shareholder

the Investment meeting of investee

Manager engages companies.

with investee companies

implementing corporate

governance principles.

------------------ ------------------- ------------------------ ------------------------- ------------------------

Key Performance Indicators(a)

The Board considers the following to be the key performance

indicators ("KPI") for the Company:

-- Net asset value total return over various periods, compared to its benchmark;

-- Share price and discount;

-- Dividend and revenue earnings; and

-- Ongoing charges ratio.

The Ten Year Record of the KPIs is shown on pages 3 and 4 of the

Annual Report.

Net asset value performance

Net asset value performance data is presented within the Company

Overview on page 1 along with the Ten Year Record on pages 3 and 4

of the Annual Report.

The Chairman's Statement on pages 5 to 8 and the Investment

Manager's Report on pages 23 to 44 of the Annual Report include

further commentary on the Company's performance.

Share price and discount

Details of the Company's share price and discount are presented

within the Financial Summary on page 2 of the Annual Report. On 24

May 2021, the latest date for which information was available, the

discount had narrowed to 6.2%.

The Company has powers to buy back its shares as a discount

control mechanism when it is in the best interests of the Company's

shareholders. The Company was authorised at its AGM on 9 July 2020

to buy back up to 14.99% of the Company's issued share capital on

that date. The present authority expires on the conclusion of the

AGM on 8 July 2021. The Directors are seeking to renew this at the

2021 AGM, as further detailed in the Directors' Report on pages 59

and 60 of the Annual Report. The Board ensures that the share price

discount to NAV is actively monitored on a daily basis. Discount

management is reviewed regularly by the Board to ensure that it

remains effective in the light of prevailing market conditions. The

Board introduced in 2019 a Conditional Tender Offer, which is

described on page 12 of the Annual Report. The introduction of the

Conditional Tender Offer will not affect the Board's current

approach to discount management. The Board will continue to

exercise the Company's right to buy back shares when it believes

this to be in shareholders' interests and with the aim of reducing

volatility in the discount.

Details of share buybacks in the year can be found on pages 6,

54 and 92 of the Annual Report. From 1 April 2021 to 24 May 2021,

no shares were bought back.

Dividend and revenue earnings

Total income earned in the year was GBP59.9 million (2020:

GBP75.1 million) which translates into net revenue earnings of

28.64 pence per share (2020: 24.40 pence per share), an increase of

17.4% over the prior year. The movement in net revenue earnings

year-on-year is explained in the Chairman's Statement on page 5 of

the Annual Report.

The Company paid an interim dividend of 5.00 pence per share and

a special dividend of 10.00 pence per share, both on 11 January

2021. The Board is proposing a final dividend of 14.00 pence per

share, making total ordinary dividends for the year of 19.00 pence

per share and total dividends including the special dividend of

29.00 pence per share.

Ongoing charges ratio(a) ("OCR")

The OCR fell to 0.97% for the year ended 31 March 2021, compared

to 1.02% in the prior year. This was largely driven by the AIFM fee

reduction as detailed within the Chairman's Statement on page 6 of

the Annual Report and an increase in average net assets over the

year.

Costs associated with the purchase and sale of investments are

taken to capital and are not included in the OCR. Transaction costs

are disclosed in Note 8 of the Notes to the Financial Statements on

page 90 of the Annual Report.

Principal risks

The Board has carried out a robust assessment of the principal

and emerging risks facing the Company, including those that would

threaten its business model, future performance, solvency or

liquidity. These are summarised in the table below. Further

explanation of the monitoring of risk and uncertainties is covered

within the Report of the Audit and Risk Committee on pages 70 and

71 of the Annual Report. Information on the risks that TEMIT is

subject to, including additional financial and valuation risks, are

also detailed in Note 15 of the Notes to the Financial

Statements.

(a) A glossary of alternative performance measures is included

on pages 112 and 113 of the Annual Report.

