TIDMDOCS

RNS Number : 1717C

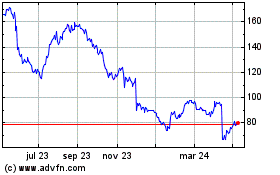

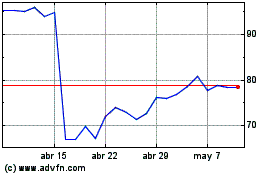

Dr. Martens PLC

17 June 2021

Click on, or paste the following link into your web browser, to

view the formatted version of the following announcement

http://www.rns-pdf.londonstockexchange.com/rns/1717C_1-2021-6-17.pdf

17 June 2021

Dr. Martens plc

Preliminary results for the year ended 31 March 2021

BRAND CUSTODIAN MINDSET DELIVERING STRONG RESULTS

"I am pleased to be reporting our first results as a publicly

listed company. The pandemic presented challenges to our operations

and ways of working, and our priority throughout was to keep our

people and consumers safe. I am very proud of the resilience,

dedication and agility of our teams across the globe. This hard

work, together with the investments we continued to make in our

brand, resulted in revenue up 15% and EBITDA(1) up 22%.

"Our DOCS strategy is delivering strong results. We continue to

prioritise selling directly to our consumers, and, with retail

severely impacted by Covid-19 restrictions, we focused our efforts

on a step-change in ecommerce, achieving revenue growth of 73%,

representing 30% of total mix. The investments and improvements we

made in our supply chain in recent years, along with our

multi-country sourcing model and close supplier relationships

allowed us to quickly react to a rapidly changing environment,

ensuring minimal disruption and maintaining good availability

throughout.

"Our product durability and timeless design are rooted in a

sustainable, long-term approach, and our brand custodian philosophy

continues to guide the decisions we take. This underpins the

financial guidance we laid out at the time of the IPO which is

unchanged. Whilst the global trading environment remains uncertain,

the strength of our iconic global brand means we look to the future

with confidence." Kenny Wilson, Chief Executive Officer

GBPm FY21 FY20 % change % change

Actual CC(4)

Revenue 773.0 672.2 15% 16%

EBITDA(1) 224.2 184.5 22% 22%

Adjusted(1) PBT 151.4 113.0 34%

PBT(2) 70.9 101.0 (30%)

Profit After Tax(2) 35.7 74.8 (52%)

Adjusted(1) Diluted

EPS(3) (p) 11.6 8.6 35%

Diluted EPS (p)(2) 3.6 7.5 (52%)

Operating cash flow(1) 234.1 142.0 65%

(1) Before exceptional items of GBP80.5m (FY20: GBP12.0m). See

pages 75 to 76 for alternative performance measures

(2) After exceptionals of GBP80.5m which relate to the IPO

(3) Normalised Adjusted EPS, excluding legacy funding costs of

preference shares, was 14.5p in FY21, as described on page 76

(4) Constant currency applies the same exchange rate to the FY21

and FY20 non-GBP results, based on FY21 budgeted rates

-- Strong growth across all regions. As we expected, revenue

grew 17% in both EMEA and Americas, and 7% in APAC. In APAC we saw

slower growth in Japan, our largest country in the region, due to

the higher physical retail mix which was significantly impacted by

Covid-19. China revenue grew by 46%

-- DTC mix 43%, down 2%pts driven by:

o Ecommerce revenue up 73%, to 30% mix (up 10%pts)

o Retail impacted by Covid-19 store closures and restrictions,

with revenue down 40% and mix at 13%, down 12%pts

-- Gross margin grew 1.2%pts to 60.9%, predominantly due to

faster delivery of supply chain efficiencies

-- EBITDA(1) margin grew by 1.6%pts to 29.0%, driven by gross margin performance

-- Continued investment in our brand and business, including

increasing our headcount by over 250 people, and opening 18 new

stores and a third-party distribution centre (DC) in New Jersey

USA

-- Building on the extensive work to date, we are today

announcing the launch of a set of ambitious sustainability targets,

including net zero by 2030 and, without compromising quality, all

footwear made from sustainable materials by 2040

FY22 and Medium-term financial outlook

The guidance set out at the time of the IPO remains unchanged,

for both FY22 and over the medium-term. In FY22 we expect high

teens revenue growth year on year, as we lap the Covid-19 impact

experienced in FY21. From FY23 and over the medium-term we

anticipate mid-teens revenue growth. We are targeting ecommerce to

grow to 40% mix, with total DTC, including retail, of 60% mix. Our

medium-term target of a 30% EBITDA(1) margin is also unchanged. We

expect to begin paying a dividend in FY22. Further guidance is

provided on page 8. Trading since the year end has been in line

with our expectations. We will provide an update on our Q1 trading

performance on 29 July 2021.

Enquiries

Investors and analysts

Bethany Barnes, Director of Investor Relations +44 7825 187465 bethany.barnes@drmartens.com

Media

Finsbury Glover Hering

Rollo Head, James Leviton +44 20 7251 3801

Gill Hammond, Director of Communications +44 7384 214248

Presentation of results

An on-demand results presentation webcast will be available from

7am today and can be accessed at https://brrmedia.news/qdhmcq

A live Q&A webcast for investors and analysts will follow at

9:30am BST today. The webcast can be accessed at

https://brrmedia.news/npczwj

Both the presentation and Q&A session will also be available

on our corporate website.

About Dr. Martens

Dr. Martens is an iconic British brand founded in 1960 in

Northamptonshire. Originally produced for workers looking for

tough, durable boots, the brand was quickly adopted by diverse

youth subcultures and associated musical movements. Dr. Martens

have since transcended their working-class roots while still

celebrating their proud heritage and, six decades later, "Docs" or

"DMs" are worn by people around the world who use them as a symbol

of empowerment and their own individual attitude.

The Company successfully listed on the main market of the London

Stock Exchange on 29 January 2021 (DOCS.L) and is a constituent of

the FTSE 250 index.

CEO review

Performance summary

This has been an unprecedented year, with the global backdrop of

Covid-19 requiring us to rapidly adapt our ways of working. Our

successful IPO in January represented a major milestone in the

Brand's history. The strong results achieved during the year are

down to the hard work and dedication of all of our people across

the globe, and we thank each and every one of our team for their

commitment and passion.

The Group delivered revenue of GBP773.0m, up 15% on the prior

year, at the top end of the guidance range set at the time of IPO,

which is testament to the strength of the brand and its deep

affection with consumers globally. This performance was

significantly driven by ecommerce, where revenue was up 73% to

represent 30% of mix. The strong ecommerce result was due to the

improvements we have made in our online proposition over recent

years, increased investment in digital marketing, together with the

shift in consumer spending from retail to ecommerce. Over the

medium-term, we expect our focus on this channel, along with the

structural shift in consumer shopping behaviour, to continue to

increase the relative importance of ecommerce to our business.

Retail is an important and profitable channel for us, to

showcase the brand and product, and support ecommerce. During the

year our retail performance was significantly impacted by Covid-19.

We saw store closures and restrictions through the year in EMEA and

Japan, together with store closures in the USA in the first

quarter. Despite Covid-19, we opened 18 new own stores globally,

taking our total own-store estate to 135. FY21 retail revenue was

GBP99.7m, down 40%.

Wholesale allows us to reach more consumers in more places

globally, and our strategy here is to have fewer, deeper wholesale

relationships with quality partners who understand and appreciate

our brand. Over the medium-term we expect wholesale revenues to

grow in absolute terms but become a smaller part of our Group

revenue in percentage terms. In FY21 wholesale revenues were

GBP437.9m, up 18%, driven by strong performance from pure play

etail customers globally, together with robust trading from USA

customers.

At a regional level, revenues increased by 17% in both EMEA and

Americas, and 7% in APAC. In EMEA we saw the strongest performance

in Germany, following the highly successful conversion to a

directly operated business in the prior year. In the Americas we

saw good growth in both USA ecommerce and wholesale channels.

As anticipated, our APAC performance was significantly impacted

by Covid-19 store closures in Japan, which is our largest market in

the region and one that is also particularly weighted towards the

retail segment. In China, where we continue to establish our brand

and lay the foundations for the future, we had a good performance,

with revenue up 46%.

