TIDMWTB

RNS Number : 1639C

Whitbread PLC

17 June 2021

Q1 FY22 Trading Update

Continued market outperformance in the UK, strong leisure demand

post 17 May

Summary

Throughout this release all percentage growth comparisons are

made on a two-year basis, comparing the current year (FY22)

performance for the 13 weeks to 27 May 2021 to the same period in

FY20 (13 weeks to 30 May 2019), with FY20 being the last financial

period before the onset of the COVID-19 crisis.

-- 98% of UK hotels and restaurants now open, with Premier Inn

UK's total accommodation sales performance 11.0 pp ahead of the

M&E market(1) in the quarter

-- Total UK accommodation sales were down 60.9% in the quarter,

with Food and Beverage total sales down 86.0%, reflecting the

Government's lockdown restrictions that were in place for most of

the quarter

-- Encouraging trends post 17 May, when overnight leisure stays were permitted

-- Very strong forward booking trends in tourist locations

throughout the summer, and improved forward bookings across the

majority of the rest of the estate, with the exception of airport

locations and central London

-- Continued gradual increase in business demand

-- 19 of 30 operational hotels open in Germany, occupancy levels

improving in a challenging but recovering market

-- "Investing to win in FY22" and driving outperformance:

o "Rest Easy" above the line marketing campaign, launched in

April, is driving strong website volumes

o New business booker tools and enhanced Travel Management

Company distribution will help continued recovery in business

demand

o Planned return to pre-COVID-19 levels of hotel refurbishment

capex for FY22; commenced rollout programme for 1,500 additional

Premier Plus rooms

o 3 new organic hotels added to the pipeline in Germany, taking

the open and committed pipeline to 73 hotels and over 13,500

rooms

o GBP100m three-year cost efficiency programme well underway

-- Cash outflow for the quarter was in-line with previous

sensitivity guidance. At the end of the quarter, net debt was

GBP70.6m, benefitting from the build up of customer deposits for

the summer

-- Now targeting net-zero carbon emissions by 2040, bringing

forward the original target by 10 years

-- Outlook and guidance remain unchanged from 27 April 2021

Comment from Alison Brittain, CEO:

"The Group traded significantly ahead of the market during the

quarter, despite the impact of the UK Government restrictions that

were in place for the majority of the first quarter. Trading in the

UK since May 17, when overnight leisure stays were permitted, and

when our restaurants fully reopened for indoor service, has been

encouraging. Additionally, our forward bookings continue to

improve, benefiting from the anticipated post-lockdown bounce in

leisure demand, and a continued gradual improvement in business

bookings. During the first quarter we opened 10 new hotels in the

UK.

We hold a uniquely advantaged position in the UK, built on our

scale, market-leading direct distribution, and strength of the

Premier Inn brand. Our position as the market leader in the

fast-recovering budget sector is combined with a broad, domestic

focussed customer mix. This, alongside our financial flexibility

and ability to invest in our customer proposition when others are

constrained, means we are well-positioned to continue our strong

performance.

In Germany, we now have a business of scale with a national

footprint. Our accelerated pipeline growth saw 3 new hotels added,

taking our open and committed pipeline to 73 hotels, and we

continue to assess opportunities to grow the pipeline through both

organic and non-organic routes. As in the UK, the German hotel

market is recovering, and we anticipate a steady improvement in

occupancy rates in our 30 operational hotels as we move through the

summer.

In both markets, our financial strength will enable us to

capitalise on the enhanced structural opportunities that will

exist, and drive long-term value for all stakeholders."

Q1 Financial Performance

Financial highlights

Q1 FY22 vs Q1 FY20

--------------------- ----------------------------

UK Germany Total

--------------------- -------- -------- --------

Sales growth:

Accommodation (60.9)% 8.8% (60.5)%

Food & beverage (86.0)% (18.8)% (85.9)%

Total (70.1)% 4.1% (69.8)%

-------- -------- --------

Like-for-like sales

growth:

Accommodation (62.1)% (80.9)% (62.2)%

Food & beverage (86.2)% (88.3)% (86.2)%

Total (70.9)% (82.1)% (71.0)%

-------- -------- --------

Total UK accommodation sales were 60.9% behind Q1 FY20 as a

result of the Government restrictions that were inplace throughout

the quarter. Despite only essential business travel stays being

permitted in the period prior to 17 May, occupancy levels grew

steadily from 35% at the start of the quarter to around 50% in the

first two weeks of May, driven by resilient demand from business

trades customers. Average room rate of GBP40.94 was down 33.4%

versus FY20. The majority of our hotel estate remained open during

the quarter, a function of our hotels only requiring low levels of

occupancy to contribute to fixed costs. By 17 May, when overnight

leisure stays were permitted, 98% of the hotel estate was open.

