By Christopher Mims | Photographs by Gavin McIntyre for The Wall Street Journal

Things had been looking good for Charleston Gourmet Burger, a

small family business based in South Carolina. Founded by

husband-and-wife team Chevalo and Monique Wilsondebriano in 2012,

it sold its burger sauces and marinades in thousands of stores

across the U.S., on the shopping channel QVC and directly to

customers through its website. Just before the pandemic led to

lockdowns in March, the couple made the fateful decision to stop

selling through stores and to concentrate on online sales.

It proved to be a near-fatal mistake for their small business,

which is the family's sole source of income, and employs all four

of the couple's teenage and adult children, as well as Mrs.

Wilsondebriano's sister and mother.

In the Amazon era, selling online is one thing, but actually

getting products to customers fast enough to make them happy is

something else. It's especially difficult if, like the

Wilsondebrianos, a merchant isn't selling via Amazon, but still

feels obligated to match the e-commerce giant's promises of free

and fast delivery.

Their sales plummeted, from upward of $20,000 a month to as

little as $3,000 a month, Mrs. Wilsondebriano says. The family had

no choice but to pack and ship orders themselves, since they could

no longer afford the third-party shipper they had been using.

Still, many potential buyers complained about shipping charges

-- around $8 on a $40 order -- and that the sauces and marinades

took too long to arrive, says Mrs. Wilsondebriano.

"It is a daily battle trying to keep up with Amazon, and it is

not fun," she says.

In fact, while Charleston Gourmet Burger left Amazon two years

ago because the fees were so high, the family business is

considering a return.

America's small and medium-size online merchants are being

separated into winners and losers according to their ability to

adapt to changes in logistics driven largely by Amazon and other

big retailers. Amazon's continuing hiring binge and warehouse

building spree facilitate ever-faster, free Prime shipping.

As a result, even merchants who don't sell on Amazon are racing

to ship products as fast as they can, either eating the extra cost

or raising prices and watching their sales decline -- while

simultaneously coping with supply-chain bottlenecks.

For the Wilsondebrianos, this means a daily ritual involving the

entire family.

Every two weeks, pallets of goods -- ranging from 1,500 to 3,000

bottles -- are dropped off from the factory at a workshop attached

to their garage, which serves as a makeshift warehouse. In addition

to running the online ad campaigns they use to drum up sales, Mrs.

Wilsondebriano and her husband must process every incoming order

from the website.

In idle moments between remote classes conducted on Zoom, their

15- and 16-year-old daughters help pack boxes, and write

personalized notes thanking customers. Their 25-year-old son, their

eldest daughter and Mrs. Wilsondebriano's mother all pitch in when

they're available.

Once they put labels on the boxes, the husband-and-wife team

loads them into an SUV and drives them to the local post

office.

"It's like an assembly line," says Mrs. Wilsondebriano.

But it's not an assembly line -- let alone a warehouse full of

humans and robots, moving in a software-optimized workflow meant to

drive down the cost of every online purchase.

Amazon was among the first e-commerce companies to turn its

supply chain into a competitive advantage, says Matt Crawford,

general manager of shipping at BigCommerce, which helps merchants

build and run shops online. Once Amazon created its Marketplace,

where anyone could sell wares, and Fulfilled by Amazon, its

logistics service for warehousing and shipping the goods those

businesses sold on Amazon, that advantage extended to all sellers

willing to pay for these services.

Amazon has continually ratcheted up the speed with which most

goods sold on its site arrive on the doorsteps of shoppers,

offering first two day, then one day, and now frequently same-day

delivery, as it rolls its Prime Now service into its main site and

app.

This has left sellers who want Amazon's coveted Prime badge --

which indicates fast shipping and yields significantly higher sales

-- with a difficult choice, says Steve Denton, chief executive of

Ware2Go, a subsidiary of United Parcel Service that matches small

and medium-size online merchants with warehouses from which to

distribute their goods.

Sellers can either pay ever-more-expensive fees to Amazon to

warehouse and ship their goods from the company's own facilities,

he says. Or they can ship from non-Amazon warehouses that meet the

stringent demands of Amazon's Seller Fulfilled Prime program,

including nationwide availability and fast shipping. Some sellers,

especially those who deal in large items or ones that don't

typically sell quickly, find this a more affordable option.

"You're going to see a continual weeding-out of merchants that

can't solve the supply-chain piece [of online sales]," says Mr.

Crawford. Merchants' shipping costs, through carriers like UPS, the

U.S. Postal Service and FedEx, are going up between 5% and 7% this

year, as demand skyrockets. And since Covid disrupted supply chains

world-wide, merchants have to pay more to warehouse a larger buffer

of goods. Meanwhile, demand for faster shipping means retailers

have to figure out exactly how many items to store in which

warehouses spread out in a network that spans the country, he adds.