FY21 EBITDA(1) was GBP224.2m, up 22%, with an EBITDA(1) margin

of 29.0%, up 1.6%pts. This strong performance was mainly driven by

improved gross margin due to the faster delivery of supply chain

efficiencies, together with the deferral of c.GBP5m of

discretionary spend into the first half of FY22 which was delayed

due to Covid-19. These factors more than offset first time

operating costs from becoming a listed business in the second

half.

Group PBT before exceptional items(1) was GBP151.4m, up 34%. We

incurred GBP80.5m of exceptional costs related to our IPO, which

included the cost of a bonus for all of GBP49.1m, including

employer's NI of GBP7.1m. This resulted in Group PBT of GBP70.9m,

down 30%. Profit after tax was GBP35.7m, down 52%, due to the

exceptional costs. Adjusted diluted earnings per share were 11.6p,

up 35%. If legacy funding costs of preference shares are also

excluded, the normalised adjusted diluted earnings per share is

14.5p, compared to 11.8p on the same basis in FY20. Operating cash

flow (1) after capex was strong at GBP234.1m, with conversion of

104%, ahead of our expectations. As at 31 March 2021 we had cash of

GBP113.6m and undrawn facilities of GBP195.4m.

Showing resilience through Covid-19

Throughout the pandemic we focused on keeping our people and

consumers safe and staying true to our long-term custodian mindset.

Our people have been united by the brand's strong ethos, our

inclusive and supportive culture, our spirit of resilience and our

clear strategy.

The first impact of Covid-19 was felt in February 2020 in our

APAC region, and the business was able to draw on the learnings

from this region to help focus resource for the rest of our global

operations as the pandemic took hold. We saw lower sales early on

in the majority of our Asian markets, although, aside from in

Japan, stores remained open (albeit with restrictions) and we also

saw the positive shift to ecommerce. This early view from APAC

helped us focus and realign resource quickly to drive this channel

in both EMEA and Americas.

At the start of the Covid-19 pandemic we quickly and prudently

adopted a cash protection approach. We temporarily extended certain

payment terms with key suppliers, whilst not cancelling any orders.

With our wholesale customers we ensured proactive communication and

cooperation to collect outstanding monies and realign orders taken

and, in certain, limited circumstances we agreed extended payment

terms. We also deferred certain capital expenditure related

projects, cancelled non-digital discretionary spend, temporarily

paused recruitment and secured an incremental GBP70m working

capital facility. Whilst we initially applied for UK government

furlough support, once it became apparent trading was resilient and

cash flow robust, we repaid the GBP1.3m received.

Ensuring our people were safe, informed and supported has been a

key priority throughout. New videoconferencing technology was

rolled out to the whole organisation. The leadership team increased

the frequency and types of internal communication, including weekly

global town hall meetings. With the majority of our people working

remotely, we worked hard to look after their wellbeing. The Culture

teams organised many initiatives for our people through which they

could socialise virtually and keep the brand's culture alive.

Our people were redeployed towards the online business, with

some teams temporarily transferred to support ecommerce, customer

services and social media teams, and tight health and safety

measures were put in place in the distribution centres to ensure

that product could continue to be shipped in a timely manner to

consumers, whilst ensuring the wellbeing of our employees.

The growth in ecommerce was due to a variety of actions. We

continued to invest in digital marketing throughout the period. Our

localised approach meant we were able to pick up a significant

amount of business lost from stores being closed or trading at

sub-optimal capacity, and inventory was redeployed to ecommerce.

Across wholesale, we saw strong growth from pure play "etail"

customers together with the online sites of our traditional retail

customers.

The DOCS strategy

Across the entire organisation we act as brand custodians,

focused on protecting and enhancing the brand and the business for

future generations. This long-term view guides everything we do and

ensures that we make the right decisions and investments for the

future.

Our strategy has four pillars, 'DOCS', which are:

-- D - Direct-to-consumer acceleration. We aim to fuel growth

through ecommerce, supported by stores as profitable brand beacons.

By focusing on DTC we can control brand engagement with our

consumers and ensure the best possible environment to showcase our

products, both digitally and physically.

-- O - Operational excellence. We are investing and improving

our operational and IT infrastructure to enable growth and unlock

value. Our supply chain and IT teams are the backbone of our

business, and we strive to ensure our future capacity requirements

are met to support our growth.

-- C - Consumer connection. We are focused on creating deeper

connections with more consumers, using insights to develop

effective marketing strategies aimed at increasing engagement and

broadening the Group's consumer base. Our sustainability strategy

is a key element of our consumer connection, and we continue to

accelerate our journey here.

-- S - Sustainable global growth. This means growing our

business in the right way. We focus predominantly on seven core

markets: UK, France, Germany, Italy, USA, Japan and China, as these

have the biggest headroom for growth over the medium-term.

Executing against our strategy

Our focus on ecommerce was particularly pleasing with revenue

growth of 73%, increasing mix by 10%pts to 30% of revenue. Due to

the Covid-19 pandemic, retail declined to 13% of mix, a decrease of

12%pts. This resulted in an overall decline in DTC mix of 2%pts to

43%.

Over recent years we have significantly invested in our digital

capability, enhanced our digital platforms and materially expanded

our teams, both centrally and our local regional trading teams. The

combination of our improved capabilities, together with the

transition of sales from retail, drove ecommerce revenue up 73% to

30% of revenue, with a strong performance across all our websites

and geographies.

The increased content on our localised websites drove longer

browsing and dwell time on site, and an improvement in conversion

rates. Driven by our regional trading teams we prioritised

marketing spend into digital, redeployed inventory to maintain good

availability and reformatted our own DCs' pick capacity to improve

speed and dispatch.

We opened 18 own stores during the year, including our first

store in Rome, six new stores in USA, four in both Germany and

France and three in APAC.

Our supply chain performance was strong, with the work to

diversify and manage risk undertaken over the past few years

meaning we could quickly react to a rapidly changing global

backdrop, global port disruptions, container shortages, as well as

Covid-19 impacts.

We have delivered our target supply chain efficiencies faster

than anticipated, due to a combination of savings from higher

volumes, our work on cross cost comparison and lower input costs on

certain key components. These savings have been achieved with no

change in quality, durability or manufacturing process.

Our distribution centres performed strongly, with good product

availability, and we opened a new third-party run DC in New Jersey

in June to support the growth in our Americas business.

Communicating directly with our consumers remains a key

priority. During the year we continued to invest in our social

community, building our teams and content, driving engagement rates

more than double our competitive set. We now have almost 5 million

Facebook followers and 4 million Instagram followers across all our

regional platforms, a double-digit increase year on year.

With the music industry unable to operate as before, we took the

stage to our social media channels and live streamed over twenty

gigs to our audience through Instagram across the year. We engaged

our social media communities to respond to the #DMsChallenge by

setting them weekly challenges to stay motivated through lockdown.

This generated over 4,000 pieces of user generated content. We

designed an augmented reality (AR) lens to connect with our social

media audiences and educate on our key Icons. The lens activity

reached 2.3 million people, with 16-24-year-olds driving the

highest volume of engagement. Finally, in March 2021 we launched on

TikTok, with our performance on the platform so far significantly

ahead of our expectations.

As part of continuing to invest in and evolve our business, the

coming months will see some changes to our Leadership Team. We are

pleased to announce that Sue Gannon joins us from Netflix as Chief

HR Officer in the coming weeks. Darren Campbell, Chief Product and

Marketing Officer, has decided to leave the business to pursue

charity work, and we are delighted that he will become a Trustee of

the Dr. Martens Foundation. We had already decided to split

Darren's role, and the recruitment for both CPO and CMO are

underway. Additionally, after three years building our digital

capabilities, Sean O'Neill, Chief Digital Officer, will be leaving

later this year. Both Sean and Darren will leave behind

exceptionally talented teams and will stay with the business as

necessary to ensure a smooth transition.

Sustainability

We have always strived to improve our ways of working, and our

people and consumers increasingly demand this too. Two of our key

principles are product durability and timeless design, and these

are rooted in a sustainable, long-term approach. We have close

supplier relationships with a relatively small number of suppliers,

which we have developed over the last few decades. In 2019 we

launched our first sustainability strategy and in recent years we

have invested in expanding our sustainability and CSR teams and

accelerating our pace of change. This has enabled us to improve our

data capture and processes, particularly in the areas of supply

chain, and social and environmental impact. However, there always

remains more work to do and we are incredibly ambitious.

