TIDMDWHT

RNS Number : 2330B

Dewhurst PLC

09 June 2021

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

Dewhurst plc (the "Group")

Interim Results for the 6 months ended 31 March 2021

Directors' Interim Report

FIRST HALF

We are pleased to report a growth in sales and record profits

for the first half of the current financial year. Overall, Group

revenue increased by 3% to GBP28.9 million (2020: GBP28.2 million)

and adjusted operating profit (before acquired intangible

amortisation) increased 28% to GBP4.4 million (2020: GBP3.4

million). Profit before tax increased 36% to GBP3.4 million (2020:

GBP2.5 million) and earnings per share improved to 26.4p (2020:

20.8p). Although some Covid-19 restrictions remain in place in the

countries in which we operate, we have been fully operational at

all our sites throughout the first half of the year.

Lift Division sales this year were very similar to last year's

first half, which was only minimally affected by the Covid-19

pandemic. The growth in sales was predominantly driven by our

Transportation Division, with deliveries of cycleway products

continuing to be strong through the period. This growth was

partially offset by a further reduction in our Keypad Division.

Demand for cash and ATMs is still depressed and is expected to

remain low, especially whilst lockdowns remain in place. First half

currency movements increased Group revenue by around GBP0.3 million

primarily as a result of the strengthening of the Australian

Dollar.

The Group balance sheet remains strong with cash at the period

end of GBP17.6 million (2020: GBP15.1 million). Since 30 September

2020, the Group has generated GBP2.4 million from operating

activities but spent a further GBP1.0 million towards developing

Dupar's new property which is now complete and in use. The sale of

Dupar's previous property was completed at the beginning of

June.

OUTLOOK

There was a release of pent-up demand during the first half of

the year as some of our markets gradually relaxed restrictions.

However there are now signs of some of that peak petering out. We

expect there to be a lull in demand until economies fully open up

again and customers start commissioning new projects. In the

meantime we expect sales could be a bit choppy and unpredictable,

particularly in regard to timing. The pandemic has severely

disrupted supply chains and it is taking time to get used to new

arrangements. Lead times have extended and purchase prices are

rising, which we expect will start to squeeze margins. Fortunately

we held reasonable stocks going into this period, but it is proving

challenging maintaining stock at the level we would like. The Group

still has strength and solidity from its balance sheet to carry it

through any short term turbulence.

DIVIDS

The Directors have declared an increased interim dividend of

4.25p per ordinary share (2020: 3.75p) which amounts to GBP343,000

(2020: GBP315,000). The interim dividend is payable on 17 August

2021 and will be posted on 12 August 2021 to shareholders appearing

in the Register on 9 July 2021 (ex-dividend date being 8 July

2021).

A final 2020 dividend of 9.25p (2019: 9.25p) which amounted to

GBP778,000 (2019: GBP778,000) was approved at the AGM held on 16

February 2021 and was paid on 24 February 2021 to members on the

register at 22 January 2021.

By Order of the Board

J C SINCLAIR

Finance Director & Secretary

8 June 2021

The unaudited consolidated statement of comprehensive income,

statement of financial position, statement of changes in equity and

cash flow statement of Dewhurst plc and its subsidiaries for the

half-year ended 31 March 2021, as compared with the corresponding

half-year ended 31 March 2020 and the year ended 30 September 2020,

shows the following results:

Consolidated statement of comprehensive income

Half year Half year Year

ended ended ended

31 March 31 March 30 Sept

2021 2020 2020

Continuing operations GBP000's GBP000's GBP000's

-------------------------------------------------- ------------- ----------- ---------

Revenue 28,881 28,172 55,617

Operating costs (25,354) (25,597) (48,654)

-------------------------------------------------- ------------- ----------- ---------

Adjusted operating profit 4,361 3,409 8,630

Amortisation of acquired intangibles (834) (834) (1,667)

-------------------------------------------------- ------------- ----------- ---------