Risk Mitigation

---------------------------------------------- ---------------------------------------------------

Pandemic

---------------------------------------------- ---------------------------------------------------

The spread of infectious illnesses The Board has regularly reviewed and

or other public health issues and discussed the situation with the Investment

their aftermaths, such as the outbreak Manager, including a review of the portfolio,

of COVID-19, first detected in China risk management and business continuity.

in December 2019 and later spreading The risks associated with a pandemic

globally, could have a significant affect all areas of the

adverse impact on the Company's operations Company's investments as well as operations.

(including the ability to find and Mitigation strategies apply as detailed

execute suitable investments) and within the specific areas of risk.

therefore, the Company's potential A global network of analysts and operations

returns. and a flexible technology setup ("Work

The current COVID-19 outbreak, as from home") at the Investment Manager

well as the restrictive measures implemented ensure operational business continuity

to control such outbreaks, could continue and continuous analyst coverage. The

to adversely affect the economies Board has also received updates on its

of many nations or the entire global key service providers' business continuity

economy, the financial condition of plans.

individual issuers or companies (including

those that are held by, or are counterparties

or service providers to, the

Company) and capital markets in ways

that cannot necessarily be foreseen,

and such impact could be significant

and long term.

---------------------------------------------- ---------------------------------------------------

Cyber The Company benefits from Franklin Templeton's

Failure or breach of information technology technology framework designed to mitigate

systems of the Company's service providers the risk of a cyber security breach.

may entail risk of financial loss,

disruption to operations or damage For key third-party providers, the Audit

to the reputation of the Company. and Risk Committee receives regular

independent certifications of their

controls environment.

---------------------------------------------- ---------------------------------------------------

Investment and concentration The Board reviews regularly the portfolio

The portfolio may diverge significantly composition/asset allocation and discusses

from the MSCI Emerging Markets Index related developments with the Investment

and may be concentrated in a more Manager and the independent risk management

limited number of securities, sectors, team. The Investment Compliance team

geographical areas or countries. This of the Investment Manager monitors concentration

is consistent with the stated investment limits and highlights any concerns to

approach of long-term value investment portfolio management for remedial action.

in companies demonstrating sustainable

earnings power at a discount to their

intrinsic worth. Investment will generally

be made directly in the stock markets

of emerging countries.

---------------------------------------------- ---------------------------------------------------

Market and geo-political The Board reviews regularly and discusses

Market risk arises from volatility with the Investment Manager the portfolio,

in the prices of the Company's investments, the Company's investment performance

from the risk of volatility in global and the execution of the investment

markets arising from macroeconomic policy against the long-term objectives

and geopolitical circumstances and of the Company. The Manager's independent

conditions, as well as from the borrowing risk team performs systematic risk analysis,

utilised by TEMIT. Many of the companies including country and industry specific

in which TEMIT invests are, by reason risk monitoring, as well as stress testing

of the locations in which they operate, of the portfolio's resilience to geopolitical

exposed to the risk of political or shocks. The Manager's legal and compliance

economic change. In addition, sanctions, team monitors sanctions. Where TEMIT

exchange controls, tax or other regulations is affected, adherence to all sanctions

introduced in any country in which and restrictions is ensured by this

TEMIT invests may affect its income team. The Board also regularly reviews

and the value and marketability of risk management reports from the Manager's

its investments. Emerging markets risk team.

can be subject to greater price volatility

than developed markets.

---------------------------------------------- ---------------------------------------------------

Sustainability and climate change The Investment Manager considers that

The Company' portfolio, and also the sustainability risks are relevant to

Company's service providers and the the returns of the Company. The Manager

Investment Manager, are exposed to has implemented a policy in respect

risks arising from ESG factors, and of the integration of sustainability

from sustainability and climate change. and climate change risks in its investment

To the extent that such a risk occurs, decision making process. The Board receives

or occurs in a manner that is not regular reports on the policies and

anticipated by the Investment Manager, controls in place on ESG matters. The

there may be a sudden, material negative Board has reviewed and fully supports

impact on the value of an investment, the Franklin Templeton Stewardship Statement

the operations or reputation of the and its Sustainable Investing Principles

Investment Manager. and Policies.