During the past year we are proud to have:

-- Sourced more than 98% of our leather from Leather Working Group medal rated tanneries

-- Started incorporating 50% post-consumer recycled plastic in

our Airwair heel loops and other synthetic components

-- Despite Covid-19, independently audited physically more than

90% of our Tier 1 finished product suppliers, all of which

surpassed our required CSR audit criteria

-- Created a dedicated Diversity, Equity and Inclusion team to

accelerate our agenda in this area

We also completed a gap and materiality analysis to

comprehensively understand our most significant impacts on the

environment and priority action areas. Using the outputs of this we

have developed ambitious sustainability targets that give a clear

direction for what we need to achieve. We recognise that at present

the technology required to achieve some of these targets is not yet

available, and we are looking to partner with innovators in this

space. Over the coming year, we will build detailed sustainability

roadmaps, metrics and KPIs to achieve these targets.

In our upcoming annual report we will provide further details on

our sustainability performance and approach. We are pleased to

announce our key sustainability targets today, which are:

-- By 2028, 100% of packaging made from recycled or other

sustainably sourced material. By the same year, ensure that zero

waste goes to landfill across the value chain

-- By 2030, achieve net zero and remove fossil-based chemicals from our products

-- By 2040, 100% of products sold have a sustainable end of life

option and, without compromising quality, all footwear made from

sustainable materials

Our full sustainability report, containing all our

sustainability targets and disclosures, will be published as part

of our upcoming Annual Report.

At Dr. Martens we have always cared about doing the right thing,

making products that last and taking a long-term approach.

Product and brand

Our product strategy is rooted in our Originals, anchored within

the 'big three' of the 1460 boot, the 1461 shoe and the 2976

Chelsea Boot. Our originals category grew revenue broadly in line

with Group revenue, to account for 57% of total revenue during the

year. The DNA of our originals category drives the rest of our

product offering; this ensures we do not deviate from our brand

essence.

We continue to see strong growth in our Fusion category, led by

the Jadon and the Sinclair. Our Sandals collection is a relatively

new part of our business and continues to perform strongly, with

revenue growth of 54% and we continue to expand and develop our

offering here to drive an all-year round brand offer. Kids, where

we operate a mini-me strategy from Originals, also saw good growth,

albeit it was impacted by retail closures given higher propensity

to buy through retail channels. We saw a decline in revenue from

our Casual category, as expected, as we reposition our range here

to further enhance our product positioning.

A key benefit of our product strategy and approach is that the

majority of our product is continuity - this means that it

continues season after season and isn't marked down. We therefore

operate with a low markdown percentage, only using markdowns to

clear seasonal stock.

Our collaborations serve to create newness and buzz for our

consumers, and further strengthen our global relationships with

artists, musicians and designers. Across calendar 2020 we

celebrated the 60(th) anniversary of the 1460 boot, with "1460

remastered", a series of twelve design collaborations with friends

of the brand, including Raf Simons, Yohji Yamamoto, Marc Jacobs and

A-Cold-Wall. We also ran other collaborations with broad appeal

through the year, celebrating our relationship with music through

our Black Sabbath collaboration, Art through Basquiat and Keith

Haring and cultural brands such as Hello Kitty and X-Girl. In March

2021 we were proud to launch our first ever collaboration in

sandals, with Japanese brand Suicoke.

Our brand is at the heart of everything we do and we continued

to invest in our marketing functions, both at a Group and regional

level. When the pandemic started to take effect we focused our

spend towards digital performance marketing, adding in out of home

spend as markets reopened. Our 'unpolished' campaign spotlighted

our three icons 1460 boot, 1461 shoe and 2976 chelsea boot, and

three of our biggest Fusion stars, the 1460 Bex, Jadon and

Sinclair.

Across our three regions we further invested in sales and

marketing capability for our "Amp" wholesale level of distribution

- this being our highest level of wholesale accounts that enable

the brand to drive deeper connections with informed consumers.

Guidance

The guidance set out at the time of the IPO is unchanged. In

FY22 we expect high teens revenue growth year on year, as we lap

the Covid-19 impact experienced in FY21. From FY23 and over the

medium-term we anticipate mid-teens revenue growth. We are

targeting a 60% DTC mix over the medium-term, with ecommerce

growing to at least 40% mix of Group. Our medium-term target of a

30% EBITDA(1) margin is also unchanged.

For FY22 specifically, we anticipate:

-- New own store openings of 20 to 25 stores

-- Depreciation and amortisation of GBP42m to GBP44m, including the impact of IFRS16

-- Net finance costs of GBP15m to GBP17m

-- Underlying tax rate of c.21%

-- Capital expenditure of between 3.0% and 3.5% of revenue

-- Year-end leverage of around 1x, including IFSR16 leases

-- We expect to pay our first dividend for the first half of

FY22 in January 2022 with a one-third, two-third split of dividend

payments across the fiscal year. We continue to plan to target a

progressive dividend with a payout ratio of between 25% to 35% of

net income (profit after tax).

For the first half of FY22 specifically, we anticipate:

-- An increase in operating costs including c.GBP5m of

discretionary spend which was deferred through FY21 due to the

pandemic

-- The annualisation of PLC and LTIP costs, representing a c.GBP5m headwind in the first half

-- A cash outflow of c.GBP100m, due to normal seasonal

fluctuations in the timing of shipments and payments

CFO Review

During the year, the financial position of the Group improved -

revenue grew 15% to GBP773.0m (FY20: GBP672.2m) and EBITDA(1) grew

22% to GBP224.2m (FY20: GBP184.5m).

The year was overshadowed by Covid-19 and the Group proved

itself to be very resilient to its negative impacts. This was,

primarily due to brand and product strength, the global nature of

our operations, our multi-channel distribution model and in

particular the focus on ecommerce - which grew by 73% to represent

30% revenue mix (FY20: 20% revenue mix).

The year also saw the Group move from private ownership to list

on the premium segment of the London Stock Exchange on 29 January

2021. In addition, as part of this process, the Group repaid all

legacy financing arrangements funded by a new loan of GBP300.0m and

existing cash. The new debt is bullet repayment in nature with a

5-year term. The Group also secured a working capital facility of

GBP200.0m with a 5-year term. At 31 March 2021 the Group had cash

of GBP113.6m and undrawn available facilities of GBP195.4m.

Results - at a glance

GBPm FY21 FY20 % change % change

Actual CC(5)

Revenue: Ecommerce 235.4 136.4 73% 73%

Retail 99.7 165.2 -40% -40%

DTC 335.1 301.6 11% 11%

Wholesale(4) 437.9 370.6 18% 20%

773.0 672.2 15% 16%

Gross margin 470.5 401.5 17% 18%

EBITDA(1,2) 224.2 184.5 22% 22%

Operating profit before

exceptionals 193.0 154.5 25%

Operating

profit 112.5 142.5 -21%

Key statistics: Pairs sold (m) 12.7 11.1 14%

No. of stores(3) 135 122 11%

DTC mix % 43% 45% -2.0%pts

Gross margin

% 60.9% 59.7% +1.2%pts

EBITDA %(1,2) 29.0% 27.4% +1.6%pts

(1) EBITDA - Earnings before exchange gains/losses, finance

income/expense, income tax, depreciation, and amortisation.

(2) Before exceptional items of GBP80.5m (FY20: GBP12.0m).

(3) Own stores on streets and malls operated under arm's length

leasehold arrangements.

(4) Wholesale revenue including distributor customers.

(5) Constant currency applies the same exchange rate to the FY21

and FY20 non-GBP results, based on FY21 budgeted rates.

Total revenues grew by 15% from GBP672.2m to GBP773.0m with very

strong growth from ecommerce. The key driver of growth was volume

with 14% more pairs of boots and shoes sold at 12.7m pairs (FY20:

11.1m pairs).

-- Ecommerce revenue was particularly strong, as consumers

shifted online due to store closures/social distancing restrictions

and also our focus of resources on this channel early when Covid-19

first became apparent. As a result ecommerce experienced a

step-change and grew by 73% to GBP235.4m (FY20: GBP136.4m) to

represent 30% of revenue (up 10%pts from FY20 mix of 20%) with very

strong growth driven by localised trading teams across all own

websites in all geographies.

-- Retail revenue, impacted by Covid-19 store closures and

restrictions, declined by 40% to GBP99.7m (FY20: GBP165.2m) with

revenue mix reducing to 13% (down 12%pts from FY20 mix of 25%).