(Amazon's fees discourage retailers from keeping items in its

warehouses for long.)

To be in the Seller Fulfilled Prime program, sellers must stock

merchandise in warehouses from which customers can be reached in

one or two days' delivery time, for most views of a product on

Amazon's site and app.

Amazon's success with its marketplace has spawned many

imitators. Things you buy on the websites of Walmart, Target,

Wayfair and dozens of other big merchants may be sold and shipped

not by those companies, but by smaller businesses that give these

retail giants a cut of sales and may pay other fees in exchange for

the listing.

The proliferation of the marketplace model, and the way Amazon

shapes customers' expectations, means that the growing demands the

company places on Prime sellers ripple across the entire e-commerce

industry, says Mr. Denton. These other marketplaces continually

change their own seller-fulfillment requirements based largely on

Amazon's standards.

Amazon says it has "made changes to Seller Fulfilled Prime so

customers have a consistent Prime delivery experience, regardless

of the fulfillment method. Amazon succeeds when sellers succeed,

and these changes help ensure that SFP sellers continue to delight

Prime customers with the shopping experience they expect."

For small or medium-size online sellers, keeping up with the

latest Prime demands requires what were until recently considered

extraordinary measures. It means operating warehouses at least six

days a week, and sometimes resorting to pricey second-day or

overnight shipping.

Some sellers are thriving in this new world. In the early 2000s,

Lee Siegel founded ECR4Kids, a manufacturer of flat-pack,

ready-to-assemble furniture and play equipment for children. The

company sold to traditional buyers, like dealers to school

districts, as well as directly to big-box stores and even Amazon --

but only as a wholesaler and vendor. In late 2018, to increase

sales, Mr. Siegel listed some of his merchandise directly on

Amazon's marketplace.

When the pandemic hit, Mr. Siegel thought his sales would

crater, but instead they boomed, as parents of children learning at

home rushed to buy things like child-size desks, chairs and

cubbies.

Around the same time he began selling on Amazon's marketplace,

ECR4Kids shifted from running its own warehouses to outsourcing its

fulfillment to third-party logistics providers, including

Ware2Go.

Previously, says Mr. Siegel, fulfillment services could be

provided by anyone with "a forklift, a loading dock and a big empty

warehouse with shelving. But to survive versus Walmart, Costco,

Amazon and Wayfair requires a completely different approach to

customer satisfaction and speed of shipping."

Some turn to companies such as Productiv, which operates six

distribution warehouses. While Amazon relies on its own bestiary of

shelf-moving and package-sorting robots, companies like Productiv

are testing systems with "follow-behind" robots that trail

warehouse employees as they walk through rows of shelving, and then

ferry to conveyors any items their humans pick from those

shelves.

As in many other industries, this automation is in part a

reaction to rising wages and a scarcity of labor. Demand for

warehousing and fulfillment is setting and breaking records by the

month, leading to both more competition for these services and a

greater variety of them to choose from.

At Charleston Gourmet Burger, things have improved a great deal.

The weather has grown warmer and millions of vaccinated Americans

are once again gathering with friends and family -- and firing up

the grill. Monthly sales rebounded to nearly $14,000 in May, and

Mrs. Wilsondebriano anticipates June will be even better.

In addition, the family is going to start experimenting with

using Amazon to both sell and fulfill orders. Amazon is launching a

pilot program aimed at providing additional assistance to Black

business owners like the Wilsondebrianos, including free

advertising, free storage and returns processing, the waiver of

some fees, free advisory services and more. Some time within the

next two weeks, about 90% of orders from the family's website will

be fulfilled by Amazon, and their products will appear on Amazon's

marketplace.

"To have so many fees waived sounds like a win-win," says Mrs.

Wilsondebriano. "But I don't know how this is going to go."

-- For more WSJ Technology analysis, reviews, advice and

headlines, sign up for our weekly newsletter.

Write to Christopher Mims at christopher.mims@wsj.com

(END) Dow Jones Newswires

June 12, 2021 00:14 ET (04:14 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

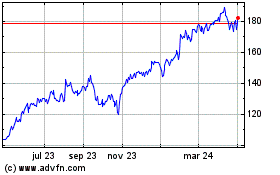

Amazon.com (NASDAQ:AMZN)

Gráfica de Acción Histórica

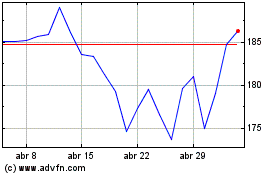

De Mar 2024 a Abr 2024

Amazon.com (NASDAQ:AMZN)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024