Operating profit 3,527 2,575 6,963

Finance income 6 34 58

Finance costs (164) (135) (281)

-------------------------------------------------- ------------- ----------- ---------

Profit before taxation 3,369 2,474 6,740

Taxation Est. (1,237) Est. (727) (2,061)

-------------------------------------------------- ------------- ----------- ---------

Profit for the financial period 2,132 1,747 4,679

-------------------------------------------------- ------------- ----------- ---------

Other comprehensive income:

Actuarial gains/(losses) on the defined

benefit pension scheme Est. 3,153 Est. (619) (1,886)

Deferred tax effect (599) 118 358

Current tax effect Est. 113 Est. 87 226

Total that will not be subsequently reclassified

to income statement 2,667 (414) (1,302)

Exchange differences on translation of

foreign operations (44) (1,483) (215)

Total that may be subsequently reclassified

to income statement (44) (1,483) (215)

-------------------------------------------------- ------------- ----------- ---------

Other comprehensive income/(expense) for

the period, net of tax 2,623 (1,897) (1,517)

-------------------------------------------------- ------------- ----------- ---------

Total comprehensive income for the period 4,755 (150) 3,162

-------------------------------------------------- ------------- ----------- ---------

Profit for the period attributable to:

Equity shareholders of the company 1,925 1,565 4,312

Non-controlling interests 207 182 367

-------------------------------------------------- ------------- ----------- ---------

2,132 1,747 4,679

-------------------------------------------------- ------------- ----------- ---------

Total comprehensive income for the period

attributable to:

Equity shareholders of the company 4,539 (214) 2,783

Non-controlling interests 216 64 379

4,755 (150) 3,162

-------------------------------------------------- ------------- ----------- ---------

Basic and diluted earnings per share 26.38p 20.78p 51.78p

-------------------------------------------------- ------------- ----------- ---------

Dividends per share 4.25p 3.75p 13.00p

-------------------------------------------------- ------------- ----------- ---------

Consolidated statement of financial position

Half year Half year Year

ended ended ended

31 March 31 March 30 Sept

2021 2020 2020

GBP000's GBP000's GBP000's

------------------------------------------- ---------- ---------- ---------

Non-current assets

Goodwill 9,766 9,332 9,743

Other intangibles 305 1,995 1,139

Property, plant and equipment 18,351 13,396 16,947

Right-of-use assets 3,035 1,942 3,273

Deferred tax asset 1,917 2,700 2,621

------------------------------------------- ---------- ---------- ---------

33,374 29,365 33,723

Current assets

Inventories 5,792 5,602 6,208

Trade and other receivables 11,790 12,556 9,553

Cash and cash equivalents 17,627 15,097 18,139

------------------------------------------- ---------- ---------- ---------

35,209 33,255 33,900

------------------------------------------- ---------- ---------- ---------

Total assets 68,583 62,620 67,623

------------------------------------------- ---------- ---------- ---------

Current liabilities

Trade and other payables 9,666 8,117 9,433

Borrowings 983 - 69

Current tax liabilities 237 15 268

Short-term provisions 343 300 343

Lease liabilities 445 353 443

11,674 8,785 10,556

Non-current liabilities

Retirement benefit obligation 7,522 10,615 11,268

Lease liabilities 2,755 1,644 2,973

------------------------------------------- ---------- ---------- ---------

Total liabilities 21,951 21,044 24,797

------------------------------------------- ---------- ---------- ---------

Net assets 46,632 41,576 42,826

------------------------------------------- ---------- ---------- ---------

Equity

Share capital 808 841 808

Share premium account 157 157 157

Capital redemption reserve 329 296 329

Translation reserve 1,994 909 2,047

Retained earnings 41,887 38,167 38,042

------------------------------------------- ---------- ---------- ---------

Total attributable to equity shareholders

of the company 45,175 40,370 41,383

------------------------------------------- ---------- ---------- ---------

Non-controlling interests 1,457 1,206 1,443

------------------------------------------- ---------- ---------- ---------

Total equity 46,632 41,576 42,826

------------------------------------------- ---------- ---------- ---------

Consolidated statement of changes in equity

For the period ended 31 March 2021

Share Share Capital Translation Retained Non Total

capital premium redemption reserve earnings controlling equity

account reserve interest

GBP(000) GBP(000) GBP(000) GBP(000) GBP(000) GBP(000) GBP(000)