Despite this decline, we understand the importance of this channel

in supporting ecommerce and brand awareness with profitable brand

beacons and we opened 18 new own stores in the year (and closed 5)

to end the year with 135 own stores.

-- Wholesale revenue grew by 18% to GBP437.9m (FY20: GBP370.6m)

and to a degree benefitted from the trend to digital (with growth

mainly pure play "etail" accounts as well as own websites from

traditional accounts). In addition, the first full year of trading

in Germany (following its conversion from third party distributor

basis to directly operated basis) was particularly strong.

Gross margins improved by 1.2%pts to 60.9% (FY20: 59.7%) mainly

due to faster delivery of supply chain efficiencies (in part volume

efficiency, part cross cost comparison and part lower input costs

on certain key components) which generated 1.1%pts of improved

gross margin. The negative margin impact from the reduction in

direct to consumer (DTC) mix and inflation was offset by targeted

price increases in the year.

The supply chain target of 5% of revenues has now been achieved,

a lot earlier than anticipated. Looking forward, we anticipate

broadly offsetting raw material headwinds from SS22 and increasing

freight and container costs with incremental future savings.

EBITDA(1) grew by 22% to GBP224.2m (FY20: GBP184.5m) and was

mainly due to volume. EBITDA(1) margin improved by 1.6%pts to 29.0%

(FY20: 27.4%) as follows:

EBITDA(1)

Margin %

FY20 27.4%

Gross margin +1.2pts

PLC/LTIP costs -0.4pts

Operational leverage +0.8pts

FY21 29.0%

The improvement in gross margin has been previously described

with margin dilution from PLC/LTIP costs representing new ongoing

costs in relation to being a 'listed' company (described later) and

were offset by lower discretionary spend due to Covid-19 of GBP5m

and also by operational leverage from the cost base increasing at a

slower rate than revenue growth. Whilst some Covid-19 related

savings will reverse and normalise in FY22, our medium term target

of 30% EBITDA(1) margin remains unchanged.

Operating profit (before exceptionals) was GBP193.0m (FY20:

GBP154.5m) and was up 25% with operating profit of GBP112.5m (FY20:

GBP142.5m) down 21%, summarised below:

GBPm FY21 FY20 % change

Revenue 773.0 672.2 15%

Gross margin 470.5 401.5 17%

Operating expenses (246.3) (217.0) (14%)

EBITDA (1,2) 224.2 184.5 22%

Depreciation and amortisation (35.0) (29.5) (19%)

Foreign exchange gains/(losses) 3.8 (0.5) Na

Operating profit before exceptionals 193.0 154.5 25%

Exceptional items (80.5) (12.0) Na

Operating profit 112.5 142.5 (21%)

Gross margin % 60.9% 59.7% +1.2%pts

EBITDA %(1,2) 29.0% 27.4% +1.6%pts

Operating profit margin -

before exceptionals 25.0% 23.0% +2.0%pts

Operating profit margin 14.6% 21.2% -6.6%pts

(1) EBITDA - Earnings before exchange gains/losses, finance

income/expense, income tax, depreciation, and amortisation.

(2) Before exceptional items of GBP80.5m (FY20: GBP12.0m).

Pre-exceptional operating expenses increased by 14% to GBP246.3m

(FY20: GBP217.0m) as follows:

GBPm FY21 FY20 % change

Staff costs: Underlying 106.7 99.8 7%

PLC/LTIP 2.9 - -

109.6 99.8 10%

Other operating

expenses 136.7 117.2 17%

246.3 217.0 14%

% revenue: Staff 14.2% 14.9% -0.7%pts

Other 17.7% 17.4% +0.3%pts

Total 31.9% 32.3% -0.4%pts

Included in staff costs was GBP2.9m in relation to PLC related

costs, including the first LTIP grant of GBP0.7m made on 9 February

(which is expected to annualise to a cost of GBP4.9m) and

incremental headcount in relation to our new Independent NED's and

the strengthening of Group Finance and Legal/Company Secretary

functions which occurred across the second half. Other operating

costs increased by 17% and was mainly due to increased marketing

spend (up 34%), before this increase, other operating expenses

increased by 9% and were mainly volume related in nature. The

increase in marketing spend was in line with our plans at +0.5%pts

of revenue and we expect to continue to increase our investment in

this area, particularly in digital marketing.

Exceptional costs in the year were GBP80.5m (FY20: GBP12.0m) and

all related to the IPO which took place on 29 January 2021. The

main cost was in relation to an all employee "IPO bonus" of

GBP49.1m, which was in part funded by shares held by EBT (and sold

at IPO date) and also cash held by the EBT totalling GBP42.0m. Also

included within this charge (of GBP49.1m) was an employer's

national insurance charge in relation to the cash payment of

GBP7.1m. In addition, the Group incurred an IFRS2 share based

payment charge in relation to the IPO of GBP10.8m (which was

non-cash and further described in note 7 of the financial report).

The balance of GBP20.6m was advisory fees and charges including an

element of unclaimable VAT. In the prior year exceptionals of

GBP12.0m included consulting fees in relation to the Company's

exploration and diligence associated with an exercise to review

strategic options of GBP7.3m, charge in relation to the

implementation of a new IT system (Microsoft Dynamics 365 in

America's region) of GBP2.2m, costs for legal obligations and

litigation of GBP1.9m with the balance mainly legal costs.

The Directors consider EBITDA(1) before exceptionals as the most

appropriate indicator of the underlying performance of the

Group.

Region analysis: (excluding exceptional items)

The results can be further analysed by region as follows:

GBPm FY21 FY20 % change

Revenue: EMEA 335.6 287.9 17%

Americas 295.8 252.2 17%

APAC 141.6 132.1 7%

773.0 672.2 15%

EBITDA(1,2) : EMEA 115.3 92.4 25%

Americas 91.9 75.4 22%

APAC 39.7 35.5 12%

Support costs(3) (22.7) (18.8) (21%)

224.2 184.5 22%

EBITDA(1,2) margin

by region: EMEA 34.4% 32.1% +2.3%pts

Americas 31.1% 29.9% +1.2%pts

APAC 28.0% 26.9% +1.1%pts

Total 29.0% 27.4% +1.6%pts

(1) EBITDA - Earnings before exchange gains/losses, finance

income/expense, income tax, depreciation, and amortisation.

(2) Before exceptional items of GBP80.5m (FY20: GBP12.0m).

(3) Support costs represent group related support costs not

directly attributable to each regions operations and including

Group Finance, Legal, Group HR, Global Brand and Design, Directors

and other group only related costs and expenses.

EMEA

EMEA revenue grew by 17% to GBP335.6m (FY20: GBP287.9m).

Ecommerce was particularly strong with retail negative (due to

store closures and social distancing restrictions which continued

throughout the year). During the year we opened 9 new stores with 4

in France (to 11 stores), 4 in Germany (to 10 stores) and also our

first store in Italy (Rome) and closed 3 stores in UK by exercising

lease break clauses. Germany had a particularly strong year

(following a highly successful conversion to a directly controlled

market in the prior year) and grew revenue by 56% to become our

second largest market in the region after the UK. The region has

two main DC's, in the UK and the Netherlands, and, as a result,

Brexit has not had a material impact on our operations or results.

EBITDA(1) was up 25% to GBP115.3m (FY20: GBP92.4m).

Americas

The Americas region grew revenue by 17% to GBP295.8m (FY20:

GBP252.2m). Our own stores were closed during April to early July

and broadly traded throughout the remainder of the financial year

at 25% to 50% capacity. In addition, a number of traditional

wholesale accounts were open all year (with capacity restrictions)

and, as a result the impact of Covid-19 restrictions was not as

negative an impact as in EMEA or APAC. Ecommerce was very strong,

and we also went live with a new Hispanic website. We had good

wholesale growth, but retail was negative. During the year we

opened 6 new stores with 2 in Texas (in Dallas and Houston), 3 in

and around LA (including Abbot Kinney Boulevard) and 1 store in

Chicago. One store was closed at the end of its lease term.

EBITDA(1) was up 22% to GBP91.9m (FY20: GBP75.4m).