---------------------------------------------- ---------------------------------------------------

Foreign currency The Board monitors currency risk as

Currency movements may affect TEMIT's part of the regular portfolio and risk

performance. In general, if the value management oversight. TEMIT does not

of sterling increases compared with hedge currency risk.

a foreign currency, an investment

traded in that foreign currency will

decrease in value because it will

be worth less in sterling terms. This

can have a negative effect on the

Company's performance.

---------------------------------------------- ---------------------------------------------------

Portfolio liquidity The closed ended structure of TEMIT

The Company's portfolio may include reduces the impact to shareholders of

securities with reduced liquidity. potential illiquidity in the portfolio.

This may impair the ability to sell

assets which could limit the Investment The Board receives and regularly reviews

Manager's ability to make significant updates on portfolio liquidity. The

changes to the portfolio. diversified nature of the portfolio

and limited investments in stocks with

lower liquidity result in a balanced

portfolio structure.

---------------------------------------------- ---------------------------------------------------

Counterparty and credit The Board receives and reviews the approved

Certain transactions that the Company counterparty list of the Investment

enters into expose it to the risk Manager on an annual basis and receives

that the counterparty will not deliver and reviews regular reports on counterparty

an investment (purchase) or cash (in risk from the Manager's independent

relation to a sale or declared dividend) risk team. A dedicated team oversees

after the Company has fulfilled its the securities lending programme and

responsibilities. The Company engages evaluates all risks on a daily basis.

in securities lending which can increase

counterparty risk.

---------------------------------------------- ---------------------------------------------------

Operational and custody The Manager's systems are regularly

Like many other investment trust companies, tested and monitored and an internal

TEMIT has no employees. The Company controls report, which includes an assessment

therefore relies upon the services of risks together with an overview of

provided by third parties and is dependent procedures to mitigate such risks, is

upon the control systems of the Investment prepared by the Manager and reviewed

Manager and of the Company's other by the Audit and Risk Committee annually.

service providers. The security, for

example, of the Company's assets, J.P. Morgan Europe Limited is the Company's

dealing procedures, accounting records depositary. Its responsibilities include

and maintenance of regulatory and cash monitoring, safe keeping of the

legal requirements depends on the Company's financial instruments, verifying

effective operation of these systems. ownership and maintaining a record of

other assets and monitoring the Company's

compliance with investment limits and

borrowing requirements. The depositary

is liable for any loss of financial

instruments held in custody and will

ensure that the custodian and any sub-custodians

segregate the assets of the Company.

The depositary oversees the custody

function performed by JPMorgan Chase

Bank. The custodian provides a report

on its key controls and safeguards (SOC

1/ SSAE 16/ISAE 3402) that is independently

reported on by its auditor, PwC.

The Board reviews regular operational

risk management reporting provided by

the Investment Manager.

---------------------------------------------- ---------------------------------------------------

Key personnel The Manager endeavours to ensure that

The ability of the Company to achieve the principal members of its management

its objective is significantly dependent teams are suitably incentivised, participate

upon the expertise of the Investment in strategic leader programmes and monitor

Manager and its ability to attract key succession planning metrics. The

and retain suitable staff. Board discusses this risk regularly

with the Manager.

---------------------------------------------- ---------------------------------------------------

Regulatory The Board, with the assistance of the

The Company is an Alternative Investment Manager, ensures that the Company complies

Fund ("AIF") and is listed on both with all applicable laws and regulation

the London and New Zealand stock and its internal risk and control framework

exchanges. The Company operates in reduces the likelihood of breaches happening.

an increasingly lex regulatory environment

and faces a number of regulatory risks.

Breaches of regulations could lead

to a number of detrimental outcomes

and reputational damage.