--------------------- --------- --------- ----------- ------------ --------- ------------ ---------

At 30 September 2020 808 157 329 2,047 38,042 1,443 42,826

Exchange differences

on

translation of

foreign

operations - - - (53) - 9 (44)

Actuarial

gains/(losses)

on

defined benefit

pension

scheme - - - - 3,153 - 3,153

Deferred tax effect - - - - (599) - (599)

Tax on items taken

directly

to

equity (Est.) - - - - 113 - 113

Dividends paid - - - - (747) (202) (949)

Profit for the

period - - - - 1,925 207 2,132

At 31 March 2021 808 157 329 1,994 41,887 1,457 46,632

--------------------- --------- --------- ----------- ------------ --------- ------------ ---------

For the period ended 31 March 2020

Share Share Capital Translation Retained Non Total

capital premium redemption reserve earnings controlling equity

account reserve interest

GBP(000) GBP(000) GBP(000) GBP(000) GBP(000) GBP(000) GBP(000)

-------------------- --------- --------- ----------- ------------ --------- ------------ ----------

At 30 September

2019 841 157 296 2,274 37,847 1,265 42,680

-------------------- --------- --------- ----------- ------------ --------- ------------ ----------

IFRS 16 transition

impact - - - - (53) - (53)

-------------------- --------- --------- ----------- ------------ --------- ------------ ----------

At 1 October 2019 841 157 296 2,274 37,794 1,265 42,627

Exchange

differences

on

translation of

foreign

operations - - - (1,365) - (118) (1,483)

Actuarial

gains/(losses)

on defined benefit

pension

scheme - - - - (619) - (619)

Deferred tax effect - - - - 118 - 118

Tax on items taken

directly

to equity (Est.) - - - - 87 - 87

Dividends paid - - - - (778) (123) (901)

Profit for the

period - - - - 1,565 182 1,747

At 31 March 2020 841 157 296 909 38,167 1,206 41,576

-------------------- --------- --------- ----------- ------------ --------- ------------ ----------

For the year ended 30 September 2020

Share Share Capital Translation Retained Non Total

capital premium redemption reserve earnings controlling equity

account reserve interest

GBP(000) GBP(000) GBP(000) GBP(000) GBP(000) GBP(000) GBP(000)

------------------- --------- --------- ----------- ------------ ---------- ------------ ----------

At 30 September

2019 841 157 296 2,274 37,847 1,265 42,680

Impact from IFRS

16 'leases' - - - - (85) (11) (96)

------------------- --------- --------- ----------- ------------ ---------- ------------ ----------

At 30 September

2019

(restated) 841 157 296 2,274 37,762 1,254 42,584

Share repurchase (33) - 33 - (1,637) - (1,637)

Exchange

differences

on

translation of

foreign

operations - - - (227) - 12 (215)

Actuarial

gains/(losses)

on defined

benefit pension

scheme - - - - (1,886) - (1,886)

Deferred tax

effect - - - - 358 - 358

Tax on items taken

directly

to equity - - - - 226 - 226

Dividends paid - - - - (1,093) (190) (1,283)

Profit for the

year - - - - 4,312 367 4,679

At 30 September

2020 808 157 329 2,047 38,042 1,443 42,826

------------------- --------- --------- ----------- ------------ ---------- ------------ ----------

These half-year abbreviated financial statements are unaudited

and do not constitute statutory accounts within the meaning of

Section 435 of the Companies Act 2006. The results for the year

ended 30 September 2020 set out above are abridged. Full accounts

for that year reported under IFRS, on which the auditors of the

Company made an unqualified report have been delivered to the

Registrar of Companies.