APAC

Total revenue across the region was up 7% to GBP141.6m (FY20:

GBP132.1m) with the region particularly impacted by strict social

distancing restrictions. China had steady growth from both

ecommerce and distributor revenues growing by 46% and during the

year we opened a net 35 mono branded franchise stores to trade from

85 stores at year end. Japan, which is currently our largest market

in the region, experienced marginal revenue growth with

exceptionally strong ecommerce growth offset by negative retail

revenue and negative wholesale revenue due to strict social

distancing/store closure rules (particularly in and around Tokyo).

South Korea and Hong Kong were broadly flat with very good

ecommerce offset by weak retail and negative trading across most SE

Asia distributor markets.

EBITDA(1) was up by 12% to GBP39.7m (FY20: GBP35.5m) with growth

in part impacted by continuing infrastructure build to support our

long-term ambitions in China (during the year we expanded our

Shanghai based team from 7 to 25 people) and also further

investment in Japan to underpin future DTC growth.

Support costs

Support costs were up 21% to GBP22.7m (FY20: GBP18.8m) which was

mainly due to PLC/LTIP costs incurred across second half of

GBP2.9m, excluding these costs support costs were up 5%.

Retail development

During the year, we opened 18 (FY20: 16) new own retail stores

(via arm's length leasehold arrangements) as follows:

31 March Opened Closed 31 March

2020 2021

EMEA: UK 37 - (3) 34

Germany 6 4 - 10

France 7 4 - 11

Italy - 1 - 1

Other 12 - - 12

62 9 (3) 68

Americas 29 6 (1) 34

APAC: Japan 21 1 - 22

South Korea 4 1 - 5

Hong Kong 6 1 (1) 6

31 3 (1) 33

Total 122 18 (5) 135

The Group also trades from 49 (FY20: 52) concession counters in

department stores in South Korea and a further 203 mono branded

franchise stores around the world with 85 in China (FY20: 50), 32

in Japan (FY20: 33), 11 across Australia and New Zealand (FY20: 5),

50 across other South East Asia countries and the balance mainly

South America.

Leases

The Group operates its own retail stores via arm's length

leasehold arrangements (apart from two stores that are freehold)

and also leases two warehouses and its offices. At 31 March 2021,

the average lease term remaining across all property related leases

to end of term was 4.3 years (FY20: 4.7 years), and only 2.9 years

(FY20: 3.3 years) to tenant only break. The annual rent commitment

was GBP22.7m (FY20: GBP21.5m) and undiscounted total lease

commitment was GBP97.0m (FY20: GBP100.5m), reducing to GBP65.1m

(FY20: GBP70.0m) to lease break.

At 31 March 2021 under IFRS 16 accounting rules the Group has

ROU assets of GBP77.4m (FY20: GBP82.0m) and lease liabilities of

GBP84.8m (FY20: GBP88.4m). As described in the Viability and Going

Concern statements, we reviewed all stores for impairment and

concluded three stores had future cash flows lower than the ROU

asset, and accordingly expensed a GBP1.1m impairment charge to the

Consolidated Statement of Profit or Loss.

Earnings

The following table analyses the results for the year from

operating profit to profit before tax.

GBPm FY21 FY20

Operating profit 112.5 142.5

Net interest cost on bank debt (6.5) (5.3)

106.0 137.2

Non-cash interest on preference shares (28.5) (31.5)

Unamortised loan costs (2.9) (0.8)

Interest on lease liabilities (non-cash) (3.7) (3.9)

Profit before tax 70.9 101.0

Tax (35.2) (26.2)

Earnings 35.7 74.8

The Group made operating profit of GBP106.0m after interest

costs on bank debt (FY20: GBP137.2m). On 29 January the Group

refinanced its operations with new bank debt of GBP300.0m and a

working capital facility of GBP200.0m. The term debt is for 5 years

with bullet repayment on 2 February 2026 and average interest cost

of 2.75% depending on the net leverage of the Group at each

reporting period and the EURIBOR rate. Included within net interest

on bank debt (above) of GBP6.5m is interest costs post refinancing

of GBP1.2m with the balance being interest costs on previous

funding arrangements. The unamortised loan issue costs of GBP2.9m

include GBP0.2m in relation to the new financing arrangements

(annualised cost of GBP1.2m) with the balance relating to the

write-off of all issue costs on prior financing arrangements.

The Group made a profit before tax of GBP70.9m (FY20: GBP101.0m)

with profit after tax of GBP35.7m (FY20: (GBP74.8m).

The tax charge was GBP35.2m (FY20: GBP26.2m) with an effective

tax rate of 49.6% which is higher than the UK corporate tax rate of

19.0% and mainly due to non-deductibility of certain expenses and

exceptional items and also geographical mix of profits at different

tax rates as follows:

%

UK effective tax rate 19.0%

Non-UK tax mix 1.4pts

IFRS 2 accounting 1.9pts

Interest on preference shares 4.3pts

Certain exceptionals/Other 23.0pts

Reported tax rate 49.6%

On 3 March 2021, the 2021 UK budget announced an increase to the

corporation tax rate from 19.0% to 25.0% effective from April 2023.

This was substantively enacted on the 24 May 2021. The increase in

rate would have been approximately GBP0.2m. We make a significant

contribution to the public finances in all our markets and take

seriously our responsibility to the wider society through the

payment of taxes and other government revenue-raising mechanisms.

In FY21 we paid GBP137m, either directly or indirectly to various

governments.

Earnings per share was 3.6p (FY20: 7.5p) and adjusted earnings

per share (excluding exceptional items of GBP80.5m) was 11.6p

(FY20: EPS 8.6p; exceptional items GBP12.0m). For future

comparability purposes, we have also calculated a normalised

adjusted EPS figure of 14.5p (FY20: 11.8p), which excludes

exceptional items (as described in adjusted EPS) together with

legacy financing costs of preference shares, which were fully

repaid at IPO (FY21: GBP28.5m; FY20: GBP31.5m). The total number of

shares are detailed in note 23 in the financial statements. The

following table summarises these EPS figures:

FY21 FY20 % change

pence pence

Earnings per share Basic 3.6 7.5 -52%

Diluted 3.6 7.5 -52%

Add back exceptionals per

share 8.0 1.1

Adjusted earnings per share Basic 11.6 8.6 35%

Diluted 11.6 8.6 35%

Add back legacy financing

per share 2.9 3.2

Normalised adjusted Basic 14.5 11.8 23%

earnings per share Diluted 14.5 11.8 23%

The Group has not declared nor paid a dividend in the year.

Operating cash flow - before exceptionals is summarised

below:

GBPm FY21 FY20

EBITDA (1,2) 224.2 184.5

Change in net working capital(3) 28.5 (20.6)

Capital expenditure (18.6) (21.9)

Operating cash flow 234.1 142.0

Operating cash conversion 104% 77%

(1) EBITDA - Earnings before exchange gains/losses, finance

income/expense, income tax, depreciation, and amortisation.

(2) Before exceptional items of GBP80.5m (FY20: GBP12.0m).

(3) Working capital per the consolidated statement of cash

flows, less exceptionals of GBP6.1m offset by GBP0.7m of IFRS2

accounting.

Operating cash flow was particularly strong in the year at 104%

mainly due to timing of inventory purchases and resulting payments

normalisation, together with stronger trade debtors collection at

42 days (FY20: 61 days).

Capex was GBP18.6m (FY20: GBP21.9m) and represented 2.4% of

revenue (FY20: 3.3%) and was lower than prior year mainly due a

pause on certain larger IT related projects as a result of Covid-19

cash protection plans (including implementation of Microsoft

Dynamics D365 into APAC, which has now been re-started). Spend of

GBP18.6m included GBP7.7m on new stores (FY20: GBP6.8m) and IT and

ecommerce spend of GBP7.9m (FY20: GBP9.2m).

Net cash flow after interest and exceptionals

Net cash flow after interest costs and exceptionals is

summarised below:

GBPm FY21

Operating cash flow(3) 234.1

Net interest paid(1) (7.4)

Payment of lease liabilities (23.8)

Taxation (33.1)

Free cash flow(3) before exceptional

items 169.8

Proceeds from new bank borrowings 300.0

Exceptional items(2) (27.0)

Preference shares redeemed (341.4)

Net bank borrowings and facility

repayments (92.7)

Net cash flow 8.7

Opening cash 117.2

Net foreign exchange (12.3)

Closing cash 113.6

(1) Finance expense per the consolidated statement of cash flow,

GBP12.8m, less exceptional cost of GBP5.4m of fees paid in relation

to the new financing arrangements of GBP300.0m.