---------------------------------------------- ---------------------------------------------------

Emerging risks

The key emerging risk faced by the Company during the year under

review was the ramifications of the COVID-19 pandemic. While the

onset of the pandemic set many economies into decline, it is far

from clear at this stage what the full societal and economic impact

from the pandemic will be, and it is likely that new risks will

emerge over the coming year. The medical and epidemiological

implications of COVID-19 are yet to be fully understood. While

treatments for those affected by COVID-19 have improved, vaccines

are now available, many local economies are gradually reopening and

business activity is resuming, a return to full capacity is

unlikely to happen anytime soon. Further waves from the mutated

variants of the virus or ill- judged governmental responses could

result in even worse economic effects. Changing consumer behaviour,

continuing restrictions on international travel, additional

administrative burdens and new regulations could significantly

alter and negatively affect business operations in the medium to

long term, with unknown consequences for affected industries and

countries.

TEMIT is a company registered in Scotland. Scottish independence

was the dominant issue in the May 2021 Scottish parliamentary

elections. In her victory speech, the First Minister Nicola

Sturgeon said that she would press ahead with preparations for a

second vote, once the COVID-19 crisis was over. An independent

Scotland, or a Scotland with greater autonomy within the United

Kingdom, may have significant implications from changes in tax

regimes, regulations, and company law. We continue to monitor

developments and will take any appropriate steps to protect

shareholders' interests.

Brexit

TEMIT is regulated as an AIF under UK law, with its Alternative

Investment Fund Manager ("AIFM") being FTIS, a Luxembourg company.

In light of the UK Temporary Permissions Regime that allows up to a

three year extension of current "passporting" for the AIFM into the

UK, we expect that the UK FCA will continue to recognise FTIS as

TEMIT's AIFM at least until the end of 2022. The Manager has,

however, developed plans which can be implemented if and when the

regulatory position changes and the plans involve the appointment

of a UK alternative investment fund manager from Franklin Templeton

group, keeping the same key commercial terms and the same dedicated

team.

TEMIT invests most of its assets outside the EU and the vast

majority of shareholders are based in the UK, New Zealand and the

United States. There was no material adverse affect of the Brexit

process on TEMIT and the Board has decided that Brexit is not one

of the principal risks facing the Company.

Environmental, social and governance matters

The Investment Manager comments on the integral nature of

environmental, social and governance ("ESG") matters within the

investment process and how it engages with companies to promote ESG

best practices on pages 27 to 29 of the Annual Report. It is

assisted by Franklin Templeton's independent ESG specialists and

risk managers.

The Board receives regular reports on the policies and controls

in place on ESG. The Board has reviewed and fully supports the

Franklin Templeton Stewardship Statement and its Sustainable

Investing Principles and Policies. Franklin Templeton supports the

UK Stewardship Code, and seeks to protect and enhance value for our

shareholders through active management, integration of ESG factors

into investment decision making, voting and company engagement.

Franklin Templeton is a signatory to the Principles for Responsible

Investment ("PRI") from 2013 and an active member of a wide range

of organisations and initiatives that work to promote ESG

integration and responsible investment.

As a signatory, the Investment Manager reports annually on its

progress and in 2020 (the latest statistics available) ranked ahead

of the peer median score in all categories. A link to the PRI

Transparency Report and policies relating to responsible investing

are available on the Company's website - www.temit.co.uk. For

further information on: Proxy Voting Policies, Stewardship Policy,

Controversial Weapons Policy, Regional Stewardship Code Statements

and PRI Transparency Report please visit the Responsible Investing

section on www.franklintempleton.co.uk.

Franklin Templeton is a signatory of the Stewardship Code and,

as required by the Financial Reporting Council ("FRC"), reported on

how they have applied the provisions in their annual Responsible

Investment Review in early 2021.

