HSBC Offers Sustainability-Linked Loans to US Companies

17 Junio 2021 - 5:15AM

Noticias Dow Jones

By Dieter Holger

The U.S. arm of HSBC Holdings PLC started offering

sustainability-linked loans to its commercial banking clients,

tapping into a growing market that finances increasingly ambitious

environmental, social and governance goals at corporations.

HSBC Bank USA said late Wednesday that the terms of the loans

will be linked to pre-determined sustainability targets and

companies that meet the goals will pay lower interest. The loans

follow the Sustainability Linked Loan Principles set by the Loan

Market Associations.

Debt that supports aims such as greenhouse-gas emission cuts,

renewable-energy use, water conservation and workforce diversity

has increased as companies work to attract investors and meet

mounting regulations. Borrowers can often get sustainability-linked

loans with interest rates below the normal market.

ESG-linked loans reached close to $96.3 billion in the first

quarter of 2021, up from nearly $34.4 billion in the previous

year's first quarter, according to Dealogic.

"We want to provide loans and access to credit in ways that meet

the needs of American businesses, from financing growth and

investment to support their sustainability strategy," said Julie

Bennett, HSBC's Americas head of ESG.

Write to Dieter Holger at dieter.holger@wsj.com;

@dieterholger

(END) Dow Jones Newswires

June 17, 2021 06:05 ET (10:05 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

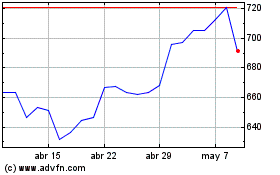

Hsbc (LSE:HSBA)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

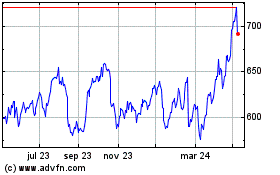

Hsbc (LSE:HSBA)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024