(2) All exceptionals paid were in relation to the IPO and

refinancing event. Included within this amount is cash received

from the EBT (from sale of share at the IPO date) of GBP42.0m which

was used to part fund an all employee "IPO bonus".

(3) Operating cash flow and free cash flow are Alternative

Performance Measures defined in the Glossary on pages 75 and

76.

Funding

The Group is funded by cash, bank debt and equity with the

refinancing event that took place in the year, previously

described. Further details on the capital structure and debt are

given in note 18 of the financial statements.

The new financing arrangements, as is normal, have a gearing

covenant test, with the first test being on 30 September 2021 and

subsequent tests every 6 months. The gearing test is calculated

with a full 12 months of EBITDA(1) (before exceptionals) with net

debt being inclusive of IFRS16 lease liabilities. At 31 March 2021

the Group had gearing of 1.15 times calculated below:

GBPm

EBITDA(1) 224.2 (A)

Bank debt(2) (287.5)

Cash 113.6

Net bank debt (173.9)

Lease liabilities (84.8)

Net financing (258.7) (B)

Gearing ratio (times, B/A) 1.15x

(2) Excluding unamortised fees of GBP5.9m

The Group borrowed EUR337.5m on 29 January 2021 (equivalent to

GBP300.0m at that date) with the value now at GBP287.5m due to

exchange rate movements. The borrowings were in Euros to reflect

the excess Euros the Group generates from trading in continental

Europe to fund interest costs (with US dollar generated broadly

funding US dollar purchase of inventory and GBP generated broadly

funding GBP related costs).

Pensions

Airwair International Limited (a subsidiary of the Group),

operates a defined benefit pension scheme in the UK, which was

closed to new members in 2002, and provides both pensions in

retirement and death benefits to members. At the most recent

triennial valuation date (June 2019), on an actuarial funding

valuation basis as agreed with the Trustees, the scheme had assets

with a value of GBP65.4m and estimated future liabilities of

(technical provisions) of GBP60.6m, resulting in a surplus of

GBP4.8m.

A detailed description of all pension commitments including the

IAS 19 accounting valuation (which is prepared on a different

valuation basis of liabilities to the actuarial funding valuation

basis, the latter being used to agree with the pension trustees

whether cash attributions are or are not required to be made and

the former being purely for accounting purposes) is given in note

29 of the financial statements. The surplus under the scheme is not

recognised as an asset benefiting the Group on the balance sheet on

the basis that the Group is unlikely to derive any economic

benefits from that surplus.

The Group also operates a defined contribution scheme for its

employees and during the year the Group contributions to this

scheme were GBP5.8m (FY20: GBP4.8m). At 31 March 2021 this scheme

had assets of GBP15.5m (31 March 2020: GBP9.8m).

Balance sheet

The balance sheet is summarised below:

GBPm 31 March 31 March

2021 2020

Freeholds 6.1 6.0

Right-of-use assets 77.4 82.0

Other fixed assets 46.6 43.2

Working capital 25.5 69.6

Deferred tax 7.2 7.4

Operating net assets 162.8 208.2

Goodwill 240.7 240.7

Cash 113.6 117.2

Bank debt(1) (281.6) (94.3)

Lease liabilities (84.8) (88.4)

Preference shares - (312.9)

Net assets 150.7 70.5

(1) Bank debt net of GBP5.9m unamortised debt issue costs

The working capital balance of GBP25.5m (FY20: GBP69.6m)

predominantly reflects inventory of GBP101.5m (FY20: GBP90.0m),

trade and other receivables of GBP59.4m (FY20: GBP68.2m), trade and

other payables of GBP133.0m (FY20: GBP88.9m) and other items

(derivatives, tax, and provisions). The reduction in working

capital was mainly increased creditors, resulting from a

normalisation of inventory purchases compared to the prior

year.

Equity of GBP150.7m at 31 March 2021 can be analysed as

follows:

GBPm

Share capital 10.0

Hedging reserve (0.1)

Merger reserve (1,400.0)

Non-UK translation reserve 2.7

Retained earnings 1,538.1

150.7

Included in retained earnings is Dr. Martens plc (the Company)

distributable reserves of GBP1,385.0m.

Viability assessment

In accordance with the UK Corporate Governance Code, the

Directors have assessed the viability of the Group over a three

year period to 31 March 2024, which is longer than the 15 month

outlook adopted in the going concern basis of accounting (as

described on note 2 of the financial statements). As part of this

assessment, the Directors have analysed the prospects of the Group

by reference to its current financial position, recent trading

trends and momentum (in particular the resilient trading

performance in the last financial year during Covid-19), it's

forecasts and financial projections, strategy, economic model and

the principle risks and mitigating factors, and also those arising

from Covid-19 described on page 4.

Over the last three years, the Group has grown revenue by

GBP318.6m to GBP773.0m representing CAGR% growth of 19% and grown

EBITDA(1) to GBP224.2m (from GBP85.0m), representing a CAGR% growth

rate (excluding IFRS16 accounting in latter two years) of 33%. The

assessment is described in more detail below.

Group Planning Process

Our normal planning process consists of a rigorous review of the

DOCS strategy (described on pages 4 to 5) by the Leadership Team on

an annual basis, following which an updated long-term financial

plan is derived and reviewed with the Board. Before the beginning

of a new financial year a detailed, bottom up budget is prepared

with thorough review and discussion between each region President

and CEO, CFO & COO, and presentation and discussion with the

Board. We monitor our performance through the financial year

against this budget and prior year actual performance with formal

re-forecast processes conducted as required. The key assumptions

considered in all reviews are:

-- trading performance by channel,

-- trading performance by product and geography, expenditure plans, and

-- cash generation.

We also consider projected liquidity, balance sheet strength and

potential impact on shareholder returns.

Assessment Period

The Directors have assessed the viability of the Group over a

three year period to March 2024, as this aligns to our internal

planning cycle. The planning for this three year period is assessed

by month and includes well thought through investments, plans and

actions.

Trading Outlook

The immediate outlook for the year as a whole is likely to be

volatile and 'bumpy' and closely linked to vaccination progress,

easing of social restrictions and economies normalising and

evolving to whatever a post Covid-19 normality might be. Whilst all

our core markets have begun vaccination programmes, the pace of

these has varied significantly by country. At the time of writing

the UK and USA look likely to have the majority of their

populations vaccinated by mid-summer with Continental Europe

probably later in the autumn and Asia maybe not majoritively

vaccinated until the end of the calendar year. In addition, new

variants may complicate and delay our pathway to new normality.

Further, we need to see how consumers will react post Covid-19

with an upside scenario from potential pent up demand maybe driving

economic activity, further fuelled in the US with stimulus payments

versus a downside scenarios of increased unemployment and lower

spending power. At the time of writing the outcome remains

uncertain both globally and by geography.

Our central planning assumptions are:

-- the trend towards ecommerce to continue, though probably at a

slower pace than during the financial year ended March 2021,

-- stores not fully returning to pre Covid-19 levels of

profitability across the period under review,

-- our core markets to continue to be negatively impacted by

some form of social restrictions through the first year and then

slowly recover but we do not plan for a speedy recovery to pre

Covid-19 level of economic activity across the period under

review.

These conservative central assumptions form the base case for

our FY22 budget, Viability statement assessments, Going Concern

statement and store impairment analysis.

We have modelled the impact on one severe but plausible scenario

represented by revenue growth at 10% pts lower than the base plan

across all channels and geographies.

Under this scenario we did not model any mitigating actions

(including dividend payments). The outputs of this scenarios is

described below.

Assessment of Viability

Viability has been assessed by:

-- Where appropriate and practical, we assessed the impact of a

number of risks (which also describes likelihood of occurrence)

crystalising and subsequent impact on trading, cashflows and

covenant compliance. The main risks assessed are given below and

the Group continues to have satisfactory liquidity and covenant

headroom under each risk modelled:

-- the impact of a large distribution centre being out of action

for a period of around 6 months (being the estimated time to set up

a new third party operation),

-- the impact of a large third party factory being out of

operation for a period of around 6 months (being the estimated time

to divert production capacity to other factories),

-- websites out of action for a period (here we assessed an

average day lost at peak trading as if much longer it would be

likely a significant proportion of revenue would be transferred to

our own stores and wholesale stores and websites).