TEMIT has no greenhouse gas emissions to report from the

operations of the Company, as all of its activities are outsourced

to third parties, nor does it have responsibility for any other

emissions-producing sources under the Companies Act 2006 (Strategic

Report and Directors' Report) Regulations 2013. On 26 March 2015,

the Modern Slavery Act 2015 came into force. TEMIT has no employees

and is not an organisation that provides goods or services as

defined in the Act and thus the Company considers that the Act does

not apply. In any event, the Company's own supply chain consists

predominantly of professional services advisers.

Diversity

TEMIT's aim is to have an appropriate level of diversity in the

boardroom.

The Board acknowledges and welcomes the recommendations from the

Hampton-Alexander Review on gender diversity and the Parker Review

about ethnic representation on the Board. The Nomination and

Remuneration Committee considers diversity generally when making

recommendations for appointments to the Board, taking into account

gender, social and ethnic backgrounds, thought, experience and

qualification. The prime responsibility, however, is the strength

of the Board and the overriding aim in making any new appointments

must always be to select the best candidate based on objective

criteria and merit.

In all of the Board's activities, there has been and will be no

discrimination on the grounds of gender, race, ethnicity, religion,

sexual orientation, age or physical ability.

As at 31 March 2021 the Board comprised six Directors, four male

and two female.

The Investment Manager has a culture which embraces individual

differences and the wealth of perspectives brought by global

diversity. As a global company, Franklin Templeton believes that it

benefits from the unique skills and experiences of an inclusive

workforce made up of employees who span different generations,

genders, preferences, capabilities and cultural identification. It

also believes that an inclusive culture can drive innovation and

allows the firm to deliver better client outcomes. This culture

aided Franklin Templeton's inclusion, for the fourth consecutive

year, in the 2020 Bloomberg Gender-Equality Index ("GEI"), which

recognises diverse and equitable workplaces. Franklin Templeton

sponsors thousands of volunteer activities each year through its

global Involved programme which helps to provide better outcomes

for local communities. In the UK, it is an active sponsor/supporter

of several organisations that promote inclusion and social mobility

such as the Diversity Project, Stonewall and Career Ready.

Viability Statement

The Board considers viability as part of its continuing

programme of monitoring risk. In preparing the Viability Statement,

in accordance with the UK Corporate Governance Code and the AIC

Corporate Governance Code, the Directors have assessed the

prospects of the Company over a longer period than the 12 months

required by the 'Going Concern' provision.

The Board has considered the Company's business and investment

cycles and is of the view that five years is a suitable time

horizon to consider the continuing viability of the Company,

balancing the uncertainties of investing in emerging markets

securities against having due regard to viability over the longer

term.

In assessing the Company's viability, the Board has performed a

robust assessment of controls over the principal risks. The Board

considers, on an ongoing basis, each of the principal and emerging

risks as noted above and set out in Note 15 of the Notes to the

Financial Statements. The Board evaluated a number of scenarios of

possible future circumstances including a material increase in

expenses and a continued significant and prolonged fall in equity

markets as a result of the COVID-19 pandemic. The Board also

considered the latest assessment of the portfolio's liquidity.

Further details regarding the impact of COVID-19 on the Company are

detailed within the Chairman's Statement on pages 5 to 8 and the

principal risks section starting on page 17 of the Annual Report.

The Board monitors income and expense projections for the Company,

with the majority of the expenses being predictable and modest in

comparison with the assets of the Company. The Company sees no

issues with meeting interest and other principal obligations of the

borrowing facilities. A significant proportion of the Company's

expenses are an ad valorem AIFM fee, which would naturally reduce

if the market value of the Company's assets were to fall. The Board

has also taken into consideration the operational resilience of its

service providers in light of COVID-19.

Taking into account the above, and with careful consideration

given to the current market situation, the Board has concluded that

there is a reasonable expectation that, assuming that there will be

a successful continuation vote at the 2024 AGM, the Company will be

able to continue to operate and meet its liabilities as they fall

due over the next five years.

Future strategy

The Company was founded, and continues to be managed, on the