The presentation of these Interim Financial Statements is

consistent with the 2020 Financial Statements and its accounting

policies, but where necessary comparative information has been

reclassified or expanded from the 2020 Interim Financial Statements

to take into account any presentational changes made in the 2020

Financial Statements or in these Interim Financial Statements.

Consolidated cash flow statement

Half year Half year Year

ended ended ended

31 March 31 March 30 Sept

2021 2020 2020

GBP000's GBP000's GBP000's

--------------------------------------------- ---------- ---------- ---------

Cash flows from operating activities

Operating profit 3,527 2,575 6,963

Depreciation and amortisation 1,283 1,321 2,663

Right-of-use asset depreciation 245 229 351

Additional contributions to pension scheme (683) (552) (1,366)

Exchange adjustments 595 (91) (33)

(Profit)/loss on disposal of property,

plant and equipment (28) (16) 64

--------------------------------------------- ---------- ---------- ---------

4,939 3,466 8,642

(Increase)/decrease in inventories 416 408 (198)

(Increase)/decrease in trade and other

receivables (2,237) (1,563) 1,385

Increase/(decrease) in trade and other

payables 233 (63) 1,243

Increase/(decrease) in provisions - 23 66

--------------------------------------------- ---------- ---------- ---------

Cash generated from operations 3,351 2,271 11,138

Interest paid (13) - (2)

Tax paid (976) (946) (1,871)

--------------------------------------------- ---------- ---------- ---------

Net cash from operating activities 2,362 1,325 9,265

--------------------------------------------- ---------- ---------- ---------

Cash flows from investing activities

Acquisition of business and assets (649) (624) (624)

Proceeds on disposal of a subsidiary (net

of cash disposed) - - 55

Proceeds from sale of property, plant

and equipment 58 16 35

Purchase of property, plant and equipment (1,888) (1,158) (4,257)

Development costs capitalised - - (12)

Interest received 6 34 58

--------------------------------------------- ---------- ---------- ---------

Net cash generated from/(used in) investing

activities (2,473) (1,732) (4,745)

--------------------------------------------- ---------- ---------- ---------

Cash flows from financing activities

Dividends paid (949) (901) (1,283)

Purchase of own shares - - (1,637)

Repayment of lease liabilities including

interest (285) (266) (381)

Proceeds from bank borrowings 908 - 69

Net cash used in financing activities (326) (1,167) (3,232)

--------------------------------------------- ---------- ---------- ---------

Net increase/(decrease) in cash and cash

equivalents (437) (1,574) 1,288

--------------------------------------------- ---------- ---------- ---------

Cash and cash equivalents at beginning

of period 18,139 16,980 16,980

Exchange adjustments on cash and cash

equivalents (75) (309) (129)

--------------------------------------------- ---------- ---------- ---------

Cash and cash equivalents at end of period 17,627 15,097 18,139

--------------------------------------------- ---------- ---------- ---------

Contacts:

Dewhurst Plc Tel: +44 (0)208 744 8200

Richard Dewhurst, Chairman

Jared Sinclair, Finance Director

www.dewhurst.plc.uk

N+1 Singer (Nominated Adviser and Sole Broker) Tel: +44 (0)207 496 3000

Will Goode / Rick Thompson / James Fischer

Person responsible:

The person responsible for arranging the release of this

announcement on behalf of Dewhurst plc is Jared Sinclair

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR MZGGVNRKGMZM

(END) Dow Jones Newswires

June 09, 2021 02:00 ET (06:00 GMT)

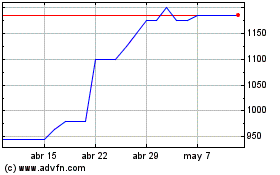

Dewhurst (LSE:DWHT)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Dewhurst (LSE:DWHT)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024