-- 'Top-down' sensitivity and stress testing, which included a

review of the cashflow projections and covenant compliance under a

severe but plausible scenario in relation to the downside scenario

described above. Experience through the year to March 2021

indicated minimal wholesale bad debt risk, and minimal margin risk

with the principle risk being lower revenue. In the scenario

modelled, the Group continues to have satisfactory liquidity and

covenant headroom throughout the period under review.

-- A series of reverse stress tests were also carried out to

determine what could 'break' covenant compliance estimates and

liquidity on an annual and three year cumulative basis before

mitigating actions. To model these reverse stress tests we

calculated the impact on revenue of zero covenant headroom at end

year 1 and end year 3 and also impact of zero liquidity on these

dates. Under all reverse stress tests modelled, we did not model

any mitigating actions (including dividend payments) and then

assessed the resulting revenues calculated and likelihood of

occurring. We assessed the likelihood of occurrence to be

remote.

We will continue to monitor the effects of Covid-19 on our Group

and the economies of the countries where we operate and we plan to

maintain maximum flexibility to react, on a market by market basis,

taking into consideration the various national and local government

regulations and policies as events unfold.

Statement

Based on the analysis, the Directors have a reasonable

expectation that the Group will continue in operation and meet its

liabilities as they fall due over the three-year period of this

assessment.

Consolidated Statement of Profit or Loss

For the year ended 31 March 2021

Total 2021 Total

GBPm 2020

Notes GBPm

Revenue 3 773.0 672.2

Cost of sales (302.5) (270.7)

Gross profit 470.5 401.5

Selling and administrative expenses 4 (358.0) (259.0)

Operating profit 112.5 142.5

EBITDA 3224.2 184.5

Exceptional items 4(80.5) (12.0)

EBITDA (post exceptional

items) 143.7 172.5

Depreciation, amortisation

and foreign exchange gains/(losses) 4(31.2) (30.0)

Operating profit 4 112.5 142.5

Finance expense(1) 8 (41.6) (41.5)

Profit before tax 70.9 101.0

Tax expense 9 (35.2) (26.2)

Profit for the year 35.7 74.8

2021 2020

(Restated(2)

)

Earnings per share

Basic 10 3.6p 7.5p

Diluted 10 3.6p 7.5p

Adjusted earnings per share

Basic 10 11.6p 8.6p

Diluted 10 11.6p 8.6p

(1) Finance expense includes non-cash interest on preference

shares of GBP28.5m (FY20: GBP31.5m) and on 28 January 2021 all

preference shares were redeemed in full.

(2) Following a reorganisation of the Group and share dilution

on IPO, the Group has applied IAS33 to restate earnings per share

to reflect the sub-divis io n of shares during the year but where

there has been no inflow of resources due to shares being issued to

existing shareholders for no consideration.

The results for the years presented above are derived from

continuing operations and are entirely attributable to the owners

of the Parent company.

Consolidated Statement of Comprehensive income

For the year ended 31 March 2021

Total Total

2021 2020

Notes GBPm GBPm

Profit for the year 35.7 74.8

Other comprehensive(expense)/income

Items that may subsequently be reclassified

to profit or loss

Currency translation differences (7.4) 2.7

Cash flow hedges (1.6) 1.4

(9.0) 4.1

Items that will not be reclassified to profit

or loss

Re-measurement of post-employment benefit obligations 29 - -

Tax relating to post-employment benefit obligations 29 - -

- -

Total comprehensive income for the year 26.7 78.9

Consolidated Balance Sheet As at 31 March

2021

Total 2021 Total

Notes GBPm 2020

GBPm

Non-current assets

Intangible assets 12 260.8 257.2

Property, plant and equipment 13 32.6 32.7

Right-of-use assets 13 77.4 82.0

Deferred tax assets 22 7.2 7.4

Pension fund surplus 29 - -

378.0 379.3

Current assets

Inventories 14 101.5 90.0

Trade and other receivables 15 59.4 68.2

Income tax assets - 0.3

Derivatives and other financial assets 20 0.3 1.5

Cash and cash equivalents 16 113.6 117.2

274.8 277.2

Total assets 652.8 656.5

Current liabilities

Trade and other payables 17 (133.0) (88.9)

Borrowings - Bank 1 18 - (20.0)

- Lease liabilities 18 (18.2) (21.8)

Income tax payable (1.1) -

(152.3) (130.7)

Non-current liabilities

Borrowings - Bank 1 18 (281.6) (74.3)

- Redeemable preference shares 18 - (312.9)

- Lease liabilities 18 (66.6) (66.6)

Provisions 19 (1.6) (1.5)

(349.8) (455.3)

Total liabilities (502.1) (586.0)

Net assets 150.7 70.5

Equity attributable to the owners of the

parent

Share capital 23 10.0 -

Hedging reserve 24 (0.1) 1.5

Capital redemption reserve 24 - (165.8)

Merger reserve 24 (1,400.0) -

Non-UK currency translation reserve 24 2.7 10.1

Retained earnings 24 1,538.1 224.7

Total equity 150.7 70.5

1 Included in bank debt is GBP5.9m of unamortised

fees (FY20: GBP0.5m).

The notes on pages 27 to 72 are an integral

part of these financial statements.

Consolidated Statement of Changes in Equity

For the year ended 31 March 2021

Foreign

Capital Capital exchange

Share Hedging reserve redemption Merger translation Retained

-

capital reserve own shares reserve reserve reserve earnings Total

1 equity

Notes GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

At 1 April 2019 - 0.1 - (186.0) - 7.4 170.1 (8.4)

Comprehensive income

Profit for the

year - - - - - - 74.8 74.8

Other comprehensive

income - 1.4 - - - 2.7 - 4.1

Total comprehensive

income for the

year - 1.4 - - - 2.7 74.8 78.9

Capital redemption

reserve distributions - - - 20.2 - - (20.2) -

At 31 March 2020 - 1.5 - (165.8) - 10.1 224.7 70.5

Comprehensive income -

Profit for the

year - - - - - - 35.7 35.7

Other comprehensive

expense - (1.6) - - - (7.4) - (9.0)

Total comprehensive

income for the

year - (1.6) - - - (7.4) 35.7 26.7

Own shares and

other equity

transactions - - (0.9) - - - 1.2 0.3

Share issues during

the period - - 0.3 - - - 3.6 3.9

Own shares sold

in the year - - 0.6 - - - 37.2 37.8

Shares issued 23 - - - - - - - -

Share for share

exchange 23 1,400.0 - - - (1,400.0) - - -

Capital reduction 23 (1,390.0) - - - - - 1,390.0 -

Capital redemption

reserve distributions 23 - - - 165.8 - - (165.8) -

Share based payments 25 - - - - - - 11.5 11.5

At 31 March 2021 10.0 (0.1) - - (1,400.0) 2.7 1,538.1 150.7

(1) Included within retained earnings Dr. Martens plc (the

Company) has distributable reserves of GBP1,385.0m.

For further information on the nature of each reserve, please

refer to note 24.

The notes on pages 27 to 72 are an integral part of these

financial statements.

Consolidated Statement of Cash Flows

For the year ended 31 March 2021

Notes 2021 2020

GBPm GBPm

Profit after taxation 35.7 74.8

Add back: income tax expense 35.2 26.2

finance expense 41.6 41.5

Operating profit 112.5 142.5

Depreciation and amortisation 35.0 29.5

Net foreign exchange rate (losses)/gains (3.8) 0.9

Share-based payments 25, 26 11.5 -

Restricted cash 4.2 -

Increase in inventories (18.1) (36.1)

Decrease/(increase) in trade and other

receivables 0.8 (16.6)

Increase in trade and other payables 51.2 35.7

Change in working capital 33.9 (17.0)

Cash flows from operating activities

Cash generated from operations 193.3 155.9

Taxation paid (33.1) (34.5)

Cash generated from operating activities 160.2 121.4

Cash flows from investing activities

Additions to intangible assets 12 (8.2) (8.4)

Additions to property, plant and equipment 13 (10.4) (13.5)

Cash used in investing activities (18.6) (21.9)

Cash flows from financing activities

Finance expense(1) (12.8) (5.4)

Payment of lease liabilities 28 (23.8) (20.4)

Proceeds from new bank borrowings 18 300.0 -

Net bank borrowings and facility (repayments)/drawdowns 18 (92.7) 16.8

Preference share repayments 18 (341.4) (35.0)

Sale of shares from EBT 37.8 -

Cash used in financing activities (132.9) (44.0)

Net increase in cash and cash equivalents 8.7 55.5

Cash and cash equivalents at beginning

of year 117.2 58.4

Effect of exchange on cash held (12.3) 3.3

Cash and cash equivalents at end of year 16 113.6 117.2

(1) Included in finance expense in the current year are fees

paid of GBP5.4m in relation to the new financing arrangements of

GBP300.0m.