Post 17 May, trading has been strong, with high levels of demand

in tourist locations in particular, driven by the anticipated

bounce in leisure demand post reopening, and the period including

May half-term school holidays. Demand has also improved markedly

across the rest of the estate, with the exception of central London

and airport locations. Total UK accommodation sales improved to

down 27.3% in the 30 day period from 17 May to 14 June 2021 versus

the same period in FY20, with occupancy levels at 74.2%. The more

flexible labour model, that was implemented across the estate in

the second half of the prior year, has enabled the business to

quickly flex-up hours from its existing labour force, in response

to the significant increase in demand in both hotels and

restaurants.

Total UK food and beverage sales were 86.0% behind Q1 FY20

reflecting the fact that all restaurants were closed from the start

of the quarter until 12 April, when outdoor service was permitted

in England, where 165 restaurants opened for outdoor service in the

following weeks, while over 37 restaurants were opened in Scotland

for restricted indoor service. The remaining estate, with the

exception of a small number of restaurants that were being

refurbished, reopened on 17 May. In the 30 day period from 17 May

to 14 June 2021, total food and beverage sales were down 24.9%

versus the same period in FY20.

The Group's balance sheet strength has allowed investment in

commercial initiatives, including the high-profile "Rest Easy"

cross-platform advertising campaign, launched in mid-April, that is

driving high levels of brand consideration and website visits.

Actions to drive business demand are well-underway, including

improved business account management, a relaunched business booker

tool and a broadened Travel Management Company distribution

platform. Whilst these actions are helping drive a continued

increase in business bookings, a sustained recovery in office-based

business demand is not anticipated until the Autumn.

During the quarter, 10 new hotels were opened, totalling 1,189

rooms and 5 hotels were disposed, totalling 169 rooms, as the Group

continues to take the opportunity to optimise the estate as and

when opportunities arise.

In Germany, 30 hotels were operational at the end of the

quarter, of which 19 were open, 7 were being rebranded to Premier

Inn, and 4 were temporarily closed due to low levels of demand in

the market in those locations. Government restrictions were in

place throughout the quarter, severely restricting demand levels in

the market, and as a result, Premier Inn Germany occupancy levels

were 14.6% in the quarter, improving to 18.2% in the last two weeks

of May, as Government restrictions began to ease, and consumer

confidence improved. Total Germany accommodation sales were 8.8%

ahead of Q1 FY20, reflecting the larger estate that is now in

operation. During the period, three new hotels were added to the

pipeline, in Rosenheim, Hamburg Meile and Berlin Airport, bringing

the total operational and committed pipeline to 73 hotels and over

13,500 rooms. The Group continues to assess opportunities to grow

the pipeline through both organic and non-organic routes.

Outlook

The Group's outlook and guidance is unchanged from our full year

results on 27 April 2021, despite the four-week delay in the UK

Government's Step 4 of lockdown release. We expect leisure demand

in coastal and other tourist locations to remain very strong

throughout the summer, while the full recovery of leisure demand is

dependent on the final release of lockdown, and the return of

unrestricted events. Trades business demand remains resilient,

albeit at prices some way below pre-COVID levels, and our

expectation is that office-based business demand does not start to

recover in earnest until the Autumn.

Notes:

1: STR data, full inventory basis, M&E market excludes

Premier Inn

For more information please contact:

Investor queries | Whitbread | investorrelations@whitbread.com

Media queries | Tulchan Communications, Sunita Chauhan / Jessica Reid | +44 (0) 20 7353 4200

A live Q&A teleconference hosted by Alison Brittain and

Nicholas Cadbury will be held at 8:00am BST. Details of which are

below.

Q&A teleconference participant dial-in numbers:

Start time - 8:00am BST

United Kingdom (Local): 020 3936 2999

All other locations: +44 203 936 2999

Participant Access Code: 467868

Appendix:

1) Premier Inn UK key performance indicators

March April May Q1

=================================== ======== ======== ======== =========

Room capacity open (average) 72% 83% 95% 83%

Occupancy (full inventory) 32.8% 40.2% 56.0% 42.2%

Average room rate GBP40.94

Revenue per available room GBP17.30

Total accommodation sales

growth (69.8)% (63.4)% (48.8)% (60.9)%

=================================== ======== ======== ======== =========

Restaurants open (average) 0% 17% 67% 26%

Total food and beverage

sales growth (98.4)% (92.6)% (64.6)% (86.0)%

=================================== ======== ======== ======== =========

Total sales growth (80.5)% (74.3)% (54.4)% (70.1)%

Outperformance vs M&E market(1) 7.5pp 11.0pp 15.0pp 11.0pp

Market share gains(2) 7.5pp 7.3pp 5.2pp 6.4pp

=================================== ======== ======== ======== =========

2) Premier Inn Germany key performance indicators

March April May Q1

================================ ======== ======== ======== =========

Room capacity open (average) 62% 63% 67% 64%

Occupancy (full inventory) 13.6% 14.0% 16.4% 14.6%

Average room rate GBP32.42

Revenue per available room GBP4.75

Total accommodation sales

growth (4.2)% 65.0% (5.4)% 8.8%

================================ ======== ======== ======== =========

Total food and beverage

sales growth (18.4)% (17.3)% (20.4)% (18.8)%

================================ ======== ======== ======== =========

Total sales growth (6.3)% 46.3% (7.7)% 4.1%

================================ ======== ======== ======== =========

Notes:

1: STR data, full inventory basis, M&E market excludes

Premier Inn

2: STR data, revenue share of total UK hotel market

3) UK Quarterly sales & RevPAR growth

FY21 FY22

====================== ================================================== ========

Q1 Q2 Q3 Q4 Full Year Q1(1)

====================== ======== ======== ======== ======== ========== ========

Accommodation (79.1)% (77.1)% (55.4)% (70.3)% (70.4)% (60.9)%

Food & Beverage (80.1)% (72.6)% (53.9)% (91.9)% (74.4)% (86.0)%

UK total sales

growth (79.5)% (75.6)% (54.9)% (79.0)% (71.8)% (70.1)%

====================== ======== ======== ======== ======== ========== ========

Regions (79.2)% (73.8)% (48.2)% (66.1)% (66.8)% (56.3)%

London (78.7)% (88.9)% (78.0)% (83.5)% (82.3)% (77.3)%

UK accom. sales

growth(1) (79.1)% (77.1)% (55.4)% (70.3)% (70.4)% (60.9)%

====================== ======== ======== ======== ======== ========== ========

Accommodation (79.4)% (77.6)% (56.2)% (70.7)% (70.9)% (62.1)%

Food & Beverage (80.5)% (72.8)% (54.3)% (92.0)% (74.7)% (86.2)%

UK LFL total

sales growth (79.8)% (76.0)% (55.5)% (79.3)% (72.3)% (70.9)%

====================== ======== ======== ======== ======== ========== ========

Regions (79.8)% (74.4)% (49.2)% (66.6)% (67.5)% (57.7)%

London (79.5)% (89.3)% (78.6)% (84.0)% (82.9)% (78.7)%

UK RevPAR growth(1) (79.7)% (77.7)% (56.3)% (70.8)% (71.1)% (62.4)%

====================== ======== ======== ======== ======== ========== ========

Regions (79.7)% (74.5)% (49.4)% (66.6)% (67.6)% (57.8)%

London (79.1)% (89.1)% (78.6)% (83.8)% (82.7)% (78.3)%

UK LFL RevPAR

growth(1) (79.6)% (77.7)% (56.4)% (70.8)% (71.0)% (62.3)%

---------------------- -------- -------- -------- -------- ---------- --------

Regions (78.3)% (73.9)% (53.5)% (71.6)% (69.2)% (63.8)%

London (79.6)% (87.6)% (79.9)% (83.5)% (82.7)% (80.5)%

M&E market

total sales

growth(2) (78.6)% (77.4)% (61.0)% (75.0)% (72.8)% (68.0)%

---------------------- -------- -------- -------- -------- ---------- --------

Regions (78.4)% (73.7)% (53.0)% (71.2)% (68.9)% (64.1)%

London (79.9)% (87.8)% (80.1)% (83.6)% (82.9)% (81.0)%

M&E market

total RevPAR

growth(2) (78.7)% (77.3)% (60.7)% (74.7)% (72.7)% (68.4)%

---------------------- -------- -------- -------- -------- ---------- --------

Notes:

1: Q1 FY22 data is vs Q1 FY20

2: STR data, M&E market includes Premier Inn

4) Comparison versus FY21

Financial highlights vs FY21

Q1 FY22 vs Q1 FY21

--------------------- ----------------------------

UK Germany Total

--------------------- -------- -------- --------

Sales growth:

Accommodation 87.0% 140.7% 87.6%

Food & beverage (29.7)% 138.0% (29.2)%

Total 45.7% 140.3% 46.4%

-------- -------- --------

Like-for-like sales

growth:

Accommodation 86.0% 31.9% 85.4%

Food & beverage (29.9)% 46.0% (29.7)%

Total 44.9% 33.6% 44.8%

-------- -------- --------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTDQLFFFQLZBBL

(END) Dow Jones Newswires

June 17, 2021 02:00 ET (06:00 GMT)

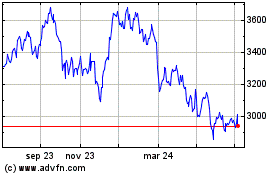

Whitbread (LSE:WTB)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

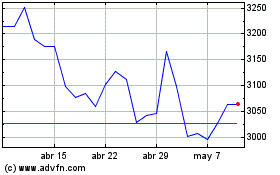

Whitbread (LSE:WTB)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024