The notes on pages 27 to 73 are an integral part of these

financial statements.

Consolidated non-GAAP Statement of Cash Flows

For the year ended 31 March 2021

Notes 2021 2020

GBPm GBPm

EBITDA(1) 3 224.2 184.5

Change in net working capital 28.5 (20.6)

Capital expenditure 12,13 (18.6) (21.9)

Operating cash flow(3) 234.1 142.0

Net interest paid (7.4) (5.4)

Payment of lease liabilities 28 (23.8) (20.4)

Taxation (33.1) (34.5)

Free cash flow(3) before exceptional items 169.8 81.7

Proceeds from new bank borrowings 18 300.0 -

Exceptional items (2) 4 (27.0) (8.0)

Preference share redemption 18 (341.4) (35.0)

Net bank borrowing and facility repayments 18 (92.7) 16.8

Net cash flow 8.7 55.5

Opening cash 16 117.2 58.4

Net cash foreign exchange (12.3) 3.3

Closing cash 16 113.6 117.2

(1) EBITDA - Earnings before exchange gains/losses, finance

income/expense, income tax, depreciation, and amortisation.

(2) All exceptionals paid were in relation to the IPO and

refinancing event. Included within this amount is cash received

from the EBT (from sale of share at the IPO date) of GBP 42 .0 m

which was used to part fund an all employee "IPO bonus" and GBP 5.4

m of fees paid in relation to the new financing arrangements of GBP

300 .0 m.

(3) Operating cash flow and free cash flow are Alternative

Performance Measures defined in the Glossary on pages 210 and

211.

Notes to the Consolidated Financial Statements (continued)

For the year ended 31 March 2021

The preliminary results were authorised for issue by the Board

of Directors on 16 June 2021. The financial information set out

herein does not constitute the Group's statutory consolidated

financial statements for the years ended 31 March 2021 or 2020, but

is derived from those accounts. Statutory consolidated financial

statements for 2021 will be delivered to the Registrar of Companies

following the Company's Annual General Meeting. Statutory

consolidated financial accounts for the previous holding company

Doc Topco Limited for 2020 are filed at Companies House. The

auditors have reported on those accounts; their report was

unqualified and did not contain a statement under section 498 (2)

or (3) of the Companies Act 2006.

1. General information

Dr. Martens plc (formerly Dr. Martens Limited) (the "Company")

was incorporated in England and Wales on 19 October 2020 as

Ampholdco Limited, a private company limited by shares in the

United Kingdom, renamed Dr. Martens Limited on 22 December 2020 and

re-registered as a public company limited by shares and renamed Dr.

Martens plc on 22 January 2021 with its registered office situated

in England and Wales. As of 18 December 2020, the Company's

registered office is: 28 Jamestown Road, Camden, London NW1 7BY.

Prior to this date the registered office was Cobbs Lane, Wollaston,

Northamptonshire, NN29 7SW.

Following the Group reorganisation described below, the

principal activity of the Company and its subsidiaries (together

referred to as the "Group") is the design, development,

procurement, marketing, selling and distribution of footwear, under

the Dr. Martens brand. On 29 January 2021, the entire issued share

capital of the Company was admitted to the premium listing segment

of the Official List of the Financial Conduct Authority and to

trading on the London Stock Exchange's Main Market for listed

securities.

2. Accounting policies

The principal accounting policies adopted in the preparation of

the financial statements are set out below. The policies have been

consistently applied to the years presented, unless otherwise

stated. Amounts are presented in GBP and to the nearest million

pounds (to one decimal place) unless otherwise noted.

2.1. Group reorganisation

On 14 December 2020, the Company acquired the entire

shareholding of Doc Topco Limited by way of a share for share

exchange. The insertion of the Company on top of the existing Doc

Topco Limited group does not constitute a business combination

under IFRS 3 'Business Combinations' and instead has been accounted

for as a common control transaction. Merger accounting has been

used to account for this transaction. Further details can be found

in note 23.

Under merger accounting principles, the assets and liabilities

of the subsidiaries are consolidated at book value in the Group

financial statements and the consolidated reserves of the Group

have been adjusted to reflect the statutory share capital of the

Company with the difference presented as the merger reserve.

These consolidated financial statements of the Group are the

first set of financial statements for the newly formed Group and

the prior period has been presented as a continuation of the former

Doc Topco Limited Group on a consistent basis as if the Group

reorganisation had taken place at the start of the earliest period

presented.

The prior period comparatives are those of the former Doc Topco

Limited Group since no substantive economic changes have

occurred.

2.2. Basis of preparation

The consolidated financial statements of the Group have been

prepared in accordance with International Accounting Standards in

conformity with the requirements of the Companies Act 2006 and with

International Financial Reporting Standards adopted pursuant to

Regulation (EC) No. 1606/2002 as it applies in the European Union.

The financial statements comply with IFRS as issued by the

International Accounting Standards Board (IASB). The Group's

consolidated financial statements have been prepared on a going

concern basis under the historical cost convention, except for

derivative financial instruments and pension scheme assets that

have been measured at fair value.

Certain amounts in the Statement of Profit or Loss and the

Balance Sheet have been grouped together for clarity, with their

breakdown being shown in the notes to the financial statements. The

distinction presented in the Balance Sheet between current and

non-current entries has been made on the basis of whether the

assets and liabilities fall due within one year or more.

Notes to the Consolidated Financial Statements (continued)

For the year ended 31 March 2021

2. Accounting policies (continued)

2.3. Basis of consolidation

The consolidated financial statements comprise the financial

statements of the Company and its subsidiaries as at 31 March 2021

and 31 March 2020. Control is achieved when the Group has rights to

variable returns from its involvement with the investee and the

ability to use its power over the investee to affect the amount of

the investor's returns. Specifically, the Group controls an

investee if, and only if, the Group has:

-- power over the investee (i.e. existing rights that give it

the current ability to direct the relevant activities of the

investee);

-- exposure, or rights, to variable returns from its involvement with the investee; and

-- the ability to use its power over the investee to affect its returns.

Generally, there is a presumption that a majority of voting

rights results in control. To support this presumption and when the

Group has less than a majority of the voting or similar rights of

an investee, the Group considers all relevant facts and

circumstances in assessing whether it has power over an investee,

including:

-- the contractual arrangement(s) with the other vote holders of the investee;

-- rights arising from other contractual arrangements; and

-- the Group's voting rights and potential voting rights.

The Group re-assesses whether or not it controls an investee if

facts and circumstances indicate that there are changes to one or

more of the three elements of control. Consolidation of a

subsidiary begins when the Group obtains control over the

subsidiary and ceases when the Group loses control of the

subsidiary. Assets, liabilities, income and expenses of a

subsidiary acquired or disposed of during the year are included in

the consolidated financial statements from the date the Group gains

control until the date the Group ceases to control the

subsidiary.

Profit or loss and each component of Other Comprehensive Income

are attributed to the equity holders of the parent of the Group and

to the non-controlling interests, even if this results in the

non-controlling interests having a deficit balance. When necessary,

adjustments are made to the financial statements of subsidiaries to

bring their accounting policies in line with the Group's accounting

policies. All intra-group assets and liabilities, equity, income,

expenses and cash flows relating to transactions between members of

the Group are eliminated in full on consolidation.

A change in the ownership interest of a subsidiary, without a

loss of control, is accounted for as an equity transaction.

If the Group loses control over a subsidiary, it derecognises

the related assets (including goodwill), liabilities, non -

controlling interest and other components of equity, while any

resultant gain or loss is recognised in profit or loss. Any

investment retained is recognised at fair value.

2.4. Adoption of new and revised standards

The Group has applied the following standards, amendments and

interpretations for the first time for the annual reporting period

commencing 1 April 2020:

-- Interest Rate Benchmark Reform - Phase 1 (Amendments to IFRS 9, IAS 39 and IFRS 7).

-- Definition of a Business - (Amendments to IFRS 3).